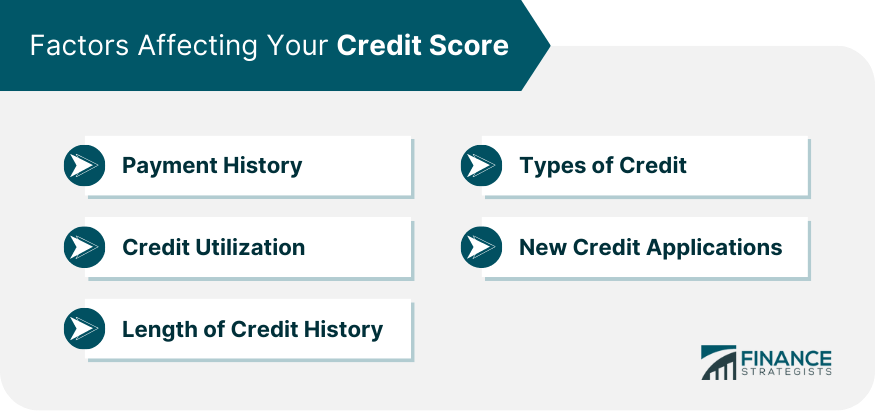

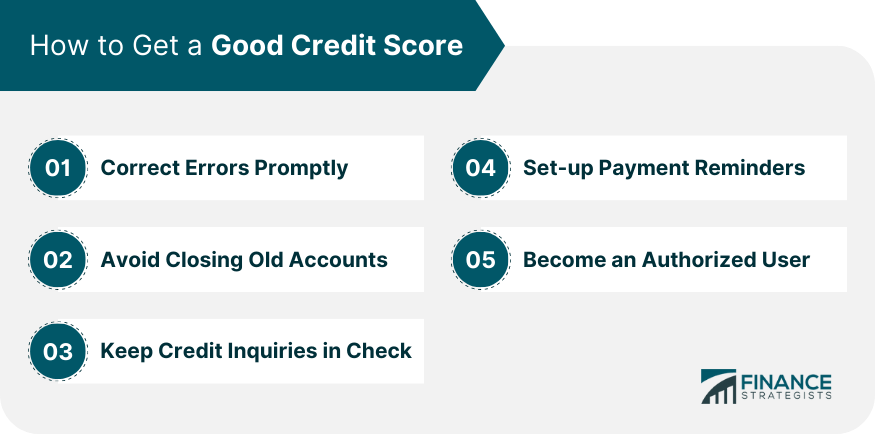

A good credit score is a numerical representation of an individual's creditworthiness and is a crucial aspect of their financial health. It is a three-digit number that ranges from 300 to 850, with 700 or above considered good and 800 or above excellent. Most consumers' average score in 2023 is 718. Both FICO Score and VantageScore use a scale from 300 to 850, with higher scores indicating better creditworthiness. For FICO, a score of 670 to 739 is considered good, while VantageScore considers 661 to 780 as good. This score is calculated based on various factors, including payment history, credit utilization, length of credit history, types of credit used, and new credit applications. By understanding the factors that contribute to a good credit score and adopting responsible credit management practices, individuals can take control of their financial well-being and pave the way for a brighter and more secure financial future. A FICO Score is a numerical representation of an individual's creditworthiness, extensively used by lenders to evaluate the risk of extending credit. Developed by the Fair Isaac Corporation (FICO), it is one of the most widely recognized credit scoring models. FICO Scores range from 300 to 850, with higher scores signaling a more positive credit history and lower credit risk. The credit score ranges are as follows: Excellent: 800 - 850 Very Good: 740 - 799 Good: 670 - 739 Fair: 580 - 669 Poor: 300 - 579 The score is calculated based on various factors, including payment history, credit utilization, length of credit history, types of credit used, and new credit applications. VantageScore is a credit scoring model developed by the three major credit bureaus in the United States: Equifax, Experian, and TransUnion. It was created as an alternative to the FICO Score to assess an individual's creditworthiness. This uses a similar scale to FICO Scores, ranging from 300 to 850, with higher scores indicating better creditworthiness. The credit score ranges are as follows: Excellent: 781 - 850 Good: 661 - 780 Fair: 601 - 660 Poor: 501 - 600 Very Poor: 300 - 500 VantageScore considers various factors to calculate a credit score, including payment history, credit utilization, credit age, credit mix, and recent credit inquiries. This model aims to provide lenders and consumers with a more consistent and comprehensive view of credit risk across all three major credit bureaus. Several factors can impact your credit score. Here are five key factors: Payment History: Making on-time payments for credit cards, loans, and other debts positively influences your score, while late or missed payments can have a negative impact. Credit Utilization: The amount of credit you use compared to your available credit limit, known as credit utilization, plays a crucial role in your credit score. Keeping your credit utilization low, ideally below 30%, can help boost your score. Length of Credit History: The length of time you have held credit accounts affects your credit score. A longer credit history demonstrates stability and responsible credit management, which can positively impact your score. Types of Credit: Having a diverse mix of credit accounts, such as credit cards, installment loans, and mortgages, can positively influence your credit score. Demonstrating the ability to manage different types of credit responsibly can improve your creditworthiness. New Credit Applications: Every time you apply for new credit, a hard inquiry is placed on your credit report. Multiple recent inquiries can indicate increased credit risk and may slightly lower your credit score. Limiting the number of new credit applications can help maintain a positive credit profile. Getting a good credit score requires a proactive and disciplined approach to managing your finances. Here are some steps you can take to improve and maintain a good credit score: Correct Errors Promptly: If you find any errors or inaccuracies on your credit reports, take immediate action to dispute and rectify them with the credit bureaus. Errors can have a significant impact on your credit score, so resolving them promptly is crucial. Avoid Closing Old Accounts: Avoid closing old credit accounts, even if you don't use them frequently. Older accounts with a positive payment history can contribute positively to your credit score. Keep Credit Inquiries in Check: Be mindful of the number of credit inquiries on your credit report. Each hard inquiry can slightly lower your score. Only apply for credit when necessary and avoid excessive credit applications within a short period. Set-up Payment Reminders: Missing payments is one of the most significant factors that can hurt your credit score. Set up payment reminders or automatic payments to ensure you never miss a due date. Become an Authorized User: If possible, become an authorized user on someone else's credit card account with a positive payment history. Being associated with an account in good standing can boost your credit score. Having a good credit score is important because it opens up a world of financial opportunities. With a good credit score, you are more likely to get approved for loans, credit cards, and mortgages at lower interest rates and better terms. This can save you money in the long run and make it easier to achieve your financial goals. Moreover, a good credit score can also lead to lower insurance premiums and improve your chances of getting approved for rental housing or other services that may require a credit check. Having a good credit score also provides peace of mind and financial security. It reflects responsible financial behavior and demonstrates to lenders and employers that you are a reliable and trustworthy individual. A strong credit score can also give you an advantage in the job market, as some employers may consider credit history when making hiring decisions, especially for positions involving financial responsibilities. By maintaining a good credit score through responsible credit management and timely payments, you can set yourself up for a brighter and more financially stable future. A good credit score plays a vital role in an individual's financial health and opens up a range of opportunities. FICO Scores and VantageScores are widely used credit scoring models, both ranging from 300 to 850. A good FICO Score falls between 670 and 739, while VantageScore considers 661 to 780 as good. Various factors impact credit scores, including payment history, credit utilization, credit age, credit mix, and new credit applications. To achieve a good credit score, individuals should correct errors promptly, avoid closing old accounts, manage credit inquiries, set up payment reminders, and become an authorized user if possible. Having a good credit score offers benefits like easier access to loans, lower interest rates, and improved employability. By maintaining responsible credit management, individuals can pave the way for a brighter financial future.What Is a Good Credit Score?

What Is a Good FICO Score?

What Is a Good VantageScore?

What Impacts Your Credit Score?

How to Get a Good Credit Score

Why Having a Good Credit Score Is Important

Conclusion

Good Credit Score FAQs

A good credit score typically ranges from 300 to 850, depending on the credit scoring model used. Higher scores indicate better creditworthiness.

You can check your credit score for free from various online platforms or credit bureaus. Some credit card companies also provide access to your credit score as a cardholder benefit.

Having a good credit score offers several advantages, including easier access to loans at lower interest rates, higher credit limits, better rental opportunities, and increased chances of securing job offers.

Yes, a good credit score can give you leverage when negotiating with lenders. A strong credit profile makes you a more attractive borrower, potentially leading to lower interest rates and better loan terms.

Two popular credit scoring models are FICO Score and VantageScore, both using a scale of 300 to 850 to evaluate creditworthiness.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.