Certificates of Deposit (CDs) are worth it for those seeking a low-risk, predictable investment. They offer guaranteed returns, typically higher than traditional savings accounts, and are insured by the FDIC, adding to their safety. CDs are particularly suitable for short-term financial goals, given their defined maturity periods. However, the advantages come with trade-offs. The returns are generally lower than riskier investments, such as stocks. Additionally, CDs can be negatively affected by inflation and have penalties for early withdrawal. Finally, your funds are tied up, which could mean missing out on more lucrative opportunities. Therefore, whether CDs are worth it largely depends on your financial goals, risk tolerance, and investment time frame. One of the most compelling advantages of investing in Certificates of Deposits is the guarantee of returns. The interest rates of CDs are predetermined and remain unchanged for the duration of the term. This feature gives you a clear picture of your expected earnings, providing you with financial certainty. CDs is considered among the safest investment options. Most CDs are insured by the Federal Deposit Insurance Corporation (FDIC) up to the legal maximum, protecting your investment even in the event of a bank failure. CDs offers a variety of term lengths, from as short as a few months to as long as several years. This variety allows you to tailor your investments to match your financial goals and timelines. Compared to traditional savings accounts, CDs often offer higher interest rates, especially for longer-term deposits. This feature allows your savings to grow at a faster rate. While CDs provide stability, they also generally offer lower returns than riskier, more volatile investments such as stocks or mutual funds. If your primary goal is high growth, CDs might not meet your expectations. Inflation can significantly impact the real return of your CD. If the inflation rate exceeds the interest rate of your CD, the purchasing power of your savings could be diminished by the time the CD matures. CDs are designed to be held until maturity. If you need to access your funds before the term ends, you're likely to face early withdrawal penalties. These fees could cut into, or even completely offset, the interest you've earned. Finally, investing in a CD means tying up your funds and potentially missing out on other investment opportunities. If the market booms while your money is locked in a CD, you could miss out on significant potential earnings. Certificates of Deposit and stocks serve distinctly different purposes within an investment portfolio. CDs are low-risk instruments providing fixed returns, making them a safe choice. Stocks, however, are more volatile and potentially offer higher returns, but come with an increased risk of losing your initial investment. Bonds, like CDs, are considered safer than stocks. However, bonds can be more complex due to factors like credit ratings and fluctuating market prices. CDs, on the other hand, are straightforward with their fixed interest rates and are often insured by the FDIC, making them a potentially safer option for risk-averse investors. While both CDs and savings accounts are considered safe places to deposit money, CDs usually offer higher interest rates. The trade-off is that savings accounts offer more liquidity, allowing you to access your funds at any time without penalty. Money Market Accounts (MMAs) and CDs both typically offer higher interest rates than a standard savings account. However, MMAs offer more liquidity, allowing limited withdrawals per month, unlike CDs, which penalize early withdrawals. MMAs may require higher minimum balances compared to CDs. Your financial goals play a key role in determining if CDs are a good fit for you. If your goal is a short-term, definite financial target, like saving for a down payment, a CD can be an excellent choice. However, if you're aiming for high growth over the long term, riskier investments may be more suitable. Your comfort level with investment risk is another critical factor. CDs are low-risk investments, providing guaranteed returns. If you're risk-averse and want to protect your initial investment, CDs may be a fitting choice. The prevailing interest rate environment can also influence whether CDs are a good investment. If rates are high, you could lock in a high-interest rate with a CD. However, if rates are low or expected to rise, locking your money in a long-term CD might not be beneficial. Liquidity needs are another consideration. If you foresee needing access to your invested funds within the CD term, the penalties for early withdrawal from a CD could make it less attractive. For those needing more fluid access to their savings, a savings account or money market account might be a more suitable option. Investing in CDs can be a prudent financial decision for those seeking guaranteed, low-risk returns. They offer a higher yield than traditional savings accounts, and their FDIC insurance adds a layer of security. Despite these advantages, the lower return potential, risk of inflation, and early withdrawal penalties make them less favorable for some investors. When compared to other investment options like stocks, bonds, and money market accounts, CDs present a distinct risk-return trade-off and liquidity profile. Therefore, the decision to invest in CDs should align with your financial goals, risk tolerance, liquidity needs, and the current interest rate environment. As with any financial decision, it is essential to thoroughly consider these factors before choosing CDs as an investment vehicle. In a nutshell, the worth of CDs largely depends on individual financial circumstances and objectives.Are CDs Worth It?

Advantages of Investing in CDs

Guaranteed Returns

Safety of Investment

Range of Maturity Periods

Higher Interest Rates

Disadvantages of Investing in CDs

Lower Potential Returns

Inflation Risk

Early Withdrawal Penalties

Opportunity Cost

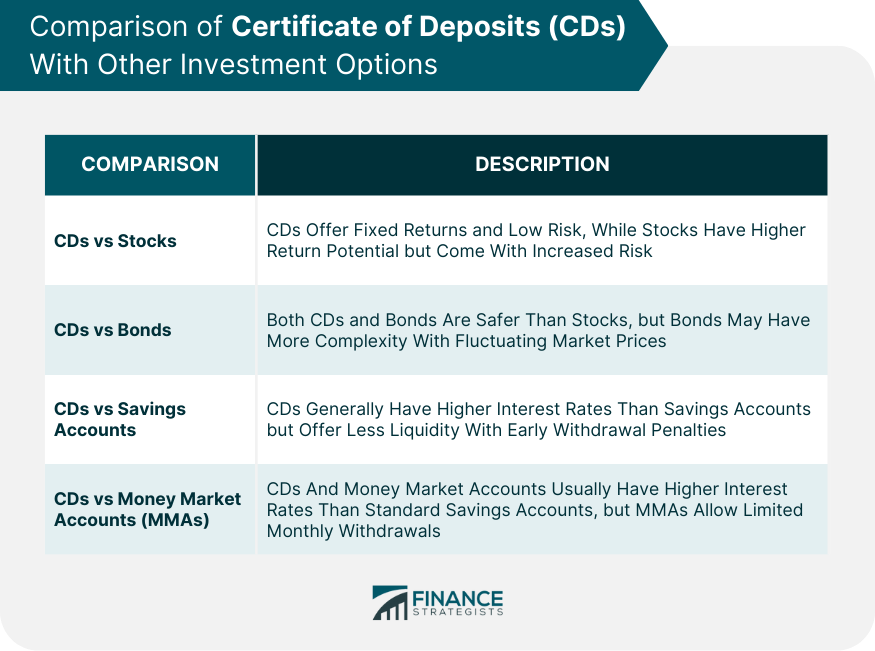

Comparison of CDs With Other Investment Options

CDs vs Stocks

CDs vs Bonds

CDs vs Savings Accounts

CDs vs Money Market Accounts

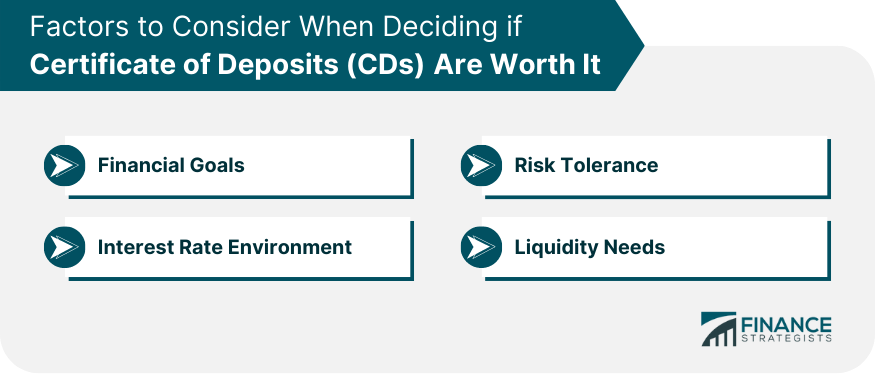

Factors to Consider When Deciding if CDs Are Worth It

Financial Goals

Risk Tolerance

Interest Rate Environment

Liquidity Needs

Conclusion

Are CDs Worth It? FAQs

A Certificate of Deposit (CD) is a type of financial product offered by banks and credit unions. It's a type of time deposit where you agree to keep a certain amount of money in the bank for a predetermined period of time, and in return, you receive interest.

Investing in CDs comes with several advantages. They offer guaranteed returns, safety due to FDIC insurance, a range of maturity periods to choose from, and often higher interest rates than traditional savings accounts.

There are a few disadvantages to investing in CDs, such as lower potential returns compared to riskier investments, the risk of inflation outpacing your return, penalties for early withdrawal, and the opportunity cost of having your funds tied up.

CDs are generally lower-risk and offer fixed returns, making them safer but potentially less lucrative than stocks. They are simpler and less risky than bonds, offer higher interest rates than savings accounts but with less liquidity, and compared to Money Market Accounts, CDs offer less liquidity but don't require high minimum balances.

Determining if CDs are worth it depends on several factors, such as your financial goals, investment time horizon, risk tolerance, current economic conditions, and your tax situation. It's recommended to consult with a financial advisor to make the best decision for your individual situation.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.