A Fixed-Rate Certificate of Deposit, often referred to as a Fixed-Rate CD, is a type of time deposit offered by banks and credit unions. When an individual invests in a Fixed-Rate CD, they are essentially lending money to the bank in exchange for a predetermined interest rate over a set period. This type of investment is a favorite among investors who want predictability in their returns. The terms and conditions, including the interest rate, are usually detailed in a document when the CD is initiated. The primary purpose of a Fixed-Rate CD is to allow individuals to earn a higher interest rate than a regular savings account without the risks associated with stock or bond investments. Moreover, for banks, CDs represent a stable source of funds they can use for lending. For many, it acts as a stepping stone between regular savings and entering the broader investment market. Upon purchasing a CD, the bank pays interest based on the amount deposited and the tenure of the CD. The rate remains unchanged for the duration of the term, hence the name "Fixed-Rate." This offers peace of mind for investors, as they can predict their exact earnings. This is unlike variable rate CDs, where the interest rate might change depending on market conditions. CDs come with varied timeframes, ranging from a few months to several years. The interest rates are usually higher for longer terms. However, until the end of this tenure, the money is effectively locked away unless one is willing to incur penalties. This means an investor needs to consider their future liquidity needs before investing. Withdrawing your funds before the maturity date often results in a penalty. This might be a fixed amount or a proportion of the interest earned. The exact amount or percentage varies by institution. This penalty is in place because banks rely on the lent money for specific periods, and early withdrawal disrupts their financial planning. Once a CD reaches its maturity date, it doesn't just cash out automatically. Typically, unless the owner specifies otherwise, banks will roll it over into a new CD, which might have a different interest rate based on current market conditions. Investors should be vigilant during this time to ensure they are getting the best rate or to decide if they want to cash out. Possibly the most attractive feature of CDs is the guaranteed return. The interest rate is predetermined and doesn't fluctuate, ensuring investors know exactly what they'll earn by the end. This sense of security is what drives many towards CDs, especially when markets are volatile. Given the penalties for early withdrawal, CDs deter unnecessary spending, fostering a disciplined saving approach. For individuals who find it hard to save, CDs act as a commitment device, forcing them to keep money untouched. Unlike stocks or bonds, where returns can be unpredictable, CDs ensure capital protection and a guaranteed return, making them an excellent choice for risk-averse investors. While they might not offer the high returns of riskier investments, they bring consistency and peace of mind. Many CDs compound interest daily or monthly, leading to higher overall earnings by the end of the term, especially for longer-duration CDs. The magic of compounding can result in significant growth, especially if the interest is left to accumulate over long periods. Money in a CD is not as readily accessible as in a checking or savings account. If sudden financial needs arise, accessing that money might result in penalties. Therefore, CDs might not be suitable for those who anticipate needing their funds on short notice. The fixed interest rate, while stable, might be outpaced by inflation. If the inflation rate surpasses the interest rate on a CD, the real value of the investment decreases over time. It's vital for investors to consider the prevailing economic environment and future inflation predictions when investing in CDs. Locking money in a CD might mean missing out on higher returns from other investments, especially in rising market environments. This is particularly the case during bull markets, where equities or other riskier investments might provide higher returns. If market interest rates rise after purchasing a CD, you'll be stuck with the lower rate until maturity, potentially leading to earnings below market potential. Thus, timing and market predictions can play a role in determining the attractiveness of CDs. As with any investment, it's wise not to put all your eggs in one basket. CDs can be a part of a diversified portfolio, balancing out riskier investments. A well-balanced portfolio often includes a mix of assets, with CDs providing stability. A CD ladder involves splitting investments across multiple CDs with different maturity dates. This strategy provides more regular access to funds and takes advantage of varying interest rates. It's an approach that offers both liquidity and the potential to capture rising rates. Before committing, ensure you're clear on the penalties. Some banks offer "no-penalty" CDs that allow early withdrawals without charges, though they might offer slightly lower interest rates. Being informed about these nuances will help in making an educated decision. In periods of rising interest rates, shorter-term CDs can be advantageous. They allow investors to reinvest more frequently at higher rates, ensuring they don't get locked into a below-market rate for long durations. Understanding market trends can thus enhance returns. Interest rates, terms, and penalties can vary significantly between institutions. It pays to shop around. By doing some research and comparing offers, investors can secure the best possible rates and terms. APY provides a clearer picture of real returns as it takes compounding into account. A CD with a higher APY is generally a better bet than one with a higher nominal interest rate but less frequent compounding. Always consider APY in comparisons, as it gives a more accurate representation of potential earnings. There are many varieties of CDs: bump-up, brokered, jumbo, and more. Each offers different advantages and terms, so it's essential to research and find the one that fits your financial goals. Some might offer the flexibility of rate adjustments or other unique features not found in traditional CDs. Always ensure your bank or credit union is FDIC insured or has the equivalent protection. This insurance covers up to $250,000 per depositor per institution, guaranteeing the safety of your investment even if the bank fails. This coverage provides an added layer of security, ensuring the safety of hard-earned savings. Fixed-rate CDs are a popular investment option for those who want a guaranteed return on their investment and a safe place to store their money. However, it's important to understand the limitations of CDs, such as limited liquidity and the potential for inflation risk. There are a number of strategies that can be used to maximize the returns on a fixed-rate CD, such as using a CD ladder or evaluating the penalty for early withdrawal. It's also important to shop around and compare offers from different banks and credit unions to get the best possible rates and terms. If you're considering investing in a fixed-rate CD, it's a good idea to speak with a financial advisor to get personalized advice. They can help you assess your individual circumstances and goals and recommend the best investment strategy for you.What Is a Fixed-Rate Certificate of Deposit?

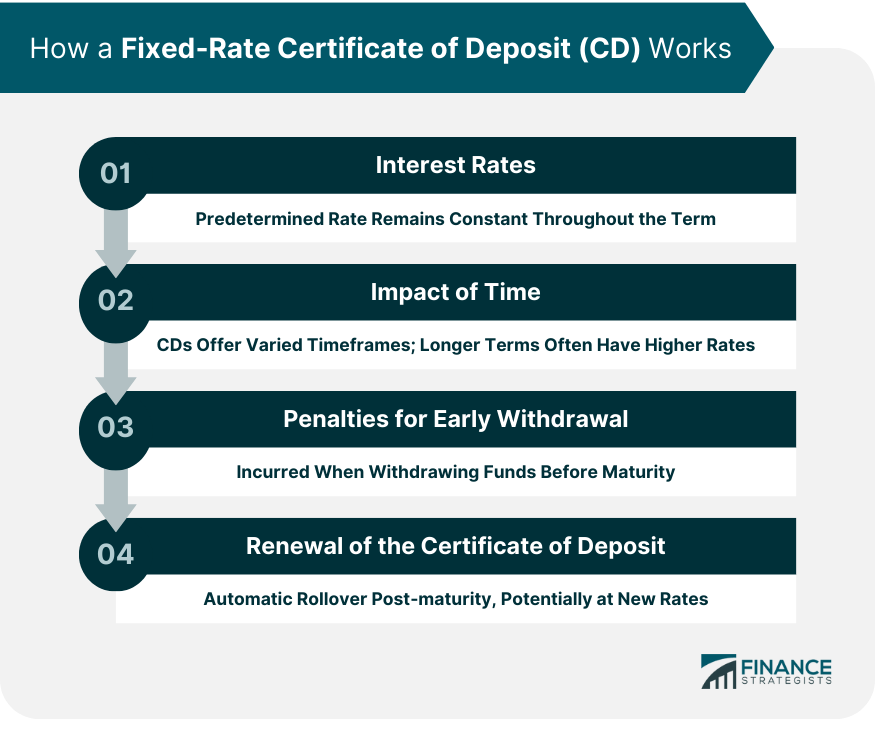

How a Fixed-Rate Certificate of Deposit Works

Role of Interest Rates

Impact of Time

Penalties for Early Withdrawal

Renewal of the Certificate of Deposit

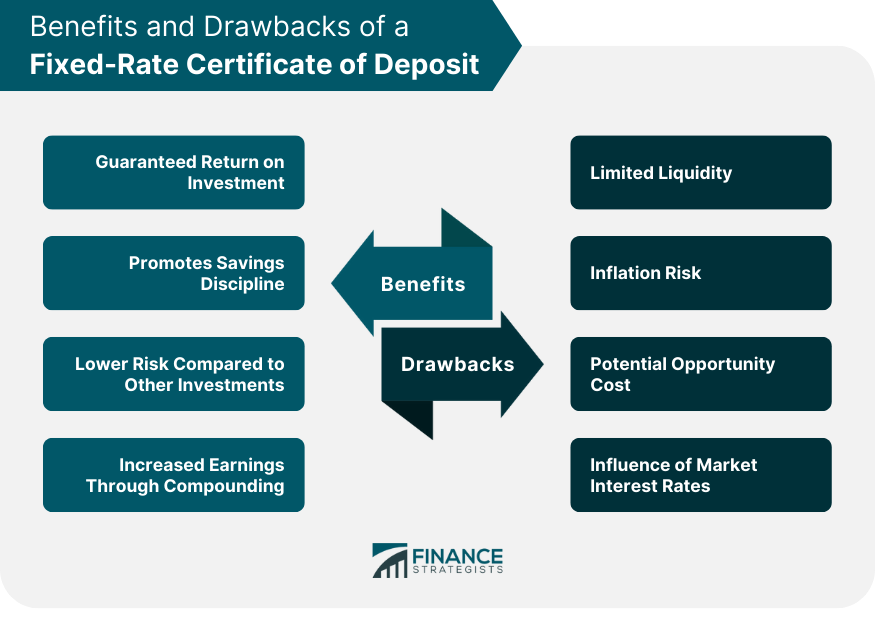

Benefits of a Fixed-Rate Certificate of Deposit

Guaranteed Return on Investment

Promote Savings Discipline

Lower Risk Compared to Other Investments

Increased Earnings Through Compounding

Drawbacks and Limitations of a Fixed-Rate Certificate of Deposit

Limited Liquidity

Inflation Risk

Potential Opportunity Cost

Influence of Market Interest Rates

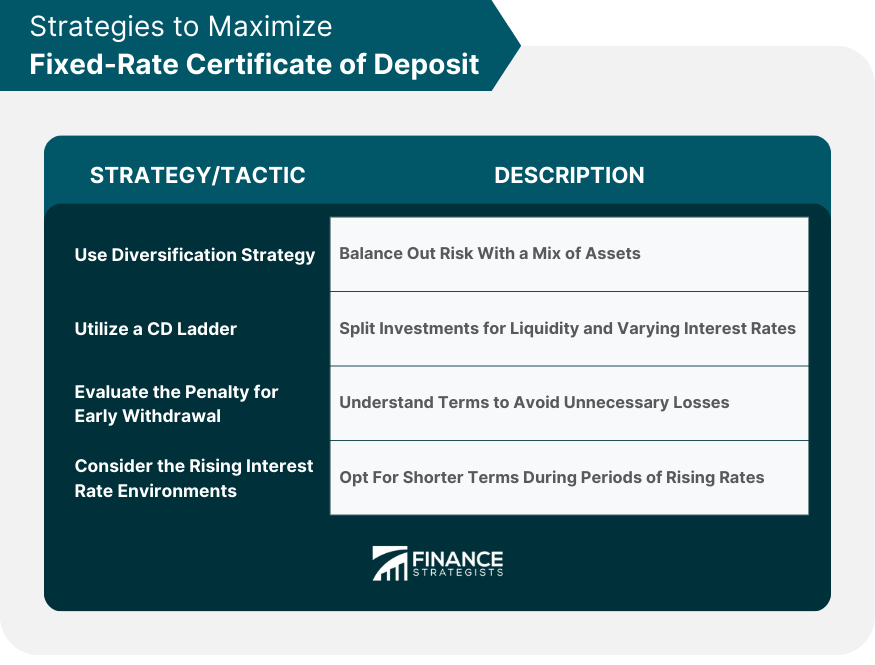

Strategies to Maximize Fixed-Rate Certificate of Deposit

Use Diversification Strategy

Utilize a CD Ladder

Evaluate the Penalty for Early Withdrawal

Consider the Rising Interest Rate Environments

Choosing the Right Fixed-Rate Certificate of Deposit

Comparing Different Banks and Credit Unions

Importance of APY (Annual Percentage Yield)

Looking Beyond the Traditional Fixed-Rate CDs

Impact of the Federal Deposit Insurance Corporation (FDIC) Coverage

Final Thoughts

Fixed-Rate Certificate of Deposit FAQs

A fixed-rate certificate of deposit is a time deposit offered by financial institutions that provides a predetermined interest rate over a specified period.

It locks in an agreed interest rate for a set term, offering guaranteed returns; however, early withdrawal may incur penalties.

It offers a guaranteed return, promotes savings discipline, has a lower risk compared to other investments, and can compound interest for increased earnings.

It has limited liquidity, potential inflation risks, and opportunity costs and may offer below-market returns if interest rates rise after purchase.

Consider strategies like diversification, using a CD ladder, evaluating early withdrawal penalties, and being aware of rising interest rate environments.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.