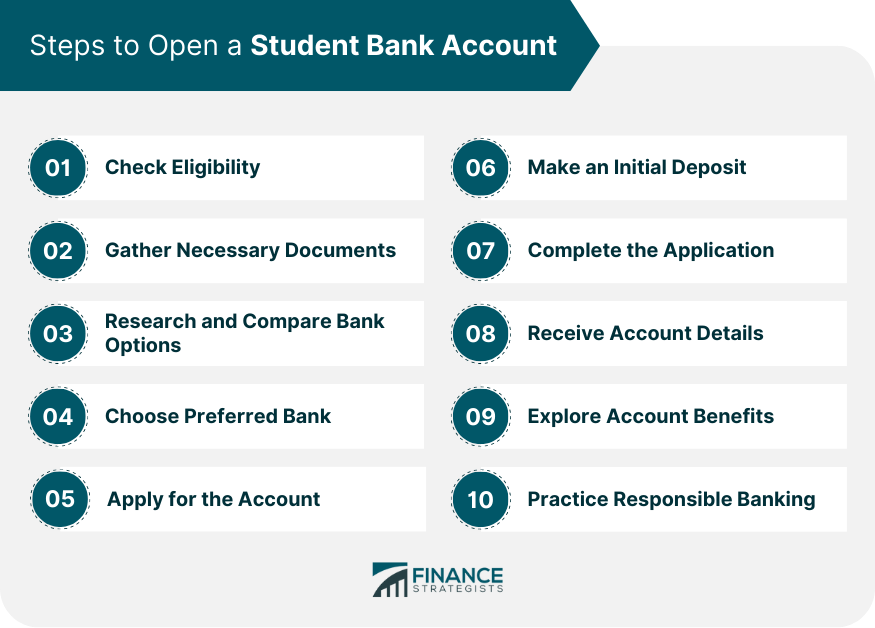

A student bank account is a financial tool for young individuals pursuing higher education. It serves as a gateway to the world of personal finance and helps students manage their money efficiently. One of the primary reasons for the importance of a student bank account is its ability to instill financial responsibility early on. By having a dedicated account, students can track their spending, manage expenses, and set budgeting goals. Opening a student bank account is accessible and straightforward for young individuals. First, ensure eligibility by being of legal age and enrolled in an educational institution. Gather required documents, such as identification, proof of student status, address, and contact details. Research and compare different bank options, considering account features, fees, interest rates, and online/mobile banking availability. Choose a preferred bank and apply either in person or online. Make an initial deposit during the application process. After successful account creation, students can enjoy benefits like promotions, waived fees, and financial education resources. Regular monitoring and responsible banking habits enhance the student bank account experience. Before you proceed with opening a student bank account, ensure that you meet the eligibility criteria set by the bank or financial institution. Most student accounts require you to be of legal age, which is typically 18 years old or older. Additionally, you must be enrolled in a recognized educational institution, such as a high school, college, or university. Some banks may have specific requirements regarding the type of educational institution, so verify that your school qualifies. Checking your eligibility first will save time and ensure you meet the necessary requirements to open a student bank account. Collect the required documents to open the account. These commonly include a valid identification card (such as a driver's license or passport), proof of student status (such as an enrollment letter or student ID), and personal information like your address and contact details. Having these documents ready will streamline the account opening process and facilitate a smooth application. Research different banks and financial institutions that offer student bank accounts. Compare their account features, benefits, fees, interest rates, and the availability of online and mobile banking services. Look for accounts that cater specifically to students with added perks and advantages. Consider factors like the bank's reputation, accessibility of branches and ATMs, and the quality of customer service. Based on your research, select the bank that best suits your needs and preferences. Consider factors like the bank's reputation, accessibility of branches and ATMs, and the quality of customer service. If the bank offers additional benefits for students, such as lower fees or special promotions, take those into account when making your decision. Once you've chosen a bank, you can apply for a student bank account. Many banks offer the option to apply either in person at a branch or through their website online. Follow the bank's application process and provide all the necessary information and documentation. Be sure to double-check all the details before submitting your application. During the account opening process, you may be required to make an initial deposit. This amount varies from bank to bank and may be as low as a nominal sum or require a more substantial initial funding. Be prepared to make the deposit using cash, check, or an electronic transfer from another account. Ensure you complete all the necessary steps of the application process. This may include signing relevant documents or agreements as well as providing any additional information the bank may require. Review the terms and conditions of the account carefully before finalizing your application. After successfully opening the account, the bank will provide you with your account details, including your account number and any relevant login credentials for online banking. Keep this information safe and confidential to protect your account from unauthorized access. Take the time to familiarize yourself with the features and benefits of your new student bank account. Some banks offer perks like discounts, cashback rewards, or access to financial education resources. Understanding the account benefits will help you make the most of your banking experience. Once your student bank account is active, practice responsible banking habits. Keep track of your transactions, monitor your account regularly, and avoid overdrawing or overspending. Responsible financial management will set you on the path to a successful and rewarding banking experience during your academic journey. To get started with online banking, the first step is to register for an account with your chosen bank. This process typically begins on the bank's official website. You'll need to provide personal information, such as your name, address, contact details, and account number. The bank may also require verification through a one-time password sent to your registered mobile number or email address. Once registered, you can create a username and password for future logins. Online banking allows you to access your account information, view transactions, check balances, and transfer funds conveniently from the comfort of your home or on the go using a computer or mobile device. Mobile banking apps take the convenience of online banking to the next level, providing a seamless and user-friendly interface optimized for smartphones and tablets. To access mobile banking, download your bank's official app from the respective app store. After installation, open the app and log in using the same credentials you set up during online banking registration. Once logged in, you may have the option to enable biometric authentication, such as fingerprint or facial recognition, for added security and quicker access. Mobile apps allow you to perform a wide range of banking tasks, including checking account balances, depositing checks, paying bills, and transferring funds between accounts. With the ability to bank on the go, mobile apps bring banking services right to your fingertips, making financial management even more convenient and accessible. As you dive into online banking and mobile apps, take the time to explore the various features and benefits they offer. These tools often provide detailed transaction history, categorized spending reports, and budgeting tools to help you manage your finances effectively. You can set up account alerts and notifications to receive real-time updates on account activity, such as large transactions or low balances. Some banks also offer features like person-to-person (P2P) transfers, where you can easily send money to friends or family using their email address or phone number. Additionally, mobile apps may integrate with payment services like Apple Pay or Google Pay, enabling contactless transactions at supported merchants. By leveraging the full range of features available, you can optimize your banking experience, stay on top of your financial health, and conduct transactions securely and efficiently. These promotions can encompass various incentives, such as cash rewards, gift cards, or waived fees for a limited period. Some banks may offer referral bonuses to encourage students to invite their friends to open accounts as well. While these promotions can be enticing, it is essential for students to read the fine print and understand the terms and conditions associated with the offers. Some promotions might require maintaining a minimum account balance or performing a specific number of transactions to qualify for the benefits. By taking advantage of these student-specific promotions responsibly, students can reap the rewards while staying mindful of any obligations or restrictions tied to the incentives. Another student benefit worth considering when opening a bank account is the potential for favorable interest rates. Some banks offer higher interest rates on savings accounts for students, allowing their savings to grow at a faster pace. This can be particularly advantageous for students who have part-time jobs or receive regular allowances and want to save their earnings for future expenses, such as tuition or travel. As interest earned on savings can compound over time, students should compare interest rates among different banks and choose an account that offers the best possible returns on their savings. While interest rates may not be substantial, every bit of extra earnings counts, and cultivating smart saving habits early on can lead to significant financial advantages down the road. These student-friendly account features can be immensely beneficial, especially for those with limited financial resources. By avoiding monthly fees, students can allocate more of their funds toward essential expenses, educational materials, or entertainment. Additionally, some banks may waive overdraft fees for students or offer grace periods to rectify minor overdraft occurrences without penalties. However, students should ensure they fully comprehend the terms and conditions of these account features to avoid any unexpected fees or consequences. Opting for an account with waived fees or low balance requirements is a prudent choice for students looking to minimize banking costs and make the most of their limited funds. This is a valuable feature offered by many banks to safeguard against the consequences of insufficient funds in a student bank account. When a transaction exceeds the available balance, overdraft protection kicks in, preventing the transaction from being declined and sparing the account holder from potential embarrassment or inconvenience. There are various forms of overdraft protection, such as linking a savings account, credit card, or a line of credit to the account. In the event of an overdraft, the necessary funds are automatically transferred from the linked account to cover the shortfall. This ensures that essential payments, like rent or utility bills, are processed smoothly. Overdraft protection grants peace of mind and can be particularly beneficial for students who are still learning to manage their finances effectively. While overdraft protection can be a lifesaver, it is crucial to understand the associated fees and limitations. Most banks charge fees for utilizing overdraft protection services, and these fees can vary significantly among institutions. It is vital for students to familiarize themselves with their bank's fee structure to avoid any surprises. Additionally, banks often set limits on the number of overdraft transactions allowed per day or per month. Exceeding these limits may result in additional fees or the suspension of overdraft protection privileges. To avoid accruing unnecessary charges, students should regularly monitor their account balance, set up alerts for low balances, and consider opting out of overdraft protection if they prefer not to incur fees. Securing your online banking and mobile app accounts begins with strong password management. Create a unique and complex password using a combination of uppercase and lowercase letters, numbers, and special characters. Avoid using easily guessable information, such as birth dates or names of family members or pets. It's crucial to use a different password for each online account to prevent unauthorized access in case one of your passwords is compromised. To help manage multiple passwords, consider using a reputable password manager, which can securely store and autofill your login credentials. Regularly update your passwords and refrain from sharing them with anyone to maintain the integrity of your accounts. To add an extra layer of protection, enable two-factor authentication (2FA) whenever it's available for your online banking and mobile apps. 2FA requires an additional verification step beyond your password, typically involving a unique code sent to your registered mobile number or email address. This code is required to complete the login process, making it significantly more challenging for unauthorized individuals to access your accounts, even if they have your password. Embrace 2FA as a powerful security measure to safeguard your financial information and transactions from potential threats. Vigilant monitoring of your account activity is fundamental to ensuring its security. Regularly review your transaction history and account statements to identify any unauthorized or suspicious transactions. If you notice any unfamiliar activity, report it to your bank immediately. Most banks offer online tools that allow you to set up account alerts for certain activities, such as large withdrawals or purchases above a specific threshold. These alerts can be delivered via email or text message, providing real-time updates on your account's activities. Stay proactive and attentive to any potential signs of fraudulent activity, and promptly report any discrepancies to your bank for investigation and resolution. Setting up a student bank account is a straightforward process that provides numerous benefits and opportunities for young individuals. By understanding eligibility requirements and gathering the necessary documents, students can embark on their financial journey with confidence. Taking advantage of special student benefits and offers, such as promotions and waived monthly fees or low balance requirements, enhances the overall banking experience. Moreover, utilizing online banking and mobile apps brings convenience and accessibility to managing finances effectively. However, amidst the convenience, ensuring safety and security measures, such as password management and two-factor authentication, becomes paramount in safeguarding financial information. By adopting responsible banking practices and diligently monitoring account activity, students can navigate the world of banking with greater ease and confidence, building a strong foundation for their future financial success.What Is a Student Bank Account?

Steps to Open a Student Bank Account

Step 1: Check Eligibility

Step 2: Gather Necessary Documents

Step 3: Research and Compare Bank Options

Step 4: Choose Preferred Bank

Step 5: Apply for the Account

Step 6: Make an Initial Deposit

Step 7: Complete the Application

Step 8: Receive Account Details

Step 9: Explore Account Benefits

Step 10: Practice Responsible Banking

Setting Up Online Banking and Mobile Apps

Registering for Online Banking

Downloading and Configuring Mobile Apps

Exploring Features and Benefits

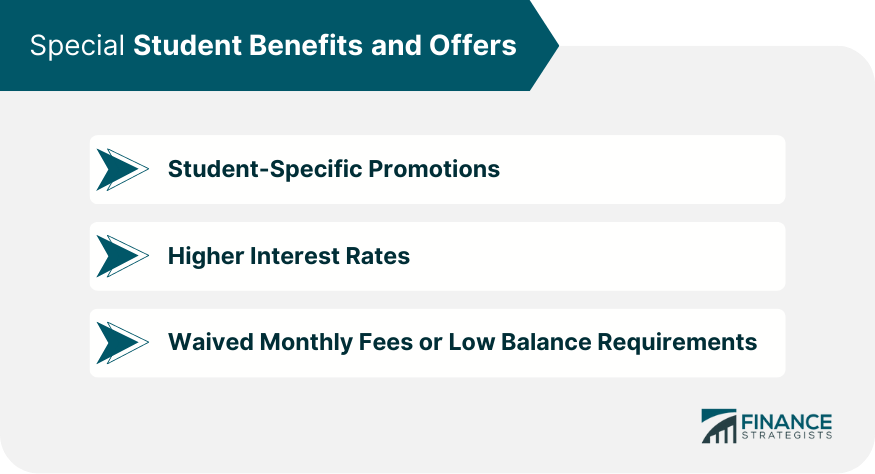

Special Student Benefits and Offers

Student-Specific Promotions

Interest Rates for Students

Waived Monthly Fees or Low Balance Requirements

Overdraft Protection and Limitations

Overdraft Protection

Overdraft Fees and Limitations

Safety and Security Measures

Password Management

Two-Factor Authentication (2FA)

Monitoring Account Activity

Conclusion

How to Open a Student Bank Account FAQs

To open a student bank account, ensure eligibility, gather required documents, research and compare bank options, apply in person or online, make the initial deposit, and enjoy the benefits tailored for students.

Yes, many banks offer student bank accounts to international students studying in the country. However, eligibility criteria and required documents may vary among banks. International students typically need to provide a valid passport, student visa, proof of enrollment, and local address details.

Student bank accounts often come with special benefits, including lower or waived fees. However, some accounts may still have fees for certain services, such as overdrafts or using out-of-network ATMs.

Many banks allow account holders to continue using their student bank accounts after graduation. However, some banks may convert the account to a regular checking or savings account with different terms and features.

Yes, student bank accounts often come with added perks. These benefits may include higher interest rates, special promotions, or access to financial education resources. Some banks also offer student-specific discounts or cash-back rewards for certain purchases.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.