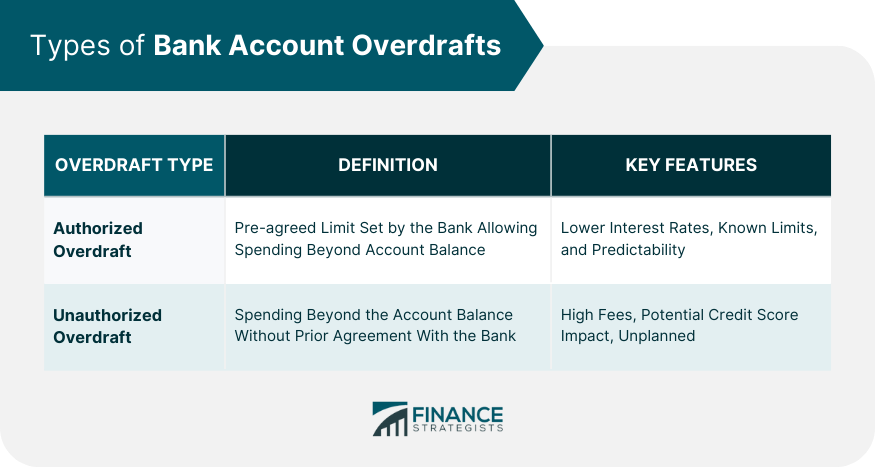

A bank account overdraft occurs when an account holder withdraws more money than is available in their account, creating a negative balance. This is typically allowed as a form of short-term lending to cover unexpected expenses. However, banks usually charge an overdraft fee for this service. The fees and rules vary by institution, and if not managed well, overdrafts can become costly. Some banks offer overdraft protection programs, which link a savings account, credit card, or line of credit to the checking account to cover the overdraft. While this can avoid overdraft fees, it may involve other charges. Customers must opt into these services. Recently, the regulatory focus on transparency and fairness has led many banks to modify their overdraft policies. For consumers, understanding how overdrafts work, including fees and protection options, can help manage finances and avoid unnecessary costs. An authorized overdraft, often known as an arranged overdraft, is a pre-agreed limit set by your bank, allowing you to spend more than the current balance in your account. It's like having a short-term loan that you can dip into whenever needed. This ensures flexibility and provides a safety net during financial crunches. Authorized overdrafts often come with a lower interest rate compared to unauthorized ones. They might also offer a buffer zone, a certain amount where no interest is charged. A clear benefit of these overdrafts is their predictability; account holders know the limits and associated costs upfront. Furthermore, it gives a sense of financial security, knowing that there's a pre-arranged limit available. These overdrafts are commonly used by individuals who may have irregular income streams such as freelancers or business owners. They are also beneficial for individuals who might face unexpected large expenses and need a short-term financial cushion. In addition, in a rapidly changing economic landscape, having this option can provide much-needed relief. An unauthorized overdraft, sometimes known as an unarranged overdraft, happens when an account holder exceeds their account balance without a prior agreement with their bank. It could occur inadvertently, like when a standing order goes out, but the account lacks sufficient funds. Such overdrafts can sometimes catch account holders by surprise and lead to unplanned expenses. The financial implications of falling into an unauthorized overdraft can be hefty. Banks often charge high interest rates, daily fees, or both. Additionally, continuous usage of unauthorized overdrafts can potentially harm one’s credit score. It’s also worth noting that excessive reliance on such overdrafts can strain financial resources and create budgeting challenges. Prevention is often about vigilance and sound financial habits. Regularly monitoring account activities, using mobile banking alerts, and having a basic budgeting system can help individuals avoid the pitfalls of unauthorized overdrafts. Staying informed about upcoming payments and ensuring there's a buffer in the account can be another effective strategy. While an authorized overdraft might suit someone with an irregular income, it might not be necessary for someone with a stable monthly salary. Assessing one's spending habits and income can provide clarity on which overdraft type might be the best fit. For instance, a frequent traveler might have different needs compared to someone with fixed monthly expenses. Overdrafts, like any financial service, come with costs. It's essential to be clear on the interest rates charged, any daily or monthly fees, and other hidden costs that might come with overdraft services. Sometimes, the aggregate costs over time can outweigh the convenience an overdraft offers, so it's vital to do the math. Frequent dips into unauthorized overdrafts can be a red flag for credit agencies. Keeping an eye on one’s credit report and understanding how overdraft usage affects it is vital. Additionally, lenders might view heavy overdraft usage as a sign of financial instability, which can impact borrowing capabilities in the future. Some banks might offer promotional periods with reduced interest rates, or they might have a cap on overdraft fees. It’s essential to be aware of these nuances when choosing an overdraft service. Thoroughly reading the terms and conditions can illuminate any potential limitations or opportunities. Regularly checking your account can help spot any potential overdrafts before they occur. Most banks offer online services and apps that make this task a breeze. With real-time transaction updates, it becomes easier to keep a tab on available funds. Many banking apps allow users to set up alerts when their account balance drops below a certain threshold, helping in preempting any unintentional overdrafts. Such alerts act as a timely reminder, ensuring that the account holder can take corrective action promptly. Financial apps and tools can offer insights into spending habits, helping users anticipate monthly expenses and adjust their spending accordingly. These tools, when used efficiently, can provide a holistic view of one's finances, highlighting areas where savings are possible. A buffer of three to six months' worth of expenses can be an invaluable safety net. Not only does this provide peace of mind, but it also reduces the reliance on overdrafts. Over time, this fund can grow, providing even more financial stability and resilience against unexpected expenses. Various consumer protection laws ensure that banks provide clear information about the costs associated with overdrafts. Familiarizing oneself with these can help users know their rights in the event of a dispute. Moreover, in cases where the bank might not adhere to the agreement, consumers have legal avenues to address grievances. Banks have a duty to disclose the terms and conditions of their overdraft services transparently. This includes interest rates, fees, and the implications of using the service. Ensuring clarity in these disclosures is not just good practice; it’s a regulatory requirement, aimed at maintaining trust and transparency between banks and their customers. Meta Description: Discover the essentials of bank account overdrafts, distinguishing between authorized and unauthorized types, their implications, and management tips. Bank account overdrafts, while offering a temporary solution for unexpected financial needs, come with both benefits and drawbacks. Authorized and unauthorized overdrafts serve different financial needs. Authorized overdrafts provide a predictable, flexible solution with usually lower interest rates, ideal for those with irregular income. Unauthorized overdrafts can occur unexpectedly, often leading to high fees and potential credit score implications, but may be a necessary last resort in emergencies. It's crucial to understand the mechanisms and potential costs of both types, and implement sound financial management strategies to minimize risks. Remember that each consumer's needs and financial behavior are unique, so it's crucial to consider individual financial circumstances when opting for an overdraft service. If you're looking to gain a better understanding of overdraft services or to explore the most suitable options for your financial needs, consider reaching out to a trusted banking professional today.Overview of Bank Account Overdrafts

Types of Bank Account Overdrafts

Authorized Overdrafts

Definition and Operation

Features and Benefits

Typical Users and Beneficial Situations

Unauthorized Overdrafts

Definition and Distinction

Consequences and Fees

How to Prevent Unauthorized Overdrafts

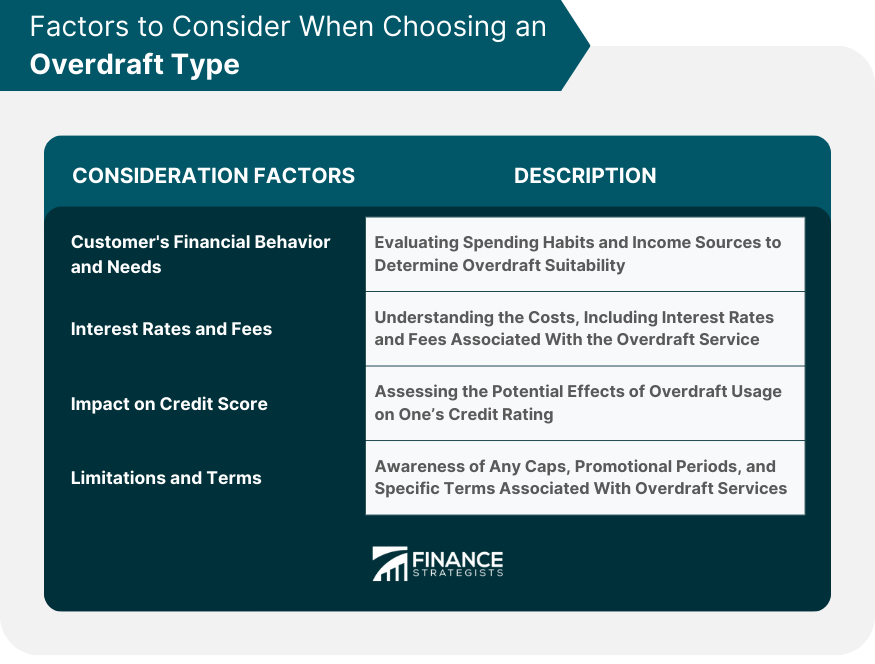

Factors to Consider When Choosing an Overdraft Type

Customer's Financial Behavior and Needs

Interest Rates and Fees

Impact on Credit Score

Limitations and Terms

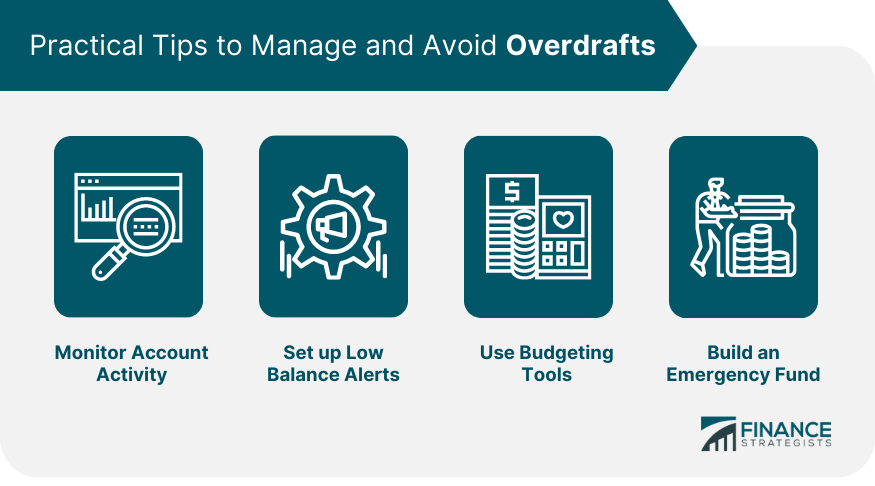

Practical Tips to Manage and Avoid Overdrafts

Monitor Account Activity

Set up Low Balance Alerts

Use Budgeting Tools

Build an Emergency Fund

Legal and Regulatory Aspects of Overdrafts

Consumer Rights and Protections

Bank Policies and Disclosure Requirements

Bottom Line

Types of Bank Account Overdrafts FAQs

An overdraft occurs when you spend more than the available balance in your bank account, either planned with the bank or unplanned.

An authorized overdraft is a pre-agreed limit with your bank, whereas an unauthorized overdraft occurs without prior arrangement, often incurring higher fees.

Yes, unauthorized overdrafts often have hefty fees, higher interest rates, and can negatively impact one’s credit score.

Regular account monitoring, setting low balance alerts, and effective budgeting can help prevent unauthorized overdrafts.

Frequent unauthorized overdrafts can be viewed negatively by credit agencies, potentially harming your credit score and future borrowing capabilities.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.