Investing in Certificates of Deposit (CDs) begins with assessing your financial goals and risk tolerance. Determine how long you're comfortable having your money tied up since CDs come with different terms, ranging from a few months to several years. Research and compare the CD rates from various financial institutions, considering the interest rate and the term length. Once you've chosen a bank or credit union, you'll need to open an account, provide necessary personal information, and make your initial deposit. Diversification can be achieved through a CD ladder, which involves investing in several CDs with different maturity dates. Be mindful of early withdrawal penalties and track the performance of your CDs. When a CD matures, decide whether to withdraw your money, reinvest it in a new CD, or let it automatically renew, based on your current financial needs and market conditions. When you open a CD, you deposit a certain amount of money, also known as the principal, with a financial institution. In return, the bank or credit union promises to pay you interest at a specified rate over a defined period, referred to as the term. The term can range from a few months to several years. CDs typically have a fixed interest rate, meaning the rate will not change over the lifespan of the CD. Usually, the longer the term of the CD, the higher the interest rate you can earn. Interest may be paid out monthly, quarterly, semi-annually, annually, or at maturity, depending on the terms of the CD. At the end of the term, when the CD matures, you can withdraw your initial deposit plus the accrued interest. If you do not take any action, many financial institutions will automatically renew the CD for the same term at the current interest rate. One important aspect to consider when investing in CDs is the potential for early withdrawal penalties. If you withdraw the money before the end of the term, you typically incur a penalty, which can eat into your earned interest and, in some cases, even the principal. Investors who want to benefit from higher interest rates but still need some level of liquidity often use a strategy called CD laddering. It involves investing in several CDs with different maturity dates. As each CD matures, you can either use the money or reinvest it into a new CD. A traditional CD is the most common type and is what people generally think of when referring to CDs. When you invest in a traditional CD, you agree to leave a certain amount of money in the bank for a fixed period, ranging from a few months to several years. Bump-up CDs offer investors the chance to increase their interest rate if rates go up during their CD term. This type of CD is a good choice when interest rates are expected to rise, as it allows you to benefit from those increases without incurring any penalties. Unlike traditional CDs, liquid CDs allow you to withdraw money from your CD without paying a penalty. This increased flexibility can be helpful if you think you might need to access your funds before the CD's maturity date, but it often comes with a lower interest rate than other CDs. Zero-coupon CDs do not pay out interest annually like other types. Instead, they are purchased at a significant discount to their face value, and at maturity, the full face value is paid out. They can be an excellent choice for long-term savers who don't need immediate income from their investment. Jumbo CDs require a much larger initial deposit than other types of CDs — usually $100,000 or more. Because of the larger deposit, banks typically offer a higher interest rate on jumbo CDs. They can be an attractive option for investors with significant funds who want a higher guaranteed return. Callable CDs give the issuing bank the right to "call" or terminate the CD before its maturity date and return your initial deposit along with any interest earned to date. This usually happens when interest rates fall, and the bank can borrow money more cheaply. Callable CDs often offer higher interest rates to compensate for the risk of the CD being called early. One of the significant advantages of CDs is the element of security they offer. As they are insured by the FDIC, they provide a virtually risk-free way to save money. Additionally, CDs provide a fixed return on investment, offering predictability that is often comforting to investors. You'll know exactly what your return will be at the end of the term, allowing you to plan your finances accordingly. Generally, CDs offer higher interest rates compared to regular savings accounts. This higher interest rate makes CDs a more attractive savings option for individuals looking to earn more from their stored-away money. Longer-term CDs typically offer the best rates, making them an appealing choice for long-term saving goals. A major drawback of investing in CDs is the lack of liquidity. Once you deposit your money into a CD, it's generally locked away until the CD reaches its maturity date. Early withdrawals usually attract penalties, which can eat into your interest earnings or even your original deposit. CDs carry interest rate risk in a rising-rate environment. When you lock in your money at a specific rate for a certain period, and the interest rates increase, you lose out on potential earnings. It's essential to keep a pulse on economic indicators and the Federal Reserve's actions to navigate this risk effectively. Inflation can impact the value of your investment in CDs. If the rate of inflation surpasses the interest rate you're earning on your CD, your investment loses purchasing power. That is, even though you're earning interest, your money might not grow as fast as the cost of living. Your financial goals should play a significant role in your decision to invest in CDs. If you're looking for a low-risk way to grow your savings over time, CDs might be a good choice. If you need your money to be readily accessible or are seeking higher returns, other investment types may be more appropriate. Another critical factor in deciding to invest in CDs is your risk tolerance. CDs are an excellent choice for conservative investors due to their low risk and guaranteed return. However, those comfortable with more risk may prefer options with potentially higher returns. The length of time you plan to invest your money can impact your decision to invest in CDs. For short-term goals, CDs can be a great choice. For long-term goals, especially those over a decade away, other investment types may offer better returns. When choosing a CD, it's crucial to understand the terms. The interest rate is one of the most significant considerations as it directly impacts your return. Longer-term CDs typically offer higher rates. Also, consider the maturity date, which is when your money becomes available without penalty. Before investing, make sure to understand the penalties for withdrawing your funds before the CD's maturity date. These penalties can vary widely and could significantly impact your return if you need to access your funds early. Before investing, it's crucial to research and compare CD rates from different financial institutions. Online resources make this process easier than ever. Make sure to consider both the interest rate and the term length when comparing options. The choice of financial institution can be as important as the CD itself. Consider factors such as the institution's reputation, the convenience of access to your funds, and the level of customer service in addition to the CD rates offered. Buying a CD is relatively straightforward. It typically involves opening a new account with the chosen financial institution, providing some personal information, and making your initial deposit. Some institutions may require a minimum deposit. A CD ladder involves dividing your investment across several CDs with different maturity dates. This approach allows you to benefit from higher interest rates of long-term CDs while also maintaining some level of liquidity as some of your CDs mature at different times. Even though CDs offer fixed returns, it's still important to track their performance. Regularly review your CD's terms, including its maturity date and interest rate, to ensure it's meeting your investment goals. When a CD matures, you typically have several options: you can withdraw your money, reinvest it into a new CD, or allow it to automatically renew. Your choice should be based on your current financial needs and the market conditions. If you decide to reinvest in a CD, you'll typically go through a process known as a rollover. This involves taking the funds from the matured CD and putting them into a new CD, either with the same or different term length. Investing in CDs offers a blend of predictability, security, and attractive interest rates, making it an excellent option for conservative investors. Understanding how CDs work, including the concept of fixed interest rates, CD terms, and maturity, is essential. It's also crucial to be aware of potential early withdrawal penalties and strategies like CD laddering to maximize returns. Different types of CDs, such as traditional, bump-up, liquid, zero-coupon, jumbo, and callable CDs, provide a variety of options to cater to individual investor needs. Despite the benefits, CDs carry liquidity concerns, interest rate risks, and inflation risks, highlighting the need for a careful selection process based on financial goals, risk tolerance, time horizons, CD terms, and early withdrawal penalties. Managing CD investments effectively includes performance tracking and making sound decisions upon CD maturity. With this comprehensive understanding, investors can leverage CDs to secure their financial future.How to Invest in CDs: Overview

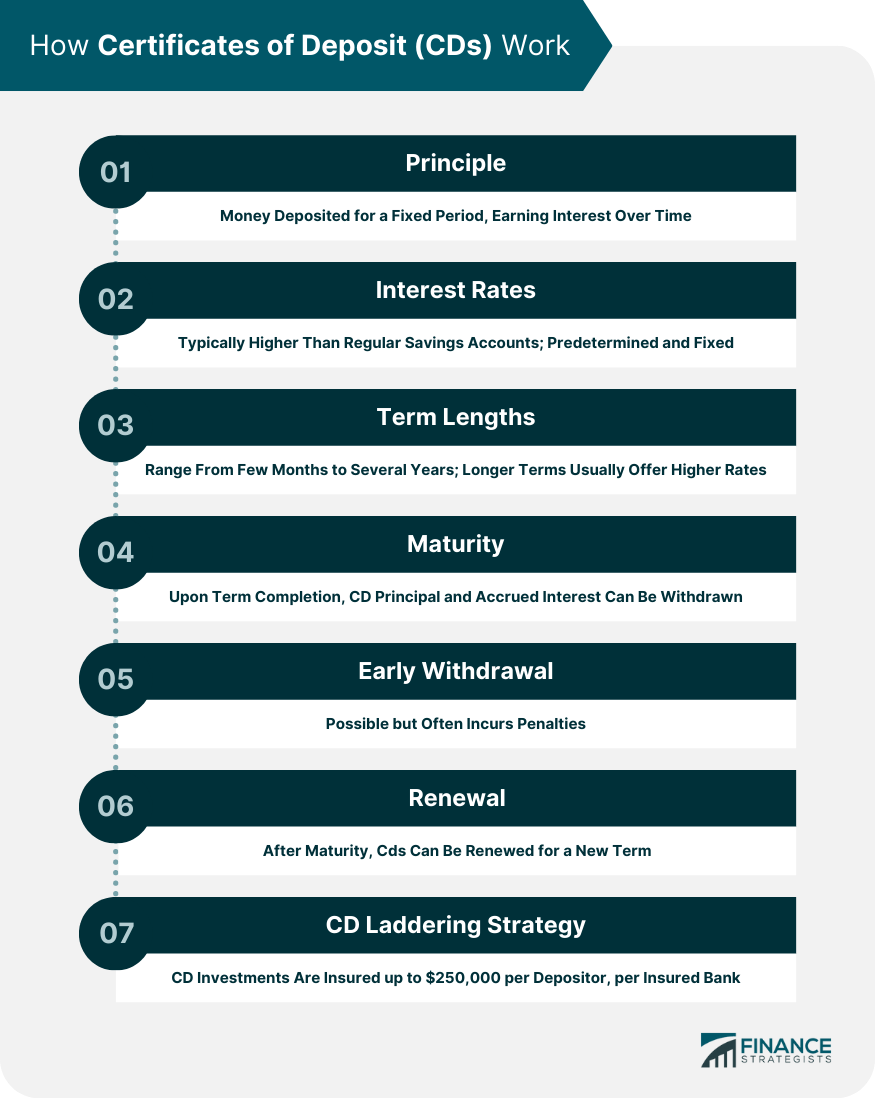

How CDs Work

Principles of CDs

Interest Rates and CD Terms

Maturity and Renewal

Early Withdrawal Penalties

CD Laddering Strategy

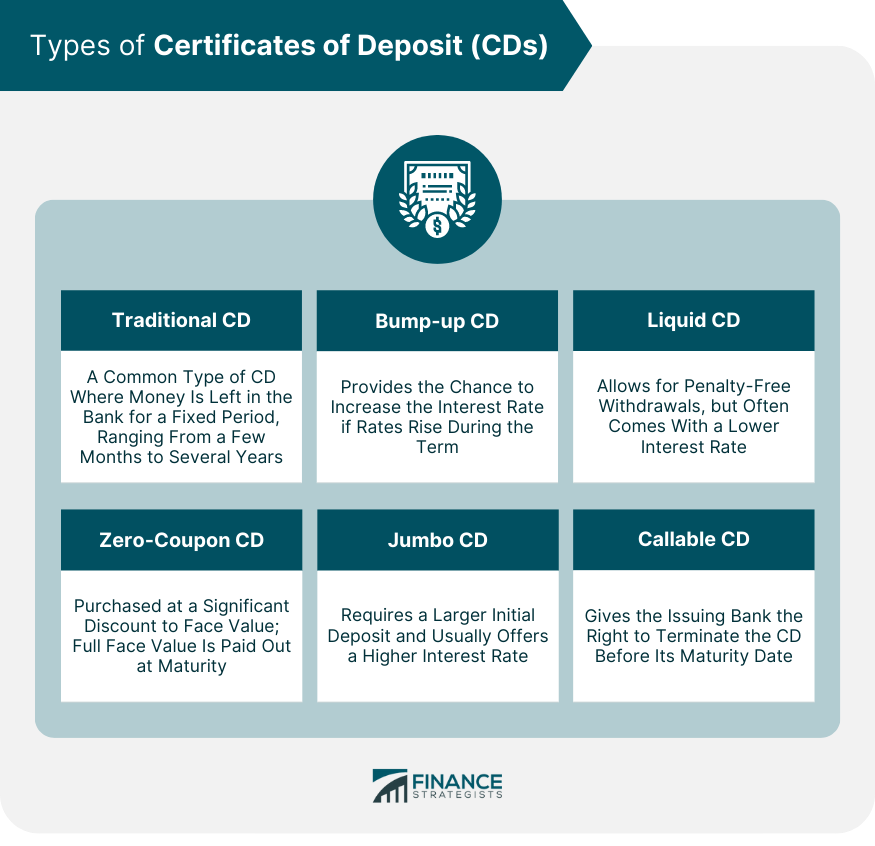

Types of CDs

Traditional CDs

Bump-up CDs

Liquid CDs

Zero-Coupon CDs

Jumbo CDs

Callable CDs

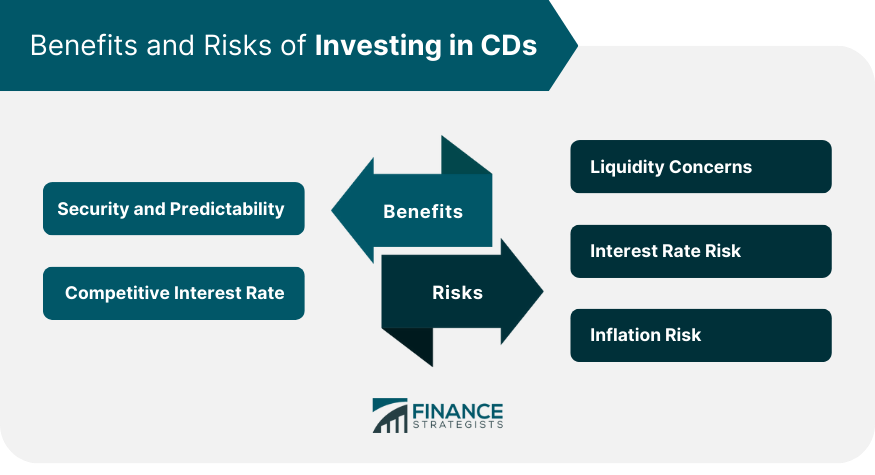

Benefits and Drawbacks of Investing in CDs

Security and Predictability

Competitive Interest Rates

Risks of Investing in CDs

Liquidity Concerns

Interest Rate Risk

Inflation Risk

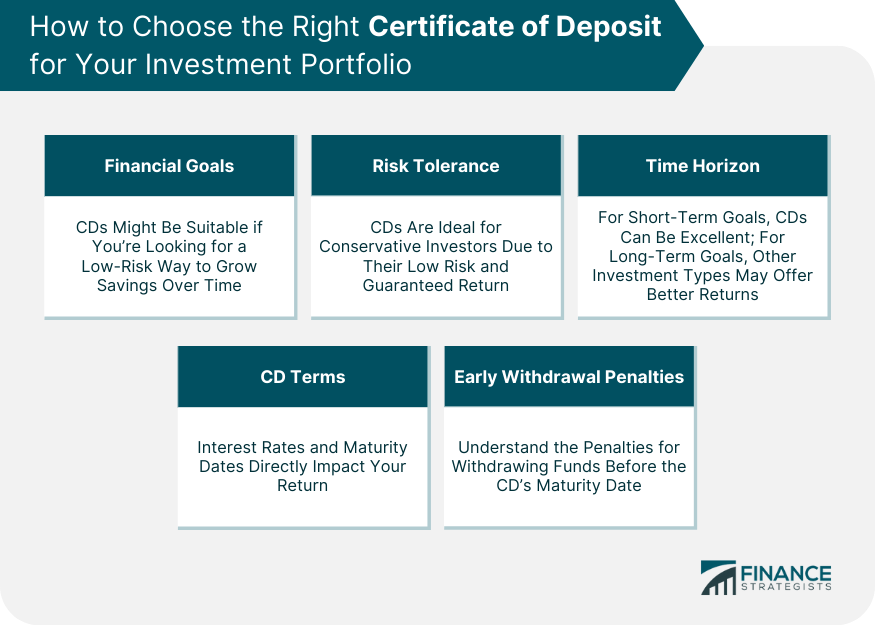

How to Choose the Right CD for Your Investment Portfolio

Assess Financial Goals

Understand Risk Tolerance

Consider the Time Horizon for Your Investment

Examine the CD Terms

Assess Penalties for Early Withdrawal

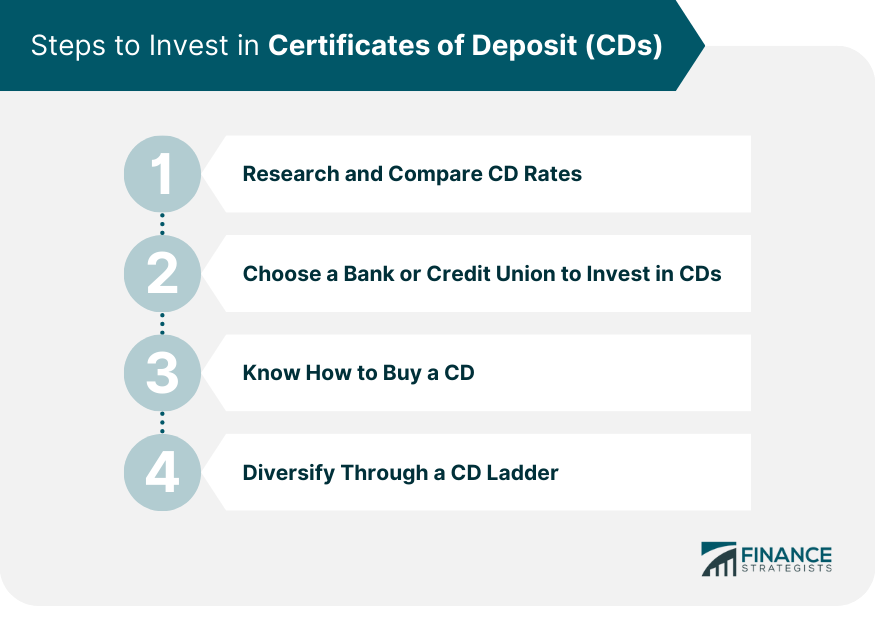

Steps to Invest in CDs

Research and Compare CD Rates

Choose a Bank or Credit Union to Invest in CDs

Know How to Buy a CD

Diversify Through a CD Ladder

How to Manage Your CD Investment

Track the Performance of Your CDs

Decide What to Do as Your CD Matures

Reinvest in CDs: Rollover Process

Conclusion

How to Invest in CDs FAQs

Investing in CDs offers several benefits including safety, predictability, and fixed returns. CDs are insured by the FDIC, meaning they're virtually risk-free. They offer a fixed interest rate that doesn't change over the term of the CD, which makes them a predictable investment.

Choosing the right CD requires considering several factors. First, you should assess your financial goals and risk tolerance. Then, consider the time horizon for your investment. You'll also need to examine the terms of the CD, including interest rates and maturity dates, and understand any penalties for early withdrawal.

One common strategy is a CD ladder, which involves diversifying your investment across several CDs with different maturity dates. This approach provides the benefit of higher interest rates from long-term CDs while maintaining some level of liquidity. CDs can also be used for retirement savings and tax planning.

While CDs are generally low-risk, they do have some potential pitfalls. Inflation can erode the purchasing power of your investment over time. There can also be penalties for withdrawing from your CD early. Additionally, changes in market conditions or Federal Reserve policies can impact the returns on new and renewed CDs.

Managing your CD investment involves tracking its performance and deciding what to do as your CD matures. You can choose to withdraw your money, reinvest it into a new CD, or let it automatically renew. The choice should be based on your current financial needs and market conditions.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.