In the world of personal finance, managing savings effectively is crucial for achieving your financial goals. However, many individuals are often surprised to find that their savings accounts come with various fees that can eat into their hard-earned money. These savings account fees, although seemingly small, can accumulate over time and have a significant impact on your overall savings. Understanding the different types of fees associated with savings accounts is essential for making informed decisions about where to keep your money and how to optimize your savings strategy. Explore the common fees that banks may charge for savings accounts and gain insights into how you can minimize or avoid these costs to maximize savings potential. Savings account fees can vary widely depending on the financial institution and the specific services or account-related activities. Understanding how these fees are structured and how they impact an individual's savings account is crucial for effective financial management. This fee is charged on a regular basis, often monthly or quarterly, for simply keeping the savings account open and active. The amount of the monthly maintenance fee varies between banks and is often dependent on the type of savings account and the level of services provided. For some accounts, the fee may be waived if the account holder maintains a minimum balance or meets specific criteria set by the bank. However, for accounts with higher-tier features or premium benefits, the monthly maintenance fee may be higher. Account holders should carefully review the terms and conditions of their savings account to understand the exact requirements and implications of this fee. Savings accounts are subject to federal regulations that limit the number of certain types of withdrawals or transfers to six per month. If an account holder exceeds this limit, the bank may impose an excess withdrawal fee for each additional transaction. It is essential to be mindful of this restriction, as frequent or excessive withdrawals can lead to repeated excess withdrawal fees and might prompt the bank to convert the savings account into a checking account, which could have different fee structures. To avoid these charges, individuals should plan their withdrawals carefully and consider using other accounts, like checking accounts, for more frequent transactions. Some savings accounts require account holders to maintain a minimum average balance in their accounts. If the account balance falls below this threshold during a specific period, the bank may levy a minimum balance fee. The purpose of this fee is to encourage individuals to keep a certain level of funds in their savings account. It is crucial to be aware of the minimum balance requirement and strive to maintain the necessary funds to avoid incurring this fee. To do so, account holders can set up budgeting strategies and regularly monitor their account balance to ensure compliance with the bank's requirements. While savings accounts are designed for long-term saving, there are instances when an account holder decides to close their account. Some banks may charge an account closure fee when an account is closed within a specific period after opening it. This fee can vary depending on the bank and the type of account. Account holders should check their bank's policies to understand the associated fees and timeframes for account closure. To avoid this fee, individuals should carefully consider their decision to close the account and explore other options, such as account upgrades or switching to a different type of savings account, before initiating the closure process. Although savings accounts are primarily intended for saving, some financial institutions allow limited ATM withdrawals. However, if the account holder exceeds the allowed number of free ATM transactions, they may face ATM transaction fees for subsequent withdrawals. The ATM transaction fee can vary depending on the bank and the number of excess transactions made. To avoid these fees, individuals should be aware of their account's ATM withdrawal limits and plan their cash withdrawals accordingly. Some individuals link their savings accounts to their checking accounts for overdraft protection. If the checking account does not have sufficient funds to cover a transaction, the bank may transfer funds from the savings account to cover the shortfall. In such cases, an overdraft fee could be applied. It is crucial for account holders to understand the terms and conditions associated with overdraft protection to avoid unexpected fees. When an account holder transfers funds from their savings account to another account within the same bank or to an account at another financial institution, a transfer fee may be charged. This fee can be a flat rate or a percentage of the amount being transferred, depending on the bank's policies. For more significant transfers, such as sending money domestically or internationally through a wire transfer, banks may charge a wire transfer fee. Wire transfers are often used for urgent or high-value transactions, and the fees can vary depending on the destination and currency involved. To avoid excessive wire transfer fees, account holders should explore alternative methods of transferring funds, such as electronic fund transfers or online payment platforms, which may offer more cost-effective solutions. If a check or payment is deposited into the savings account, but it is later returned due to insufficient funds or other reasons, the bank may impose a returned deposit fee. This fee aims to cover the administrative costs and inconvenience caused by the returned transaction. To prevent returned deposit fees, individuals should ensure that all checks or payments deposited into their savings account are valid and backed by sufficient funds. Many banks encourage electronic communication and offer paperless statements to account holders. However, for those who prefer printed records, some banks may charge a fee for providing paper statements. Opting for electronic statements can save on this fee and contribute to environmental sustainability. Successfully managing savings account fees involves adopting proactive strategies to reduce or eliminate unnecessary charges. Here are some tips to help account holders minimize savings account fees: To avoid minimum balance fees, account holders should be diligent about monitoring their account balance and ensuring it meets the bank's requirements. Depending on the account type and bank, the minimum balance may vary, so individuals should be aware of the specific amount they need to maintain. Researching and selecting fee-friendly savings accounts can help individuals avoid unnecessary expenses. Some banks offer accounts with no monthly fees or lower fees for specific features, making them more cost-effective options for account holders. Certain banks may waive monthly maintenance fees if the account holder sets up direct deposit. By having a portion of their income directly deposited into their savings account, individuals can benefit from this fee waiver and ensure a regular inflow of funds. Regularly reviewing account statements and monitoring account activity is crucial for detecting any unauthorized fees or errors. By promptly addressing any discrepancies, account holders can avoid unnecessary charges and maintain better control over their savings account. Choosing electronic statements over paper statements not only saves on paper statement fees but also contributes to environmental sustainability. Account holders can access their account information securely online and view transaction history without incurring paper-related charges. Many banks offer fee waivers for certain types of savings accounts or for account holders who meet specific qualifications. These qualifications might include maintaining a higher account balance or having multiple accounts with the same financial institution. Account holders should explore the fee waiver options available to them and ensure they meet the necessary criteria. In some cases, account holders may be able to negotiate with their bank to have certain fees waived or reduced. Having a long-standing relationship with the institution, maintaining substantial account balances, or being a loyal customer can be leverage for such negotiations. It is essential to approach the bank with a reasonable request and be prepared to explain the reasons for seeking fee adjustments. A savings account is a valuable financial tool offered by banks and credit unions, enabling individuals to securely deposit and grow their money through earned interest. However, account holders must be aware of various savings account fees that can impact their financial health. These fees include the monthly maintenance fee, excess withdrawal fee, minimum balance fee, account closure fee, ATM transaction fee, overdraft fee, transfer fee, wire transfer fee, returned deposit fee, and paper statement fee. Account holders can implement strategies such as maintaining a minimum balance, choosing fee-friendly accounts, setting up direct deposit, opting for electronic statements, understanding fee waivers, and negotiating with the bank. By being proactive and informed, individuals can maximize the benefits of their savings accounts while minimizing unnecessary expenses.What Are Savings Account Fees?

Types of Savings Account Fees

Monthly Maintenance Fee

Excess Withdrawal Fee

Minimum Balance Fee

Account Closure Fee

ATM Transaction Fee

Overdraft Fee

Transfer Fee

Wire Transfer Fee

Returned Deposit Fee

Paper Statement Fee

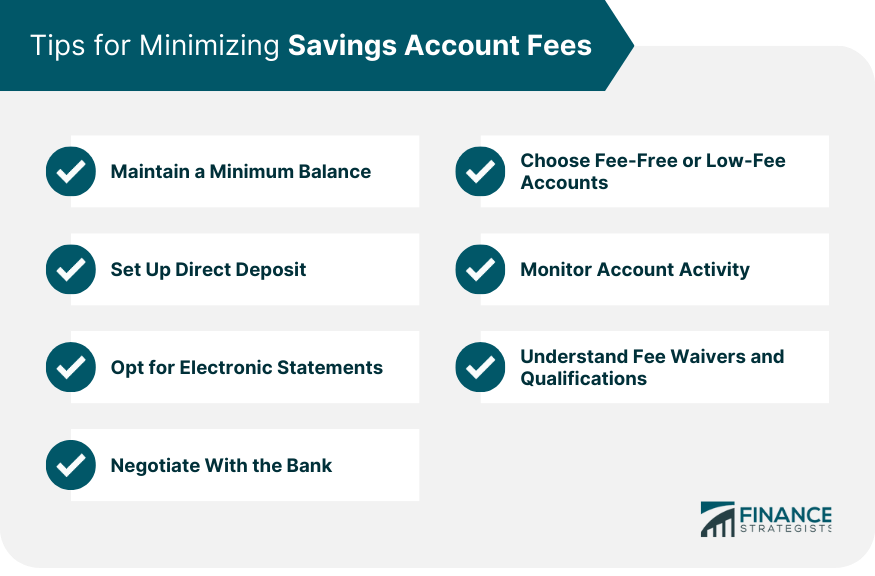

Tips for Minimizing Savings Account Fees

Maintaining a Minimum Balance

Choosing Fee-Free or Low-Fee Accounts

Setting up Direct Deposit

Monitoring Account Activity

Opting for Electronic Statements

Understanding Fee Waivers and Qualifications

Negotiating With the Bank

Conclusion

Savings Account Fees FAQs

Savings account fees are charges imposed by banks for various services and transactions related to maintaining a savings account.

The amount of savings account fees can vary depending on the bank and the specific services. Common fees include monthly maintenance fees, excess withdrawal fees, and ATM transaction fees.

Yes, many banks offer options to waive monthly maintenance fees. Maintaining a minimum balance, setting up direct deposit, or having multiple accounts with the same bank are some common ways to avoid these fees.

Yes, some banks charge excess withdrawal fees if you exceed the federally mandated limit of six withdrawals per month. However, withdrawals made in person at the bank or ATM transactions may not be subject to this limit.

To minimize fees, consider selecting a bank with low or no fees, review account terms and conditions carefully, opt for electronic statements, and be mindful of your account activity to avoid unnecessary charges.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.