A Certificate of Deposit (CD) is a fixed-term investment offered by banks and credit unions. While CDs typically offer higher interest rates than standard savings accounts, they come with a commitment to leave the deposited funds untouched until the maturity date. If an investor chooses to access their funds before this date, they encounter a CD early withdrawal penalty. This penalty can be in the form of a fixed fee, a percentage of the withdrawal amount, or the forfeiture of interest accrued for a set number of months. Instituted by banks to compensate for the disruption in their liquidity management, these penalties also serve to incentivize savers to let their funds grow until the CD’s term ends. It's essential to understand the specific penalty conditions associated with a CD before investing, ensuring you're comfortable with the potential costs of early access. Different banks, different terms. While the general principles of CDs remain consistent, the penalty can vary based on several factors. Typically, longer-term CDs come with steeper penalties. A 5-year CD might have a more substantial penalty than a 6-month CD because the bank anticipated using those funds for a more extended period. Higher interest CDs may sometimes have higher penalties. This can be seen as a trade-off for the premium interest rate you receive. Each financial institution has its own policies. Some might be more lenient, waiving penalties in specific circumstances, while others remain stringent. In fluctuating economic times, or when the Federal Reserve tweaks monetary policies, banks might adjust penalties to either incentivize or dissuade early withdrawals. The calculation of a CD early withdrawal penalty involves a simple formula based on the financial institution's policy and the terms of the CD. Generally, the penalty is expressed as a fixed number of days' worth of interest. To determine the penalty amount, the bank or credit union will calculate the interest earned on the CD up to the withdrawal date and then apply the predetermined penalty rate. The most common formula is: The resulting penalty amount is subtracted from the total interest earned, and the remaining balance is what the account holder will receive upon early withdrawal. It's important to note that the penalty can vary depending on the CD term and the institution, and in some cases, it might even result in a partial reduction of the principal amount. Before opting for an early withdrawal, it is advisable to carefully review the specific terms and conditions of the CD to understand the potential implications on your investment. When it comes to penalties, there's more than just the immediate financial cost. Financial Implications: Apart from the obvious penalty fee, there’s the missed opportunity of compound interest, particularly for CDs with longer terms. Psychological Implications: Being bound to a financial product can be stifling. The feeling of being "locked in" can induce financial stress, particularly if there’s an unforeseen need for liquidity. There are strategies to keep most of your interest while still maintaining some liquidity. Opting for CDs With Shorter Durations: This gives you flexibility, even if it comes at the expense of a slightly lower interest rate. Seeking Out Banks With Lower Penalties: Research is key. Some institutions offer CDs with relatively low early withdrawal penalties. Considering CD Laddering Strategies: Distribute your investment across CDs with varying durations. This way, you get the benefit of higher rates from longer-term CDs while maintaining some liquidity with shorter-term CDs. Using Emergency Funds or Other Savings Before Breaking a CD: Always consider tapping into your savings or emergency funds before breaking a CD. This way, you maintain the benefits of the CD and avoid penalties. All investment vehicles come with their pros and cons. Savings accounts offer liquidity but usually at lower interest rates. CDs offer higher rates but with the potential for penalties if you break the term. While MMAs provide a slightly better interest rate than traditional savings accounts and offer check-writing capabilities, they still typically fall short of CD rates. Bonds, like CDs, can be held until maturity. However, if you sell a bond before it matures, you could either gain or lose principal, depending on market conditions. Certificates of Deposit (CDs) emerge as a two-edged sword. While they promise higher interest rates compared to standard savings accounts, the caveat lies in the early withdrawal penalties that come into play if funds are accessed prematurely. These penalties, often influenced by the CD's term, its interest rate, the financial institution's policies, and prevailing economic conditions, can range from fixed fees to forfeiting interest accrued. Savvy investors, however, can employ strategies like opting for shorter-duration CDs, conducting thorough research to find banks with lenient penalties, utilizing CD laddering, or tapping into other savings to avoid these penalties. When compared with other savings instruments like savings accounts, Money Market Accounts (MMAs), and bonds, CDs stand out for their higher potential returns, albeit with associated risks. Given the dynamic financial landscape, marked by evolving bank policies and changing economic scenarios, both investors and banks are in a continuous dance, adapting their strategies to strike a balance between returns and liquidity.CD Early Withdrawal Penalty Overview

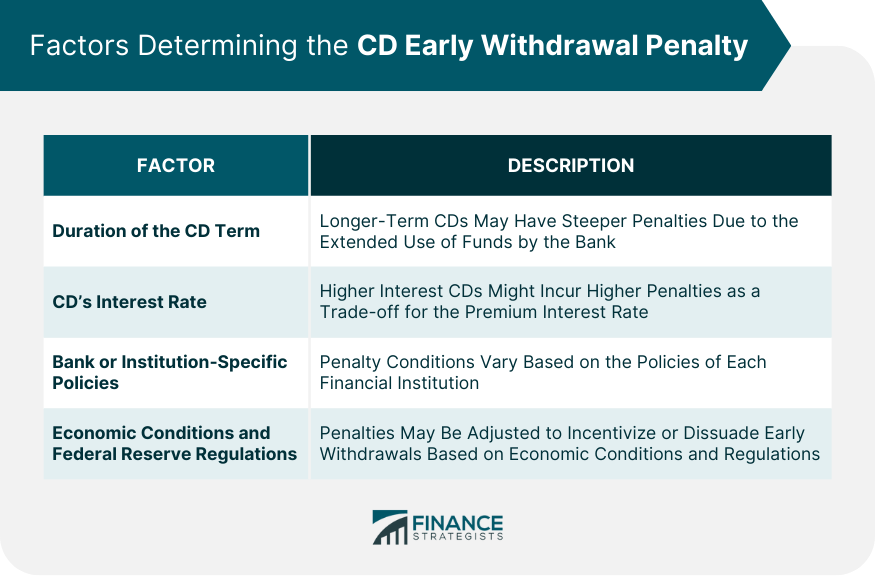

Factors Determining the CD Early Withdrawal Penalty

Duration of the CD Term

CD's Interest Rate

Bank or Institution-Specific Policies

Economic Conditions and Federal Reserve Regulations

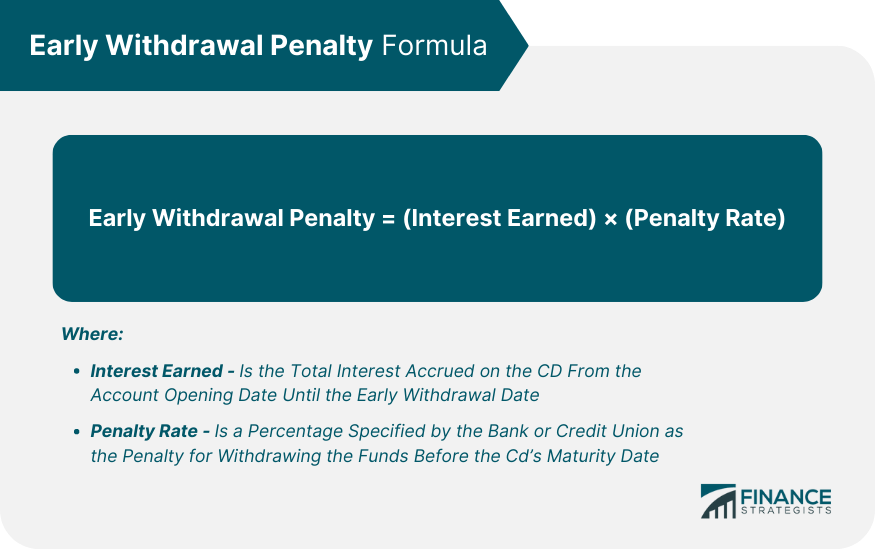

Calculation of CD Early Withdrawal Penalty

Implications of the CD Early Withdrawal Penalty

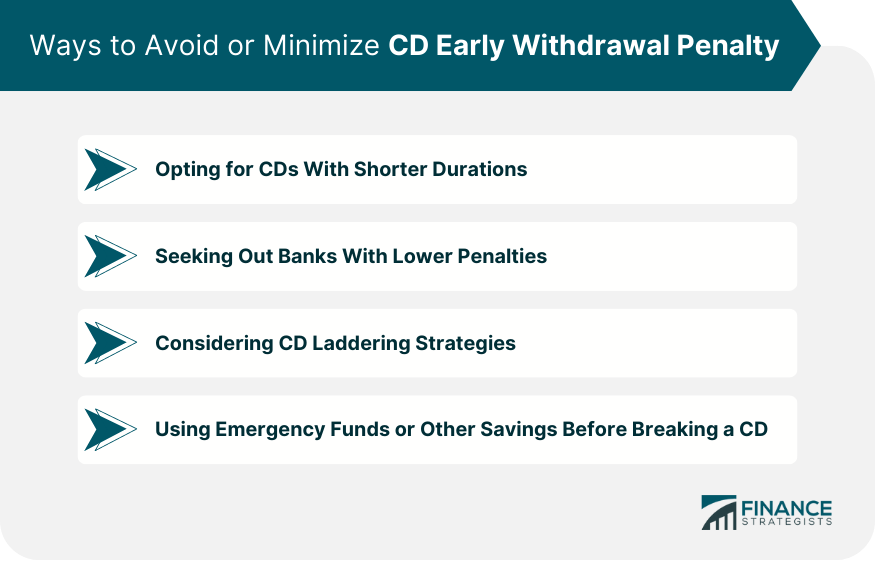

Ways to Avoid or Minimize CD Early Withdrawal Penalty

Comparing CD Early Withdrawal Penalty to Other Savings Vehicles

CDs vs Savings Accounts

CDs vs Money Market Accounts

CDs vs Bonds

Conclusion

CD Early Withdrawal Penalty FAQs

A CD early withdrawal penalty is a fee or cost imposed by banks or credit unions when an investor accesses their Certificate of Deposit funds before the agreed-upon maturity date. The penalty can vary in form, including fixed fees, percentages of the withdrawal amount, or loss of accrued interest for a certain period.

The penalty for early withdrawal from a CD is determined by several factors, including the duration of the CD term, the CD's interest rate, the specific policies of the financial institution, and broader economic conditions or Federal Reserve regulations.

Beyond the immediate penalty fee, the implications include a missed opportunity for compound interest, especially with longer-term CDs, and potential psychological effects, like feeling "locked in," which can lead to financial stress, especially in situations requiring urgent liquidity.

Investors can minimize penalties by choosing CDs with shorter durations, researching and opting for banks with lenient penalties, employing CD laddering strategies, or accessing emergency funds or other savings before breaking the CD's terms.

CDs typically offer higher interest rates than savings accounts but come with potential penalties for early withdrawals. Money Market Accounts (MMAs) might offer slightly better rates than savings accounts with more flexibility but generally have lower returns than CDs. Bonds, like CDs, have implications if sold before maturity, where the investor might gain or lose principal based on market conditions.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.