Yes, you can open a bank account without a job. Many banks offer account options that cater to individuals who may not have a traditional job but still have alternative sources of income or funds. While not having a job may raise concerns for some banks, providing evidence of financial stability, such as a good credit score and proof of assets or investments, can increase the chances of getting approved for an account. Additionally, digital or online-only banks have emerged as a viable option for those without jobs, as they often have fewer requirements and may not demand a job as a prerequisite for account approval. Overall, individuals can explore various options and demonstrate financial responsibility to open a bank account successfully without a job. When it comes to opening a bank account without a job, it's essential to be aware of the available options. Understanding these options can help individuals make informed decisions and choose the account that best suits their financial situation. This account is designed for the primary purpose of saving money. Most banks offer basic savings accounts with minimal requirements, making them accessible to a broader range of people, including those without regular employment. One of the main advantages of a basic savings account is its ease of access. Opening such an account usually requires a lower minimum deposit compared to other account types, making it an attractive option for those with limited funds. This type of account is specifically designed for everyday transactions, such as depositing and withdrawing money, writing checks, and using a debit card for purchases. While a checking account may come with monthly fees, some banks offer fee waivers under certain conditions, making them more accessible to individuals with limited financial resources. These banks operate solely through online platforms, eliminating the need for physical branches and significantly reducing overhead costs. As a result, they often offer accounts with fewer fees and lower balance requirements, making banking more affordable for a broader audience. Digital banks may be more flexible in considering alternative sources of income or funds, making it easier for those without jobs to access essential banking services. Banks have specific criteria in place to assess an individual's eligibility for an account. While not having a job may initially appear as a barrier, there are alternative ways to demonstrate financial responsibility and stability. Some examples of alternative income sources that individuals can provide include • Unemployment Benefits: Individuals who are unemployed may be eligible for unemployment benefits from the government. These benefits can serve as a source of income and demonstrate that the applicant is receiving financial support during their job search. • Social Security Benefits: Those who are retired or have disabilities may receive social security benefits. These payments can indicate a stable source of income, even if the individual is not actively employed. • Retirement Income: Individuals who have retired but have a pension or retirement savings can use this as a valid source of funds when applying for a bank account. Banks often consider retirement income as a reliable stream of funds. • Freelance or Gig-Based Income: Some individuals may be engaged in freelance work or gig-based employment. Although not a traditional job, this type of income can still demonstrate financial stability and responsibility. Regardless of job status, showing financial stability is crucial when opening a bank account. Banks want to ensure that customers can manage their finances responsibly and avoid potential risks. Several factors can demonstrate financial stability: • Maintaining a Good Credit Score: A good credit score indicates a history of responsible borrowing and timely repayment. Even without a job, individuals can maintain a good credit score by ensuring that they pay their bills and debts on time. • Providing Proof of Assets or Investments: Owning valuable assets or having investments can signify financial stability. These assets can include real estate properties, stocks, bonds, or other valuable possessions. • Presenting a Comprehensive Budget Plan: Having a well-structured budget plan can show that the individual is financially conscious and capable of managing their expenses. A budget plan should outline income sources, expenses, and savings goals. These documents are essential for the bank to verify identity, comply with anti-money laundering policies, and assess the applicant's ability to manage their finances responsibly. The following identification documents are typically required: Valid Passport or Driver's License: A valid government-issued identification document, such as a passport or driver's license, is commonly used to verify the applicant's identity. Social Security Number or Tax Identification Number: Banks often request the applicant's Social Security Number (SSN) or Tax Identification Number (TIN). These numbers are used for tax reporting purposes and to prevent identity theft. Proof of Address: To ensure that the applicant has a verifiable residence, proof of address is essential. This can be in the form of utility bills, rental agreements, or other official documents showing the individual's name and residential address. While having a job is not a mandatory requirement, providing evidence of income or a reliable source of funds is crucial for account approval. The following documents can serve as proof of income or source of funds: • Bank Statements: Bank statements from the past few months can provide a clear picture of the individual's financial activity. Even if the income is not from traditional employment, regular deposits and transactions in the account can demonstrate a steady source of funds. • Government-Issued Benefit Award Letters: For individuals receiving government benefits such as unemployment benefits or social security benefits, providing benefit award letters can serve as proof of income. • Income Tax Returns: If applicable, income tax returns can be a valuable document to support the individual's financial standing. Tax returns provide information on income sources, deductions, and tax payments, offering a comprehensive view of the individual's financial situation. Once a bank account is successfully opened without a job, effective management and utilization of the account become vital for financial stability and well-being. Banks may impose various fees, and these can significantly impact the account balance. Some common fees include: • Monthly Maintenance Fees: These fees can vary depending on the account type and the bank's policies. It is essential to understand the terms and conditions related to these fees and explore options for fee waivers. • Transaction Fees: Banks may charge fees for certain transactions, such as ATM withdrawals, over-the-counter transactions, or wire transfers. These fees can add up over time, so it's essential to be aware of the costs associated with different banking activities. • Minimum Balance Requirements: Some accounts have minimum balance requirements, and falling below this threshold can result in additional fees or account downgrading. For individuals without a steady income, budgeting becomes even more essential to make informed financial decisions. • Tracking Income: Identifying all sources of income, such as government benefits, freelance work, or any other income streams, is essential for budgeting accurately. Tracking income helps individuals understand their cash flow and set realistic financial goals. • Managing Expenses: Categorizing and tracking expenses is crucial for staying within budget limits. Essential expenses such as housing, utilities, and groceries should be prioritized, while discretionary spending should be carefully managed. • Setting Financial Goals: Budgeting can also help individuals set financial goals, such as saving for emergencies or future expenses. Establishing clear objectives helps maintain focus and discipline in managing funds. Online banking and mobile app tools have revolutionized the way individuals manage their bank accounts. These digital solutions provide convenience and accessibility, particularly for those without jobs who may prefer digital banking services. Account Monitoring: Online banking platforms allow individuals to monitor their account balances, transaction history, and pending transactions in real time. This helps keep track of available funds and detect any unauthorized activity promptly. Transaction Management: Through online banking and mobile apps, users can initiate transactions, such as bill payments, fund transfers, and check deposits, without the need to visit a physical branch. Budgeting and Expense Tracking: These features enable individuals to gain better insights into their spending habits and make informed financial decisions. Mobile Deposit: With mobile banking apps, individuals can deposit checks remotely by simply capturing images of the checks using their smartphones. This eliminates the need to visit a physical bank branch for check deposits. Individuals can open a bank account without a job by considering alternative account options and demonstrating financial stability. Banks are becoming more inclusive, acknowledging various income sources beyond traditional employment. Providing evidence of reliable income, assets, and a good credit score can increase the chances of approval. Understanding bank requirements is essential, including providing proper identification and documentation to comply with regulatory policies. Effective management of the bank account involves budgeting and being mindful of associated fees to maintain a stable financial balance. Digital banking and mobile apps offer convenient tools for individuals without jobs to monitor their accounts, conduct transactions, and deposit checks remotely. With proper knowledge and planning, individuals can navigate the banking landscape and access essential financial services, irrespective of their job status.Can You Open a Bank Account Without a Job?

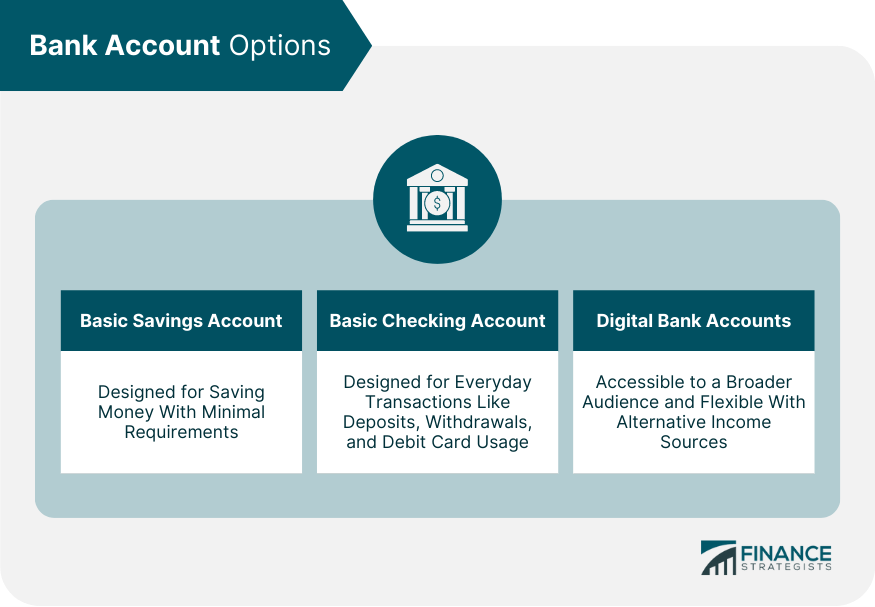

Understanding Bank Account Options

Basic Savings Account

Basic Checking Account

Digital Bank Accounts

Meeting Bank Requirements

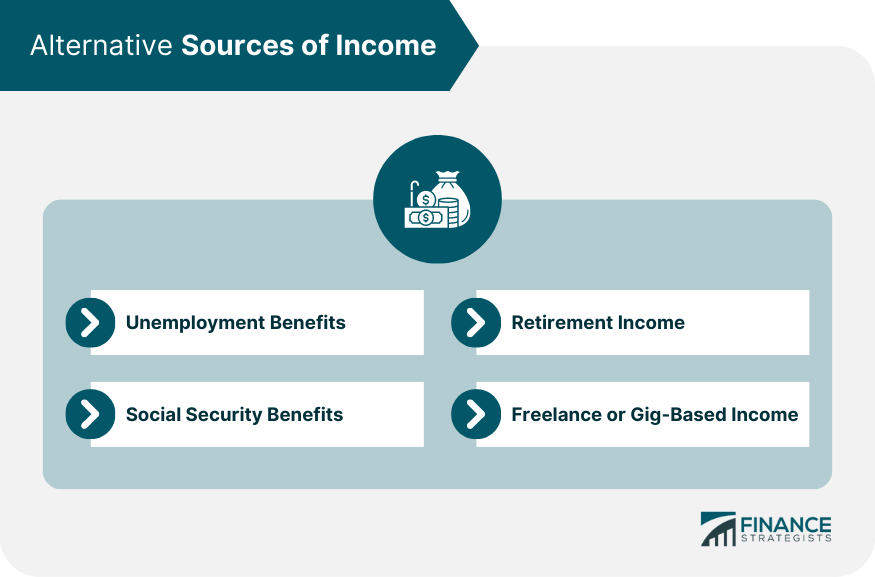

Providing Alternative Sources of Income

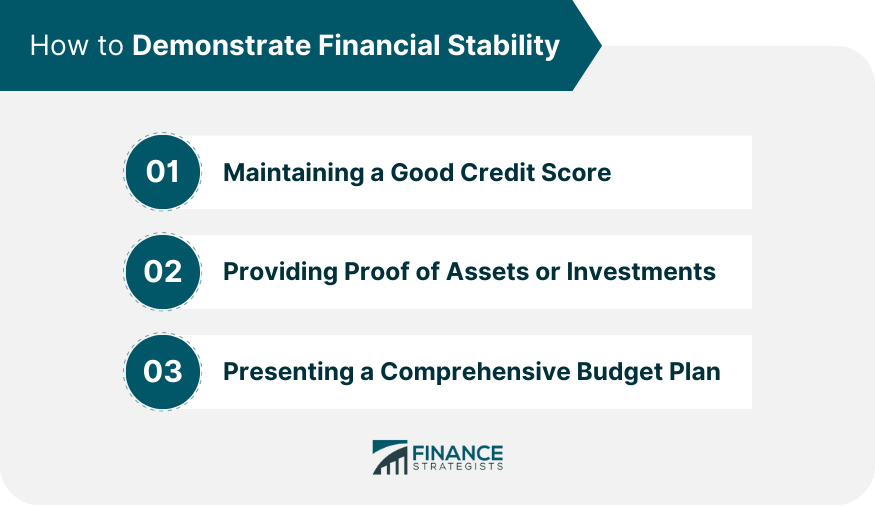

Demonstrating Financial Stability

Documents and Paperwork

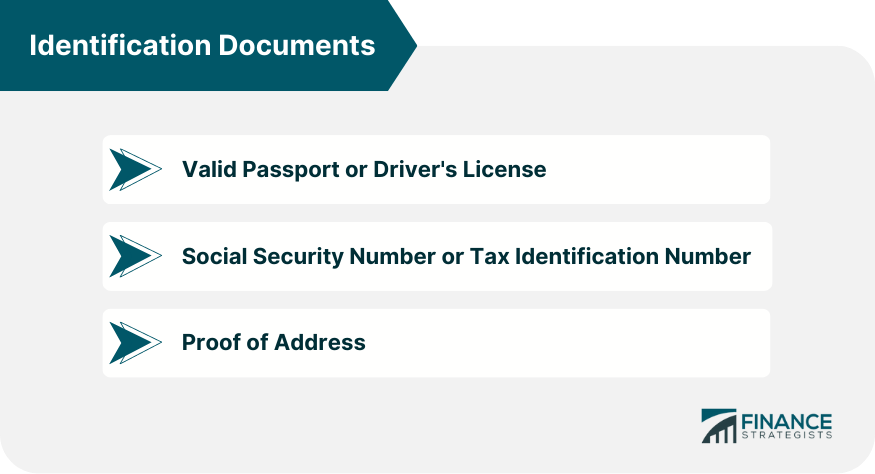

Identification Documents

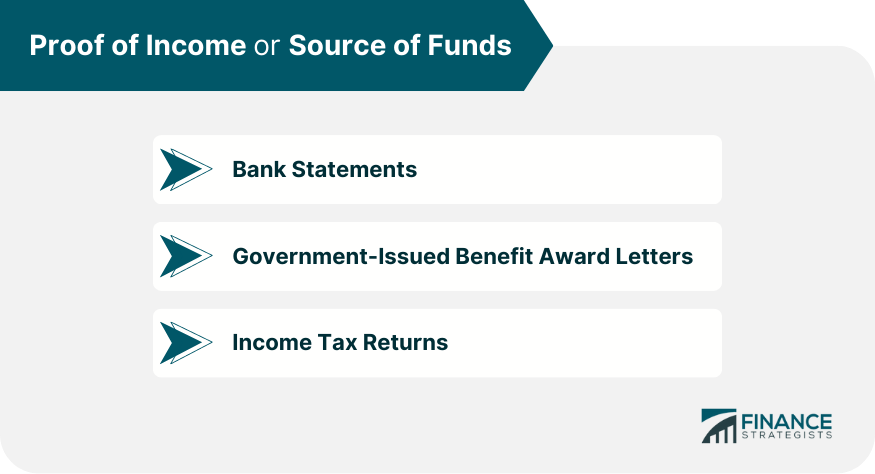

Proof of Income or Source of Funds

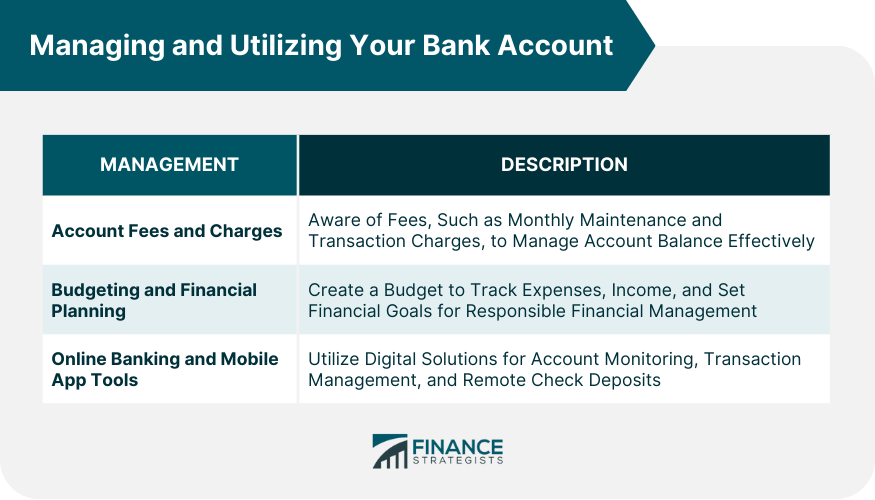

Managing and Utilizing Your Bank Account

Account Fees and Charges

Budgeting and Financial Planning

Online Banking and Mobile App Tools

Conclusion

Opening a Bank Account Without a Job FAQs

Yes, you can open a bank account without a job. Many banks offer account options that consider alternative sources of income or funds, making it accessible to individuals without traditional employment.

To open a bank account without a job, you typically need proper identification, such as a valid passport or driver's license, proof of address, and a Social Security Number or Tax Identification Number, to comply with regulatory policies.

Even without a job, you can demonstrate financial stability by maintaining a good credit score, providing proof of assets or investments, and presenting a comprehensive budget plan to showcase responsible financial management.

Yes, digital or online-only banks are a suitable option for those without jobs. They often have fewer requirements and may not demand a job as a prerequisite for account approval, making banking more accessible.

You can provide alternative income sources such as unemployment benefits, social security benefits, retirement income, and income from freelance or gig-based work to open a bank account without a job.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.