Credit monitoring is the process of regularly reviewing and tracking an individual's credit reports and scores to ensure accuracy, detect changes, and identify potential fraud or identity theft. By closely monitoring one's credit, individuals can maintain good credit health and protect their financial well-being. Credit monitoring plays a crucial role in personal finance, as credit scores impact various aspects of an individual's financial life. These include access to loans, interest rates, credit card approvals, insurance premiums, and even job opportunities. Individuals can take prompt action to improve their credit scores or address potential issues by monitoring their credit. Using credit monitoring services can help individuals stay informed about their credit status, spot inaccuracies or fraudulent activity, and take timely corrective measures. Some benefits include regular credit score updates, credit report alerts, identity theft protection, and access to credit simulators and educational tools. Credit reports are records of an individual's credit history, compiled by credit bureaus. They include four main sections: Personal Information: This section contains the individual's name, address, Social Security number, and employment information. Credit Accounts: This section lists the individual's credit accounts, such as loans and credit cards, along with the account balances, payment history, and account status. Inquiries: This section records requests for the individual's credit report, including both hard and soft inquiries. Public Records: This section includes information on bankruptcies, tax liens, and civil judgments. Credit scores are numerical representations of an individual's creditworthiness based on their credit reports. The main factors affecting credit scores include payment history, credit utilization, length of credit history, credit mix, and recent credit inquiries. Credit scores typically range from 300 to 850. Higher scores indicate better creditworthiness, while lower scores may result in higher interest rates, reduced credit access, or other financial consequences. Individuals are entitled to one free credit report per year from each of the three major credit bureaus: Equifax, Experian, and TransUnion. Credit bureaus collect and maintain credit information, generate credit reports, and calculate credit scores. They also provide credit monitoring services to help individuals stay informed about their credit status. Some credit bureaus and financial institutions offer free credit monitoring services with limited features, such as access to credit scores and basic credit report alerts. Paid credit monitoring services offer more comprehensive features, such as access to credit reports from all three bureaus, frequent credit score updates, and advanced identity theft protection. Credit monitoring services provide regular updates on credit scores, allowing individuals to track their progress and take action to improve their scores. These services send alerts when there are significant changes to the individual's credit report, such as new accounts, inquiries, or delinquencies. Some credit monitoring services offer identity theft protection features, such as monitoring for suspicious activity, dark web monitoring, and alerts for potential identity theft. Many credit monitoring services include credit simulators, which allow users to estimate the impact of various financial actions on their credit scores. They may also offer educational resources to help users understand and improve their credit. To choose the right credit monitoring service, individuals should compare the features, costs, and benefits of different services, considering their personal financial goals and needs. Reading customer reviews and researching the reputation of different credit monitoring services can provide valuable insight into the quality and reliability of the services offered. Fraud and identity theft can occur in various forms, such as credit card fraud, account takeover, tax fraud, and medical identity theft. Credit monitoring services can help detect and prevent fraud by alerting users to changes in their credit reports that may indicate fraudulent activity. This allows individuals to take swift action to report fraud, freeze their credit, and minimize the impact on their credit scores. If an individual becomes a victim of identity theft, they should immediately report the incident to the credit bureaus, financial institutions, and law enforcement. They should also consider placing a fraud alert or credit freeze on their credit reports to prevent further damage. Regularly reviewing credit reports helps individuals identify errors, monitor their credit accounts, and stay informed about their credit status. Paying bills on time is crucial for maintaining and improving credit scores, as payment history is the most significant factor in credit score calculations. Keeping credit card balances low and reducing overall debt can improve credit scores by lowering credit utilization. A diverse mix of credit types, such as credit card, installment loan, and mortgage, can positively impact credit scores. Avoiding excessive hard inquiries by only applying for credit when necessary can help prevent a negative impact on credit scores. Credit monitoring is essential for maintaining good credit health, protecting one's financial well-being, and preventing fraud and identity theft. By using credit monitoring services, individuals can stay informed about their credit status, take prompt action to improve their credit scores and address potential issues. Maintaining good credit health and security requires diligence and consistent effort. By regularly monitoring their credit and adopting responsible financial habits, individuals can achieve financial stability and enjoy the benefits of good credit throughout their lives. Consider partnering with a banking professional to further enhance your financial well-being and make the most of your credit health. These experts can provide personalized guidance on managing your finances, optimizing your investments, and achieving your long-term financial goals. What Is Credit Monitoring?

Credit Reports and Credit Scores

Explanation of Credit Reports

Understanding Credit Scores

Access to Credit Reports and Scores

Credit Monitoring Services

Types of Credit Monitoring Services

Free Services

Paid Subscription Services

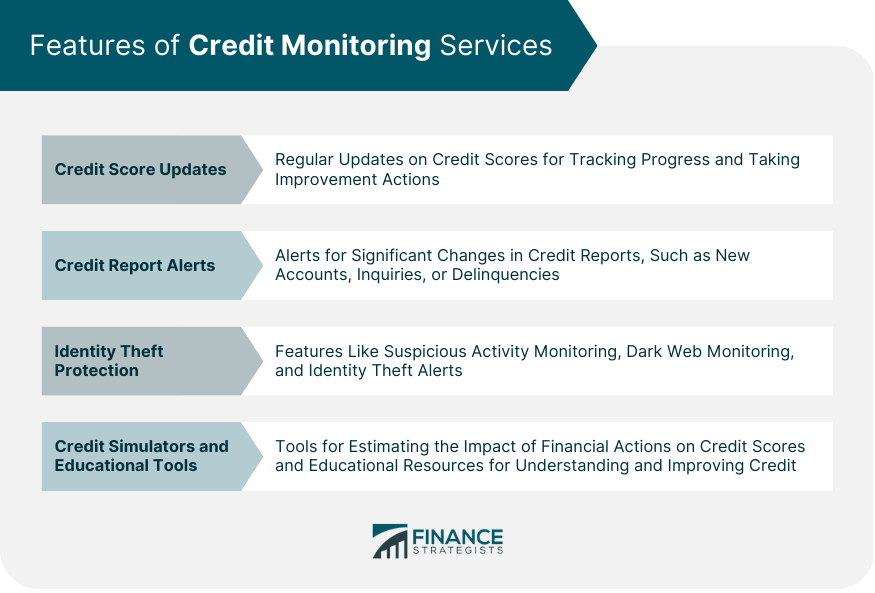

Features of Credit Monitoring Services

Credit Score Updates

Credit Report Alerts

Identity Theft Protection

Credit Simulators and Educational Tools

Choosing the Right Credit Monitoring Service

The Role of Credit Monitoring in Fraud and Identity Theft Prevention

Maintaining Good Credit Health

By consistently monitoring their credit and adjusting financial behaviors, individuals can maintain good credit health and achieve their financial goals.Tips for Improving Credit Scores

Making Timely Payments

Reducing Credit Utilization

Diversifying Credit Mix

Limiting Hard Inquiries

Conclusion

Credit Monitoring FAQs

Credit monitoring is the process of regularly reviewing and tracking an individual's credit reports and scores to ensure accuracy, detect changes, and identify potential fraud or identity theft. It is important because it helps maintain good credit health, protect financial well-being, and prevent fraud and identity theft.

Credit monitoring helps prevent fraud and identity theft by alerting users to changes in their credit reports that may indicate fraudulent activity. This allows individuals to take swift action to report the fraud, freeze their credit, and minimize the impact on their credit scores.

Key features of credit monitoring services include regular credit score updates, credit report alerts, identity theft protection, and access to credit simulators and educational tools. These features help individuals stay informed about their credit status, spot inaccuracies or fraudulent activity, and take timely corrective measures.

Yes, there are free credit monitoring options available. Some credit bureaus and financial institutions offer free credit monitoring services with limited features, such as access to credit scores and basic credit report alerts. However, paid credit monitoring services are recommended for more comprehensive features and protection.

Ideally, you should use credit monitoring services to check your credit reports and scores at least once a month. This frequency allows you to stay informed about any significant changes in your credit reports, monitor your progress in improving your credit scores, and promptly address any inaccuracies or potential issues.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.