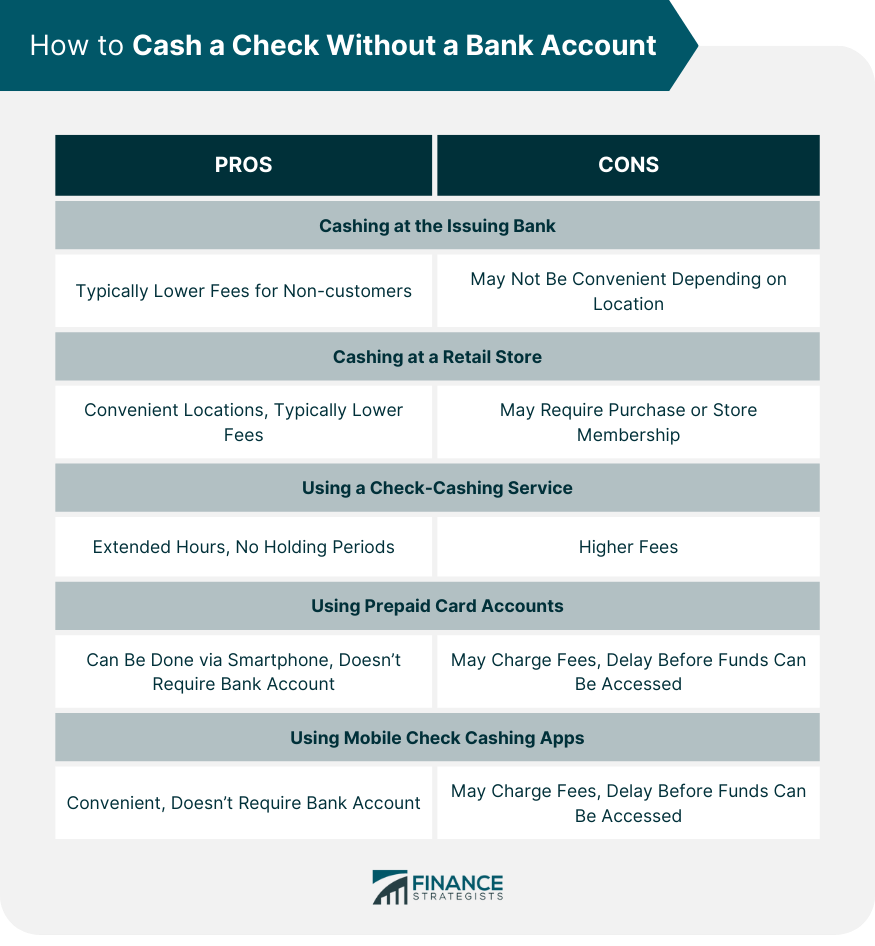

Cashing a check typically involves going to a bank or other financial institution to turn the check into cash. However, for people without a bank account, this process may not be straightforward. A check is a written, dated, and signed instrument that contains an unconditional order directing a bank to pay a definite sum of money to a payee. The issuer or drawer is the one who owns the account and writes the check. The drawee, often a bank, is asked to pay the payee. The payee is the person who is supposed to receive the money. The traditional check-cashing process usually requires a payee to deposit the check into their bank account. After a holding period to ensure the check clears, the bank makes the funds available to the payee. One of the simplest ways to cash a check is by visiting the issuing bank - the bank whose name is listed on the check. These banks are obligated to cash their checks, provided you have a valid ID. It's essential to know that fees may apply for this service, particularly if you're not a customer of the bank. Several retail stores offer check cashing services. Major retailers like Walmart and Kmart, and some grocery stores, offer this service, albeit for a fee. These services can be a convenient and relatively inexpensive way to cash a check. Be sure to bring your ID, as you will need to verify your identity. The store will either give you cash or load the amount onto a store gift card. Check-cashing services exist primarily to cash checks for people without standard bank accounts. These businesses are often found in neighborhoods that lack traditional banking services. Fees for these services are generally higher than those at a regular bank or retail store, but they offer the convenience of extended hours and no holding periods. Some prepaid card accounts allow you to deposit checks onto the card. After endorsing the check, you use the card's app to take pictures of the check and upload them. While there may be a delay before you can access your funds, this is an excellent option for those who lack a bank account but have access to a smartphone. Keep in mind that some cards may charge fees for this service. In the digital age, several apps offer check-cashing services. These apps allow you to cash a check directly from your smartphone by taking a picture of the front and back of your endorsed check. Many of these apps are tied to prepaid card accounts, but some may allow you to receive funds via alternative methods like PayPal. However, these apps may charge fees and may require a waiting period before you can access your funds. While cashing a check without a bank account is feasible, it is crucial to understand the potential costs associated with it. Banks and other check-cashing entities often charge fees to provide these services, especially for those who don't have an account with them. The charges can be either a flat fee per check or a percentage of the check's value, and in some cases, both. For example, a retail store might charge a flat fee of $3 for checks up to $1,000 and then take a percentage for checks greater than that. Banks, especially if you're not an account holder, might charge a higher flat fee, possibly ranging from $8 to $10 per check. Check-cashing services, known for their convenience, generally have the highest fees, which can be a percentage of the check's value. Despite the convenience, there are some potential pitfalls when cashing a check without a bank account that you should be aware of. As mentioned earlier, fees are a common occurrence when cashing a check without a bank account. Over time, these can accumulate and amount to a significant sum, particularly for those who frequently cash checks. Unfortunately, check fraud is a common scam. Fraudsters often target those who are in desperate need of funds. Without the protection that a bank account provides, victims of check scams may find themselves in financial ruin. Whether it's a waiting period imposed by an app or a check-cashing service or time spent traveling to a retail store or issuing bank, there can often be a delay in accessing your funds. This delay can be inconvenient, particularly if you need the money urgently. Cashing a check without a bank account might be a necessity for many, but it doesn't need to be a stressful process. Following a few essential tips can help ensure you get your money efficiently and safely. Understand Your Options: Take the time to understand what methods are available to you. This can range from visiting the issuing bank, using a retail store, a check-cashing service, a prepaid card, or a check-cashing app. Be Aware of Fees: Always be aware of any fees associated with the method you choose. These can eat into the funds you receive. Shopping around can help you find the best deal. Beware of Scams: Always verify the source of a check before you try to cash it. If you're not sure, do some research or consult with a professional. Have Identification: Whether you're cashing a check at a bank or a retail store, you'll need identification. Make sure you have appropriate and valid ID readily available. Remember, while it might be more challenging to cash a check without a bank account, it's far from impossible. By understanding your options and the potential risks, you can ensure you have access to your funds in a way that works best for you. Cashing a check without a bank account, while potentially challenging, is feasible through a variety of avenues. These avenues include visiting the issuing bank, leveraging retail store services, using check-cashing businesses, resorting to prepaid card accounts, or applying mobile check cashing apps. However, this convenience comes with potential pitfalls like fees, susceptibility to scams, and delay in accessing funds. Therefore, it's critical to understand these risks, be vigilant about the authenticity of checks, and have valid identification. Ultimately, by considering all options, being aware of associated costs, and maintaining a proactive approach to potential fraud, you can navigate the process successfully. For those who frequently need to cash checks, considering the benefits of a bank account can provide more security, reduced costs, and greater convenience. Reach out to your local bank today and discover the range of services available to cater to your financial needs.Basics of Check Cashing

How to Cash a Check Without a Bank Account

Cashing at the Issuing Bank

Cashing at a Retail Store

Using a Check-Cashing Service

Using Prepaid Card Accounts

Using Mobile Check Cashing Apps

Cost of Cashing a Check Without a Bank Account

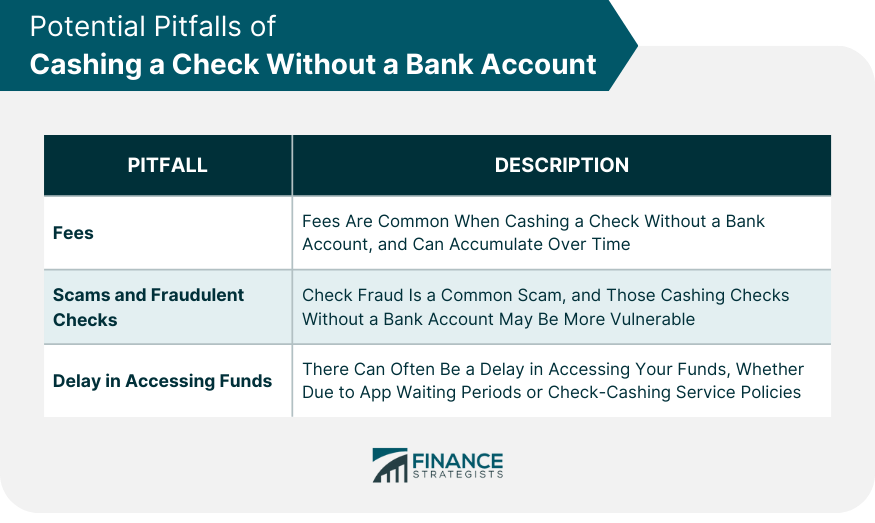

Potential Pitfalls of Cashing a Check Without a Bank Account

Fees

Scams and Fraudulent Checks

Delay in Accessing Funds

Essential Tips When Cashing a Check Without a Bank Account

Bottom Line

How to Cash a Check Without a Bank Account FAQs

You can cash a check at the issuing bank, a retail store, through a check-cashing service, using prepaid card accounts, or via mobile check-cashing apps.

Yes, most methods for cashing a check without a bank account involve fees, which can be a flat fee per check or a percentage of the check's value, or sometimes both.

Potential risks include fees, becoming a target for scams or fraudulent checks, and a delay in accessing your funds.

Yes, several mobile apps offer check-cashing services, allowing you to deposit a check directly from your smartphone. However, these may involve fees and waiting periods.

Understand your options, be aware of fees, beware of scams, and ensure you have valid identification when cashing a check.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.