CDs vs Money Market Accounts: Overview

Certificates of Deposit (CDs) and Money Market Accounts (MMAs) both serve as popular savings vehicles, but they differ in their functions.

CDs are time-bound deposits with financial institutions that offer fixed interest rates and are best for individuals who can afford to lock away their funds for a specified term. Withdrawing before maturity incurs penalties, limiting liquidity.

On the other hand, MMAs offer variable interest rates typically higher than regular savings accounts and allow limited check-writing and debit card usage, providing greater access to your funds. However, they often require higher minimum balances.

In deciding between CDs and MMAs, consider your financial goals, risk tolerance, and liquidity needs. If stability and potentially higher returns appeal to you and you can leave your money untouched, consider CDs.

If you need more flexible access to your savings, an MMA could be more fitting.

Understanding Certificates of Deposit (CDs)

Definition of CDs

Certificates of Deposit, commonly referred to as CDs, are fixed-income investment products offered by banks and credit unions.

When you purchase a CD, you're essentially lending money to the financial institution for a specified period of time. In return, you receive a guaranteed rate of return upon maturity.

How CDs Work

When you open a CD, you agree to deposit a certain amount of money for a predetermined period, usually anywhere from three months to five years.

The bank pays interest on your deposit at regular intervals, and you can't withdraw the funds before the maturity date without incurring a penalty.

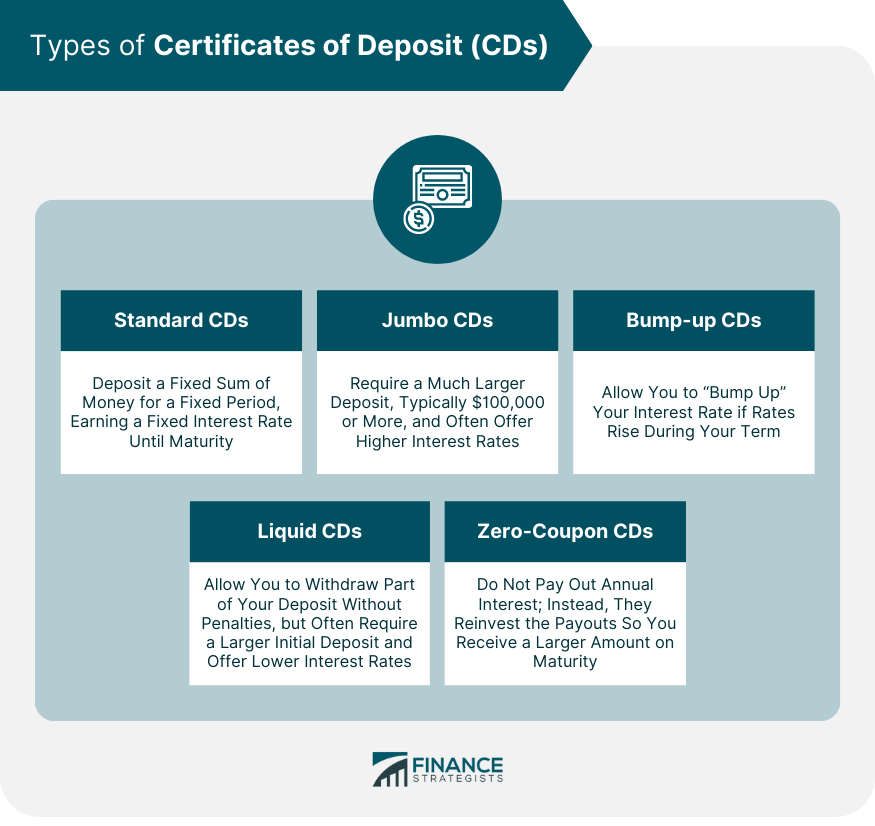

Types of CDs

Standard CDs

Standard CDs are the most common type. You deposit a fixed sum of money for a fixed period, earning a fixed interest rate until maturity.

Jumbo CDs

Jumbo CDs are like standard CDs, but they require a much larger deposit, typically $100,000 or more. In return for this large deposit, banks often offer higher interest rates.

Bump-up CDs

These CDs allow you to "bump up" your interest rate if rates rise during your term. This can be particularly useful in a rising interest rate environment.

Liquid CDs

Liquid CDs provide more flexibility by allowing you to withdraw part of your deposit without penalties. However, they often require a larger initial deposit and offer lower interest rates.

Zero-Coupon CDs

Zero-coupon CDs don't pay out annual interest. Instead, they reinvest the payouts so you receive a larger amount on maturity. It’s important to note that you'll have to pay tax on the interest earned each year, even though you don't receive it until maturity.

Pros of CDs

Guaranteed Returns

With CDs, you get a fixed interest rate, so you know exactly what your return will be at the end of the term. This predictability provides a sense of security for your investment.

FDIC Insurance

CDs are FDIC-insured up to $250,000, which means even if the bank fails, your investment is protected.

Higher Interest Rates

CDs generally offer higher interest rates compared to regular savings accounts, making them a potentially more lucrative option.

Cons of CDs

Limited Liquidity

Once you invest in a CD, your money is tied up for the duration of its term. If you need to withdraw your money early, you'll likely face a penalty.

Inflation Risk

The fixed interest rate can also be a drawback if inflation rises significantly during your CD's term. In such a case, the purchasing power of your returns might be less than expected.

Opportunity Cost

Once your money is locked in a CD, you might miss out on other investment opportunities that may offer higher returns.

Understanding Money Market Accounts

Definition

Money Market Accounts (MMAs) are interest-bearing accounts offered by banks and credit unions. They typically require a higher minimum balance than regular savings accounts but offer a higher yield in return.

How Money Market Accounts Work

MMAs function similarly to regular savings accounts but often come with additional features like check-writing and debit card access.

The interest is typically compounded daily or monthly and paid out monthly. However, there may be restrictions on the number of transactions you can make each month.

Types of Money Market Accounts

Retail Money Market Accounts

Retail MMAs are designed for individual investors. They offer competitive interest rates and typically come with check-writing and debit card privileges.

They provide a mix of the benefits of a checking and a savings account, but they usually require a higher minimum balance compared to regular savings accounts.

Business Money Market Accounts

Business MMAs are intended for business entities. They typically offer the same features as retail MMAs, such as higher interest rates than regular business savings accounts and limited transaction abilities.

These accounts are perfect for businesses looking to grow their surplus cash while retaining access to the funds when needed.

Jumbo Money Market Accounts

Jumbo MMAs are accounts that require a significantly large minimum deposit, typically over $100,000. In exchange for the large deposit, banks often offer higher interest rates.

These accounts are attractive to investors with substantial funds looking for a safe and liquid place to store their cash while earning some interest.

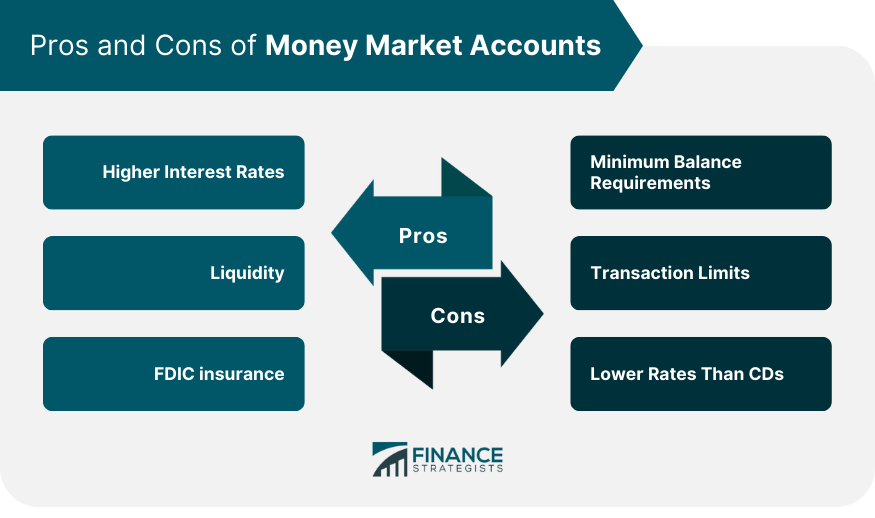

Pros of Money Market Accounts

Higher Interest Rates

Money Market Accounts often provide higher interest rates than traditional savings accounts, making them an attractive option for earning more on your deposits.

Liquidity

Unlike CDs, Money Market Accounts allow a limited number of withdrawals and transfers per month, giving you better access to your funds.

FDIC Insurance

Just like regular savings accounts and CDs, Money Market Accounts are insured by the FDIC up to $250,000, adding a layer of safety to your investment.

Cons of Money Market Accounts

Minimum Balance Requirements

MMAs usually require higher minimum balances to open and maintain the account. Falling below the required minimum can result in fees or lower interest rates.

Transaction Limits

Although MMAs allow withdrawals, federal regulations limit certain types of withdrawals and transfers to six per month. Exceeding this limit could result in fees.

Lower Rates Than CDs

While MMAs generally offer higher rates than savings accounts, they typically provide lower interest rates than CDs, particularly for longer-term CDs.

CDs vs Money Market Accounts: Comparing Liquidity

Liquidity in CDs

CDs are considered low-liquidity investments because they tie up your money until the maturity date. Early withdrawal usually incurs penalties, which can eat into your earnings.

Liquidity in Money Market Accounts

In contrast, MMAs offer higher liquidity. You can typically make up to six withdrawals or transfers per month without incurring penalties. However, going beyond the limit may attract fees or even cause the bank to close your account.

Importance of Liquidity in Investment Decision-Making

Liquidity is vital in financial planning. It ensures you have ready access to your money in case of emergencies. If you're planning for short-term financial goals or need frequent access to your funds, an MMA could be a better option than a CD.

CDs vs Money Market Accounts: Interest Rate Comparison

Interest Rates for CDs

CDs usually offer fixed interest rates, which means the rate won't change for the duration of the term. This can be advantageous in a falling interest rate environment as your investment is shielded from the drop.

Interest Rates for Money Market Accounts

MMAs usually offer variable interest rates, which means the rate can fluctuate depending on market conditions. This could be advantageous in a rising interest rate environment where your investment can benefit from the increase.

Impact of Interest Rates on Return on Investment

Interest rates directly impact your return on investment. Higher rates mean higher returns, but the predictability of the return may be equally important depending on your financial goals.

If stability is a priority, CDs may be more attractive, but if you're looking for potentially higher returns, consider MMAs.

CDs vs Money Market Accounts: Risk Analysis

Risk Factors in CDs

The primary risk in CDs is interest rate risk - the risk that interest rates will rise after you've locked in your rate, leading to a missed opportunity for higher returns. However, they are low-risk in terms of principal protection due to FDIC insurance.

Risk Factors in Money Market Accounts

MMAs also carry interest rate risk due to their variable rates. However, they provide better access to funds, which can be advantageous during emergencies or sudden financial needs. Like CDs, they are FDIC-insured, providing principal protection.

Risk Mitigation and Management

Investors should balance risk and reward by diversifying their investment portfolios. Both CDs and MMAs can play a role in a balanced portfolio, serving different financial goals and risk tolerance levels.

CDs vs Money Market Accounts: Access to Funds

Access to Funds in CDs

With CDs, your access to funds is limited until the maturity date. Early withdrawal can result in penalties, which could erode your interest earnings or even touch the principal in some cases.

Access to Funds in Money Market Accounts

MMAs offer greater access to funds with limited transactions per month, making them a more flexible option for those who may need to access their savings more frequently.

Considerations When Accessing Funds

It's crucial to consider your potential need for funds when choosing an investment. If you're confident you won't need the money until the maturity date, a CD could be a good choice. But if you anticipate needing frequent access to your funds, an MMA might be more appropriate.

CDs vs Money Market Accounts: Investment Periods

Typical Investment Periods for CDs

CD terms can range from a few months to several years. Longer terms usually offer higher interest rates but come with lower liquidity due to longer lock-in periods.

Typical Investment Periods for Money Market Accounts

MMAs do not have a fixed term and can be opened and closed at any time. This makes them suitable for investors who do not want to commit their funds for a specific period.

Influence of Investment Periods on Financial Goals

The length of your investment period can significantly impact your financial goals. If you're saving for a specific future expense, CDs can provide guaranteed returns. For ongoing savings and liquidity, MMAs are usually more flexible.

Factors to Consider When Choosing Between CDs and Money Market Accounts

Personal Financial Goals and Needs

The choice between CDs and MMAs will largely depend on your financial goals. If you're looking for a higher return and can leave your money untouched for a set period, a CD might be better. But if you need flexibility and quick access to your money, an MMA might be a better fit.

Market Conditions

Market conditions can also influence your decision. In a rising interest rate environment, an MMA could provide higher returns. In contrast, in a falling interest rate environment, a CD could offer protection with its fixed rates.

Individual Risk Tolerance

Your risk tolerance is another key factor. If you're risk-averse and prefer knowing exactly what your return will be, a CD may be your preferred choice. If you're willing to take on a little more risk for potentially higher returns, an MMA might be the right choice.

Account Features and Benefits

Finally, the specific features and benefits offered by different banks and credit unions can influence your decision.

Some institutions may offer bonus rates for larger deposits or for bundling services, which could make either a CD or an MMA more attractive. It's always wise to shop around to find the best deal.

Conclusion

Choosing between Certificates of Deposit (CDs) and Money Market Accounts (MMAs) depends on individual financial goals, risk tolerance, and liquidity needs.

CDs offer guaranteed returns and stability, locking away your money for a specified period with penalties for early withdrawal.

They are ideal for those with longer-term saving goals who won't need to access funds in the short run.

MMAs, conversely, offer greater flexibility and access to funds, with typically higher interest rates than regular savings accounts. However, they often necessitate higher minimum balances.

In fluctuating market conditions, MMAs may provide better returns, while CDs protect your investment with fixed rates. Both options, being FDIC-insured, offer a safe investment route.

Considering the distinctive features, advantages, and risks associated with both CDs and MMAs, investors can make an informed choice suitable for their unique financial circumstances.

CDs vs Money Market Accounts FAQs

The main difference lies in the liquidity and the interest rates. CDs offer fixed interest rates and lock your money until the end of the term, while Money Market Accounts provide variable interest rates and more flexibility in terms of access to funds.

Both CDs and Money Market Accounts are generally considered safe investments because they are insured by the FDIC up to $250,000. However, like all investments, they are subject to some risks, primarily related to interest rates.

Typically, CDs offer higher interest rates than Money Market Accounts, but this can vary depending on the bank and the economic environment. It's always a good idea to compare rates from different institutions before making a decision.

You can withdraw money from a Money Market Account a few times per month without penalty. However, withdrawing money from a CD before its maturity date will typically result in an early withdrawal penalty.

For short-term financial goals, you might prefer a Money Market Account due to its greater liquidity. However, if you're sure you won't need the funds before the maturity date, a CD could offer a higher return. The best choice depends on your individual needs and circumstances.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.