A bank scam, also known as a financial scam, involves deceitful and fraudulent activities aimed at exploiting individuals, financial institutions, or weaknesses in the banking system for illegal monetary gains or sensitive information. Scammers employ various deceptive tactics, often through electronic means, to trick unsuspecting victims into divulging their personal and financial details, granting unauthorized access to their bank accounts or stealing their identities. Bank scams can take on diverse forms, ranging from sophisticated cyber-attacks to old-fashioned confidence tricks, all exploiting trust for illicit gains. With schemes continuously evolving and becoming more sophisticated, staying vigilant and informed about the latest scamming techniques is crucial. These scams can target anyone, regardless of age, background, or financial knowledge, emphasizing the necessity of education and awareness to combat fraudulent activities in the financial domain. There are several techniques employed by scammers to carry out financial fraud. Staying informed about these methods is crucial for individuals to recognize potential threats and protect themselves from falling victim to these scams. Among the most prevalent and cunning techniques, phishing scams involve the use of fraudulent emails, messages, or websites that closely resemble legitimate banking platforms. Unsuspecting recipients are prompted to provide their personal information under the guise of updating their accounts or resolving urgent issues. Scammers often employ psychological tricks to create a sense of urgency, compelling victims to act impulsively without carefully scrutinizing the authenticity of the communication. A method where fraudsters install hidden devices on ATM machines to capture card information and personal identification numbers (PINs) from unsuspecting users. These devices, cleverly disguised to blend seamlessly with the ATM's appearance, capture data when a card is inserted or when the PIN is entered. The stolen information is then used to create cloned cards or directly access the victim's account. Scammers employ malicious software, or malware, to infect victims' computers or mobile devices. Once installed, malware can capture sensitive data, such as login credentials and personal information, and transmit it back to the attackers. This stolen data is then exploited to gain unauthorized access to the victim's bank accounts. This method relies on psychological manipulation to deceive individuals into divulging sensitive information. Scammers may impersonate bank employees, government officials, or other trustworthy figures to gain the victim's trust and extract confidential information or money. These schemes exploit human vulnerabilities, such as fear or a desire to help, to achieve their illicit objectives. Fraudsters create counterfeit websites or mobile applications that closely resemble legitimate banking platforms. Unsuspecting users may unknowingly input their login credentials and other sensitive data into these fake platforms, providing scammers with the information they need to perpetrate bank scams. A form of phishing that takes place over the phone. Scammers impersonate legitimate organizations, such as banks or government agencies, and use social engineering techniques to trick victims into revealing personal information, such as account numbers or PINs. They may use caller ID spoofing to appear as a trusted entity, making it difficult for victims to identify the fraud. In CNP fraud, scammers use stolen credit or debit card information to make unauthorized transactions without physically presenting the card. This type of fraud often occurs in online or phone transactions where the card details are sufficient for payment without requiring the actual card to be present. Scammers target individuals with weak security on their mobile phone accounts. They impersonate the victim and convince the mobile carrier to transfer the victim's phone number to a new SIM card under the scammer's control. With access to the victim's phone number, the fraudster can bypass two-factor authentication and gain unauthorized access to bank accounts. A type of malware that encrypts a victim's data, rendering it inaccessible until a ransom is paid. In the context of bank scams, ransomware can target individuals, financial institutions, or businesses, leading to significant financial losses and disruptions. Scammers target businesses by sending fake invoices or payment requests that appear legitimate. Unsuspecting employees may process these payments, leading to financial losses for the company. Instead of stealing card information, scammers use devices to trap cash dispensed by ATMs. Victims believe the ATM malfunctioned and leave without their money, allowing the fraudster to later retrieve the trapped cash. Scammers convince individuals to grant them remote access to their computers under the pretense of providing technical support. Once granted access, the fraudster can steal personal information or install malware to carry out financial fraud. Pretexting involves fabricating a fictional scenario to deceive individuals into divulging sensitive information. Scammers may pose as a trusted individual, such as a bank employee or colleague, to extract personal data from the victim. The risk of falling victim to bank scams is a pressing concern for individuals and businesses alike. The following are essential techniques to identify bank scams: Phishing emails and messages often contain telltale signs, such as misspellings, grammar errors, or suspicious email addresses. Legitimate banks never ask for sensitive information via email or messages. Exercise caution and verify the sender's legitimacy before responding to any requests for personal information. Before entering your login credentials on any website, ensure that it is secure and legitimate. Look for "https://" in the URL, which indicates a secure connection. Additionally, check for padlock symbols in the address bar, indicating that the website has a valid security certificate. When using mobile apps related to banking or finance, review the permissions requested by the app. Be cautious if an app requests access to sensitive information that seems unnecessary for its functionality. If in doubt, refrain from granting unnecessary permissions. Regularly review your bank statements and account activity. Set up alerts for account transactions to be notified promptly of any suspicious or unauthorized activity. If you notice any unfamiliar transactions, report them to your bank immediately. In the digital age, where online banking and financial transactions have become the norm, it is essential to be proactive in protecting yourself from the looming threat of bank scams. Here are some preventive measures you can take to fortify your financial security: Create robust and distinct passwords for each of your online accounts. Avoid using easily guessable information, such as your birthdate or common words. Instead, opt for a combination of uppercase and lowercase letters, numbers, and special characters to make your passwords strong and resilient against hacking attempts. To manage multiple passwords securely, consider using a reliable password manager tool that generates and stores complex passwords, ensuring easy access without compromising security. Activate Two-Factor Authentication (2FA) whenever possible for an added layer of protection. With 2FA, when you log in to your account, you will need to provide a second verification step, such as a one-time code sent to your phone or generated by an authenticator app. Even if a scammer manages to obtain your password, they won't be able to access your account without this second factor, significantly reducing the risk of unauthorized access. Regularly update the software on your devices, including your computer, smartphone, and tablets. These updates often contain security patches that fix vulnerabilities exploited by scammers. Additionally, install reputable antivirus software and keep it up-to-date to protect your devices from malware, ransomware, and other online threats that scammers may use to steal your sensitive information. Exercise caution when sharing personal information online or over the phone, especially if you receive unexpected requests. Legitimate banks and financial institutions will never ask for sensitive data like your passwords, Social Security number, or credit card details via unsolicited emails or phone calls. If in doubt, independently verify the legitimacy of the request before providing any personal information. Avoid conducting sensitive banking transactions, such as logging into your online account or making financial transactions, on public Wi-Fi networks. Public Wi-Fi networks are more susceptible to interception by scammers, potentially exposing your data to prying eyes. Instead, use a secure and private internet connection, such as your home network or a trusted cellular data network, when handling sensitive financial information. Bank scams pose a significant threat to individuals and businesses, exploiting trust and vulnerabilities for illicit gains. Understanding the various types of bank scams and their techniques is crucial in safeguarding finances and personal information. Techniques such as recognizing phishing emails, verifying website authenticity, checking app permissions, and monitoring account activity can aid in identifying potential scams. To protect against bank scams, individuals should use strong passwords, enable two-factor authentication, keep software and antivirus updates, exercise caution with personal information sharing, and use trusted Wi-Fi networks. By staying vigilant and implementing preventive measures, individuals can fortify their financial security and combat the ever-evolving landscape of fraudulent activities in the financial domain.What Is a Bank Scam?

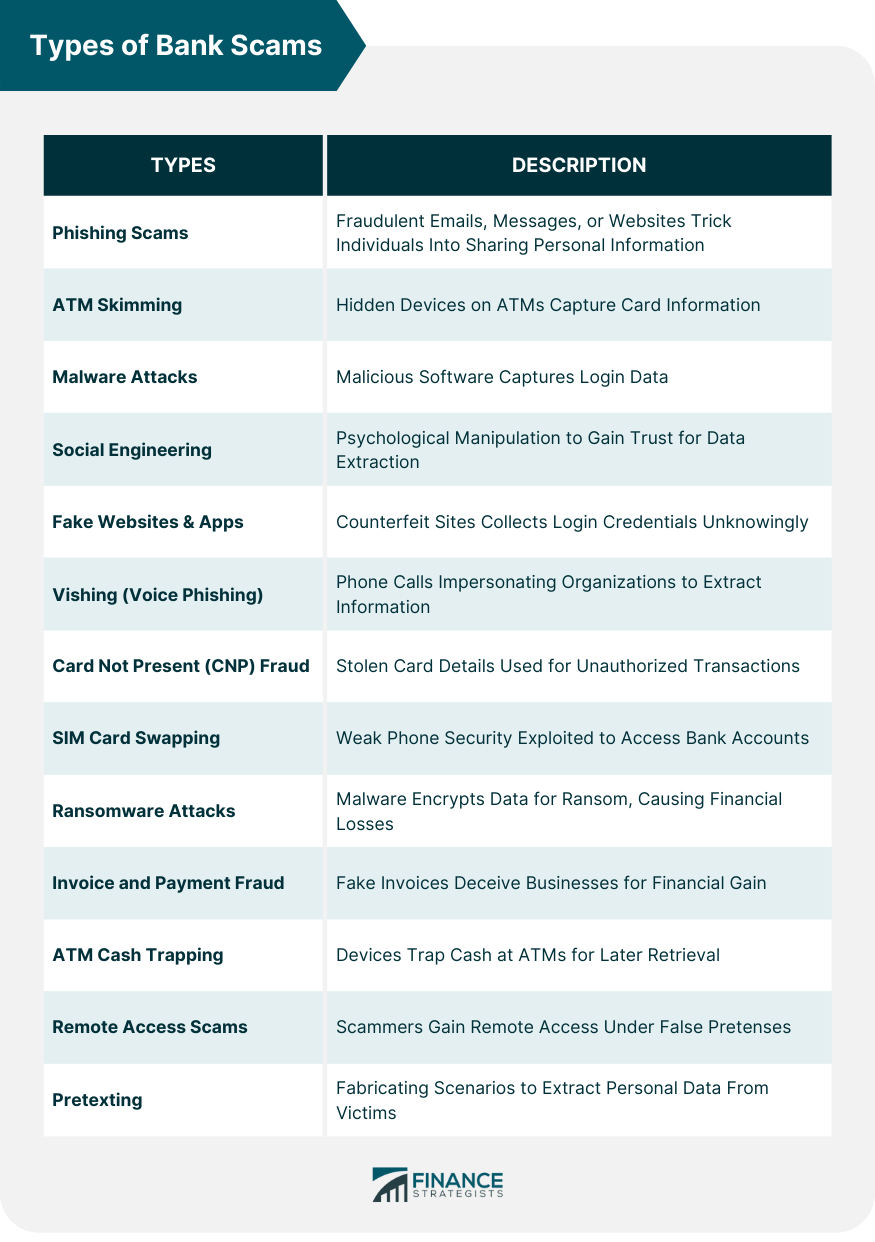

Types of Bank Scams

Phishing Scams

ATM Skimming

Malware Attacks

Social Engineering

Fake Websites and Apps

Vishing (Voice Phishing)

Card Not Present (CNP) Fraud

SIM Card Swapping

Ransomware Attacks

Invoice and Payment Fraud

ATM Cash Trapping

Remote Access Scams

Pretexting

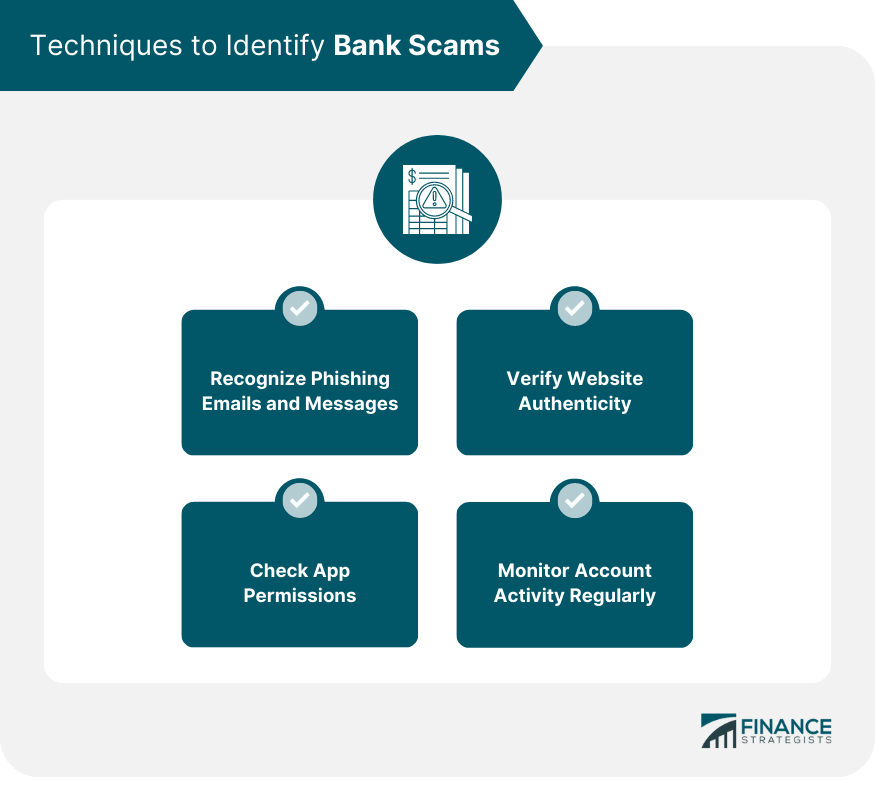

Techniques to Identify Bank Scams

Recognizing Phishing Emails and Messages

Verifying Website Authenticity

Checking App Permissions

Monitoring Account Activity Regularly

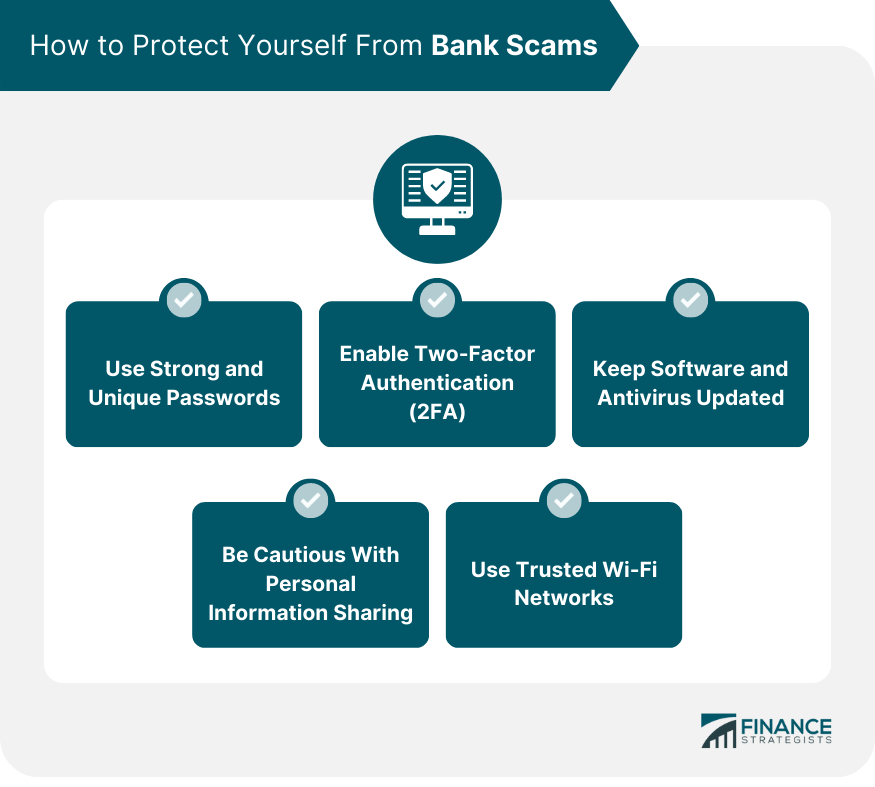

How to Protect Yourself From Bank Scams

Use Strong and Unique Passwords

Enable Two-Factor Authentication (2FA)

Keep Software and Antivirus Updated

Be Cautious With Personal Information Sharing

Use Trusted Wi-Fi Networks

Conclusion

Types of Bank Scams FAQs

A bank scam involves fraudulent activities aimed at exploiting individuals, financial institutions, or weaknesses in the banking system for illegal monetary gains or sensitive information, often through deceptive tactics and electronic means.

Phishing scams use fraudulent emails, messages, or websites that resemble legitimate banking platforms to trick individuals into sharing personal information under the guise of updating accounts or resolving urgent issues.

To identify bank scams, watch for telltale signs in phishing emails, verify website authenticity by checking for "https://" and padlock symbols, review app permissions, and regularly monitor account activity for any suspicious transactions.

Protect yourself from bank scams by using strong and unique passwords, enabling two-factor authentication (2FA) for added security, keeping software and antivirus updated, being cautious with personal information sharing, and using trusted Wi-Fi networks for sensitive transactions.

Yes, bank scams can target anyone, regardless of age, background, or financial knowledge, making education and awareness essential in combating fraudulent activities in the financial domain.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.