Joint Bank Account Pros and Cons

One of the decisions that couples have to make when they get married or move in together is whether to open a joint bank account or keep their finances separate.

A joint bank account is a type of bank account that allows two or more people to share access to the same funds and transactions.

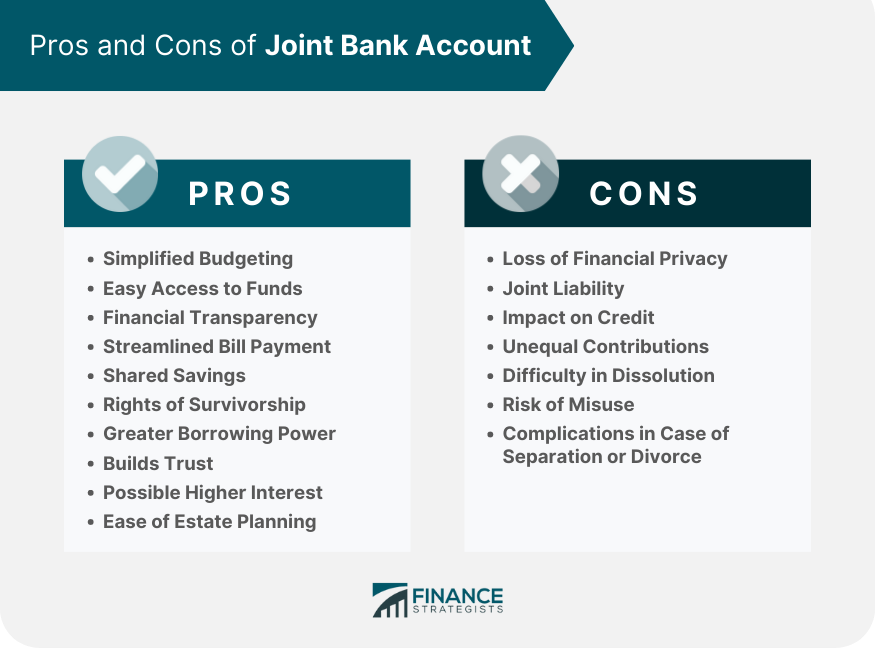

There are some advantages and disadvantages to having a joint bank account, depending on your situation and preferences.

Pros of a Joint Bank Account

Simplified Budgeting

One of the significant benefits of a joint bank account is streamlined budgeting. When multiple people contribute to shared expenses like rent, utilities, and groceries, tracking and splitting costs can get complicated.

A joint account can simplify this process, as all shared expenses and income can be managed from one place.

Easy Access to Funds

In emergencies, immediate access to funds can be crucial. In a joint bank account, all parties can withdraw money, providing an extra layer of financial security.

Financial Transparency

A joint bank account offers complete transparency for shared finances. All account holders can view all transactions, leading to open financial discussions and helping everyone understand the collective financial situation.

Streamlined Bill Payment

Paying shared bills is easier with a joint account. Instead of splitting bills and transferring money between individual accounts, you can pay all shared bills directly from the joint account.

Shared Savings

A joint account can also serve as a communal savings pot. Whether saving for a shared goal like a vacation or a home, a joint account can help you accumulate and manage shared savings.

Rights of Survivorship

In many cases, joint bank accounts have a feature called "rights of survivorship," meaning if one account holder passes away, the other becomes the sole owner of the account, bypassing complex legal processes.

Greater Borrowing Power

When applying for credit, a joint account can show greater financial stability and income, potentially leading to higher credit approvals.

Builds Trust

Sharing a bank account can build trust, as it requires open communication and mutual agreement on spending and saving habits.

Possible Higher Interest

Some banks offer higher interest rates for joint savings accounts, meaning your shared savings could grow faster.

Ease of Estate Planning

Joint accounts can simplify estate planning. The surviving account holder typically gets full ownership of the account, avoiding probate.

Cons of a Joint Bank Account

Loss of Financial Privacy

One drawback of joint accounts is the loss of financial privacy. Since all transactions are visible to all account holders, you won't have private finances unless you maintain a separate personal account.

Potential for Financial Disputes

Financial disagreements can cause strain in any relationship. Differences in spending habits or disagreements about how much each party should contribute can become contentious issues.

Joint Liability

Joint bank accounts come with joint liability. If the account goes into overdraft or incurs debt, all account holders are equally responsible, regardless of who caused it.

Impact on Credit

Mismanagement of a joint account, such as consistent overdrafts, can negatively impact all account holders' credit scores.

Unequal Contributions

Sometimes, one party may end up contributing more than the other, which could lead to disagreements or feelings of unfairness.

Difficulty in Dissolution

Closing a joint account or removing a party from it can be complicated, requiring agreement and cooperation from all parties.

Risk of Misuse

With equal access to funds, there's a risk that one party could misuse the funds, causing financial and personal issues.

Complications in Case of Separation or Divorce

In the case of a separation or divorce, dividing the money into a joint bank account can be complex and contentious, adding to an already stressful situation.

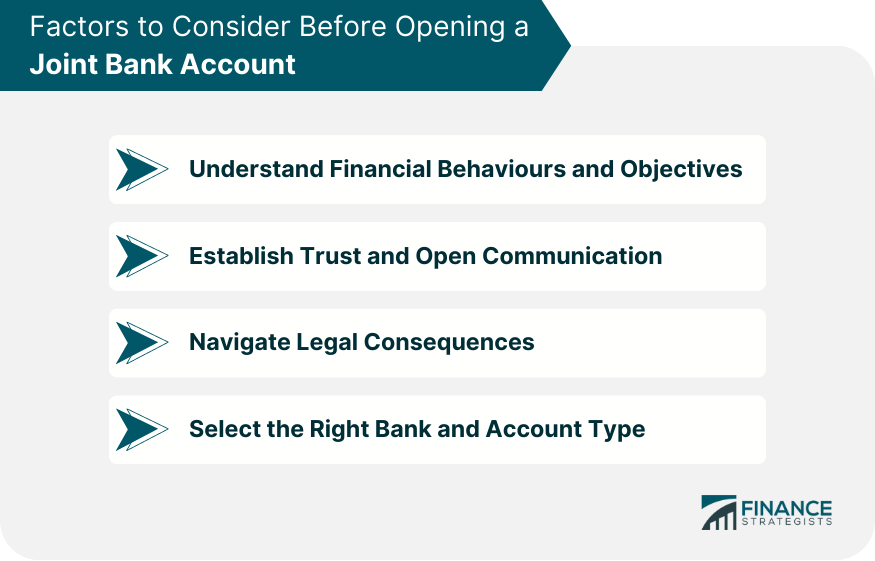

Factors to Consider Before Opening a Joint Bank Account

Understand Financial Behaviours and Objectives

Before taking the plunge and opening a joint bank account, it's essential to have an in-depth conversation about each party's financial habits and objectives.

Understanding each other's financial philosophies, spending patterns, and long-term financial goals is key. This mutual understanding can set the stage for successful shared financial management and ensure everyone is comfortable with the joint arrangement.

Establish Trust and Open Communication

Managing a joint bank account effectively requires a strong foundation of trust and open communication.

All parties should feel confident discussing financial matters honestly and transparently. Issues like spending limits, saving goals, and how to handle discrepancies should be communicated openly.

Establishing this foundation of trust and ongoing dialogue will help prevent misunderstandings and conflicts down the line.

Navigate Legal Consequences

It's important to be aware of the legal implications that come with a joint account. This includes understanding the liability issues - all parties are equally responsible for any debts incurred.

Additionally, the concept of "rights of survivorship" should be understood - the surviving account holder becomes the sole owner if the other passes away. Fully understanding these implications can prevent future legal complexities and disputes.

Select the Right Bank and Account Type

Lastly, not all joint bank accounts are created equal. Different banks offer various types of joint accounts, each with its own features, benefits, and drawbacks.

Researching the different options available, comparing interest rates, service fees, and account benefits is a crucial step.

Take time to thoroughly evaluate the options and choose a bank and account type that best aligns with your collective financial needs and goals.

Alternatives to Joint Bank Accounts

Separate Accounts With Authorized Users

One alternative to a joint account is having separate accounts and authorizing each other to access and use the accounts as needed. This allows for some level of shared finances while maintaining individual control over separate accounts.

Linked Accounts

Some banks offer the option to link separate accounts. This allows for easy transfers between accounts while keeping the accounts separate.

Financial Management Apps

Financial management apps can help track and manage shared expenses without the need for a joint account. These apps allow you to link individual bank accounts, track shared expenses, and make payments directly from the app.

Bottom Line

Joint bank accounts offer numerous benefits, including simplified budgeting, easy access to funds, financial transparency, streamlined bill payment, shared savings, and potentially higher credit approvals.

However, they also come with drawbacks such as the loss of financial privacy, the potential for financial disputes, joint liability, impact on credit scores, and potential complications in dissolution.

It's essential to consider factors like financial habits, trust levels, legal implications, and the specifics of the bank and account type before opening a joint account.

Alternatives such as separate accounts with authorized users, linked accounts, and financial management apps can offer some of the benefits of joint accounts without the potential drawbacks.

Ultimately, whether a joint bank account is right for you depends on your individual circumstances and needs.

Joint Bank Account Pros and Cons FAQs

A joint bank account is a shared bank account that two or more individuals, typically partners or family members, can access. All account holders have equal ownership, rights, and liabilities associated with the account.

Some advantages of a joint bank account include simplified budgeting, easy access to funds, financial transparency, streamlined bill payment, shared savings, greater borrowing power, and ease of estate planning. Joint accounts can also build trust between the account holders and sometimes offer higher interest rates.

Yes, there can be several drawbacks to a joint bank account. These include a loss of financial privacy, potential for financial disputes, joint liability for debts, impact on credit scores, unequal contributions, difficulty in closing the account, risk of misuse of funds, and potential complications during separation or divorce.

Before opening a joint bank account, consider the financial habits and goals of all parties, the level of trust and communication between them, the legal implications of joint account ownership, and the specifics of the bank and the type of account you're considering.

Yes, there are several alternatives to joint bank accounts. These include maintaining separate accounts with authorized users, linking individual accounts for easy transfers, or using financial management apps that allow users to track and split expenses.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.