Bank scams encompass a range of deceptive practices aimed at defrauding individuals or institutions. Some common types include phishing attacks, identity theft, social engineering tactics, malware and cyber attacks, insider fraud, and advanced persistent threats (APTs). These scams exploit vulnerabilities in digital systems and prey on unsuspecting victims. Understanding how these scams occur is crucial for safeguarding personal and financial information. Though diverse in their execution, bank scams share common characteristics that enable fraudsters to succeed. Recognizing these elements is crucial in recognizing potential threats. Moreover, the impact of bank scams extends beyond financial losses, often causing emotional distress and loss of trust in financial institutions. Bank scams are orchestrated through a diverse range of deceptive tactics, exploiting technological vulnerabilities and human susceptibilities. Understanding these methods is crucial in safeguarding personal and financial security. Phishing attacks are among the most prevalent methods used by scammers to gain unauthorized access to sensitive information. Scammers imitate legitimate entities, sending fraudulent emails or messages that appear authentic to recipients. These messages often contain urgent requests or alarming information, compelling users to act impulsively and overlook warning signs. Recognizing phishing attempts is vital to avoid falling victim to these scams. By being aware of common red flags, such as generic greetings, misspellings, and suspicious links, and employing security measures like two-factor authentication, users can protect themselves from phishing attacks. Identity theft involves stealing personal information, such as Social Security numbers or date of birth, to impersonate an individual for fraudulent purposes. This technique allows scammers to open fraudulent accounts or make unauthorized transactions in the victim's name. Fraudsters utilize various methods, including data breaches, dumpster diving, and social engineering, to gather personal information. Once acquired, they exploit this data for financial gain, leaving victims with potential financial ruin and reputational damage. To mitigate the risk of identity theft, individuals must adopt secure online habits, such as avoiding oversharing personal information on social media and using strong, unique passwords. This method focuses on exploiting human psychology, particularly trust and emotions, to manipulate victims into providing sensitive information or performing certain actions. By pretending to be legitimate representatives of banks or other trusted entities, scammers deceive victims into sharing confidential data. This tactic is particularly effective when combined with social engineering techniques that create a sense of urgency or fear. Scammers often leverage emotions such as fear, urgency, or sympathy to manipulate victims into making hasty decisions, bypassing their rational judgment. Emotional manipulation can cloud individuals' judgment, making them more susceptible to falling for scams. Pretexting involves creating fabricated scenarios to obtain personal information from victims. Scammers create elaborate backstories to convince individuals to divulge sensitive data, enabling them to perpetrate financial fraud. To avoid falling for pretexting schemes, individuals must exercise caution when sharing information with unknown parties. Verifying the identity of requesters and questioning unusual or unexpected requests can provide an additional layer of protection. Malware plays a significant role in bank scams, enabling fraudsters to gain unauthorized access to systems, extract sensitive information, and execute unauthorized transactions. Common types include keyloggers, Trojan horses, and ransomware. Keyloggers silently record keystrokes to capture sensitive information such as login credentials and account numbers. Trojan horses, named after the deceptive wooden horse in Greek mythology, masquerade as harmless software to trick users into downloading them, allowing scammers to gain access to systems and execute fraudulent transactions. Ransomware, on the other hand, encrypts a victim's data, rendering it inaccessible until a ransom is paid, posing a severe threat to both individuals and financial institutions as it can lead to data breaches and significant financial losses. Awareness of these delivery methods is vital for individuals and financial institutions to stay vigilant against potential threats. This involves individuals within an organization using their position and access to facilitate fraudulent activities. Motivations for insider fraud can range from financial gain and personal grievances to coercion by external actors. Organizations must implement robust internal controls, conduct regular audits, and foster a strong ethical culture to detect and mitigate the risks associated with insider fraud. Encouraging employees to report suspicious behavior can also help uncover potential fraud. APTs are sophisticated and prolonged cyber-attacks orchestrated by well-funded and organized groups. These threats often target financial institutions due to the potential for significant gains. APTs employ various techniques, such as spear-phishing, zero-day exploits, and lateral movement within networks, to compromise sensitive data and gain unauthorized access. These attacks are often characterized by persistence and stealth. To counter APTs, banks must invest in advanced threat detection systems, conduct regular security audits, and continuously update their cybersecurity protocols. Collaboration with industry peers and sharing threat intelligence can also enhance defenses against APTs. Protecting yourself from bank scams requires a combination of awareness, proactive measures, and cautious online behavior. Here are some key ways to safeguard your finances and personal information: Enable Two-Factor Authentication (2FA): 2FA adds an extra layer of security by requiring a second form of verification, such as a one-time password sent to your mobile device, in addition to your regular login credentials. Regularly Monitor Accounts: Regularly review your bank and financial accounts for any unusual or unauthorized transactions. Promptly report any suspicious activity to your bank to take immediate action and prevent further harm. Stay Informed About Common Scam Tactics: Stay up-to-date with the latest scam tactics and fraud trends. Being aware of potential risks can help you recognize and avoid scams more effectively.. Use Strong, Unique Passwords: Create strong, unique passwords for each of your online accounts, including your bank accounts. Avoid using easily guessable information like birthdays or common words. Secure Your Devices: Install and regularly update security software, antivirus programs, and firewalls on your devices to protect against malware and cyber threats. Report Suspicious Activity: If you encounter any suspicious or fraudulent activities, report them to your bank, relevant authorities, and consider notifying local law enforcement or consumer protection agencies. By following these best practices and remaining vigilant, you can significantly reduce the risk of falling victim to bank scams and protect your financial well-being. Remember, staying informed and cautious is the key to maintaining a secure online banking experience. Banks hold a crucial responsibility in safeguarding their customers from the ever-evolving threats of bank scams and financial fraud. Implementing robust fraud detection and prevention mechanisms, they monitor account activities in real-time, analyze transaction patterns, and employ anomaly detection algorithms to identify and halt suspicious transactions promptly. Additionally, banks educate their customers about potential risks, such as phishing attempts, while offering fraud alerts and notifications to notify customers of any suspicious account activities. Collaborating with authorities and other financial institutions, conducting security audits, and providing secure banking platforms further bolster their efforts to protect customers from potential breaches and scams. By prioritizing customer safety and adhering to regulatory standards, banks ensure a secure banking environment that fosters trust and loyalty among customers. Banks' commitment to protecting their customers from bank scams and financial fraud is evident through their implementation of robust fraud detection and prevention mechanisms. By closely monitoring account activities, analyzing transaction patterns, and employing anomaly detection algorithms, banks swiftly identify and halt suspicious transactions, safeguarding customer funds and information. Collaboration with authorities and other financial institutions further strengthens the defense against cyber threats, as banks share information about emerging risks and potential scams. They remain vigilant against common methods used in bank scams, such as phishing attacks, identity theft, social engineering tactics, malware and cyber attacks, insider fraud, and advanced persistent threats (APTs). By prioritizing customer safety and adhering to regulatory standards, banks foster an environment of trust and loyalty among their customers, ensuring a secure and resilient banking experience for all.What Is a Bank Scam?

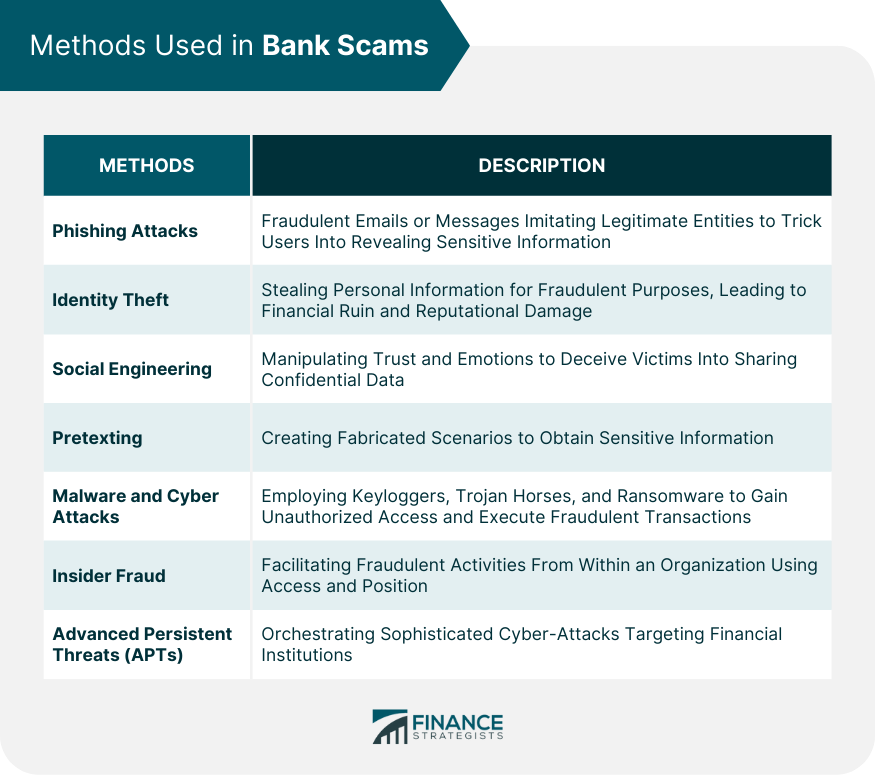

How Do Bank Scams Happen?

Phishing Attacks

Identity Theft

Social Engineering Tactics

Pretexting

Malware and Cyber Attacks

Insider Fraud

Advanced Persistent Threats (APTs)

Protect Yourself From Bank Scams

Banks’ Role in Safeguarding Customers

Conclusion

How Do Bank Scams Happen? FAQs

Bank scams occur through a range of deceptive tactics, including phishing attacks, identity theft, social engineering, and malware. Scammers exploit vulnerabilities in digital systems and prey on unsuspecting victims to gain unauthorized access to sensitive information and financial assets.

Social engineering plays a significant role in bank scams by manipulating human emotions and trust. Scammers use tactics like impersonation, emotional appeals, and urgency to deceive victims into sharing confidential information or performing certain actions.

In bank scams, scammers send fraudulent emails or messages that appear authentic, imitating legitimate entities. These messages often contain urgent requests or alarming information, compelling users to reveal personal data, such as login credentials and credit card information.

Bank scams can have devastating consequences for victims, leading to financial losses, identity theft, emotional distress, and loss of trust in financial institutions. Recovering from such incidents can be challenging and time-consuming.

To protect themselves from bank scams, individuals should practice secure online habits, enable two-factor authentication, and be cautious about sharing personal information. Staying informed about common scam tactics and reporting suspicious activities promptly are crucial for safeguarding personal and financial security.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.