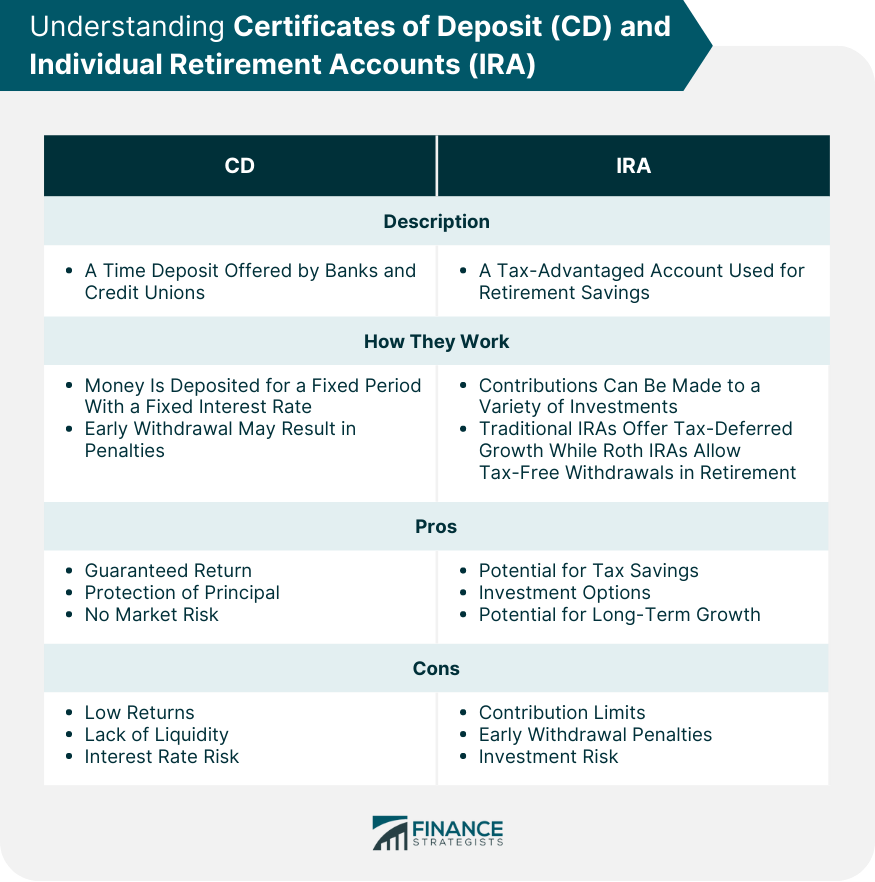

A Certificate of Deposit (CD) and an Individual Retirement Account (IRA) are both savings vehicles, but with different uses and features. A CD is a type of savings account that offers a fixed interest rate over a specified term. CDs typically offer higher interest rates than traditional savings accounts but have penalties for early withdrawal. CDs are usually considered safer and more predictable, often used for short-term saving goals. An IRA, on the other hand, is a retirement savings account that provides tax advantages. The two main types, Traditional and Roth IRAs, have different tax implications. Contributions to a Traditional IRA may be tax-deductible, while withdrawals in retirement are taxed. Roth IRA contributions are made with post-tax dollars, but withdrawals in retirement are generally tax-free. The choice between a CD and an IRA depends on one's savings goal, risk tolerance, and tax situation. A Certificate of Deposit, more commonly known as a CD, is a type of time deposit offered by banks and credit unions. When you open a CD, you agree to deposit a certain amount of money for a fixed period – anywhere from a few months to several years. The term "Certificate of Deposit" comes from the certificate that the bank gives you, which shows you’ve deposited a sum of money for a certain length of time. The interest rates on CDs are usually fixed, meaning you know upfront exactly how much you'll earn over the term of the CD. This makes them an attractive option for conservative investors seeking stable, predictable returns. The interest you earn on a CD is usually compounded and added to the principal. The term lengths of CDs can vary widely. Generally, the longer the term, the higher the interest rate. However, it's worth noting that withdrawing your money before the term ends typically results in an early withdrawal penalty, which could erode a significant part of your earnings. This encourages savers to let their money grow until the CD reaches its maturity date. Guaranteed Return: CDs offer a fixed interest rate for a specified term, making them one of the most predictable investment options. You know exactly how much you'll earn by the end of the term. Protection of Principal: The principal amount you invest in a CD is typically insured by the Federal Deposit Insurance Corporation (FDIC) up to the maximum allowed by law, so even if the bank fails, your money is safe. No Market Risk: CDs are not subject to fluctuations in the stock market, so they are a safer choice for conservative investors who prefer low-risk investments. Low Returns: While CDs are safe, they often yield lower returns compared to riskier investments like stocks or bonds. They might not keep pace with inflation, reducing the purchasing power of your savings over time. Lack of Liquidity: Your money is tied up for the duration of the CD term. If you withdraw money from a CD before its maturity date, you'll likely pay an early withdrawal penalty. Interest Rate Risk: If interest rates rise after you've purchased a CD, you'll be locked into the lower rate until your CD matures, missing out on potential earnings. An Individual Retirement Account (IRA) is a tax-advantaged account that individuals use to save and invest for retirement. There are two primary types of IRAs – Traditional and Roth – each with its own tax benefits and rules. The key difference between the two lies in when you get to claim your tax advantage. A Traditional IRA is a type of retirement savings account that offers tax advantages to incentivize individuals to save for retirement. The contributions you make to a Traditional IRA may be tax-deductible in the year they are made, depending on your income level and whether you or your spouse have access to a workplace retirement plan. Your investments grow tax-deferred within the account, meaning you don't owe any taxes on dividends, interest, or capital gains until you start taking distributions. The potential tax savings can be significant, especially if you are currently in a high tax bracket and expect to be in a lower one upon retirement. However, when you start taking distributions, typically after age 59½, these withdrawals are subject to income tax. Also, beginning at age 72, you're required to start taking minimum distributions (RMDs) from a Traditional IRA, whether you need the money or not. A Roth IRA operates differently from a Traditional IRA. Contributions to a Roth IRA are made with after-tax dollars, so you don't get an immediate tax deduction. However, your investments grow tax-free, and withdrawals in retirement are also tax-free, given that certain conditions are met. This can be a significant advantage for those who expect to be in a higher tax bracket in retirement, as it allows you to lock in your current tax rate and avoid potentially higher future tax rates. Moreover, Roth IRAs offer more flexibility compared to Traditional IRAs. There are no Required Minimum Distributions (RMDs), so you can leave your money in the account to continue growing tax-free if you don't need it. Also, you can withdraw your contributions (but not earnings) at any time without taxes or penalties, providing more liquidity compared to a Traditional IRA. Potential for Tax Savings: With a Traditional IRA, you get a tax deduction when you contribute, effectively reducing your taxable income for the year. With a Roth IRA, you pay taxes upfront, but your withdrawals in retirement are generally tax-free. Investment Options: IRAs allow you to invest in a wide range of assets, such as stocks, bonds, and mutual funds. This gives you greater control over your investment strategy and the potential for higher returns. Potential for Long-Term Growth: With the power of compounding, your investments in an IRA can grow significantly over time. This can help you accumulate a larger retirement nest egg compared to savings options with lower returns, like CDs. Contribution Limits: IRAs come with annual contribution limits. As of 2024 and 2025, the limit was $7,000 per year, or $8,000 if you're age 50 or older. This may limit the amount you can save for retirement in an IRA. Early Withdrawal Penalties: You'll generally have to pay income tax on the withdrawal plus a 10% penalty when withdrawing money from a Traditional IRA before age 59½. Investment Risk: Unlike CDs, the return on investment in an IRA isn't guaranteed and depends on the performance of the market. While this can result in higher returns, it also comes with the risk of loss. When it comes to potential returns, CDs and IRAs can vary significantly. CDs have fixed interest rates set by the issuing bank or credit union, providing a predictable and stable return over the term of the deposit. The longer the term, generally the higher the rate, providing an incentive for depositors to leave their money untouched. This can be appealing to those who value certainty in their investments. IRAs, on the other hand, don’t have a fixed rate of return. Instead, the return depends on the performance of the investments within the account. While this means the potential returns can be much higher than those offered by CDs, it also introduces a greater degree of risk. The value of your IRA can fluctuate based on market conditions, and it's possible to lose money, especially in volatile markets. Safety is often a significant consideration when comparing CDs and IRAs. CDs are considered low-risk investments. The money you deposit in a CD is insured by the Federal Deposit Insurance Corporation (FDIC) up to $250,000 per depositor, per institution. This insurance means that even if the bank fails, your investment is protected, making CDs a secure place to keep your savings. On the contrary, investments in an IRA are not guaranteed. The value of your IRA depends on the performance of the investments within the account. This means your investment could decrease in value or even be lost if the investments perform poorly. However, this higher risk also comes with the potential for higher returns, making IRAs potentially more lucrative for those willing to weather market fluctuations. When comparing liquidity, CDs and IRAs have different levels of accessibility. With a CD, your money is tied up for a specified period. If you withdraw your money before the term ends, you'll likely pay a penalty, which could eat into your earnings. This lack of liquidity is one reason why CDs are considered more suitable for people with a clear timeline and who won't need to access their savings early. IRAs also have restrictions on withdrawals. If you withdraw money from a traditional IRA before age 59½, you might have to pay income tax plus a 10% early withdrawal penalty. Roth IRAs offer more flexibility, allowing you to withdraw contributions (but not earnings) at any time without penalty. However, certain conditions must be met to withdraw earnings tax-free, so it's important to understand the rules fully before making any decisions. Tax considerations play a significant role in the CD vs. IRA decision. The interest you earn on a CD is fully taxable as income in the year it is earned, regardless of whether you withdraw the interest or leave it in the CD. This means you'll have to account for this additional income when planning your taxes. In contrast, both traditional and Roth IRAs offer tax advantages. Traditional IRA contributions may be tax-deductible, and the investments grow tax-deferred, meaning you won’t pay taxes until you take distributions in retirement. For Roth IRAs, contributions are made with after-tax dollars, but both contributions and earnings can be withdrawn tax-free in retirement, provided certain conditions are met. This unique characteristic makes Roth IRAs particularly appealing for those who anticipate higher tax rates in their retirement years. If you're a conservative investor who values safety over high returns, a CD might be a suitable choice. The principal is protected, and the return is guaranteed. With a CD, there's no need to worry about the ups and downs of the stock market affecting your investment. However, if you're willing to take on more risk for potentially higher returns, an IRA could be more appealing. By investing in an IRA, you're betting on the long-term growth potential of the market. If you're saving for a short-term goal, a CD's fixed term might fit your needs. With a clearly defined maturity date and fixed interest rate, you know precisely when you'll get your money back and how much you'll have. But for long-term goals, especially retirement, an IRA's potential for higher long-term returns could be beneficial. With decades to ride out market volatility, an IRA could help grow your savings more effectively over time. If you're looking for a way to reduce your taxable income now, a traditional IRA might be worth considering. The potential tax deduction could lower your current tax bill, providing immediate savings. If you prefer to pay taxes now in order to enjoy tax-free income in retirement, a Roth IRA could be a better choice. With a CD, remember that you'll owe taxes on the interest you earn each year. This can add to your annual tax burden, depending on your overall income and tax situation. Your overall financial goals and retirement plans should guide your decision. If your primary goal is to save for retirement and you're willing to take on some risk, an IRA is often the recommended choice. An IRA, especially when invested in a diversified mix of assets, has the potential to provide higher returns over the long run, helping you accumulate more for retirement. If your aim is to preserve capital or you're saving for a short-term goal, a CD might be the better option. CDs are especially useful when you have a specific, short-term financial goal in mind, such as saving for a down payment on a house or building an emergency fund. With their fixed interest rates and set maturity dates, CDs can provide the certainty needed for such goals. The decision between a Certificate of Deposit (CD) and an Individual Retirement Account (IRA) is not a one-size-fits-all proposition. It largely hinges on your financial goals, time horizon, tax situation, and risk tolerance. If you're risk-averse or saving for a short-term goal, a CD could be the better option due to its predictable returns and principal protection. Conversely, an IRA, with its potential for higher long-term growth and tax benefits, might be more suitable if you're planning for retirement and are comfortable with market risks. Irrespective of the choice you make, it's vital to ensure it aligns with your financial objectives and risk comfort. Certificate of Deposit (CD) vs Individual Retirement Account (IRA): Overview

Understanding CDs

What Is a CD?

How CDs Work

Pros of CDs

Cons of CDs

Understanding IRAs

What Is an IRA?

Different Types of IRAs

Traditional IRA

Roth IRA

Pros of IRAs

Cons of IRAs

Roth IRAs allow you to withdraw contributions without penalty, but early withdrawal of earnings can result in taxes and penalties.

Detailed Comparison: CD vs IRA

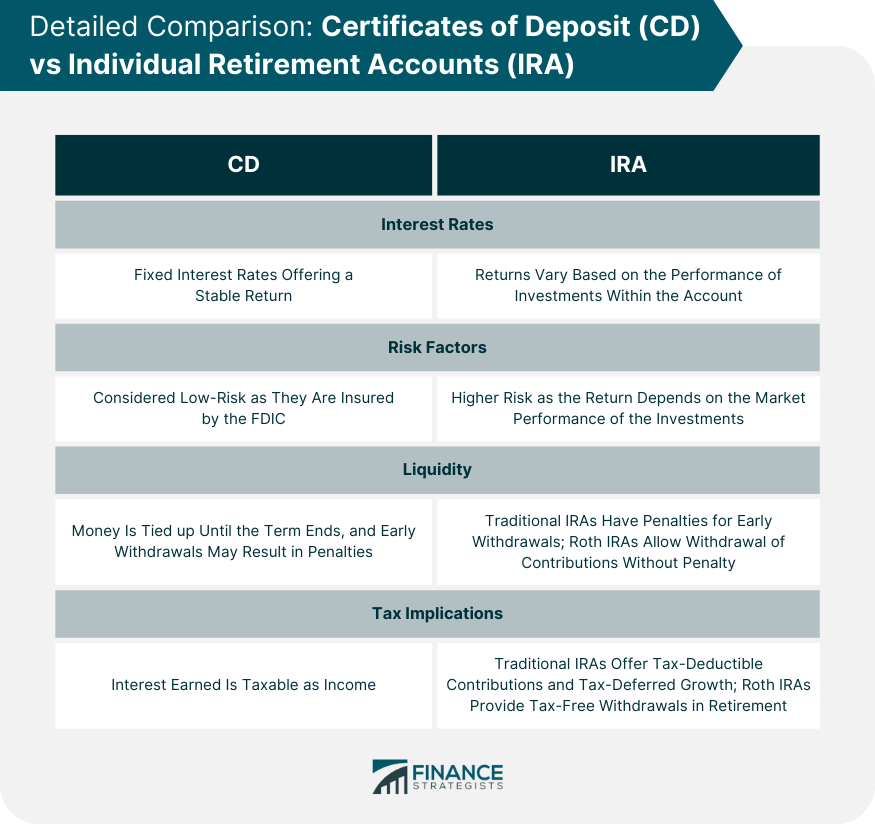

Interest Rates

Risk Factors

Liquidity

Tax Advantages

Factors to Consider When Choosing Between a CD and an IRA

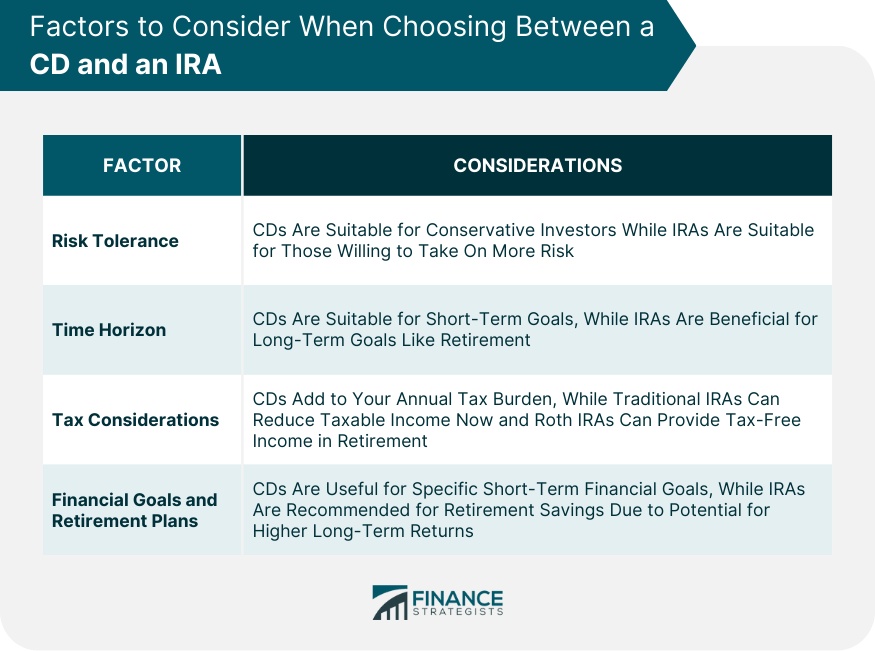

Risk Tolerance

Time Horizon

Tax Considerations

Financial Goals and Retirement Plans

Bottom Line

CD vs IRA FAQs

CDs offer fixed interest rates for a specified term and are considered low-risk, while IRAs offer potential tax advantages with a variety of investment options, but with higher risk.

While CDs offer stable, predictable returns, IRAs potentially offer higher returns depending on the performance of the investments within the account.

CDs are considered safer as they are insured by the FDIC and offer guaranteed returns. In contrast, IRAs carry market risks and the return isn't guaranteed.

The interest earned on CDs is taxable as income, while Traditional IRAs offer tax-deductible contributions and tax-deferred growth, and Roth IRAs provide tax-free withdrawals in retirement.

Both CDs and IRAs have penalties for early withdrawal, but Roth IRAs offer more flexibility allowing you to withdraw contributions (not earnings) anytime without penalty.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.