Certificates of Deposit (CDs) are low-risk financial products offered by banks and credit unions. The pros of investing in CDs include higher interest rates than standard savings accounts, a fixed rate of return, federal insurance through the FDIC, and a variety of term lengths to suit different savings goals. They provide a safe, predictable option for those wanting a guaranteed return. However, CDs also come with certain cons. Money invested in a CD is not easily accessible before the end of the term without incurring penalties, which can be a disadvantage for those needing liquidity. Additionally, the fixed interest rate can prove less advantageous if inflation rises significantly, eroding the value of returns. Lastly, compared to riskier investment options like stocks, CDs might offer lower returns. One of the significant advantages of CDs is that they often offer higher interest rates compared to traditional savings accounts. This allows your money to grow faster, providing a more substantial return on your investment. The interest rate is fixed and will not change over the life of the CD, regardless of fluctuations in the broader market. CDs provide a fixed rate of return. When you invest in a CD, the interest rate is set, and it won't change until the CD matures. This can be a significant advantage for investors looking for a predictable income stream, particularly during times of financial market volatility. You know exactly how much you'll earn and when you'll receive it, providing financial certainty and stability. CDs are covered by federal insurance provided by the Federal Deposit Insurance Corporation (FDIC) up to the maximum allowed by law—currently $250,000 per depositor, per institution. This protection means that even if the bank or credit union fails, your investment is still safe. It's a critical advantage for those seeking a low-risk place to store their cash. CDs come in a variety of term lengths, ranging from as short as a few days to as long as several years. This variety allows investors to choose a term that aligns with their financial goals and timelines. If you know you won't need your funds for a specific time, you can select a CD with a term that matches, maximizing your earnings. Perhaps the most significant advantage of CDs is their low-risk nature. Because they offer fixed, guaranteed rates of return and are covered by FDIC insurance, they're one of the safest investment vehicles available. For conservative investors or those saving for short-term goals, CDs can be an excellent choice. One of the main downsides of CDs is that your funds are not easily accessible. When you invest in a CD, your money is tied up for the term of the CD. If you need to access your funds before the term ends, you'll likely face an early withdrawal penalty, which could eat into your earnings and even your original deposit. Inflation risk is another disadvantage associated with CDs. While the fixed rate of return can be an advantage in terms of predictability, it also means you could end up losing purchasing power if inflation rates rise above the interest rate you're earning on your CD. If inflation is high, your CD may not earn enough to keep pace, effectively eroding the value of your savings. While CDs are low-risk, they also have the potential for lower returns compared to other investment options, such as stocks or bonds. If you're willing to take on more risk for the possibility of higher returns, investing in these other types of assets might be more advantageous. Finally, CDs often come with early withdrawal penalties. If you need to access your money before the term of the CD ends, you'll likely face a penalty, which could be a significant percentage of the interest earned or even a portion of the principal. These penalties can be steep, so it's important to be sure you won't need the funds before the term ends. First and foremost, consider your risk tolerance. CDs are generally low-risk investments as they offer a fixed, guaranteed return. However, the low-risk nature also means potentially lower returns compared to other investments such as stocks or bonds. If you're a conservative investor seeking stability and predictability, CDs could be an excellent choice. On the other hand, if you're willing to take on more risk for potentially higher returns, other investment vehicles might be more appropriate. Your financial goals should significantly influence your decision to invest in CDs. If you're saving for a short-term goal and don't want to risk the principal, a CD might be a great fit. However, if your financial objective involves substantial growth over the long term, you might be better off with investments that have higher return potential. CDs require you to commit your money for a specific time frame, usually ranging from a few months to several years. Consider your investment timeline before you decide to invest in a CD. If you're certain you won't need the funds for a while, CDs can offer a higher return than a regular savings account. However, if you might need the funds sooner, be aware that early withdrawal can come with penalties. When considering a CD, it's important to consider the potential impact of inflation. CDs come with fixed interest rates. If the inflation rate rises above the interest rate on your CD, you could end up losing purchasing power. Therefore, if you expect high inflation in the near future, a CD might not be the best investment choice. Keep in mind that most CDs have early withdrawal penalties. These penalties can cut into your earned interest, and sometimes even your initial deposit. If you think there's a likelihood that you'll need to withdraw your money before the CD's term is up, you might want to look for a no-penalty CD or consider a different investment entirely. Certificates of Deposit (CDs) present a compelling low-risk investment choice, offering a higher interest rate than typical savings accounts, an unwavering return rate, and diverse term lengths to accommodate various financial objectives. Their federally insured nature adds another layer of security, making them a safe option for conservative investors. However, accessibility of funds and potential penalties upon early withdrawal, coupled with inflation risks and comparatively lower returns vis-a-vis riskier investments, necessitate careful evaluation before investing in CDs. A keen understanding of personal risk tolerance, investment timelines, inflation projections, and the potential necessity for premature withdrawal can steer investors toward making informed and profitable decisions, maximizing the benefits while mitigating potential drawbacks.What Are Certificates of Deposits (CDs)?

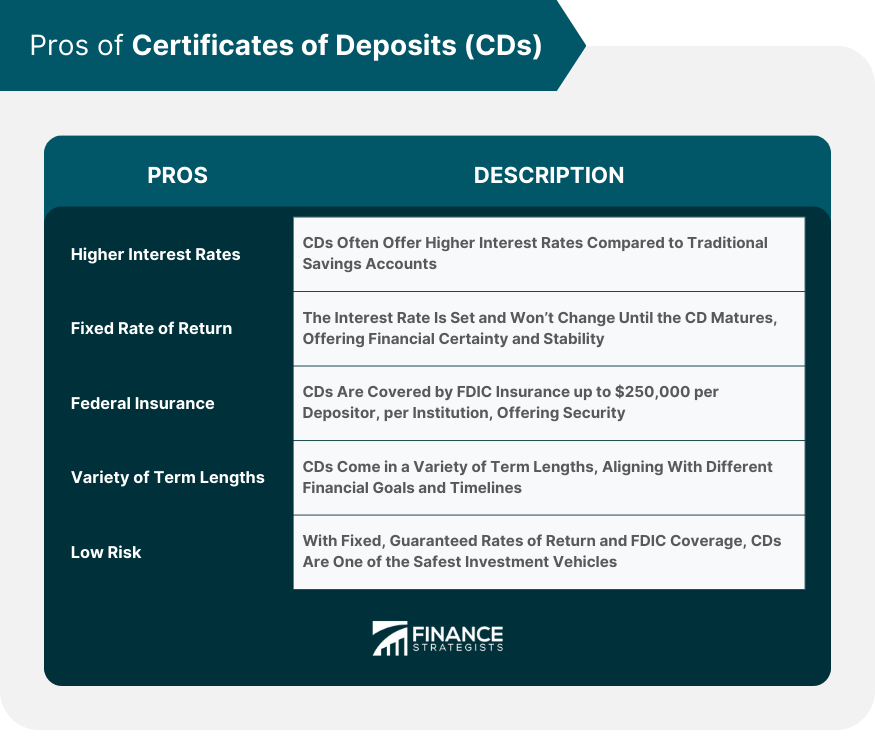

Pros of Certificates of Deposits (CDs)

Higher Interest Rates Than Savings Accounts

Fixed Rate of Return

Federal Insurance

Variety of Term Lengths

Low Risk

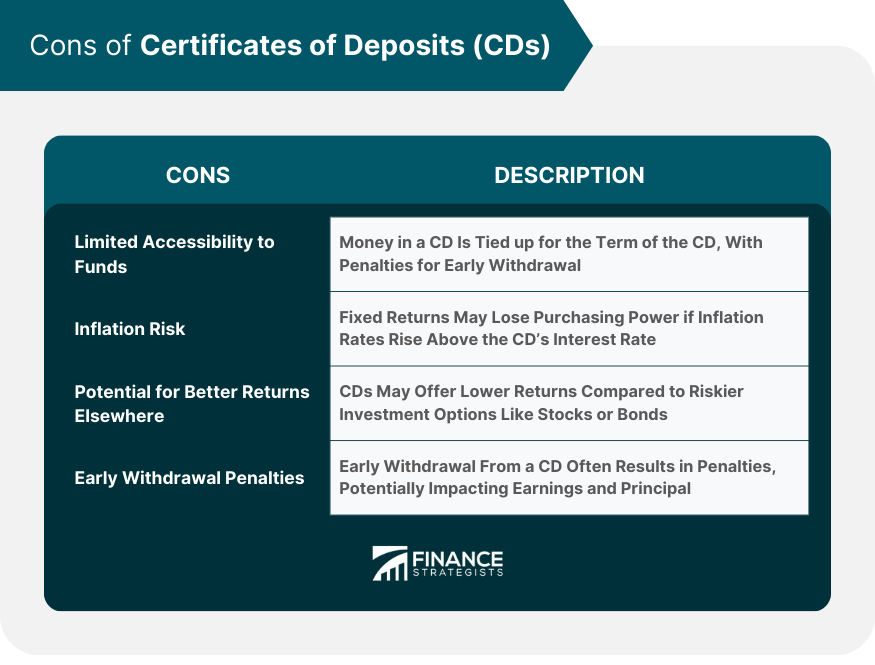

Cons of Certificates of Deposits (CDs)

Accessibility to Funds

Inflation Risk

Potential for Better Returns Elsewhere

Early Withdrawal Penalties

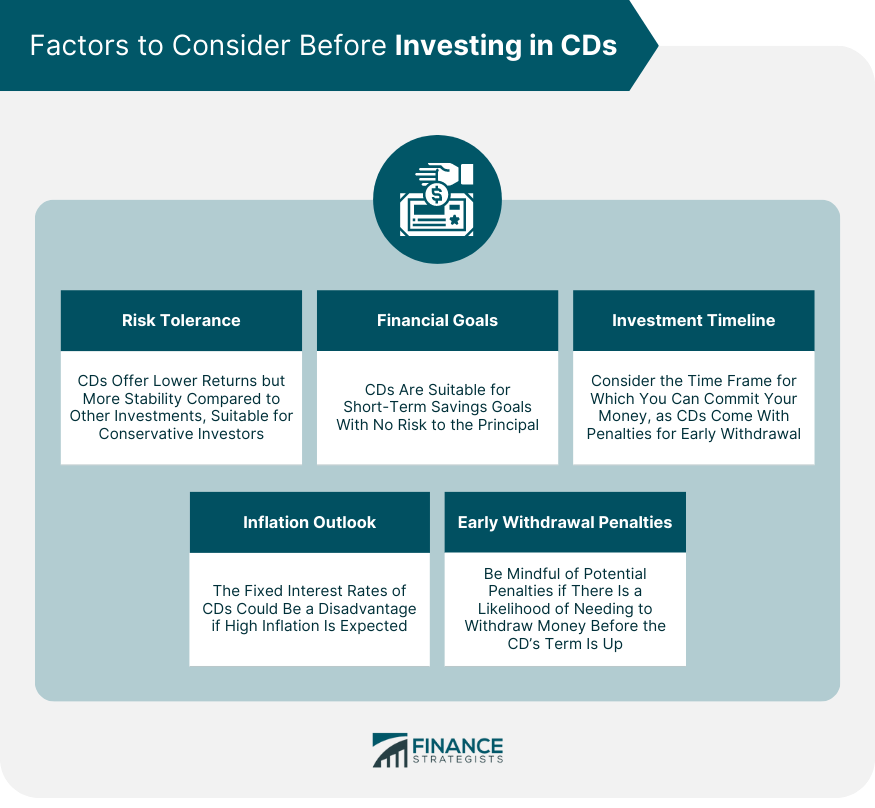

Factors to Consider Before Investing in CDs

Risk Tolerance

Financial Goals

Investment Timeline

Inflation Outlook

Early Withdrawal Penalties

Conclusion

Pros and Cons of CDs FAQs

Term lengths for CDs can vary widely, from as short as a few weeks to as long as several years. Most banks and credit unions offer CDs with term lengths of 3 months, 6 months, 1 year, 18 months, 2 years, 3 years, and 5 years.

Yes, funds in CDs are insured up to the maximum amount allowed by law, which is $250,000 per depositor, per FDIC-insured bank, per ownership category. This makes CDs a low-risk investment option.

While you technically can withdraw money from a CD before its maturity date, doing so will likely result in an early withdrawal penalty. This penalty could eat into the interest you've earned or even the principal amount.

No, the interest rate of a CD can vary based on factors such as the issuing bank, the term length of the CD, and the current interest rate environment. Typically, longer-term CDs offer higher interest rates.

Typically, the interest rate of a CD is fixed for the duration of its term. However, some types of CDs, such as variable-rate or adjustable-rate CDs, can have interest rates that change over time. It's important to understand the terms of your specific CD.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.