A check is a written, dated, and signed instrument that directs a bank to pay a specific sum of money to the bearer or a designated beneficiary. Checks are a widely used form of payment in the banking and financial industry, allowing individuals and businesses to transfer funds from one account to another without needing physical cash. The purpose of a check is to provide a convenient and secure method for transferring funds between parties. Checks serve as a written instruction from the account holder, or drawer, to their bank, directing the bank to pay a specified amount to the payee, or recipient. This allows for efficient, traceable transactions without the need for exchanging large sums of cash or relying on electronic methods. Checks play a vital role in the banking system as they offer a reliable and widely accepted method of payment. They facilitate trade and commerce by enabling individuals and businesses to make transactions without the need for physical cash. Checks also provide a record of payment, allowing account holders to track their expenses and maintain accurate financial records. Bearer checks are checks that are payable to the person possessing the check, rather than a specified payee. These checks are easily transferable and can be cashed by anyone holding the check, making them a convenient but less secure form of payment. Order checks are checks made payable to a specific individual or entity, as designated on the payee line of the check. This type of check offers greater security than bearer checks, as it can only be cashed or deposited by the designated payee or their authorized representative. Certified checks are personal checks that have been verified and guaranteed by the issuing bank. The bank confirms that the account holder has sufficient funds to cover the check amount and places a hold on those funds until the check is presented for payment. Certified checks offer greater security and assurance to the payee that the check will not bounce due to insufficient funds. Cashier's checks are checks issued by a bank, drawn on the bank's own funds rather than the account holder's funds. These checks provide a higher level of security for the payee, as they are guaranteed by the issuing bank and are less likely to be returned due to insufficient funds or other issues. Traveler's checks are pre-printed, fixed-amount checks that can be used as a secure and convenient alternative to cash while traveling. They can be replaced if lost or stolen and are widely accepted at hotels, restaurants, and other establishments around the world. Personal checks are checks issued by individuals from their personal bank accounts. They are a common form of payment for everyday transactions, such as paying bills or making purchases. Personal checks offer convenience and flexibility but may be subject to fees and other limitations, depending on the account holder's bank and account type. The name of the account holder, or drawer, is typically printed on the upper left corner of the check. This identifies the person or entity responsible for the funds and the account from which the funds will be drawn. The address of the account holder is also usually printed on the upper left corner of the check. This provides additional identifying information and may be used for correspondence or verification purposes. The payee line is the space on the check where the drawer writes the name of the person or entity to whom the check is payable. This designates the recipient of the funds and ensures that only the specified payee can cash or deposit the check. The amount of the check is written out in words on a designated line, typically located to the right of the payee line. This ensures that the check amount is clear and helps prevent tampering or alteration of the check. The date on which the check is written is indicated on the upper right corner of the check. This is important for record-keeping purposes and may affect the validity of the check, as some checks become stale-dated if not cashed or deposited within a specific time frame. The drawer's signature is required on the bottom right corner of the check. The signature authorizes the bank to pay the specified amount to the designated payee and serves as a security measure to verify the authenticity of the check. The name of the bank where the drawer's account is held is usually printed on the check. This provides the payee with information about the institution responsible for processing the check and may be used for verification purposes. The bank's routing number is a nine-digit code printed on the bottom left corner of the check. This number identifies the specific financial institution and its location and is used to route the check through the banking system for processing. The account number of the drawer is printed on the bottom of the check, following the bank's routing number. This number identifies the specific account from which the funds will be drawn and is used by the bank to process the check and transfer funds to the payee's account. The check clearing process begins when the payee deposits the check at their bank. The bank then forwards the check to the drawer's bank for payment. The drawer's bank verifies the check's authenticity and validates the account holder's signature, account number, and available funds. If the check is found to be valid, the bank proceeds with the clearing process. The funds are transferred from the drawer's account to the payee's account through an interbank clearing system. This process may take several days, depending on the banks involved and the specific clearing system used. Once the check has been cleared and the funds have been transferred, the payee's bank makes the funds available for withdrawal or use. The time it takes for funds to become available may vary depending on the bank's policies and the type of check deposited. MICR is a technology used to print the routing number, account number, and check number on checks using magnetic ink. This allows banks to process checks quickly and accurately by using specialized equipment to read the magnetic characters. Watermarks are faint designs or images embedded in the check paper, visible when held up to light. They serve as a security feature to deter counterfeiting and can be used to authenticate genuine checks. Security threads are thin, embedded strips running through the check paper. They may be visible or invisible under normal light and may contain text, images, or other security features to help deter counterfeiting. Holograms are three-dimensional images created using laser technology and embedded in the check paper or applied as a foil stamp. They serve as a highly visible security feature, making it difficult for counterfeiters to reproduce the check accurately. Chemical reactive paper is specially treated paper that changes color or reveals a hidden pattern when exposed to certain chemicals. This security feature helps protect against check alteration by making it difficult to remove or modify printed information without detection. Checks provide a clear paper trail, making it easy for both the payer and payee to track transactions and maintain accurate financial records. This can be helpful for budgeting, tax purposes, and dispute resolution. Checks offer flexibility in payment amounts, allowing the payer to specify the exact amount they wish to pay. This can be especially useful in situations where the amount due may change, such as variable utility bills or payments based on a percentage of sales. A canceled or cleared check can serve as proof of payment, providing evidence that the transaction has occurred and the funds have been transferred. This can be valuable in situations where a receipt or other documentation may be lost or disputed. Checks are widely accepted as a form of payment, making them a convenient option for individuals and businesses alike. While electronic payments and digital platforms have gained popularity, many people still rely on checks for a variety of transactions. Using checks can help individuals maintain better control over their finances, as each check must be written and signed, providing a tangible reminder of the transaction. This can encourage more mindful spending and make it easier to stick to a budget. Checks are vulnerable to forgery and counterfeiting, as criminals may attempt to create fake checks or alter existing checks to fraudulently obtain funds. While security features can help deter such activity, it remains a risk associated with check usage. Checks can be lost or stolen, potentially leading to unauthorized access to funds or the need to reissue payments. This can be inconvenient for both the payer and payee and may result in additional costs or delays. Checks may be returned due to insufficient funds in the drawer's account, resulting in bounced check fees and potential damage to the drawer's credit score. This can be an issue for both the payer and payee, as the payee may need to seek alternative methods of collecting payment. A check is a written, dated, and signed instrument that directs a bank to pay a specific sum of money to the or a designated beneficiary. Checks remain an important form of payment in the banking and financial industry, offering convenience, security, and flexibility in transactions. There are several types of checks, including bearer checks, order checks, certified checks, cashier's checks, traveler's checks, and personal checks. Each type has its own unique features, benefits, and limitations. Checks offer several advantages, such as ease of tracking and record-keeping, payment flexibility, proof of payment, wide acceptance, and financial control. However, they also have limitations, including susceptibility to forgery and counterfeiting, loss or theft, and the potential for insufficient funds. Despite the rise in electronic payments and digital platforms, checks remain a valuable and widely used method of payment. Understanding the different types of checks, their components, and the advantages and limitations they present can help individuals and businesses make informed decisions about the most appropriate payment methods for their needs.What Is a Check?

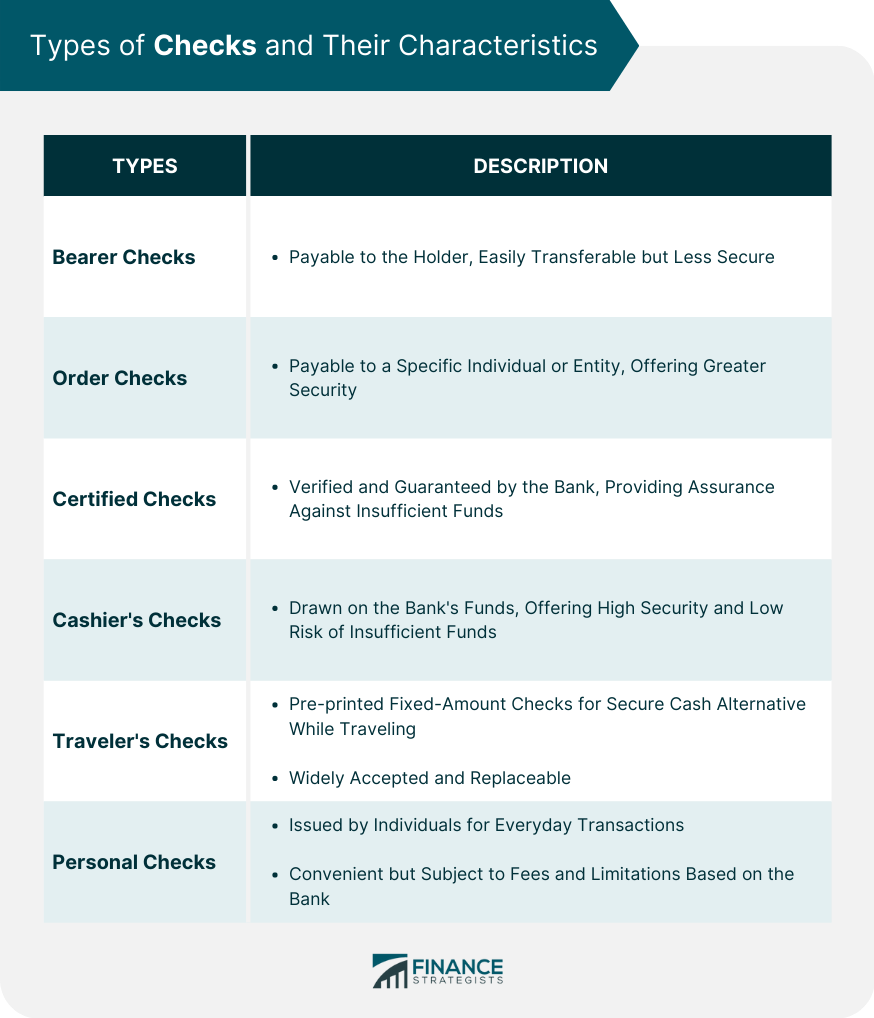

Types of Checks

Bearer Checks

Order Checks

Certified Checks

Cashier's Checks

Traveler's Checks

Personal Checks

Components of a Check

Name

Address

Payee Line

Amount in Words

Date of the Check

Signature of the Drawer

Bank Name

Bank's Routing Number

Account Number

Check Clearing Process

Deposit of the Check

Verification and Validation

Clearing and Settlement

Funds Availability

Security Features of Checks

Magnetic Ink Character Recognition (MICR)

Watermarks

Security Threads

Holograms

Chemical Reactive Paper

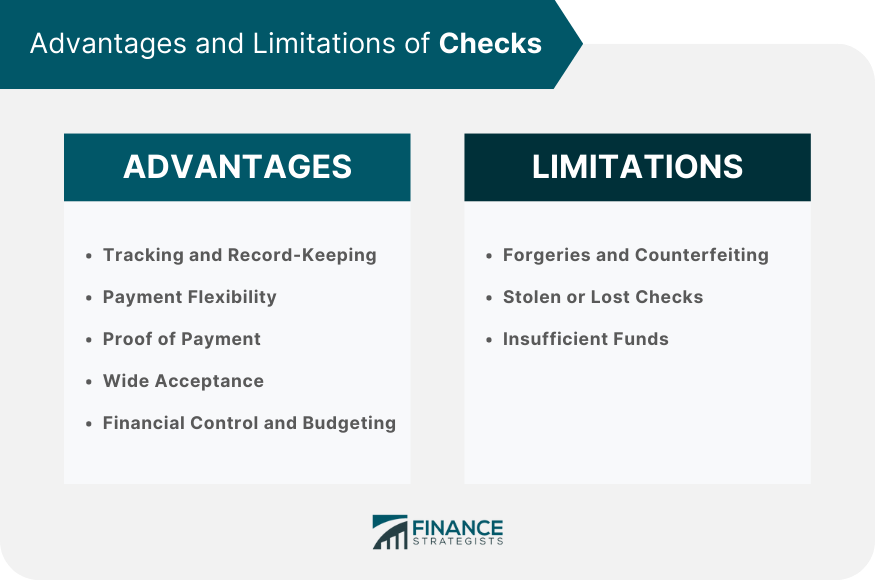

Advantages of Checks

Tracking and Record-Keeping

Payment Flexibility

Proof of Payment

Wide Acceptance

Financial Control and Budgeting

Limitations of Checks

Forgeries and Counterfeiting

Stolen or Lost Checks

Insufficient Funds

Conclusion

Check FAQs

A certified check is a personal check that has been verified and guaranteed by the issuing bank, while a cashier's check is a check issued by the bank itself, drawn on the bank's own funds. Both types of checks provide greater security and assurance to the payee compared to a regular personal check.

The check clearing process can take several days, depending on the banks involved and the specific clearing system used. Generally, funds from deposited checks should be available within two to five business days, although this may vary depending on the bank's policies and the type of check deposited.

If a check is lost or stolen, the drawer should contact their bank immediately to place a stop payment on the check, preventing it from being cashed or deposited. The drawer may then need to reissue a new check to the payee. It is important to report lost or stolen checks promptly to minimize the risk of unauthorized access to funds or fraudulent activity.

If you receive a check that you believe may be fraudulent, do not attempt to cash or deposit it. Instead, report the check to the issuing bank and your local law enforcement agency. Providing them with the check and any relevant information can help prevent further fraud and protect your own finances.

In most cases, you cannot deposit a check made out to someone else into your own account. However, the original payee may be able to endorse the check over to you by signing the back of the check and writing "Pay to the order of [your name]." This is known as a third-party endorsement. Keep in mind that not all banks will accept third-party endorsed checks, and those that do may have specific requirements or restrictions. It is best to check with your bank before attempting to deposit a third-party endorsed check.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.