A Certificate of Deposit (CD) is a type of fixed-income investment product offered by banks and credit unions. When you purchase a CD, you agree to deposit a sum of money for a fixed period, typically ranging from a few months to several years. The financial institution pays you interest on your deposit, typically at a higher rate than standard savings accounts. At the end of the term, known as the maturity date, you receive your initial deposit back along with the accrued interest. However, if you withdraw the money before the maturity date, you usually incur a penalty. CDs are considered to be one of the safest investment vehicles, insured up to $250,000 by the Federal Deposit Insurance Corporation (FDIC) in the US, making them a suitable choice for risk-averse investors seeking stable returns. When it comes to depositing money into a Certificate of Deposit, most banks and financial institutions have established their respective standard limits. This standard limit is often dictated by the type of CD a customer chooses. For instance, a traditional or standard CD generally requires a lower minimum deposit, such as $500 or $1,000, whereas a jumbo CD might require a minimum deposit of $100,000. However, the concept of a maximum CD deposit limit is not as commonly discussed or regulated. Typically, banks do not restrict the maximum amount that a customer can deposit in a CD. But it is essential to note that the Federal Deposit Insurance Corporation only insures up to $250,000 per depositor, per FDIC-insured bank, per ownership category. As a result, depositing amounts larger than this limit may expose the customer to a certain degree of risk. Banks often have a policy that dictates the maximum deposit amount for a CD. This policy may vary based on a variety of factors such as the bank's size, financial health, risk tolerance, and strategic goals. The policy could be crafted to manage the bank's risk exposure, ensure regulatory compliance, or balance its portfolio of financial products. A bank's current financial health can also impact the maximum deposit amount. A bank that is financially strong may be able to accept larger deposits, as they have the resources to handle potential losses or challenges. On the other hand, a bank that is financially weaker may limit deposit amounts to reduce exposure to risk and improve stability. The type of customer can also influence the maximum deposit amount for a CD. For example, retail customers may have lower limits compared to institutional customers like corporations, non-profits, or government agencies. This is because institutional customers usually have larger amounts of money to deposit and a lower likelihood of defaulting on their obligations. Banks might also consider the history and depth of their relationship with a customer when setting maximum deposit amounts. Long-standing customers with a positive history may be allowed to deposit larger amounts. This is especially true for customers who have other relationships with the bank, such as loans, mortgages, or significant deposits in other accounts. While not always the case, there may be some regulatory constraints that influence the maximum CD deposit amount. For example, the FDIC in the United States insures deposits up to $250,000 per depositor, per insured bank, for each account ownership category. Therefore, banks may set their maximum limits around this mark to ensure that all deposits remain insured. General economic conditions can also impact the maximum deposit amount. During periods of economic uncertainty or instability, banks may lower their maximum deposit limits to reduce risk. Conversely, during periods of economic growth, banks might increase their limits to attract more deposits and expand their lending operations. There are several types of CDs, including standard CDs, jumbo CDs, and brokered CDs. Each of these comes with its own set of rules and limits. Standard CDs usually have lower minimum deposit requirements, making them more accessible to the average saver. Jumbo CDs, on the other hand, require a significantly larger minimum deposit (often $100,000 or more) but usually offer higher interest rates in return. Brokered CDs are bought and sold through brokerage firms rather than directly through banks. They often offer higher rates than standard CDs and, as they are sold in a competitive marketplace, the maximum deposit amounts may be higher than those offered directly by banks. Banks often provide tiered interest rates, where higher deposits receive higher interest rates. By maximizing your CD deposit, you may qualify for these higher rates, leading to greater earnings over the CD's term. When you stay within the FDIC insurance limit of $250,000 per depositor, per bank, you ensure that even if the bank fails, your deposit is still protected. This assurance can provide a significant peace of mind, especially for conservative investors. CDs offer a fixed interest rate over a specific period, providing a guaranteed and predictable return. For investors with a large sum of money, this can translate into substantial guaranteed earnings. CDs can be a safe haven for large sums of money, especially during volatile market conditions. By placing your money in a CD, you avoid the ups and downs of the stock market or other risky investment ventures. CDs require you to lock in your money for a specified period. If you need to withdraw your funds before the CD matures, you'll likely face an early withdrawal penalty, which can eat into your earned interest and even your initial deposit. Life is unpredictable, and you might need access to your funds unexpectedly. If this happens, the cost of breaking your CD can be substantial. Early withdrawal penalties differ from bank to bank but can sometimes be severe enough to reduce your original principal. If interest rates rise after you open your CD, you're locked into the lower rate until the CD matures. Thus, having a large sum locked in a CD could mean missing out on potential earnings from other investments with rising yields. In a climate of high inflation, the returns on CDs – especially those with long terms – might not keep up with the rising cost of living. In such cases, even a maximum CD deposit might not yield the desired return in real terms. One strategy to safeguard a large amount of money while still earning interest is to split your funds across multiple CDs or banks. This way, you stay within the FDIC insurance limit at each institution, and your money is protected even if a bank fails. Splitting funds across different CDs, also known as a CD ladder, can also provide more regular access to your funds without facing early withdrawal penalties. You can structure your ladder so that CDs mature at different times, providing you with a steady stream of accessible funds. Money Market Accounts (MMAs) can be a suitable alternative to CDs. They offer competitive interest rates, often higher than savings accounts, and are less restrictive than CDs. MMAs offer more liquidity as you can make a limited number of withdrawals or write checks against your account each month. Treasury Bills, or T-Bills, are short-term securities issued by the U.S. government. They're considered one of the safest investments and can be a good option if you're looking for a short-term place to park a large sum of cash. However, the returns on T-Bills are generally lower than those of CDs and other investments. Investing in bonds can be a viable option for a large sum of money. They offer the potential for higher returns than CDs but do come with additional risk. Bonds are loans that you give to companies or governments, and while they promise to pay back the loan with interest, there's always a risk that the issuer might default. Maximizing CD deposits can bring about substantial benefits, particularly in terms of higher interest earnings, assurance of FDIC insurance coverage, predetermined return on investment, and reduced exposure to market volatility. However, it also poses certain challenges such as limited liquidity, risk of penalties for early withdrawal, potential loss of rising investment opportunities, and risk of inflation outpacing earnings. It's essential to consider the factors that influence maximum CD deposit amounts, including the bank's policy, financial position, customer type and relationship, regulatory limits, economic conditions, and CD types. Exploring alternatives like splitting deposits across multiple CDs or banks, and other investment options such as MMAs, T-Bills, and bonds can also be worthwhile. To navigate these complexities and optimize your financial decisions, reach out to a banking service professional today to guide you on how to best manage your CD deposits.Understanding Certificate of Deposits (CDs)

Standard Limits for CD Deposits

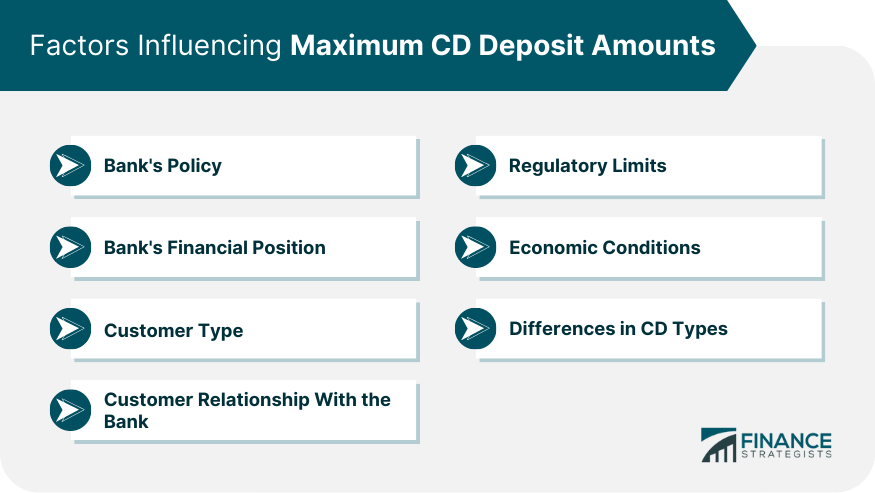

Factors Influencing Maximum CD Deposit Amounts

Bank's Policy

Bank's Financial Position

Customer Type

Customer Relationship With the Bank

Regulatory Limits

Economic Conditions

Differences in CD Types

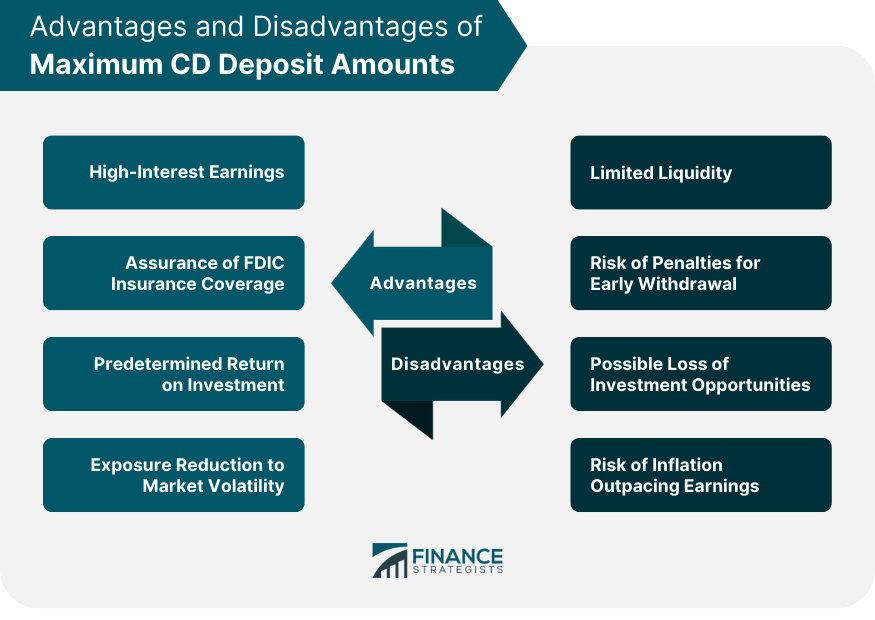

Advantages of Maximum CD Deposit Amounts

High-Interest Earnings

Assurance of FDIC Insurance Coverage

Predetermined Return on Investment

Exposure Reduction to Market Volatility

Disadvantages of Maximum CD Deposit Amounts

Limited Liquidity

Risk of Penalties for Early Withdrawal

Possible Loss of Investment Opportunities in Rising Interest Market

Risk of Inflation Outpacing Earnings

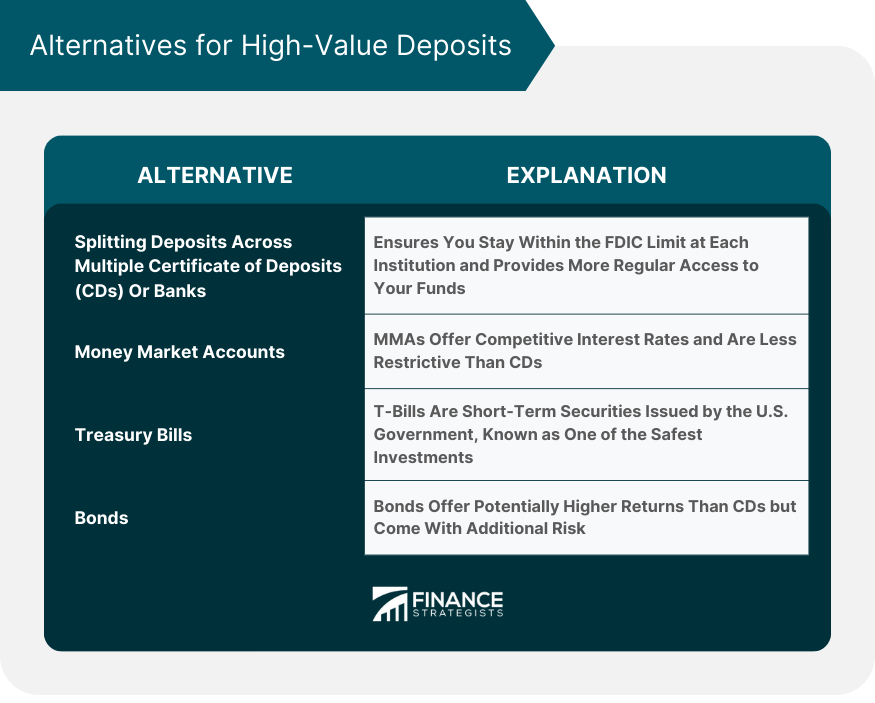

Exploring Alternatives for High-Value Deposits

Splitting Deposits Across Multiple CDs or Banks

Other Investment Options

Money Market Accounts (MMA)

Treasury Bills

Bonds

Bottom Line

Maximum CD Deposit Amounts FAQs

Factors like bank policies, FDIC insurance limitations, and the type of CD chosen can influence maximum CD deposit amounts.

Higher interest earnings, assured FDIC insurance coverage, predetermined ROI, and reduced market volatility exposure are some benefits.

High CD deposits can lead to limited liquidity, risk of early withdrawal penalties, potential loss of rising market opportunities, and inflation risk.

You can navigate this by splitting your deposits across multiple CDs or banks to stay within the FDIC's $250,000 insurance limit.

Alternatives include splitting funds across multiple CDs or banks, investing in Money Market Accounts, Treasury Bills, or Bonds.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.