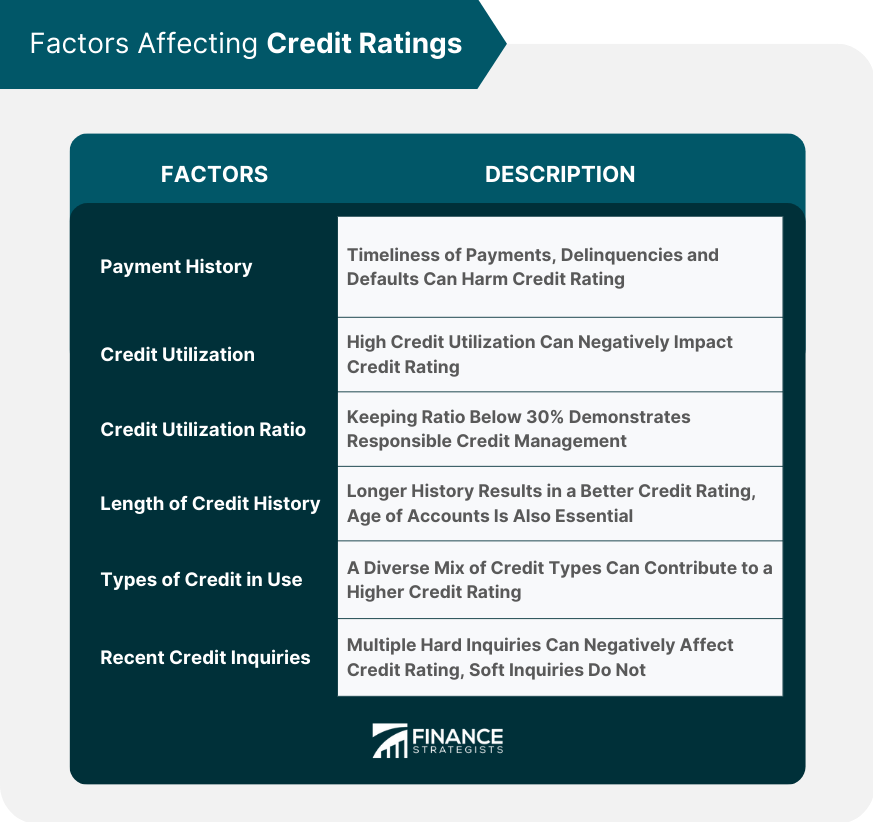

Credit ratings are an assessment of the creditworthiness of individuals, businesses, or governments, indicating their ability to repay debt. They are expressed as a letter grade, ranging from AAA (highest) to D (default), and are assigned by credit rating agencies. Credit ratings play a crucial role in the financial world. They help lenders, investors, and other stakeholders make informed decisions about the credit risk associated with a specific borrower or investment. A high credit rating typically indicates a lower risk of default, while a low rating suggests a higher risk. Credit rating agencies (CRAs) are specialized organizations that evaluate and monitor credit risk. They gather information about borrowers and their credit history, analyze the data, and issue credit ratings. The three major CRAs are Standard & Poor's (S&P), Moody's, and Fitch Ratings. The borrower's payment history is one of the most critical factors in determining credit ratings. Late or missed payments can negatively impact credit ratings, while a history of timely payments can help build a strong credit profile. Delinquencies, such as late payments and defaults on loans or other financial obligations, can significantly harm a borrower's credit rating. Borrowers should avoid delinquencies and defaults whenever possible to maintain good credit. Credit utilization is the proportion of a borrower's outstanding balance relative to their available credit limits. High credit utilization can negatively impact credit ratings, indicating that the borrower may be overextended. To maintain a good credit rating, keeping the credit utilization ratio below 30% is essential. This demonstrates responsible credit management and lowers the perceived risk of default. A longer credit history generally results in a better credit rating, providing more data for credit rating agencies to evaluate the borrower's creditworthiness. The average age of accounts is essential in determining credit ratings, with older accounts contributing positively. The age of the borrower's oldest account also plays a role in determining their credit rating. Older accounts demonstrate a longer track record of responsible credit or debit management. A diverse mix of credit types can contribute to a higher credit rating. Installment loans, such as mortgages or auto loans, reflect a borrower's ability to manage long-term debt responsibly. Revolving credit, such as credit cards, is another factor considered by CRAs. Demonstrating responsible use of revolving credit can positively impact credit ratings. Hard inquiries occur when a lender or creditor checks a borrower's credit as part of a lending decision. Multiple hard inquiries in a short period can negatively affect credit ratings, as they may indicate that the borrower is seeking multiple new lines of credit. Soft inquiries, such as checking one's own credit or pre-approval offers, do not impact credit ratings. Borrowers should be mindful of hard inquiries to protect their credit rating. S&P is one of the largest credit rating agencies, known for its S&P Global Ratings, which provide credit ratings for corporate and government entities worldwide. Their rating scale ranges from AAA (highest) to D (default). Moody's Investors Service is another prominent CRA, offering credit ratings for various debt securities and financial institutions. Moody's credit rating scale is similar to S&P's, ranging from Aaa (highest) to C (lowest). Fitch Ratings is the third major CRA, providing credit ratings for corporations, financial institutions, and governments. Their rating scale ranges from AAA (highest) to D (default). Credit rating agencies assess the credit risk associated with borrowers by analyzing their financial data, payment history, and other relevant factors. They assign a credit rating based on this evaluation, which indicates the borrower's creditworthiness. Once the assessment is complete, CRAs issue credit ratings that serve as a reference for lenders, investors, and other stakeholders. These ratings are regularly updated to reflect the borrower's credit profile changes. CRAs continuously monitor borrowers and their credit profiles to ensure the accuracy of their credit ratings. They update ratings based on new information, such as changes in financial performance, economic conditions, or credit management practices. Some critics argue that CRAs face conflicts of interest, as they are often paid by the entities they rate. This can potentially lead to biased credit ratings that favor the paying clients. The accuracy and reliability of credit ratings have been questioned, particularly following the 2008 financial crisis. CRAs have been criticized for failing to predict the collapse of several high-rated financial institutions and securities. Credit ratings directly impact an individual's ability to secure loans and the interest rates they are offered. A higher credit rating often results in better loan terms, including lower interest rates and more favorable repayment options. Employers and landlords may review credit ratings when deciding about job applicants or potential tenants. A poor credit rating can hinder an individual's ability to secure employment or housing. Some insurance providers use credit ratings to determine auto, home, or renters insurance premiums. A lower credit rating may result in higher insurance premiums. Credit ratings significantly impact borrowing costs for businesses and governments. Higher-rated entities can secure loans and issue bonds at lower interest rates, reducing their overall cost of capital. A strong credit rating can boost investor confidence in a company or government, leading to increased investment and a more robust financial market. Credit ratings help maintain financial market stability by providing transparent and reliable information about credit risk. This enables investors to make informed decisions and allocate capital more efficiently. Making timely payments on all financial obligations is crucial for maintaining and improving credit ratings. Setting up automatic payments or reminders can help ensure consistent, on-time payments. Keeping credit utilization below 30% demonstrates responsible credit management and can positively impact credit ratings. Borrowers can reduce credit utilization by paying down outstanding balances, requesting credit limit increases, or using a combination of both strategies. A diverse mix of credit types, such as installment loans and revolving credit, can contribute to a higher credit rating. Borrowers should consider diversifying their credit mix responsibly without taking on unnecessary debt. Limiting the number of hard inquiries on a credit report can help protect and improve credit ratings. Borrowers should only apply for new credit when necessary and avoid opening multiple accounts in a short period. Regularly reviewing credit reports can help identify and correct errors that may negatively impact credit ratings. Borrowers can request a free annual credit report from each of the major CRAs and should promptly dispute any inaccuracies. Monitoring credit reports can also help detect signs of identity theft, such as unauthorized accounts or inquiries. Early detection is crucial in minimizing the damage caused by identity theft and protecting credit ratings. Individuals struggling to manage their credit or improve their credit ratings may benefit from credit counseling services. These nonprofit organizations provide financial education and assistance in developing personalized debt management plans. Debt management plans (DMPs) are structured repayment plans negotiated with creditors by credit counseling agencies. DMPs can help borrowers reduce their interest rates, waive fees, and establish a more manageable repayment schedule, ultimately improving their credit rating over time. Credit ratings play a vital role in the financial world, as they provide lenders, investors, and other stakeholders with essential information about credit risk. Maintaining a good credit rating is crucial for individuals and organizations seeking to secure loans, attract investment, or access other financial opportunities. For individuals, a good credit rating can lead to better loan terms, employment and housing opportunities, and lower insurance premiums. For businesses and governments, a strong credit rating can result in lower borrowing costs, increased investor confidence, and overall financial market stability. As the importance of credit ratings continues to grow, so does the need for increased accuracy and transparency in the credit rating system. Efforts are underway to address the criticisms and controversies surrounding CRAs, with the goal of creating a more reliable and unbiased credit rating system for all stakeholders. If you need help improving your credit rating, consider hiring a banking professional. A qualified banking professional can provide valuable advice and guidance on improving and maintaining a good credit rating, ultimately helping you achieve your financial goals. What Are Credit Ratings?

Factors Affecting Credit Ratings

Payment History

Credit Utilization

Length of Credit History

Type of Credit in Use

Recent Credit Inquiries and New Accounts

Credit Rating Agencies

Major Credit Rating Agencies

Standard & Poor's (S&P)

Moody's

Fitch Ratings

Functions of Credit Rating Agencies

Evaluating Credit Risk

Issuing Credit Ratings

Monitoring and Updating Rating

Criticisms and Controversies

Conflicts of Interest

Accuracy and Reliability of Ratings

The Impact of Credit Ratings

On Individuals

Loan Eligibility and Interest Rates

Employment and Housing Opportunities

Insurance Premiums

On Businesses and Governments

Borrowing Costs

Investor Confidence

Financial Market Stability

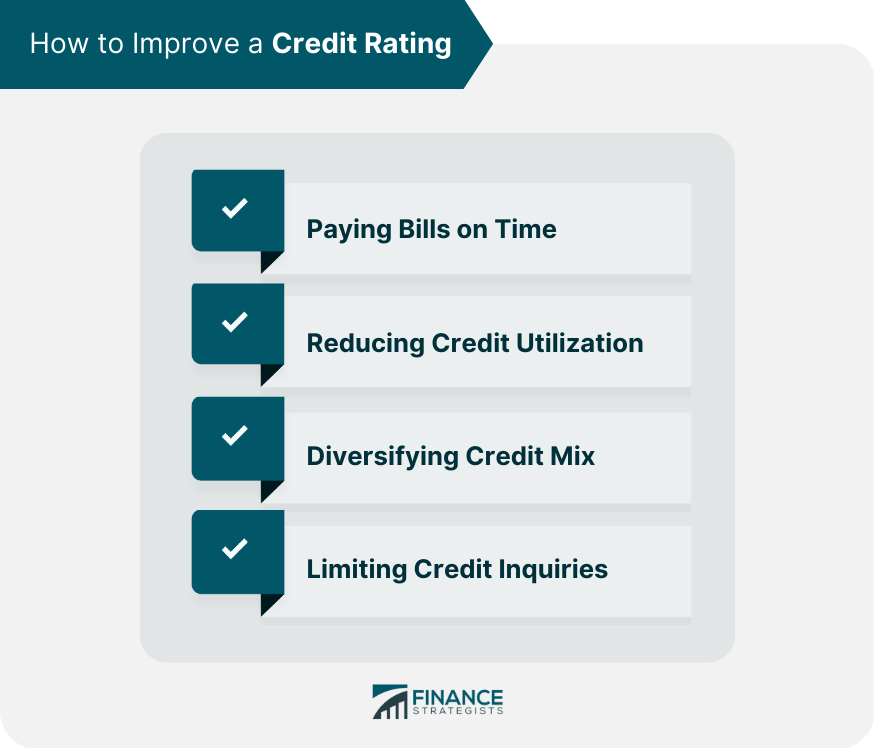

Improving and Maintaining a Good Credit Rating

Strategies for Improvement

Paying Bills on Time

Reducing Credit Utilization

Diversifying Credit Mix

Limiting Credit Inquiries

Regularly Monitoring Credit Reports

Detecting and Disputing Errors

Identifying Signs of Identity Theft

Seeking Professional Help

Credit Counseling Services

Debt Management Plans

Conclusion

Credit Ratings FAQs

Credit ratings are an evaluation of the creditworthiness of individuals, businesses, or governments that indicate their ability to repay debt. They are expressed as a letter grade, ranging from AAA (highest) to D (default), and are assigned by credit rating agencies.

Credit ratings are determined by credit rating agencies (CRAs) which gather and analyze data related to borrowers' credit history, payment history, credit utilization, length of credit history, types of credit in use, and recent credit inquiries and new accounts.

Credit ratings are important because they help lenders, investors, and other stakeholders make informed decisions about the credit risk associated with a specific borrower or investment. A high credit rating typically indicates a lower risk of default, while a low rating suggests a higher risk.

Credit ratings directly impact loan eligibility and interest rates offered to borrowers. A higher credit rating often results in better loan terms, including lower interest rates and more favorable repayment options.

Individuals can improve their credit ratings by paying bills on time, reducing credit utilization, diversifying their credit mix, limiting credit inquiries, regularly monitoring credit reports, and seeking professional help such as credit counseling services or debt management plans.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.