A student bank account is a unique financial product tailored specifically for those in higher education. Banks understand that students have different financial needs than typical customers and thus offer these specialized accounts. These accounts often come with features like low fees, lower minimum balance requirements, and sometimes, overdraft protection, recognizing the unique financial challenges that students face. Student bank accounts serve more than just a basic financial function; they offer students an important first step into the world of personal finance. These accounts are a valuable educational tool, enabling students to learn money management skills, like budgeting, saving, and balancing income and expenses. As many students are managing their finances for the first time, a student bank account can serve as a crucial stepping stone toward financial independence. Applying for a student bank account usually requires proof of enrollment at a higher education institution. Most banks require a student ID or acceptance letter as evidence. The process typically involves completing an application form, either online or at a branch. Some banks also require proof of address or other identification documents, so it's important to have these handy when applying. Student bank accounts offer several features designed to accommodate the lifestyle and needs of students. These may include mobile and online banking, direct deposit, fee-free transactions, and overdraft protection. Some banks even offer financial management tools, like spending trackers and budgeting tools, to help students manage their finances effectively. Maintaining a student bank account is usually straightforward. Most banks require the account to be used regularly for its intended purpose, like receiving student loan payments or other forms of income. Some banks may also require students to confirm their student status annually to ensure they're still eligible for the account. One of the key benefits of a student bank account is its affordability. Many banks offer these accounts with low or no monthly fees, understanding that many students operate on a tight budget. Furthermore, many student accounts come with other cost-saving features, like low-fee or fee-free money transfers, free checks, and no minimum balance requirements. Perhaps one of the most important benefits of a student bank account is its role as a tool for financial education. It allows students to acquire a hands-on understanding of how real-world finance works, equipping them with skills to manage funds effectively. By managing their own accounts, students learn the importance of budgeting, saving, and strategizing for future financial security, setting them up for successful money management in adulthood. Also, many banks offer financial literacy resources to their student customers, providing valuable guidance on how crucial it is to keep enough money in their account to avoid fees, and see how even a small amount, when saved regularly, can grow over time. Many banks offer robust mobile and online banking features with their student bank accounts, enabling students to manage their money on the go. From transferring funds to paying bills or checking account balances, these tasks can be done quickly and easily from a computer or smartphone. Many banks also offer features such as mobile check deposit, which allows students to deposit checks using their smartphone's camera. This level of accessibility makes managing money much more straightforward for students, who often juggle hectic schedules. With easy access to banking services, they can keep track of their finances anytime, anywhere. While it's crucial for students to learn to budget wisely and avoid overspending, sometimes, mistakes happen. Overdraft protection is a common feature in student bank accounts that can provide a safety net in such instances. If a student accidentally spends more than what's available in their account, the bank can cover the difference up to a certain limit. This feature can be a lifesaver, especially in emergency situations. It can help prevent the embarrassment and inconvenience of declined transactions when there are insufficient funds in the account. Additionally, it can stop checks from bouncing, an event which not only can cause financial disruption, but also damage one's credit history. The overdraft protection saves the account holder from incurring hefty fees typically associated with banking mishaps. However, it is essential to remember that overdraft protection is not a free pass to overspend - it's a safety net meant to catch occasional mistakes. While student bank accounts offer many benefits, they also come with some limitations. One of the key restrictions is that they often offer limited services compared to regular bank accounts. For example, student accounts may not come with the same variety of credit products or access to investment services. They're designed to offer basic banking services, and while they can meet most students' needs, they may not offer every service a student might want. Despite offering overdraft protection, student bank accounts often come with strict regulations around this feature. Banks typically limit the amount a student can overdraw, and the overdraft protection is usually only free up to a certain limit. Exceeding this limit may lead to substantial fees, which can make the financial situation even more challenging for students. Understanding the terms and conditions of a bank account, including fees, interest rates, and withdrawal limits, is critical when choosing a student bank account. Banks often advertise attractive features, but it's important to scrutinize the fine print to ensure there are no hidden costs or conditions. Choosing the right student bank account also involves comparing different accounts. Each bank has different features, terms, and conditions, so students should compare these aspects to identify the account that best suits their needs. An overdraft can be a useful safety net for unexpected expenses, but over-reliance on it can lead to a cycle of debt. This habitual overdrawing often results in hefty fees and interest payments, eating away at their limited resources. Additionally, it establishes unhealthy financial habits that can be hard to break in the future, leading to prolonged financial difficulties. Reviewing these statements can help students spot any errors, avoid fees, and keep track of their spending. This promotes financial literacy, helping students become more informed and responsible in managing their personal finances. Mismanagement of student loan deposits can lead to financial difficulties. It's essential to remember that these funds should last the entire term or year and cover essential costs like tuition fees and living expenses. Student bank accounts are critical financial tools designed specifically for the unique needs of students. With features like lower fees and balance requirements, they provide an excellent introduction to personal finance. These accounts facilitate financial transactions, offer educational opportunities, and help students build valuable money management skills. However, like any financial tool, they come with limitations and require careful use. Understanding the terms, comparing different accounts, and avoiding common mistakes like overdraft overuse or mismanaging loans, are crucial steps towards utilizing these accounts effectively. Ultimately, a student bank account is a foundational element in the journey towards financial independence, enabling students to navigate their financial affairs during their academic yearsWhat Is a Student Bank Account?

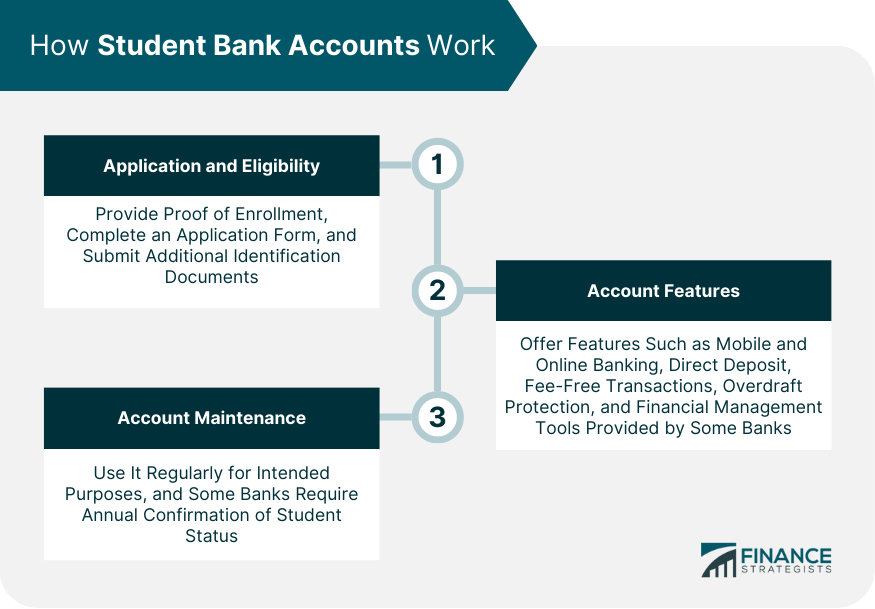

How Student Bank Accounts Work

Application and Eligibility

Account Features

Account Maintenance

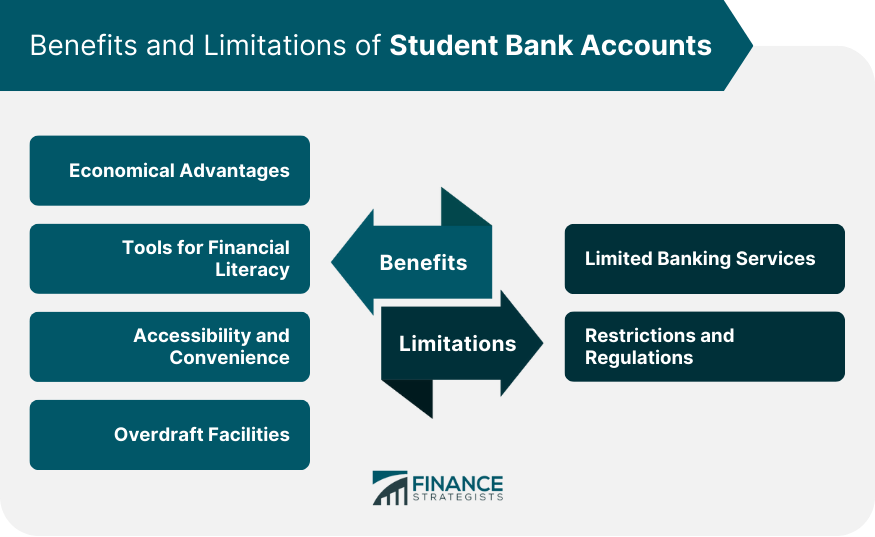

Benefits of Student Bank Accounts

Economical Advantages

Tools for Financial Literacy

Accessibility and Convenience

Overdraft Facilities

Limitations of Student Bank Accounts

Limited Banking Services

Restrictions and Regulations

Choosing the Right Student Bank Account

Understand the Fine Print

Compare Different Accounts

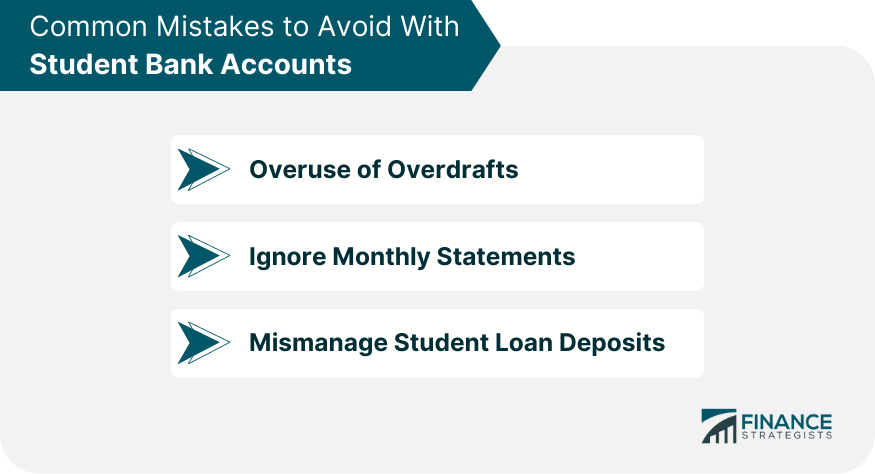

Common Mistakes to Avoid With Student Bank Accounts

Overuse of Overdrafts

Ignoring Monthly Statements

Mismanaging Student Loan Deposits

Conclusion

Student Bank Account FAQs

A Student Bank Account is a specific type of bank account designed for students in higher education. It often includes features tailored to their needs, such as lower fees, lower minimum balance requirements, and sometimes overdraft protection.

Typically, anyone enrolled in a higher education institution like a university or college can open a Student Bank Account. Most banks require proof of student status, such as a student ID or admission letter.

The benefits of a Student Bank Account include lower costs (reduced or no fees), easy access to banking services, financial education tools, and sometimes, an overdraft facility. These accounts are designed to help students manage their finances effectively.

Drawbacks of a Student Bank Account may include limited services compared to regular bank accounts, restrictions around overdraft facilities, and the potential for financial mismanagement if not used responsibly.

When choosing a Student Bank Account, it's important to understand the terms and conditions, scrutinize the fees and benefits, and compare different accounts. Look for accounts that offer features most relevant to your financial needs and habits.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.