A business bank account offers a separate financial platform for managing business cash flow and transactions, which is crucial for tax records and protecting personal assets. While accommodating higher transaction volumes and aiding in building credit, these accounts may have higher fees and stricter requirements. Depositing and withdrawing money from a business bank account is typically done through checks, ATMs, online transfers, or bank branches. While most banks offer a certain number of free transactions each month, it's important to understand any potential fees for excess transactions. Business bank accounts usually come with checkbooks that allow you to make payments or transfers. Many banks also offer online bill payment services, which let you pay bills or send money directly from your business account. These services can often be scheduled in advance, making it easier to manage recurring payments. Most business bank accounts require a minimum balance to avoid monthly maintenance fees. Additionally, be aware of any fees for excess transactions, ATM use, or additional services. Keeping a close eye on your account can help avoid unexpected charges and keep your costs down. Business bank accounts differ from personal ones in several ways. They often come with higher fees due to the complexity of business transactions and require more documentation for setup. However, they also offer benefits such as higher withdrawal limits, the capacity for bulk transactions, and additional services like payroll management or business credit. One significant advantage of business bank accounts is the legal protection they offer. By maintaining a clear separation between personal and business finances, business owners can protect their personal assets in case of lawsuits or business debts. This is especially relevant for limited liability companies (LLCs) and corporations. Business bank accounts simplify financial management by streamlining transactions, facilitating record-keeping, and offering insights into cash flow. They provide various tools and features for efficient money management, including mobile banking, online bill payment, cash flow forecasting, and integration with accounting software. Accounts are the workhorses of a business's financial management system. They are designed for daily transactions, including deposits, withdrawals, and payments. These accounts often come with a debit card and check-writing capabilities, providing flexibility in how you manage your finances. Advantages: Frequent Transactions Business checking accounts are designed to handle a large number of transactions without incurring excessive fees. Disadvantages: Higher Fees. They may have higher fees compared to other types of accounts, particularly if you exceed the transaction limits. A business savings account is an excellent place to stash your surplus cash. It's designed for money that you don't need for daily operations but may want to use for future investments or unexpected expenses. Advantages: Earns Interest: Business savings accounts allow your funds to grow over time through the accumulation of interest. Disadvantages: Limited Transactions. Savings accounts aren't designed for frequent transactions, and excessive withdrawals can lead to fees. A merchant services account, while not a traditional bank account, plays a vital role in a business's financial landscape. These accounts enable businesses to accept credit and debit card transactions from customers. Advantages: Facilitates Card Transactions. Essential for businesses accepting card payments, enabling a smoother customer experience. Disadvantages: Associated Fees: Each card transaction typically comes with a fee, which can add up and impact your bottom line. When choosing a business bank account, several factors need to be considered: the nature and volume of transactions, availability of customer service, monthly fees, interest rates, ATM access, and online banking features. Also, the choice of the bank can be influenced by the need for additional services like business loans or credit cards. Assess the type and volume of transactions that your business conducts. Do you make numerous transactions daily, or are your transactions fewer but of larger amounts? The answer to this question will guide you to an account that can handle your transaction volume without incurring unnecessary fees. Banks often charge service fees for business accounts, which could include maintenance fees, transaction fees, ATM fees, and more. These can add up over time, so it's crucial to understand what charges apply to your account and how you can avoid or reduce them. Some business accounts require a minimum balance to avoid fees or to avail specific benefits. This requirement can tie up funds that could otherwise be invested back into the business. Be sure to understand the minimum balance requirement and whether your business can comfortably meet it. Prompt and effective customer service is essential, especially if issues arise with the account. Research the bank’s reputation for customer service and whether they offer dedicated business support. This can include in-branch service, phone support, and online chat services. Your business might benefit from additional services such as business loans, merchant services, payroll services, and more. These can be valuable assets for your business and should factor into your decision when choosing a bank. Before you start the application process, gather all the necessary paperwork. The documents you'll need may vary by bank but generally include: Proof of Business Registration: This might be articles of incorporation for corporations, articles of organization for LLCs, or a business license for sole proprietors. Employer Identification Number (EIN): This is issued by the IRS for tax purposes. Sole proprietors can typically use their Social Security Number. Ownership Agreements: If your business is a partnership, LLC, or corporation, you may need to provide partnership agreements or operating agreements. Business Licenses: Any relevant licenses showing you are legally allowed to operate your business. Different banks offer different benefits. When choosing the best bank for your business, consider factors like: Reputation: The bank's standing in the industry can be a good indication of its reliability. Customer Service: Excellent customer service can be a lifesaver when dealing with financial issues. Additional Services: Some banks offer more than just banking, such as merchant services, payroll, and business loans. Once you've gathered your documents and chosen a bank, you're ready to open your business bank account. The exact process will depend on the bank but typically includes: Completing an Application: This will likely require information about your business, including its name, address, and EIN/SSN. Providing Your Documentation: The bank will need to see all the documents you've gathered in Step 1. Depositing Initial Funds: Most banks require a minimum deposit to open a business bank account. Once you have your documents ready and have selected a bank, the process is relatively straightforward. You'll need to fill out an application, either online or in-person, provide the necessary documentation, and deposit the required initial amount. A business bank account can play a significant role in building a business's credit rating. Consistent positive banking actions, like keeping a robust balance and timely payments, can foster a solid banking relationship and enhance your likelihood of securing business loans or credit lines. A good business credit score can open up new opportunities for your business, such as lower interest rates on loans, higher credit limits, and better terms with suppliers. It's a key factor that lenders consider when determining whether to extend credit to a business. Building business credit takes time and consistent financial management. Key strategies include always paying bills on time, keeping a low credit utilization rate, regularly reviewing your credit report for errors, and maintaining a positive cash flow in your business bank account. Having a dedicated business bank account helps entrepreneurs and business owners keep personal and business finances separate, facilitating efficient financial management and simpler tax preparation. A business account lends a professional image to a business, enhancing its credibility in the eyes of customers, vendors, and potential investors. Business banking services extend beyond mere account management. Banks often offer additional services such as payroll management, merchant services, business loans, and credit facilities tailored to business needs. Regular and positive banking activity can help businesses establish a solid financial history, boosting their creditworthiness and improving their chances of securing business loans and other financial products. Many business accounts come with online banking features, allowing 24/7 access to account details, easy transaction tracking, expense management, and real-time alerts. Business banking often comes with higher fees and charges than personal banking. These may include monthly service fees, transaction fees, and minimum balance requirements. Handling a business bank account can be more complex than managing a personal account, with more rules and regulations to adhere to. While having multiple business bank accounts can offer benefits, it also introduces increased complexity in terms of accounting and financial management. While convenient, online banking comes with potential security risks. Businesses must ensure their sensitive information is protected against cyber threats. Business bank accounts offer a critical financial infrastructure tailored to the diverse needs of businesses. These accounts facilitate day-to-day transactions, fund storage, and customer payments while providing a transparent financial history for taxation and legal protection. The choice of business bank accounts should match the specific operational needs, factoring in the transaction volume, fees, customer service, and additional services. Furthermore, careful management of these accounts plays a pivotal role in building a business's credit rating, thus, affecting its future financial opportunities. With the advent of online business banking, managing these accounts has become more convenient and accessible while also requiring stringent security measures. Despite the potential complexity and costs, multiple business bank accounts could offer benefits in certain scenarios. Nonetheless, mismanagement can lead to legal and credit issues, underscoring the need for proper financial conduct.How Business Bank Accounts Work

Deposit and Withdraw Money in a Business Bank Account

Write Checks and Online Payments

Maintain Minimum Balance and Avoiding Fees

Fundamentals of Business Bank Accounts

How Business Bank Accounts Differ From Personal Accounts

Legal Protection Offered by Business Bank Accounts

How Business Bank Accounts Facilitate Financial Management

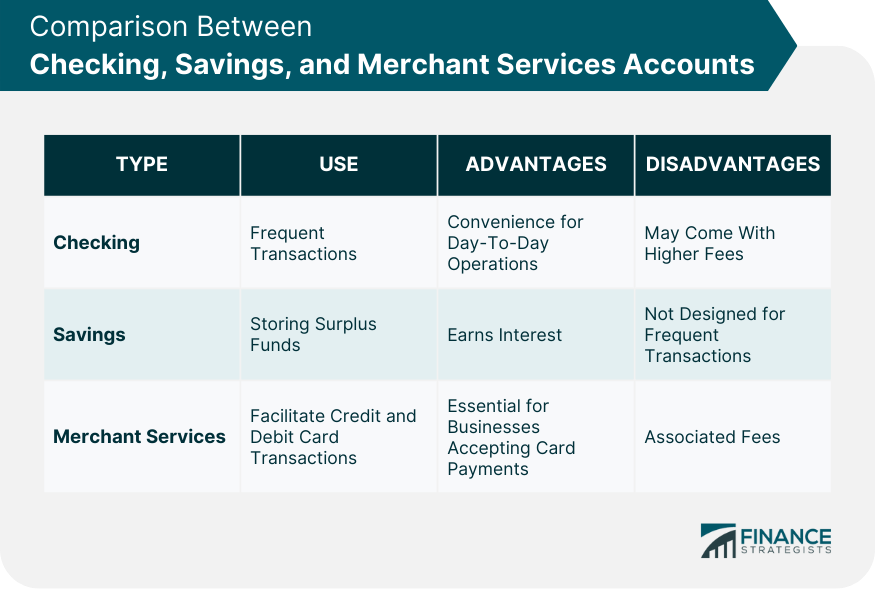

Comparison Between Checking, Savings, and Merchant Services Accounts

Business Checking

Business Savings Accounts

Merchant Services Accounts

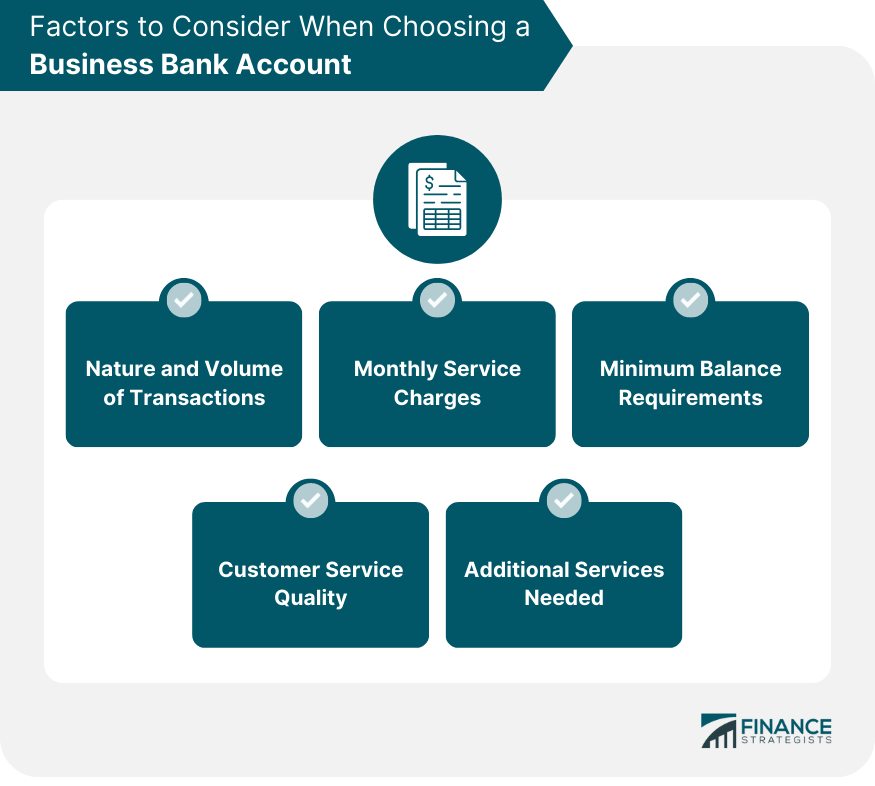

Factors to Consider When Choosing a Business Bank Account

Nature and Volume of Transactions

Monthly Service Charges

Minimum Balance Requirements

Quality of Customer Service

Additional Services Needed

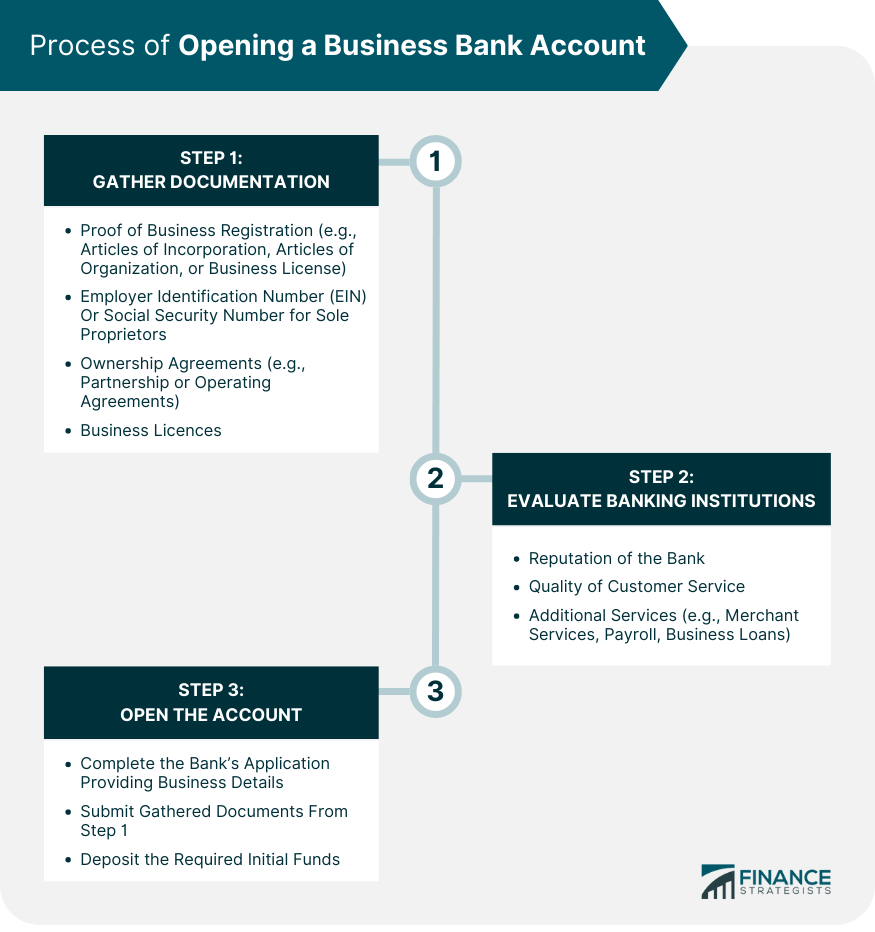

Process of Opening a Business Bank Account

Gather the Necessary Documentation

Evaluate Different Banking Institutions

Open the Account

Role of Business Bank Accounts in Credit Building

How Business Bank Accounts Influence Credit Ratings

Importance of a Good Business Credit Score

Strategies for Building Business Credit Through a Bank Account

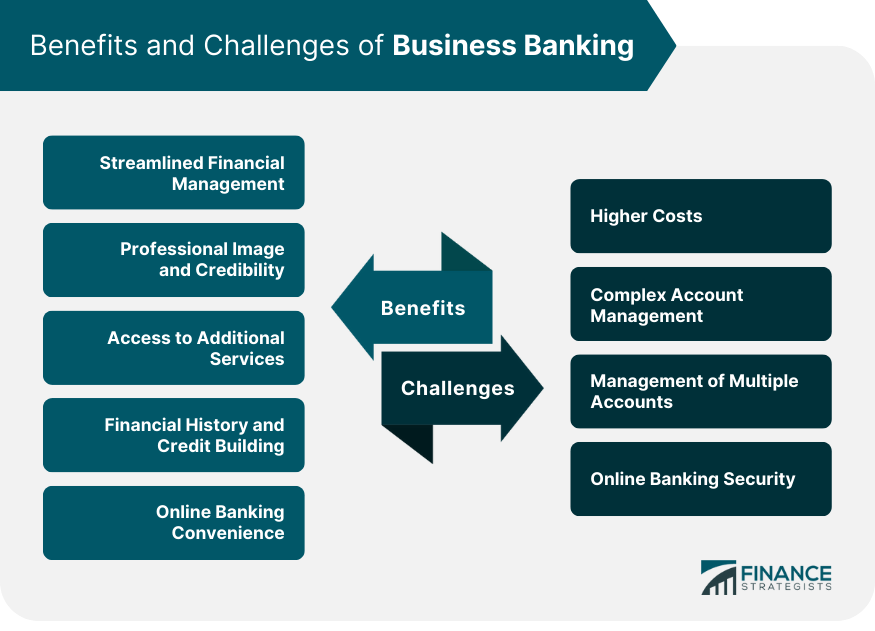

Benefits of Business Banking

Streamlined Financial Management

Professional Image and Credibility

Access to Additional Services

Financial History and Credit Building

Online Banking Convenience

Challenges of Business Banking

Higher Costs

Complex Account Management

Multiple Accounts Management

Online Banking Security

Conclusion

How Business Bank Accounts Work FAQs

Business bank accounts are specifically designed to manage the complex needs of businesses. Unlike personal accounts, they have higher transaction limits, provide access to various business services such as merchant accounts or payroll services, and can help establish a business credit history. However, they may also come with higher fees and more stringent requirements.

There are several types of business bank accounts to cater to different business needs, including business checking accounts for day-to-day transactions, business savings accounts for storing surplus funds and earning interest, and merchant services accounts to facilitate credit and debit card transactions.

When opening a business bank account, you should consider the nature and volume of your business transactions, monthly service charges, minimum balance requirements, customer service quality, and any additional services you may need, such as business loans or merchant services.

Yes, having multiple business bank accounts can be beneficial. It allows you to separate different types of transactions for easier management and accounting, spread risk among different banks, and take advantage of specific features offered by different banks. However, it can also add complexity and cost, so it's crucial to balance these factors.

A business bank account helps build a business credit score by demonstrating your business's financial responsibility. Regular, positive banking activity, such as maintaining a healthy balance and making timely payments, can establish a good banking relationship. This can improve your business's creditworthiness, increasing the chances of obtaining loans or other forms of credit.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.