To unfreeze a bank account, start by identifying the reason behind the freeze. This could be due to an overdrawn balance, legal judgments, suspected fraudulent activity, or violations of bank policies. Next, contact your bank immediately to understand the specific process for lifting the freeze. If it's an overdrawn balance, you may need to pay off the debt or establish a payment plan. For suspected fraud, you might have to verify your identity and validate recent transactions. If it's due to a legal judgment, resolving the outstanding issue with your creditor or presenting the case to a court may be necessary. To prevent future freezes, ensure regular account management, update personal information promptly, and stay within your account's stipulated terms and conditions. Banks have a responsibility to protect their financial interests, and one way they do this is by freezing accounts that have been overdrawn. Overdrawing occurs when the account holder withdraws more money than is available in the account, which can lead to significant debts. Banks may freeze the account until the negative balance is paid off. As a solution, most banks offer overdraft protection services that can help prevent overdrafts and the subsequent freezing of accounts. In our increasingly digital world, fraudulent financial activities have become more common. Banks use sophisticated algorithms to detect unusual activity in your account. If suspicious activity is detected, your account may be frozen to prevent further transactions and protect your money. Examples of fraudulent activities include large or unusual transactions, a rapid succession of transactions, or transactions in locations you don't typically visit. If you owe money to a creditor and have not made arrangements to pay the debt, the creditor may seek a court judgment to freeze your bank account. This process is known as a bank levy. Once the account is frozen, you won't be able to use it until the debt is paid off. This can be particularly challenging as it can disrupt your ability to manage your day-to-day finances. Banks are regulated entities, and they have obligations under the law to monitor and report any suspicious activities that may suggest money laundering or other illegal activities. If such activities are detected, your account may be frozen pending investigation. This freeze can last for an extended period depending on the complexity of the investigation. Every bank has policies that account holders must adhere to. Failure to comply with these policies may result in your account being frozen. This can include anything from not providing updated personal information to violating the terms of service. Managing your account balance is a simple but crucial step in preventing your account from being frozen. Regularly checking your balance, keeping track of incoming and outgoing transactions, and avoiding overdrafts are practical ways to ensure that your account remains in good standing. Banks often freeze accounts when they suspect that the account holder's information might be outdated or incorrect. Regularly updating your personal information, such as your address, contact number, and email, can help prevent such issues. By frequently reviewing your account activity, you can spot any suspicious transactions and report them to your bank. Early detection of fraudulent activities can prevent your account from being frozen and protect your finances. Understanding your bank's policies and staying up-to-date with any changes can help you avoid violating any terms that could lead to your account being frozen. It's advisable to read all communications from your bank and seek clarification if you're unsure about any terms or conditions. If your bank account has been frozen, the first step is to contact your bank. Reach out to your bank's customer service department or your bank manager and ask for the reasons behind the freeze. They can guide you through the necessary steps to unfreeze the account. Banks have set procedures in place for unfreezing accounts. They will provide you with instructions on the required documents, the time frame for resolution, and the steps you need to take. Following these instructions is crucial for the smooth unfreezing of your account. If the freeze on your account was due to a misunderstanding or a false fraud alert, clarify the situation with your bank as soon as possible. This could involve providing proof of identity or confirming recent transactions. If your account is frozen due to legal issues, such as unpaid debts, it's important to understand the legal implications. This freeze means a court has decided that your creditor has the right to access funds in your account to repay the debt. In these situations, you might need to consult with an attorney. They can provide advice on your rights and help you navigate the legal process of unfreezing your account. The payment of the debts or the judgment in question is usually the most straightforward way to unfreeze your account. Once your bank receives proof that you've paid, they should unfreeze your account. In some cases, you might be able to negotiate a payment plan with your creditors. If they agree, they may instruct the bank to unfreeze your account. If you can't pay off your debt in full, another option is to file a motion to release your bank levy. This can be a complex process and often requires the assistance of an attorney. If the court agrees to your motion, your bank will unfreeze your account. When a bank freezes an account due to suspected fraud, they're aiming to protect the account holder's funds. The bank will investigate the suspicious transactions, and if they find that fraud has occurred, they'll typically reimburse the account holder for any lost funds. If your account was frozen due to suspected fraud, you would need to prove your identity and confirm your recent transactions. This could involve answering security questions, providing identification documents, and reviewing your recent transactions with a bank representative. There are several measures you can take to protect your account from fraud in the future. These include regularly changing your online banking password, setting up account alerts for unusual activity, and being cautious about sharing your banking information. If your account was frozen due to being overdrawn, you'd need to pay back the amount you owe to unfreeze it. You might also have to pay additional fees or interest. If you're unable to pay back the overdrawn amount immediately, you might be able to arrange a repayment plan with your bank. This could involve making smaller, manageable payments over time until the debt is fully repaid. Preventing future overdrafts is crucial to avoid having your account frozen again. Consider setting up balance alerts, which notify you when your balance falls below a certain level. Also, create a budget and stick to it to ensure you're living within your means. Overdraft protection, a service provided by many banks, can also be a good safety net. Unfreezing a bank account, while potentially daunting, is manageable when you understand the reasons and procedures involved. Whether the freeze is due to an overdrawn balance, legal issues, fraud suspicions, or policy violations, communication with your bank is pivotal. Clearing misunderstandings, proving identity, or settling debts may be necessary, and legal counsel can be beneficial for complex cases. To prevent future freezes, adhere to good financial practices such as managing your account balance, updating personal information, reviewing account activity, and staying abreast of bank policies. By maintaining a proactive and responsible approach to your banking activities, you can navigate and even avert the inconvenience of a frozen bank account.How to Unfreeze a Bank Account

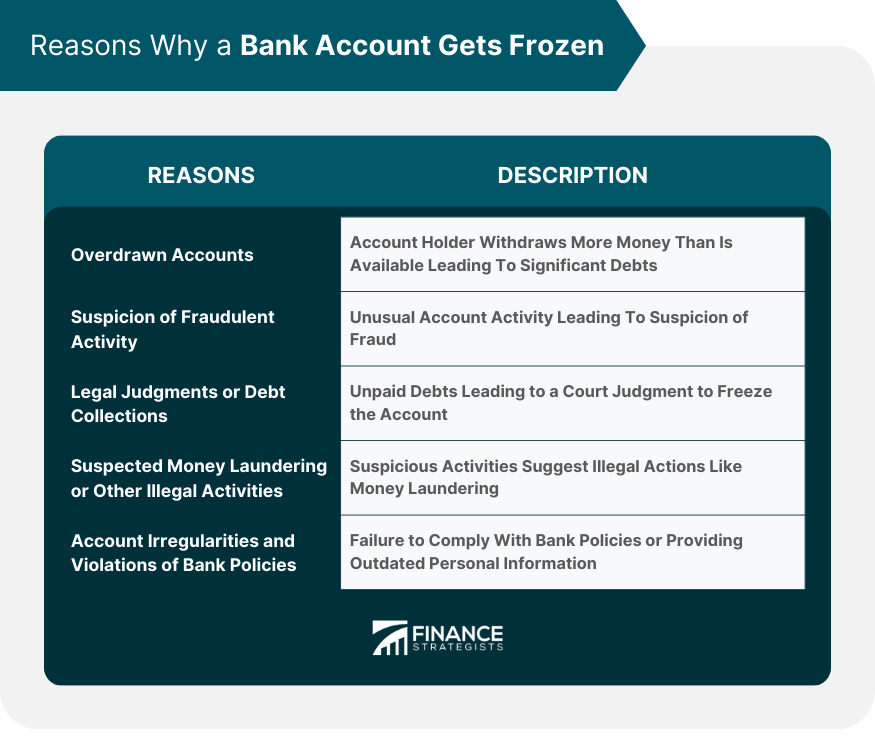

Reasons Why a Bank Account Gets Frozen

Overdrawn Accounts: Consequences and Solutions

Suspicion of Fraudulent Activity: How Banks Respond

Legal Judgments or Debt Collections: Process and Implications

Suspected Money Laundering or Other Illegal Activities

Account Irregularities and Violations of Bank Policies

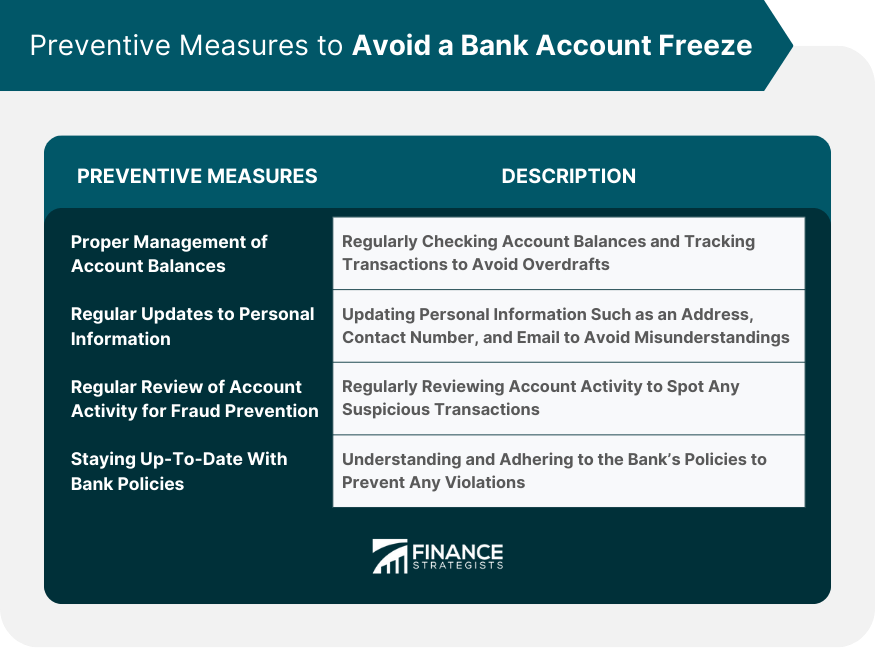

Preventive Measures to Avoid a Bank Account Freeze

Proper Management of Account Balances

Regular Updates to Personal Information

Regular Review of Account Activity for Fraud Prevention

Staying Up-To-Date With Bank Policies

Immediate Actions to Unfreeze a Bank Account

Contact Your Bank

Understand Bank’s Instructions

Clear up Misunderstandings or Fraud Alerts

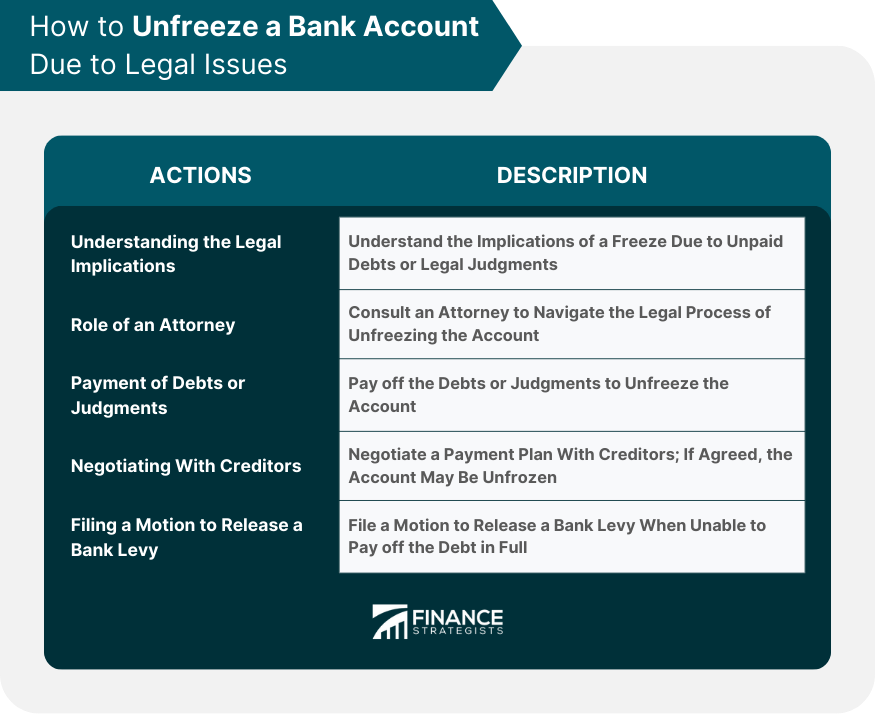

How to Unfreeze a Bank Account Due to Legal Issues

Understanding the Legal Implications of a Frozen Account

Role of an Attorney in Unfreezing a Bank Account

Payment of Debts or Judgments

Negotiating With Creditors

Process of Filing a Motion to Release a Bank Levy

Unfreezing a Bank Account due to Fraudulent Activity

How Banks Deal With Suspected Fraudulent Activity

Process of Proving Identity and Confirming Transactions

Measures to Take to Protect Your Account in the Future

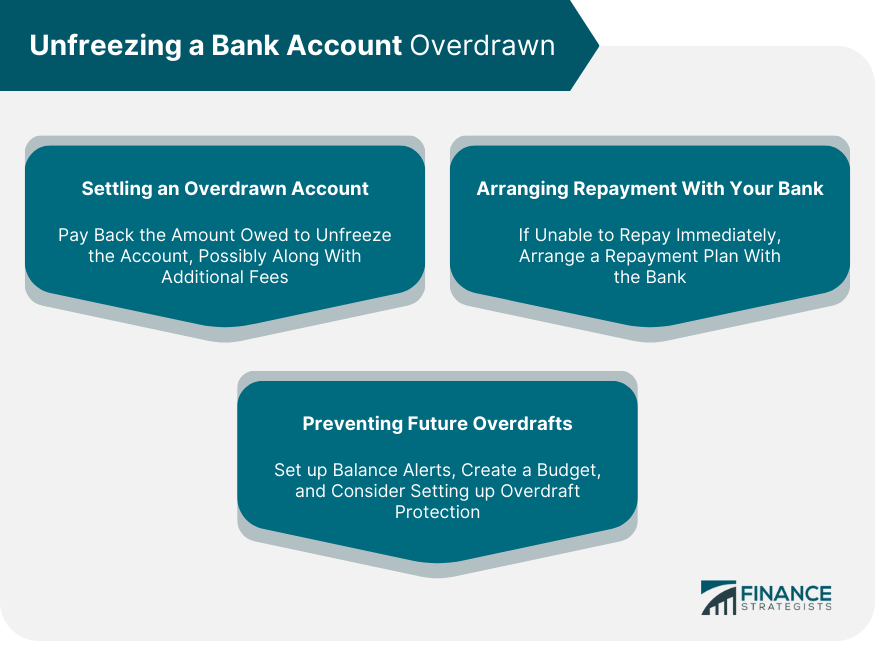

Unfreezing a Bank Account Overdrawn

Process for Settling an Overdrawn Account

Arrangements for Repayment With Your Bank

Measures to Prevent Future Overdrafts

Conclusion

How to Unfreeze a Bank Account FAQs

The first step you should take to unfreeze a bank account is to contact your bank. They will be able to inform you why the account was frozen and guide you on the necessary steps to resolve the issue.

The time it takes to unfreeze a bank account largely depends on the reason it was frozen. If it's a simple misunderstanding, the account could be unfrozen quickly. If the account is frozen due to legal issues or fraud, it might take a few days or even weeks to resolve.

Yes, typically, you can still make deposits into a frozen bank account, but you will not be able to withdraw or transfer funds until the account is unfrozen.

Banks can freeze your account without prior notice, especially in cases of suspected fraud or illegal activities. However, they usually inform the account holder about the freeze shortly afterward.

To prevent your bank account from being frozen in the future, maintain good financial habits, such as not overdrawing your account, regularly monitoring your account for suspicious activity, paying debts on time, and updating personal information with the bank as needed.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.