A joint bank account functions as a shared financial resource accessible to two or more individuals, commonly couples or business partners. All account holders enjoy equal rights, sharing in the duties and privileges that the account entails. Depending on the specific needs of the involved parties, this shared account could be established as either a checking or savings account. The primary purpose of such an arrangement is to facilitate easy financial management between the account holders, allowing them to collaboratively handle their financial matters with shared responsibility and access. It stands as a testament to financial cooperation, presenting a convenient way for involved parties to manage shared funds effectively. Two common forms of joint bank accounts exist Joint Tenants with Rights of Survivorship (JTWROS) and Tenants in Common (TIC). In JTWROS, all co-owners have equal rights to the account. Upon the death of one account holder, the surviving account holder automatically inherits the deceased's share, regardless of the deceased's will. On the other hand, a TIC account allows co-owners to own different portions of the account. Upon the death of an account holder, their share can be passed on to a beneficiary of their choice. To open a joint bank account, follow these steps: Both parties need to prepare their necessary identification documents, such as passports or driver's licenses Proof of address, often in the form of a utility bill or lease agreement, is required Proof of income might also be requested by the bank. This could be a pay stub or tax return Once the documents are prepared, both parties should visit their chosen bank to initiate the process An agreement on the account's terms and conditions is necessary. This agreement outlines the rights and responsibilities of each party After providing all the necessary documents and agreeing to the terms, the account can be opened This streamlined process, while it may vary slightly among different banks, ensures that both parties are duly recognized as co-owners of the account. Joint bank accounts are advantageous for managing shared expenses. This applies especially to couples cohabitating or managing shared assets and business partners coordinating company finances. Such accounts streamline bill payments and budgeting, promoting a unified approach to financial management. Emergencies can strike unexpectedly, and joint bank accounts ensure funds are accessible to both parties when necessary. This access is crucial if one account holder becomes incapacitated, safeguarding financial stability during crises. For couples, adult children overseeing their elderly parents' finances, and business partners, joint accounts can simplify financial transactions. The shared nature of these accounts ensures fluid financial operations, aiding efficient money management. The health of a relationship can directly impact joint bank account management. If relations sour, one party may unilaterally deplete the account or incur fees, negatively affecting the other's financial stability. With a joint bank account, either party can make decisions about the funds without consulting the other. This includes making withdrawals, writing checks, or incurring debt. Since joint accounts link credit histories, irresponsible financial behavior by one account holder could negatively impact the other's credit score. Both parties should disclose their financial habits and be comfortable with their partner's approach to managing money. Open conversations about financial expectations, plans, and goals are essential in fostering mutual understanding and alignment. This includes an assessment of their spending tendencies, debt obligations, and overall financial responsibility. Knowing these aspects can help avoid potential conflicts and ensure you are aligning with someone who shares similar financial values and goals. Given that all transactions are visible to both parties, a level of financial privacy is forfeited. It's important to weigh these considerations against the benefits of a joint account, such as shared responsibility and easier management of common expenses. If independence and privacy are high priorities, alternative solutions such as linked accounts or separate accounts may be more suitable. Regular Communication About Expenses and Deposits: Regular communication is key to managing a joint bank account. Discussing expenses and deposits helps avoid misunderstandings and maintains financial harmony. Set Rules for Major Expenses: To prevent disagreements, set rules about major expenses. Decide what constitutes a major purchase and agree to discuss such purchases before making them. Balance Individual and Joint Spending: To maintain a healthy financial relationship, balance individual and joint spending. It's often helpful to have individual accounts for personal expenses and a joint account for shared expenses. Separate Bank Accounts: Some individuals prefer maintaining separate bank accounts to preserve their financial independence. Linked Bank Accounts: offer an alternative that provides each person access to funds but maintains individual control. Using a Mix of Joint and Separate Accounts: can offer the benefits of shared financial management while preserving some degree of financial independence. Joint bank accounts serve as an effective tool for managing shared finances, offering benefits like streamlined budgeting, emergency readiness, and simplified transactions for couples, caregivers, and business partners. They exist primarily in two forms: Joint Tenants with Rights of Survivorship and Tenants in Common, each with unique features and implications. However, these accounts can pose challenges, such as relationship disputes, the risk of unilateral decisions, and potential impacts on credit scores. Thus, before establishing such an account, it's crucial to consider factors like financial trust, co-owner habits, and the effects on individual independence and privacy. Regular communication and defined spending rules can help maintain harmony in a joint account. Finally, alternatives like separate or linked accounts can provide a balance between shared financial responsibilities and individual financial independence.How Joint Bank Accounts Work

Joint Tenants With Rights of Survivorship (JTWROS) vs Tenants in Common (TIC)

Process of Opening a Joint Bank Account

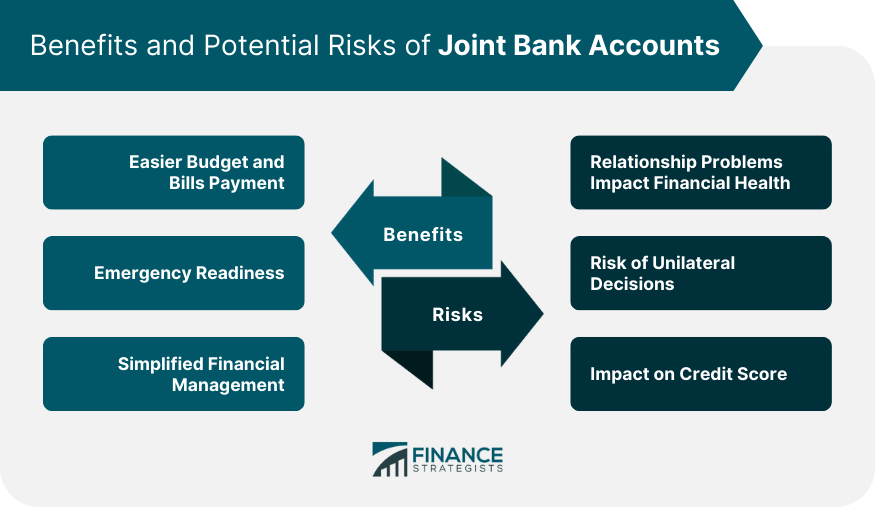

Benefits of Joint Bank Accounts

Easier Budget and Bills Payment

Emergency Readiness

Simplified Financial Management

Potential Risks of Joint Bank Accounts

Relationship Problems Impact Financial Health

Risk of Unilateral Decisions

Impact on Credit Score

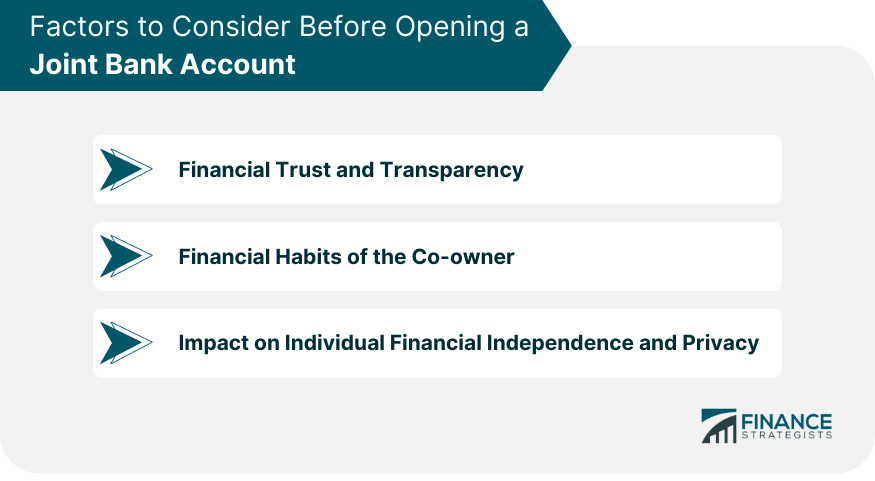

Factors to Consider Before Opening a Joint Bank Account

Financial Trust and Transparency

Financial Habits of the Co-owner

Impact on Individual Financial Independence and Privacy

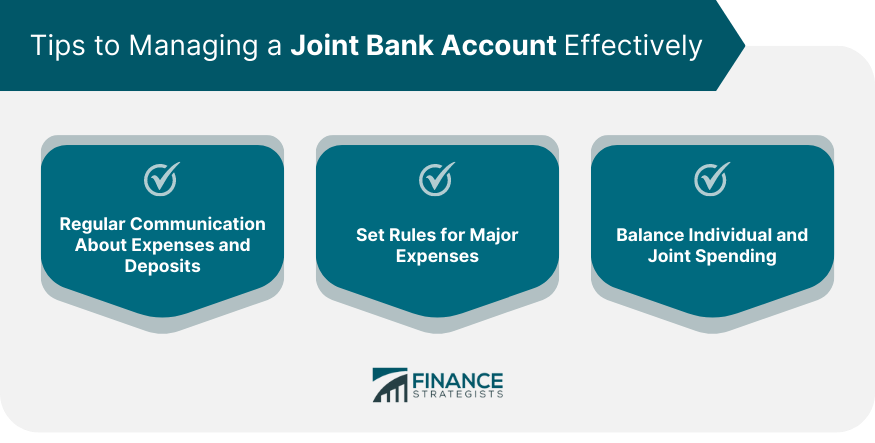

Tips to Managing a Joint Bank Account Effectively

Alternatives to Joint Bank Accounts

Bottom Line

How Joint Bank Accounts Work FAQs

A joint bank account is a type of bank account that is shared by two or more individuals. All account holders have equal access to the account and share the rights and responsibilities associated with it.

The two main types of joint bank accounts are Joint Tenants with Rights of Survivorship (JTWROS) and Tenants in Common (TIC). In JTWROS, all co-owners have equal rights to the account and the surviving holder automatically inherits the deceased's share. In TIC, co-owners can own different portions of the account, and the deceased's share can be passed on to a beneficiary of their choice.

The benefits of a joint bank account include easier budgeting and bill paying, access to funds in emergencies, and ease of managing finances for couples, elderly parents, and business partners.

Risks associated with joint bank accounts include relationship problems affecting financial health, the risk of unilateral decisions made by one party without the consent of the other, and a potentially negative impact on one's credit score due to the financial misbehavior of the other party.

Alternatives to joint bank accounts include maintaining separate bank accounts, linking bank accounts, or using a mix of joint and separate accounts. These alternatives can provide a balance of shared financial management and individual financial independence.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.