A certificate of deposit is a type of time deposit offered by banks and credit unions. It's a financial product where an investor deposits a sum of money for a fixed period, usually six months, one year, or up to five years, in return for a specific interest rate. The interest rate offered by banks on CDs is known as the CD rate. This interest rate is predetermined and guaranteed, providing a level of predictability and stability that many investors find attractive. In the context of CDs, the interest rate is the cornerstone that decides the attractiveness of the investment. This rate determines the amount of money that the investment will generate over the term of the CD. Interest rates are a significant indicator of the health of an economy. They represent the cost of borrowing and are closely tied to the central bank's monetary policy. Economic indicators such as the GDP growth rate, unemployment rate, and consumer confidence index play a significant role in determining CD rates. Generally, a strong economy encourages higher CD rates as banks need to attract deposits. High consumer confidence can also stimulate spending and investment, leading to a higher demand for CDs and, consequently, higher CD rates. The monetary policy set by the Federal Reserve directly impacts the CD rates. When the Federal Reserve raises or lowers the short-term interest rates, banks usually follow suit with their CD rates. Changes in monetary policy can often serve as an indicator of potential changes in CD rates, allowing investors to strategically time their investments. Inflation and overall market conditions also significantly impact CD rates. If inflation is high, banks usually offer higher CD rates to attract investors, as people are less likely to save when prices are rising. Conversely, in times of economic downturn, investors may find lower CD rates as banks have less incentive to attract deposits due to the lower demand for loans. These are the most common type of CDs. They have a fixed term and a fixed interest rate. The rate depends on the term length - the longer the term, the higher the interest rate. This encourages investors to leave their money in the CD for longer periods, offering the bank more stability in its deposit base. These allow investors to request a rate increase if the bank's rates go up during their term. These CDs typically start at lower rates than traditional CDs due to their additional flexibility. However, they can be a smart choice for investors who anticipate that interest rates will rise in the future. These allow investors to withdraw part of their deposit without facing a penalty. As a trade-off for this flexibility, liquid CDs usually offer lower rates than other CDs. They can be an ideal option for investors who want the benefits of a CD but also need occasional access to their funds. These CDs do not pay interest annually but instead pay the interest lump sum at maturity. The CD rates for zero-coupon CDs are usually higher due to the lack of periodic interest payments. These CDs can be a suitable option for investors who don't require immediate income and want to maximize their overall return at maturity. These are CDs with a high minimum deposit, typically $100,000. Banks often offer higher CD rates for jumbo CDs due to the large deposit amount. These types of CDs can be particularly appealing to high-net-worth individuals looking for secure investments with competitive returns. CDs usually offer a higher interest rate compared to savings accounts. This is because the money is tied up for a specified term in CDs, while savings account funds can be withdrawn at any time. However, savings accounts offer more liquidity, which might be crucial for certain individuals based on their financial needs. CDs and bonds are both considered safe investments. However, the CD rates and bond yields can vary significantly depending on the economic environment. For example, in a low-interest-rate environment, CDs can offer a higher yield than Treasury bonds. Investors need to weigh the safety of their investments against potential returns when choosing between CDs and bonds. Compared to other fixed-income securities such as corporate bonds and mortgage-backed securities, CDs are considered safer due to FDIC insurance. However, the trade-off is that CD rates can be lower than the yields offered by these securities. Therefore, while CDs can provide a secure investment, investors seeking higher returns might opt for these riskier fixed-income securities. Don't put all your eggs in one basket. Invest in CDs with different terms and rates to benefit from both short-term and long-term rates. This approach not only spreads the risk across various investments but also provides opportunities for higher returns. This involves buying CDs with different maturity dates. As each CD matures, you reinvest the funds in a new CD. This approach allows you to take advantage of rising rates and provides regular access to your funds. It's a balanced strategy that provides a combination of liquidity, safety, and return. CDs often have penalties for early withdrawal. Understand the terms and conditions before investing. If there's a chance you'll need the money before the CD's maturity date, consider a liquid CD or one with a shorter term. Carefully consider your cash flow needs before committing to a CD term to avoid unnecessary penalties. Certificate of deposit (CD) rates are a significant factor to consider when making an investment decision. It is important to understand the different types of CDs and their rates before making an investment. Some factors to consider include the term length, the interest rate, and any early withdrawal penalties. One strategy to maximize returns from CD rates is to diversify your investments across different terms and rates. Another strategy is to ladder your CDs, which involves buying CDs with different maturity dates. It is also important to be aware of the early withdrawal penalties associated with CDs. If you think you may need to access your money before the CD matures, consider a liquid CD or one with a shorter term. If you are looking for a safe and secure investment with the potential for some growth, CDs can be a good option.Understanding the Basics of Rates

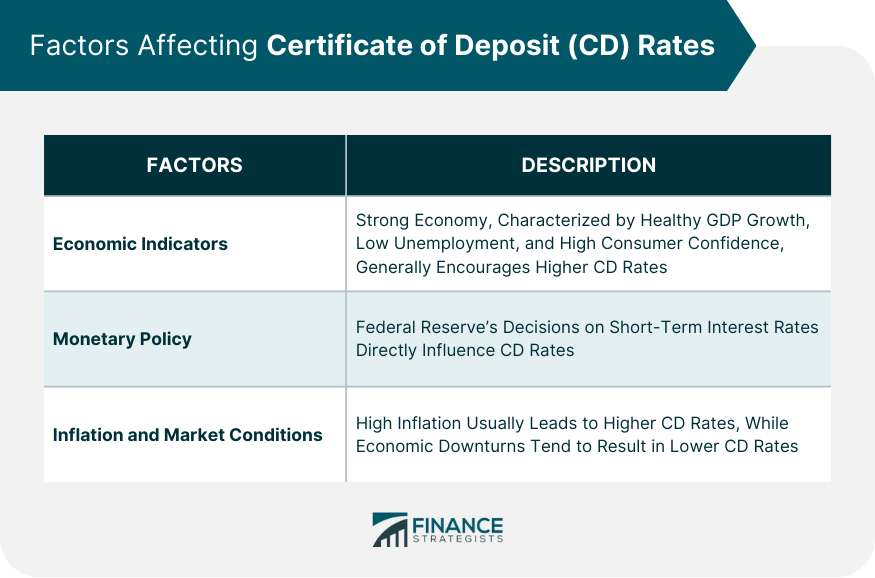

Factors Affecting Certificate of Deposit Rates

Economic Indicators

Monetary Policy

Inflation and Market Conditions

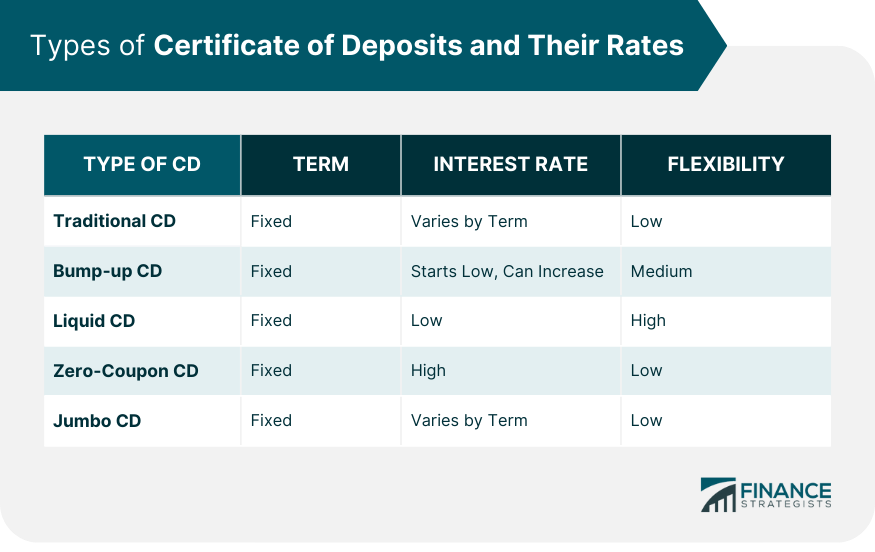

Types of CDs and Their Rates

Traditional CDs

Bump-up CDs

Liquid CDs

Zero-Coupon CDs

Jumbo CDs

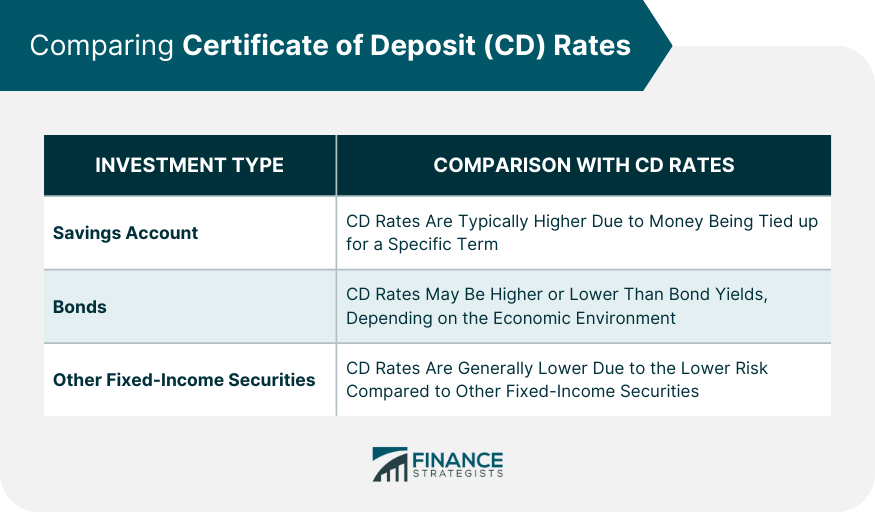

Comparing Certificate of Deposit Rates

Comparison With Savings Account Rates

Comparison With Bond Rates

Comparison With Other Fixed-income Securities

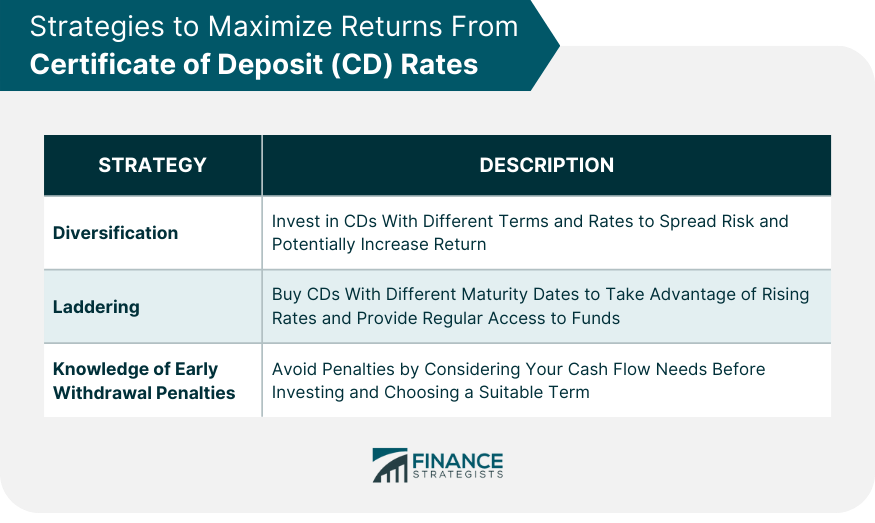

How to Maximize Returns From Certificate of Deposit Rates

Diversification Strategy

Laddering Strategy

Knowledge of Early Withdrawal Penalties

Bottom Line

Certificate of Deposit Rates FAQs

Certificate of deposit rates, or CD rates, are the interest rates offered by banks or credit unions on the amount deposited in a CD.

CD rates are influenced by various factors, including economic indicators, monetary policy set by the Federal Reserve, and current market conditions, including inflation.

There are multiple types of CDs, such as traditional, bump-up, liquid, zero-coupon, and jumbo CDs, each offering different terms and rates based on their unique features.

CD rates are usually higher than savings account rates, can be more or less than bond yields depending on the economic environment, and are generally lower than other riskier fixed-income securities.

Strategies such as diversification across different CD types and terms, laddering by buying CDs with different maturity dates, and understanding early withdrawal penalties can help maximize returns.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.