Preventing bank account hacking requires a combination of vigilant practices and utilization of bank-provided security measures. Always use strong, unique passwords for your banking accounts, and consider enabling two-factor authentication for an added layer of security. Regularly monitor your account activity for any suspicious transactions, and promptly report any anomalies to your bank. Exercise safe internet browsing habits: Avoid clicking on suspicious links, refrain from downloading unknown attachments and use secure internet connections. Never share sensitive information like your social security number or bank account details. When using mobile banking, only use official banking apps and avoid public Wi-Fi networks. Stay informed about the latest security practices and make use of the security resources and education provided by your bank. Implementing these steps can significantly reduce the risk of bank account hacking. To effectively protect against bank account hacking, understanding the techniques hackers employ is crucial. Hackers utilize various methods to gain unauthorized access to bank accounts. Phishing scams, for instance, trick users into revealing their credentials. Malware, malicious software, can steal information or damage systems. ATM skimming involves capturing debit card information through a device installed on an ATM. Card cracking scams often persuade account holders to share their details with the promise of quick money. Factors that increase vulnerability to hacking include weak passwords, lack of two-factor authentication, unsecured internet connections, and falling victim to phishing scams or malicious software. Awareness of these risks is the first step in prevention. Prevention is key when it comes to bank account hacking. Here are several strategies that can enhance the security of your bank account. Strong passwords are a crucial defense against hacking. Passwords should be unique, complex, and not easily guessable. This involves using a combination of letters, numbers, and special characters and refraining from using personal information in your password. Two-factor authentication (2FA) adds an extra layer of security by requiring a second form of verification, such as a text message or biometric data, in addition to your password. Enabling 2FA can prevent unauthorized access even if your password is compromised. Regularly reviewing your account activity can help detect any unauthorized transactions. Many banks offer alert systems that notify you of any suspicious activities. Practicing safe internet browsing can reduce your risk of falling victim to online scams. This includes avoiding clicking on suspicious links, not downloading unknown attachments, and using secure and reliable internet connections. Guarding your personal information can prevent it from falling into the wrong hands. This means not sharing sensitive information like your social security number, bank account details, or PIN numbers. Mobile banking has its risks, but secure practices can mitigate them. This includes only using official banking apps, not using public Wi-Fi for banking, and regularly updating your smartphone's operating system and applications Banks play a significant role in preventing account hacking, both by implementing security measures and by responding effectively to hacking incidents. Banks employ a range of security measures to protect their clients' accounts. These include data encryption, regular security audits, fraud monitoring systems, and secure websites and applications. They also provide security resources and education to help customers protect themselves. In the event of a hacking incident, banks act promptly to secure the account, investigate the incident, and restore any lost funds as part of their fraud protection services. They also help victims take the necessary steps to protect themselves from future attacks. There are several legal protections in place to help victims of bank account hacking. Consumers have rights and protections under various federal laws. For instance, the Electronic Fund Transfer Act (EFTA) provides protections against electronic fraud, including bank account hacking. Under EFTA, a bank must investigate any errors reported by consumers and restore the stolen funds. If you suspect that your account has been hacked, it's important to report it to your bank immediately. The quicker the incident is reported, the better your chances of recovering your funds. Additionally, documenting the event and filing a police report can help with the reimbursement process. The future of bank account security will likely involve technological advancements and continued education. Emerging technologies like artificial intelligence (AI) and machine learning are promising new ways to enhance bank account security. AI, for instance, can be used to detect unusual activity or patterns that might indicate a hacking attempt. As hackers become more sophisticated, so must our defenses. This means staying informed about the latest hacking methods and how to protect against them. Banks and individuals must continually adapt to keep up with evolving threats. Bank account hacking is a real threat that can have severe financial implications. However, understanding how hacking occurs and the common techniques used by hackers can equip individuals with the knowledge necessary to protect their accounts. Implementing strong password practices, using two-factor authentication, regularly monitoring account activity, exercising safe internet habits, and safeguarding personal information are all pivotal in preventing hacking. Banks play a crucial role, both by employing robust security measures and by responding effectively to hacking incidents. Legal protections, like the Electronic Fund Transfer Act, also offer certain safeguards. Looking forward, technological advancements like artificial intelligence are promising new ways to bolster account security. Amidst all this, continuous learning remains key to adapting to the evolving landscape of cyber threats. Thus, to prevent bank account hacking, vigilance, knowledge, and proactive defense strategies are essential.Bank Account Hacking Prevention Overview

Understanding How Bank Account Hacking Occurs

Common Techniques Used by Hackers

Risks and Vulnerabilities

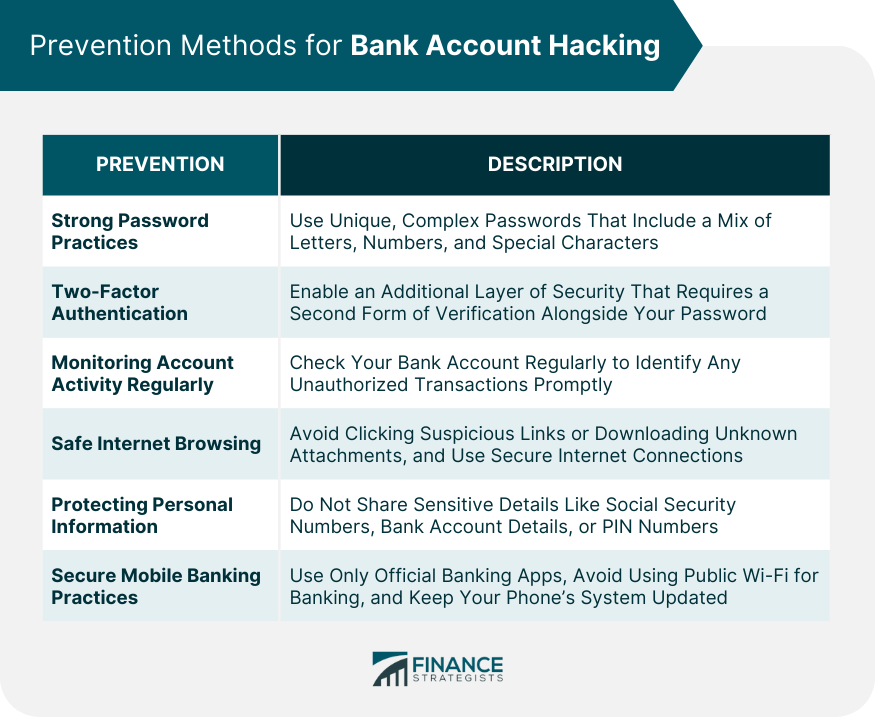

Prevention Methods for Bank Account Hacking

Establish Strong Password Practices

Use Two-Factor Authentication

Monitor Account Activity Regularly

Practice Safe Internet Browsing Habits

Protect Personal Information

Secure Mobile Banking Practices

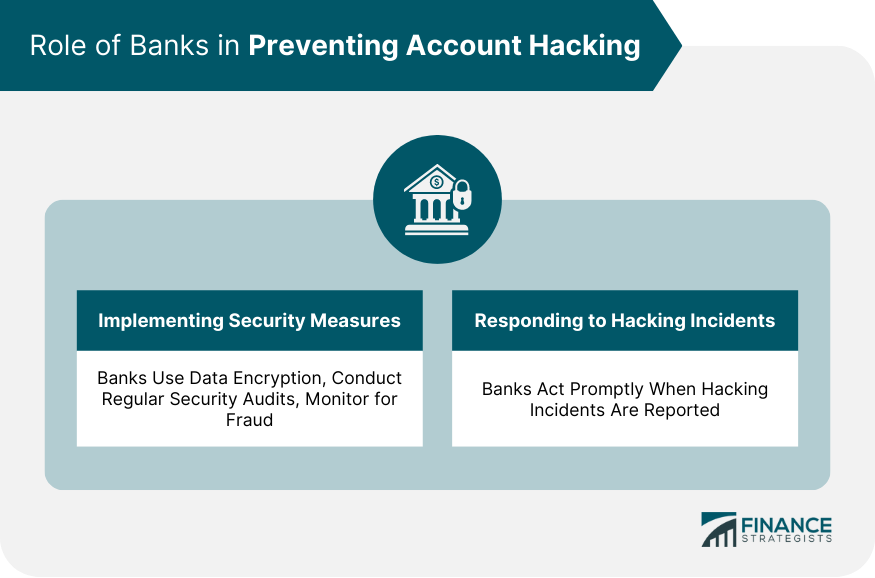

Role of Banks in Preventing Account Hacking

Security Measures Employed by Banks

How Banks Respond to Hacking Incidents

Legal Protections Against Bank Account Hacking

Consumer Rights and Protections

Report and Reimbursement Procedures

Future of Bank Account Security

Technological Advancements in Banking Security

Importance of Continuous Learning and Adaptation

Conclusion

How to Prevent Bank Account Hacking FAQs

Some key tips include creating strong and unique passwords, enabling two-factor authentication, monitoring your bank account activity regularly, practicing safe internet browsing habits, and never sharing your personal information like your bank account details or social security number.

Mobile users can prevent hacking by using only the official banking apps, avoiding banking on public Wi-Fi networks, keeping their mobile operating system and apps up to date, and following standard security practices like strong passwords and two-factor authentication.

Banks play a significant role by implementing robust security measures like data encryption, regular security audits, fraud monitoring systems, and secure websites and applications. They also provide resources and education to help customers protect themselves, and respond promptly and effectively to hacking incidents.

Federal laws, like the Electronic Fund Transfer Act, provide protections against electronic fraud, including bank account hacking. This law obligates banks to investigate reported errors and restore stolen funds.

Staying informed about the latest hacking techniques and security measures is crucial. Regularly check updates from your bank, engage with security resources, and educate yourself about cybersecurity. It's also important to keep an eye on emerging technologies enhancing bank account security.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.