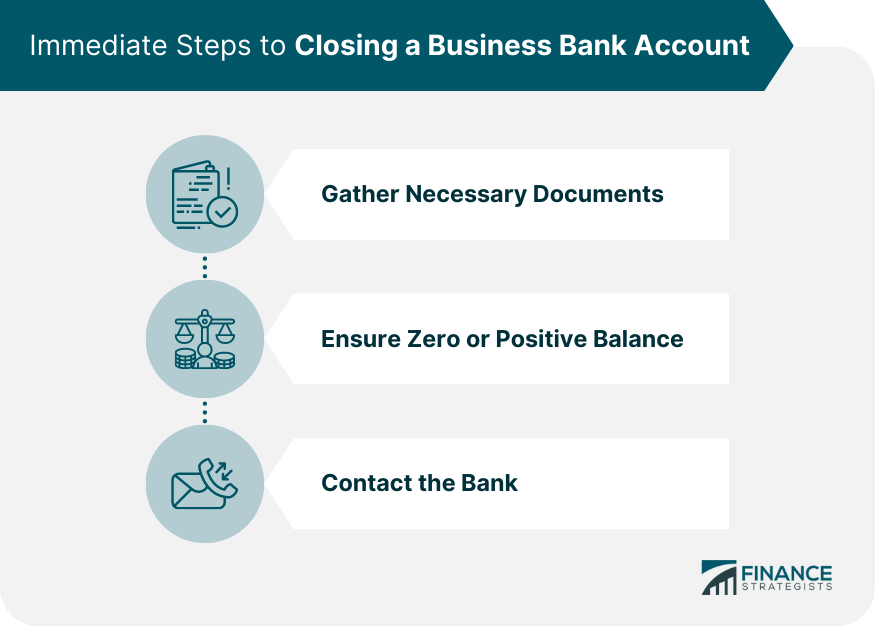

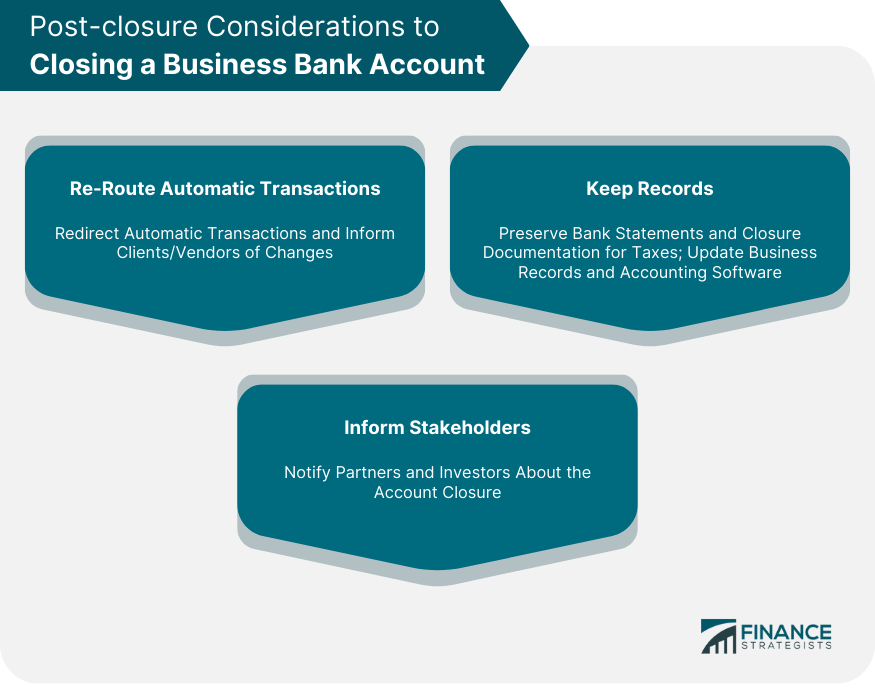

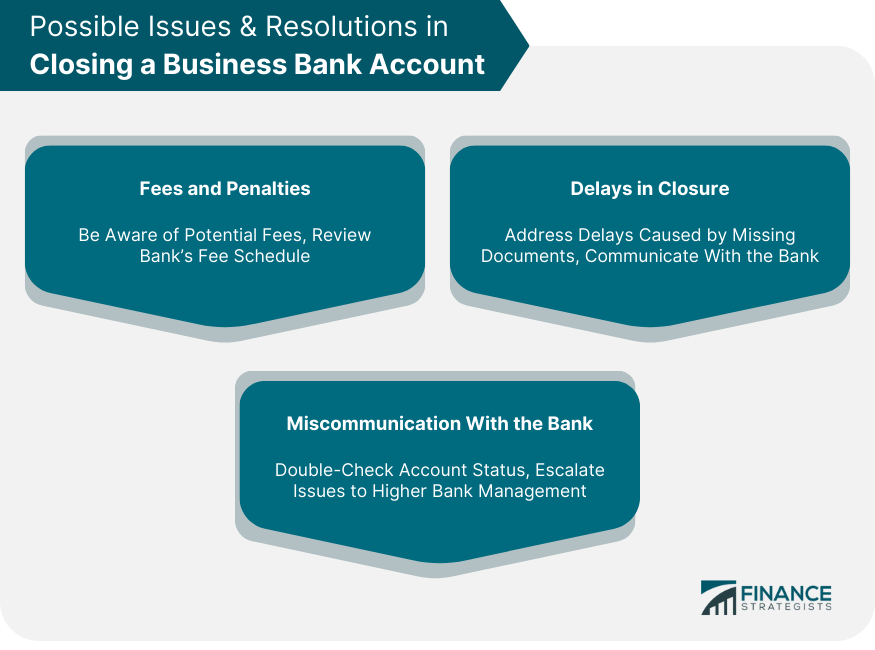

Closing a business bank account requires precision and caution. You're not just dealing with money; you're handling the financial reputation and history of your entire enterprise. Before even approaching your bank, you need to have all the requisite paperwork in place. Start by securing your account details. This includes the account number, business identification number, and other related information. Equally important are the identification documents, which might include your business registration or license and the personal IDs of the designated account holders. Some banks might also require proof that the decision to close the account was agreed upon, especially if your business has multiple stakeholders. This could be in the form of business resolutions or minutes from a meeting highlighting the closure decision. It might seem straightforward, but before you can close an account, it has to either have a zero balance or be in credit. This means ensuring that any outstanding loans, overdrafts, or other debts associated with the account are settled. Once debts are cleared, if there are residual funds in the account, you must decide whether to withdraw them or transfer them to another account. Often, transferring can be more efficient, especially if the funds are substantial. Now that your affairs are in order, it's time to inform the bank of your intentions. Start by either calling the bank's customer service or paying a visit to your local branch. You'll typically be directed to a business banking representative or even a branch manager, given the nature of the transaction. They'll provide the necessary paperwork to initiate the closure. Once filled out, these forms, along with any required documents, should be submitted. Ensure you get a receipt or acknowledgment of the submission to track the process. Closing the account is just the first step. There are other logistical elements to consider after the actual closure. Business accounts, more often than not, have numerous automatic transactions set up. This can range from automated bill payments to direct deposits from clients or vendors. Before closure, ensure all these transactions are rerouted to another functioning account. It's also prudent to notify all clients or vendors of this change in your bank account details so future transactions are seamless. Post-closure, it's imperative not to discard any bank statements or related documents hastily. Maintain a file containing all statements, especially the ones leading up to the closure, and the official documentation confirming the account's closure. Such documents can be crucial for tax purposes or any potential financial reviews. Furthermore, update your business's financial records and accounting software to reflect this significant change. This step can't be emphasized enough, especially for businesses with multiple stakeholders or investors. It's crucial to notify business partners, co-owners, and other relevant stakeholders about the account's closure. This ensures transparency and prevents any future confusion, especially if the closed account was previously a major part of business operations. As with any significant business operation, there can be bumps along the way. Preparing for potential issues can make the process smoother. While closing a business account, it's important to be aware of any fees associated with the closure. Some banks charge an early closure fee, especially if the account hasn't been open for a minimum duration. Additionally, if there's any delay in the closure, you might still be subject to monthly maintenance fees. Always check the fee schedule related to business accounts at your bank. Though you might want a swift closure, sometimes delays occur. Reasons can range from missing documentation, discrepancies in the balance, or even clerical errors. If you experience a delay, revisit the closure criteria, ensure all documents are provided, and maintain open communication with your bank. In some rare cases, even after submitting the closure request, the account might still appear active. This is why it's advisable to double-check the account status a few weeks post-submission. If issues persist, consider escalating the matter to the bank's higher management or the customer grievance department. Navigating the closure of a business bank account entails more than just settling balances. It involves safeguarding the financial standing and history of a business, emphasizing the significance of preparation through document assembly and stakeholder communication. With many automatic transactions often tied to business accounts, rerouting these is pivotal, along with updating financial records and preserving them for potential future audits. While most of the process might seem linear, anticipating issues like early closure fees and potential miscommunication with the bank becomes crucial. The objective isn't merely account closure but ensuring the transition happens seamlessly, safeguarding the enterprise's financial credibility. Prior knowledge, diligent action, and responsive communication are the triad to success in this endeavor.Immediate Steps to Closing a Business Bank Account

Gather Necessary Documents

Ensure Zero or Positive Balance

Contact the Bank

Post-closure Considerations to Closing a Business Bank Account

Re-Route Automatic Transactions

Keep Records

Inform Stakeholders

Possible Issues & Resolutions in Closing a Business Bank Account

Fees and Penalties

Delays in Closure

Miscommunication With the Bank

Bottom Line

How to Close a Business Bank Account FAQs

Gathering all necessary documents beforehand ensures a smooth and efficient process. This avoids potential delays or issues caused by missing or incomplete information. It demonstrates preparedness and streamlines communication with the bank.

While withdrawing all funds can lead to a zero balance, it doesn't automatically close the account. You still need to formally notify the bank of your intention to close the account and complete the required paperwork. Additionally, some fees or charges might be deducted after withdrawal, potentially causing the account to go negative.

Ideally, all automatic transactions should be rerouted before closing the account. If any transaction attempts to go through a closed account, it will typically be declined. However, you should notify the sender immediately, provide them with new account details, and ensure all future transactions are redirected appropriately.

It's advisable to retain records related to a closed business bank account for at least seven years. This duration allows for any potential audits, tax reviews, or financial inquiries where such documents might be required.

Yes, some banks impose an early closure fee if the business account hasn't been open for a minimum specified duration. It's essential to review your bank's fee schedule or discuss with a representative to understand any potential penalties or charges.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.