A joint bank account is a shared bank account that allows two or more individuals to have equal access to the funds within it. These individuals, known as co-owners, have the right to deposit and withdraw money, make transactions, and monitor the account's activities collectively. Joint accounts are typically utilized by couples, family members, business partners, or friends who wish to pool their resources for a common purpose, such as managing household expenses, saving for a shared goal, or handling business finances. The procedure for opening a joint bank account is relatively straightforward, but it is crucial to approach it with careful consideration and transparency. Before you embark on the journey of opening a joint bank account, it is essential to understand the different types of joint accounts available. The two most common types are "Joint Tenants with Rights of Survivorship" and "Joint Tenants in Common." In the former, if one account holder passes away, the surviving account holder automatically inherits the entire account. In contrast, a Joint Tenancy in Common allows each account holder to leave their share of the account to a beneficiary of their choice in their will. Choosing the right bank or credit union for your joint account is a crucial step. Look into factors such as the bank's reputation, customer service, access to branches and ATMs, digital banking features, and any fees associated with the account. Additionally, consider the interest rates on savings accounts if you plan on saving together. Opening a joint bank account requires providing several key documents. Usually, you and the other account holder will need to provide proof of identity, such as a passport or driver's license, social security numbers, and proof of address. The specific requirements may vary slightly between banks. Although some banks allow online applications, most require at least one visit to a branch to open a joint account. It's typically a straightforward process where you fill out an application and provide the necessary documents. After submitting your documents, the bank will process your application. The process includes a verification check of your provided details. Once this is completed, your joint account will be activated. Most banks require an initial deposit to open the account. Be sure to check if there's a minimum deposit requirement. You can fund the account through cash, check, or an electronic transfer from another account. Before opening a joint account, it's crucial to have an open and honest discussion about your financial habits and goals. It's important to ensure both parties are on the same page about budgeting, spending, and saving. Joint bank accounts come with joint liability. This means both account holders are responsible for any overdrafts or debts, regardless of who incurred them. It's vital to understand this responsibility before opening the account. A joint account can potentially impact your credit score. If the account becomes overdrawn and the debt isn't paid, it could harm both account holders' credit scores. Discuss and plan for potential future situations, such as a disagreement about money management, divorce, or the death of one account holder. Planning for these contingencies can prevent future financial conflicts. Joint bank accounts, without a doubt, come with a host of advantages that make financial management simpler for those sharing expenses. One of the foremost benefits is the ease of budgeting. With all shared expenses flowing from one account, tracking spending becomes straightforward, offering a comprehensive view of where the money is going. Furthermore, the account provides a built-in safety net in emergency situations. Since both individuals have equal access to the funds, either person can handle unexpected expenses without delay. This accessibility offers a sense of financial security, knowing that resources are readily available when needed. One significant risk is the loss of financial privacy. With a joint account, every transaction can be seen by both account holders. This transparency might be uncomfortable for those who prefer to keep some aspects of their financial lives private. Additionally, disagreements over spending habits or financial decisions can arise, potentially leading to relationship strains. Therefore, communication is key when managing a joint account to ensure both parties feel comfortable and in agreement about financial decisions. If a joint account doesn't seem like the right fit, there are alternatives. Separate accounts with authorized users can give access without full joint liability. Linked accounts offer another option where separate accounts are connected for the purpose of transferring funds. Moreover, numerous financial apps are designed to help manage shared expenses. Opening a joint bank account is a significant financial decision that requires careful consideration and planning. The process involves deciding on the type of joint account, choosing the right bank, providing necessary documents, and understanding the implications of joint liability. A joint bank account can simplify financial management for shared expenses, offer a sense of financial security, and serve as a valuable resource during emergencies. However, it also entails potential risks such as loss of financial privacy and potential for disputes over spending habits. Additionally, it's crucial to understand the potential impact on your credit score and to plan for various contingencies. For those who prefer not to merge their finances fully, alternatives such as separate accounts with authorized users, linked accounts, or financial apps for managing shared expenses can be considered. The decision ultimately depends on your financial habits, goals, and comfort level with shared financial responsibility. While a joint account can offer many benefits, it's vital to thoroughly discuss and agree on its use to ensure it serves its purpose effectively and harmoniously.What Are Joint Banks Accounts?

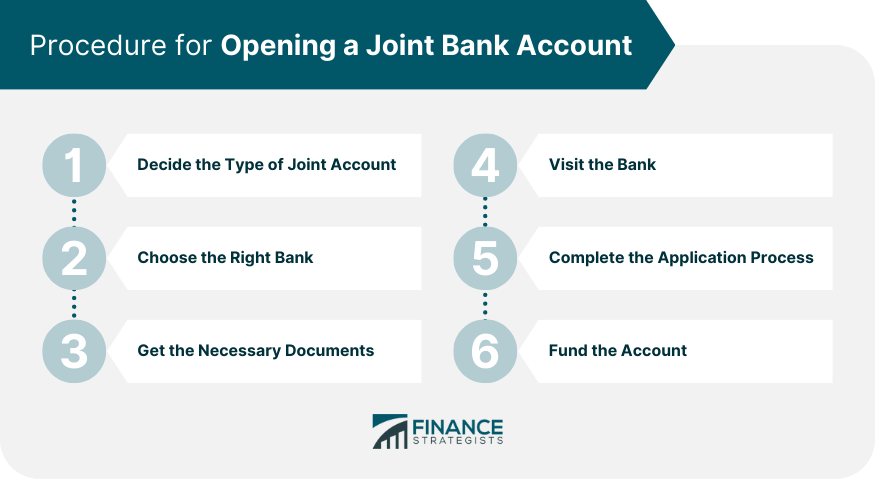

Procedure for Opening a Joint Bank Account

Decide the Type of Joint Account

Choose the Right Bank

Get the Necessary Documents

Visit the Bank

Complete the Application Process

Fund the Account

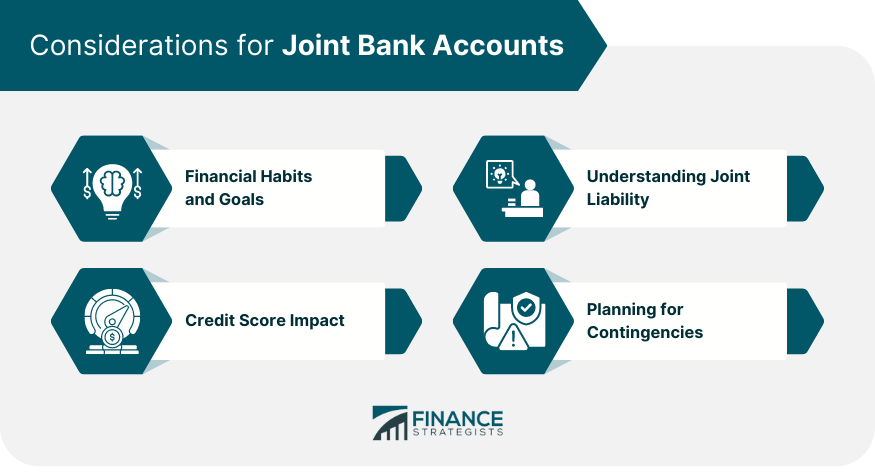

Considerations for Joint Bank Accounts

Financial Habits and Goals

Understanding Joint Liability

Credit Score Impact

Planning for Contingencies

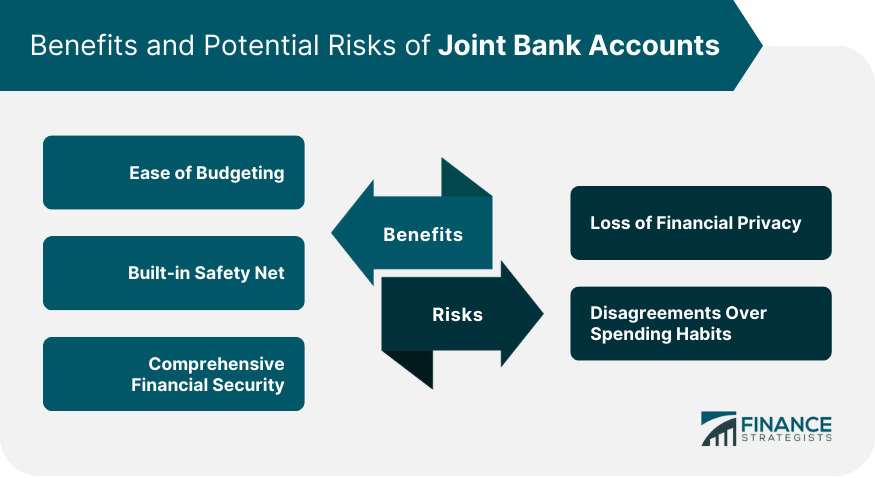

Benefits and Risks of Joint Bank Accounts

Benefits

Risks

Alternatives to Joint Bank Accounts

Final Thoughts

How to Open a Joint Bank Account FAQs

While some banks do offer the option to open a joint account online, many still require at least one in-person visit to a branch. It's best to check with your chosen bank to understand their specific process.

If the joint account is a "Joint Tenants with Rights of Survivorship" account, the surviving account holder automatically inherits the entire account. However, if it's a "Joint Tenancy in Common," the deceased owner's share of the account can be left to a chosen beneficiary.

Disputes over a joint account can be challenging to resolve. It's essential to have clear communication and mutual agreement on the use of the account from the outset. If disagreements arise, you may consider seeking financial counseling or legal advice.

A joint bank account can impact your credit score if the account becomes overdrawn and the debt is not promptly paid. Both account holders are jointly responsible for any debts, and any failure to repay them could negatively affect both account holders' credit scores.

Yes, there are several alternatives to joint bank accounts. You might consider having separate accounts with authorized users, linking individual accounts for easier fund transfers, or using financial apps designed to manage shared expenses. The best choice depends on your specific needs and comfort levels.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.