Banking, the cornerstone of modern economies, provides the infrastructure for safekeeping funds, executing financial transactions, and fostering economic growth. It empowers individuals and businesses to invest, borrow, save, and transfer money, ensuring financial convenience, speed, and security. Savings, on the other hand, refer to the income set aside for future use, playing a crucial role in financial planning. This practice allows individuals to cushion unforeseen expenses, invest in prospects, and meet financial objectives. Viewed as a safety net or a stepping stone to wealth accumulation, savings spur investments that catalyze economic development. Through banking, saving becomes not only achievable but also beneficial, with interest accrual enabling money growth over time. One of the significant ways your bank safeguards your savings is through the Federal Deposit Insurance Corporation (FDIC). Established in 1933 in response to the widespread bank failures during the Great Depression, FDIC insurance provides a blanket of security over your deposits. The FDIC is an independent agency created by the U.S. Congress. Its primary goal is to maintain stability and public confidence in the nation's financial system. The agency achieves this by providing deposit insurance, supervising financial institutions for safety and consumer protection, and managing receiverships. Essentially, FDIC insurance covers depositors' accounts at each insured bank, dollar-for-dollar, including principal and any accrued interest up to the insurance limit, in the event of a bank failure. The standard insurance amount is $250,000 per depositor, per insured bank, for each account ownership category. While the FDIC covers a wide array of deposit accounts, such as checking and savings accounts, money market deposit accounts, and certificates of deposit, it's critical to understand that not all financial products are insured. The FDIC doesn't cover investments in stocks, bonds, mutual funds, life insurance policies, annuities, or municipal securities, even if these investments were bought from an insured bank. Banks also protect your savings by ensuring that all financial transactions are secure. In the digital age, financial transactions occur online, and banks utilize robust security measures to keep your data and savings safe. Modern banks uses sophisticated encryption technology to secure all digital transactions. This encryption works by scrambling the data in your transactions into an unreadable format, which can only be returned to a readable format with the correct decryption key. This system makes it incredibly difficult for unauthorized individuals to access your information. Besides encryption, banks employ other security measures such as two-factor authentication (2FA), which requires users to verify their identity in two ways before they can access their accounts. Additionally, secure socket layer (SSL) technology establishes an encrypted link between a web server and a browser, ensuring all data passed between them remains private and integral. Banks have multiple lines of defense in place to protect your savings. These include active fraud monitoring and prevention, account alerts and notifications, and overdraft protection. Fraud monitoring systems are essential tools used by banks to prevent unauthorized transactions. These systems track your typical banking behavior and alert both you and the bank of any suspicious activity. For instance, if a transaction is attempted at an unusual time or from a new location, the bank's system may flag it as potential fraud. Account alerts and notifications play a significant role in keeping your savings safe. Banks send out automatic notifications regarding account activities like withdrawals, deposits, or if your balance drops below a certain amount. These real-time alerts can help you quickly identify any unauthorized transactions or suspicious activity. Overdraft protection is a service offered by banks that allows you to withdraw money from your account even if it doesn't have enough funds, preventing an "insufficient funds" scenario. This can protect your savings by avoiding overdraft fees, returned check fees, and credit score damage. While banks offer numerous protections, individual responsibility also plays a crucial role in protecting your savings. It's imperative to develop secure personal banking habits and know what steps to take if your savings account security is compromised. Being proactive in your banking habits can add another layer of protection to your savings. Regularly reviewing account statements helps you spot any irregularities. Using strong, unique passwords and changing them periodically can safeguard against unauthorized access. It's also recommended to avoid using public Wi-Fi networks when conducting banking transactions, as they may not be secure. If you believe your account has been compromised, the first step is to contact your bank immediately. This enables them to take protective measures, such as locking down your account or issuing a new debit or credit card. It's also essential to change your online banking password and review your transactions to identify any unauthorized activity. In the long term, monitor your credit reports to ensure no new fraudulent accounts have been opened in your name. The safety of your savings is a collaborative effort between you and your bank. With their advanced security measures and vigilant habits, you can confidently trust that your savings are in safe hands. Banking services offer multiple layers of protection for your savings, reinforcing the security of your financial resources. From FDIC insurance and secure transactional frameworks to fraud monitoring systems and overdraft protection, banks provide comprehensive safeguards to ensure the safety of your deposits. Despite these robust mechanisms, personal responsibility plays a crucial role in enhancing the security of your savings. Through proactive habits such as regular account monitoring, secure password management, and swift action in case of a breach, individuals can further fortify their financial protection. Trust in banking systems, combined with personal vigilance, creates an unassailable fortress of security for your savings. Explore and leverage banking services as they not only safeguard your savings but also catalyze your financial growth and prosperity. Seek a bank that aligns with your financial goals and enjoy the assurance of knowing your savings are well-protected.Overview of Banking and Savings

Understanding How Bank Accounts Protect Your Savings

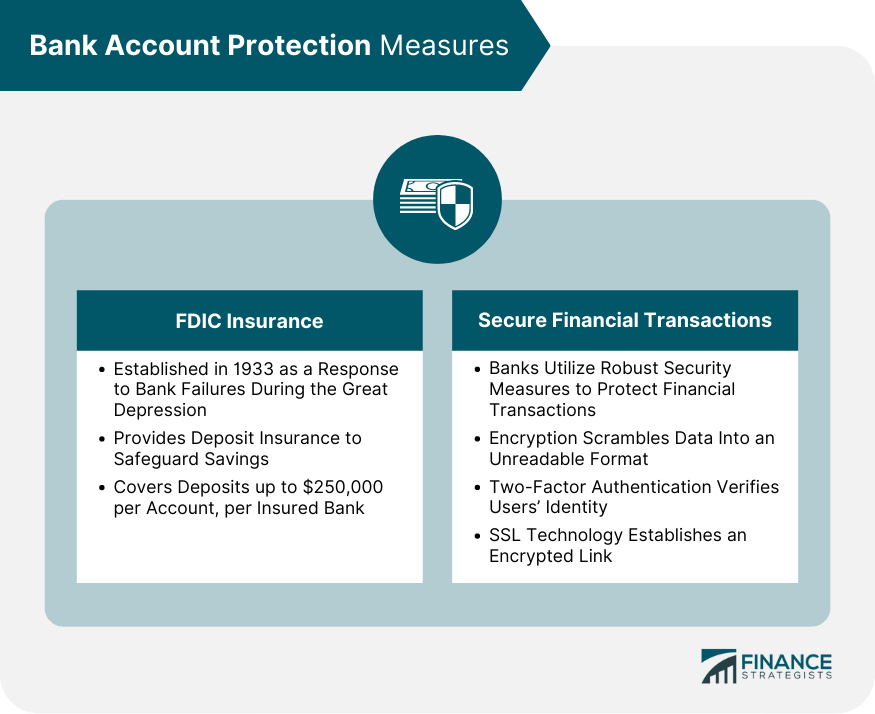

FDIC Insurance and Its Role

What Is the FDIC and How Does It Work?

FDIC Insurance Limits and Scope

Secure Financial Transactions

Secure Transactional Framework of Banks

Role of Other Security Measures in Online Banking

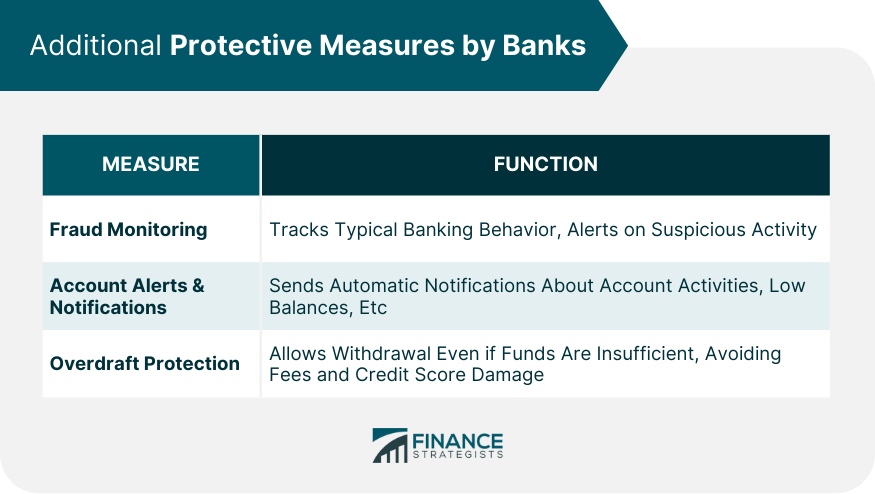

Additional Protective Measures Provided by Banks

Fraud Monitoring and Prevention

Account Alerts and Notifications

Overdraft Protection

Role of Personal Responsibility in Protecting Your Savings

Secure Personal Banking Habits

Steps to Take if Savings Account Security Is Compromised

Bottom Line

How Bank Accounts Protect Your Savings FAQs

FDIC insurance covers depositors' accounts, including savings, at each insured bank up to $250,000, in case of a bank failure.

Banks use encryption technology, two-factor authentication, and secure socket layer (SSL) technology to secure all financial transactions.

Banks offer fraud monitoring, account alerts and notifications, and overdraft protection to add extra layers of safety to your savings.

Personal responsibility, such as using secure banking habits and taking immediate action if account security is compromised, plays a crucial role in protecting your savings.

Overdraft protection allows you to withdraw money even if your account lacks funds, avoiding overdraft fees, returned check fees, and potential credit score damage.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.