A credit purchase, or to purchase something “on credit,” is to purchase something you receive today that you will pay for later. For example, when you swipe a credit card, your financial institution pays for the goods or services up front, then collects the funds from you later. The collateral they hold against you is ruining your FICO score (or credit score). Companies offer credit purchases to lower the barrier or threshold of the purchase, which increases their revenues. In a B2B company, a company will offer their goods or services to be made with a credit purchase, and collect the invoice payment later. B2B companies sometimes incentivize faster payment with 2/10 Net 30 credit terms, which means, if the company pays within 10 days, they receive a 2% discount on the invoice, otherwise they must fulfill the invoice within 30 days at full price. This helps companies improve their accounts receivable turnover ratio and avoid lingering outstanding invoices. Credit purchases can be used in various ways. You might use them to buy expensive items that you cannot afford upfront, or buying an item on some accounts means that you are paying back some of the money with interest. What some people do not realize is that credit cards will only give you a very small amount of time to pay off your debt, so if you are not tracking your expenses well, it can take a very long time to repay your debt. Different types of credit purchases have different rules on when they should be paid off or how much interest should be added for delaying payment. The best policy, in general, is the one that's closer to "pay no interest" rather than "low interest". When you make a credit purchase, your seller will most likely compare it to your credit card account and find out if any of the funds on that account can go toward the purchase right now. If you do not have enough money on your credit card account to pay for your purchase, you will most likely be declined and the transaction will not go through. If you have the funds on your account, however, it is likely that you will be given options. If you are allowed to put the purchase on your credit card account, the amount of money owed for your purchase is added to your next bill. What happens after this varies depending on how long until the new bill will arrive. Perhaps one of the greatest benefits of credit purchases is that you can buy things now without having to pay upfront. If you need an urgent item or something very expensive, you can get it right away without having to wait for your next paycheck. What is more, the item you are putting on credit might have a promotion during which you are exempt from paying certain fees or receive benefits upon purchasing something with your card account. What you would need to watch out for is not overspending, because if you don't pay your bills in time, you will get charged interest. One of the risks of credit purchases is that you might end up spending more than what you can afford. If you are not careful with how much money you spend on these types of transactions, it can be very easy to push yourself over the edge financially. What's worse is that you might not even know about it until your next bill arrives. Another downside of credit purchases is that there are sometimes fees associated with them, though this varies depending on the seller and your terms. A debit card allows you to spend your money in real-time, so when you make a transaction with a debit card, it is directly deducted from your checking account. What happens after the purchase depends on your balance and whether the purchase was more than what was available in your account. The downside of using a debit card instead of a credit card for purchases is that there is a limit on how much you can spend. If your transaction had any fees associated with it, you will have to pay those as well. Credit cards, on the other hand, allow you to make purchases without having to worry about having enough money in your account. For some credit cards, there are no fees for purchases. Credit purchases should generally not be a default method of buying something, as it can put you into debt if you are not careful. Debit cards have the option of being tied to your savings accounts so that even when you use money from them, they will be deducted from your bank account first before making a purchase. This gives you a lot more control over your spending and keeps you from buying something that is not necessary. If you still do not want to use your debit card, at least try to separate between credit purchases for necessities and luxuries. There is no rule on how many times you can make a credit purchase in a day or even within the month. However, if you are making more than one purchase every single day, it might be a sign that you are overspending. Credit cards can be a very easy way to buy things, so you need to know yourself and how easily it is for you to go overboard on your purchases. Pay off your balance as soon as it is possible so that you will not have a large bill come due at once. If you can't afford to pay for something with cash, you probably shouldn't be buying it. The bottom line is that credit purchases are useful for making large purchases that you wouldn't otherwise be able to afford, but there are risks associated with them that should not be ignored. What's more, it can be very easy to go overboard on your spending if you are not careful. What you need to do is make sure that this type of purchase is only a last resort and not something you use for pretty much everything. Credit purchases offer some benefits, such as convenience and approval despite past credit issues. These transactions tend to have additional perks like warranties and special deals for future use. Some credit cards have a good rewards program too. Using a debit card has its benefits. They often do not require fees or limit your spending. If they are connected to your checking account, they theoretically should not cause overdrafts. The most important thing to remember is that things are only going to get harder if you don't start paying everything back. When Should You Use Credit Purchases

How Do I Make a Credit Purchase

What Are the Benefits of Using Credit Purchases

What Are the Downsides to Using Credit Purchases

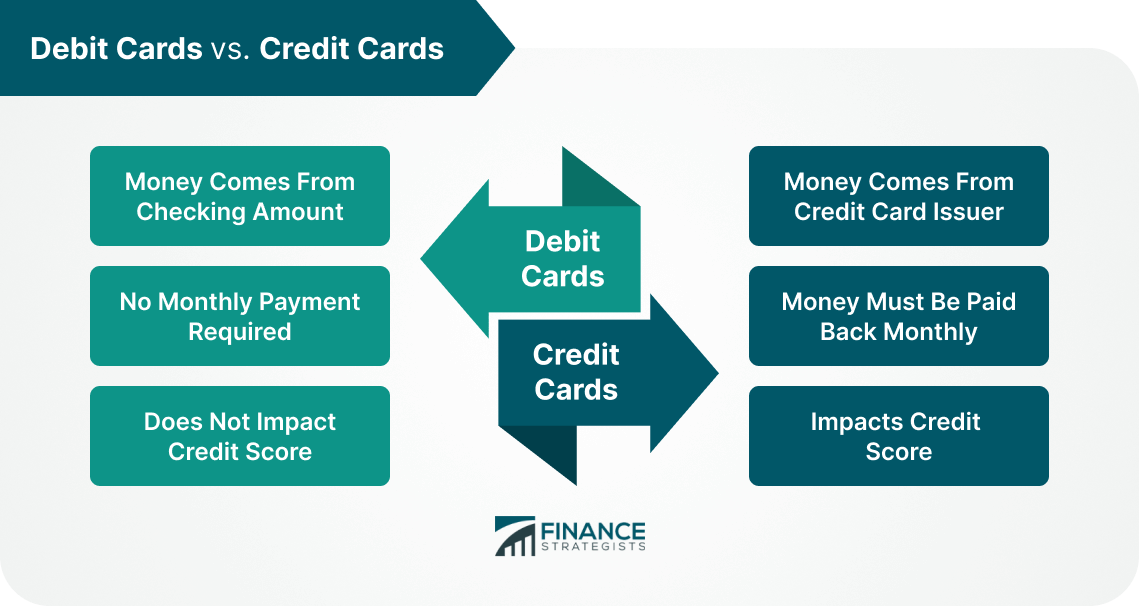

The Difference Between Debit and Credit Cards

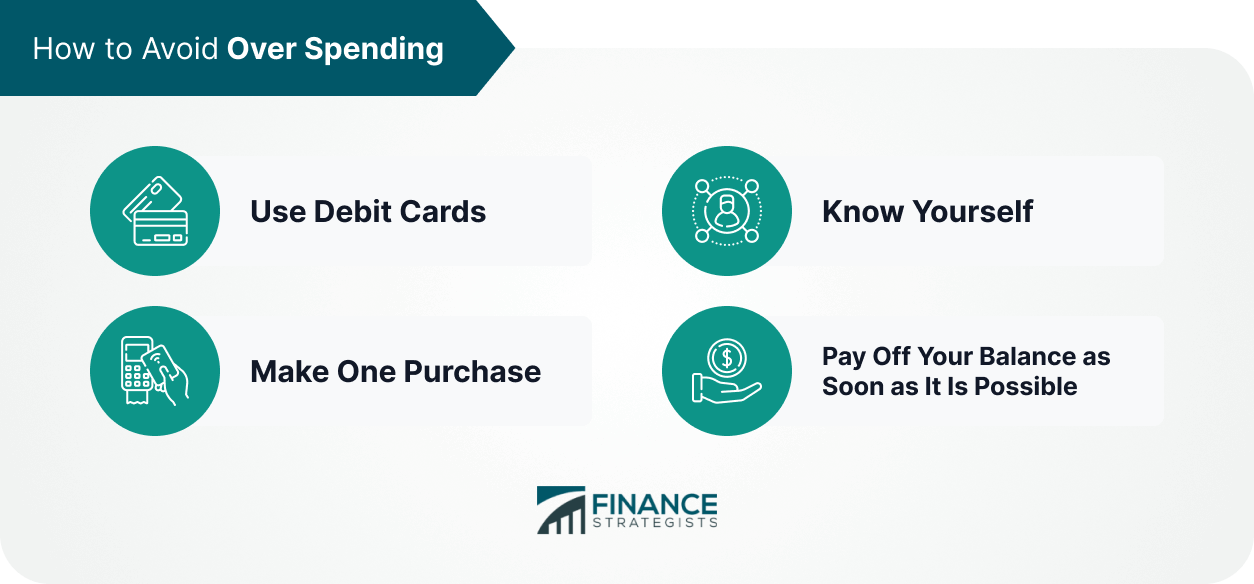

How to Avoid Over Spending

Use Debit Cards

Make One Purchase

Know Yourself

Pay Off Your Balance as Soon as It Is Possible

The Bottom Line

Credit Purchases FAQs

A credit purchase is defined as money spent using credit instead of cash.

Credit purchases are recommended when paying with cash or debit would be inconvenient or impractical, such as for big-ticket items like vehicles, appliances, and furniture.

To make a credit purchase, you can contact your retail seller or place an order using the phone or internet. You then have to provide some information about yourself before paying for the item. What you need to do will depend on the business and what methods they allow.

Credit purchases are very easy. You can make a purchase without having to worry about carrying cash or trying to find an ATM machine if you don't have your debit card with you. What's more, you do not need to wait for the money to transfer over from your bank account if it is coming directly from your savings account.

The risk of making a credit purchase is that you could end up spending more than you have, causing yourself harm financially. Stores usually charge fees for this type of transaction so it can be expensive. While most places do allow you to change your mind on a credit purchase, you can sometimes be charged fees if you do not go through with the transaction.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.