A credit score is a numerical representation of an individual's creditworthiness derived from their credit history and financial behaviors. It acts as a key indicator for lenders to gauge the risk associated with lending money or providing credit to that individual. Various factors, such as the amount of debt, payment history, credit age, and type of credit, converge to form this score, which plays a pivotal role in determining loan approvals, interest rates, and even employment opportunities in some cases. One of the most influential factors in the credit score is payment history. Missing a single payment on a loan or credit card can have a detrimental impact on one's credit score. Such missed payments are recorded on credit reports and can remain there for up to seven years. The immediate fallout of a missed payment often results in a significant drop in the credit score. Repeated missed payments can further intensify the decline, making future financial activities more challenging and potentially more expensive due to higher interest rates or stricter lending terms. A single missed payment can result in a sharp decline in your credit score. For individuals with higher scores, the drop can be especially dramatic, sometimes as much as 180 points. This is due to the pronounced effect of any negative activity against an otherwise impeccable credit history. If you try to borrow money later, you might get hit with higher interest rates or stricter rules. This means when you borrow money, it could cost you a lot more in the long run. Just one missed payment can make borrowing more expensive for a long time. Some credit card companies have clauses that trigger penalty APRs (Annual Percentage Rates) if a payment is missed. This means interest rates on existing balances can skyrocket, making it more expensive to carry debt. In addition to harming your credit score, missing a payment can often result in immediate financial costs. Creditors might levy late fees, and if the payment continues to be overdue, even more penalties can accumulate over time. For secured loans (like mortgages or auto loans), consistently missed payments could result in the lender taking action against the asset tied to the loan. This could mean foreclosure on a house or repossession of a car, leading to the loss of valuable assets. If you miss a payment, it can stick around on your credit report for seven years. That means one mistake today can affect you for a long time. So, every time you try to borrow money or get a good deal on loan, that missed payment could make things harder for you, even years later One missed payment might be seen as a slip-up. But if you keep missing payments, people will start to think you're not good with money. This can be a problem when you try to rent a place or get certain jobs. Lenders, landlords, and even some employers occasionally check credit reports to gauge reliability. Consistent missed payments make lenders skeptical about your financial responsibility. As this pattern emerges, your standing as a trustworthy borrower diminishes, making many financial institutions increasingly reluctant to extend credit. In the long run, this diminished creditworthiness might limit your access to various financial products or force you to seek alternative, often less favorable, lending sources. A track record riddled with missed payments can put a damper on significant financial goals, such as purchasing a home or a vehicle. With lenders questioning your repayment capabilities, securing loans for these milestones might necessitate jumping through more hoops or settling for less beneficial terms. When it comes to credit, many people think 'late' and 'missed' payments are the same thing. But they're not. Each word means something different, and each one can affect your credit in a different way. A 'late' payment is when you pay a bill a little past its due date but still within a certain window of time that the lender allows. During this window, called a grace period, you might have to pay a small fee for being late. However, as long as you pay within this grace period, the late payment usually won't be told to credit bureaus. So, it won't affect your credit score. On the other hand, a 'missed' payment is more serious. This is when you don't pay the bill at all, even after the grace period has ended. If you don't pay for more than 30 days, the lender usually tells the credit bureaus about it. This missed payment then shows up on your credit report. And the longer you wait to pay, like 60 or 90 days, the worse it looks on your credit report. This can drop your credit score a lot and make lenders worried about lending you money in the future. As soon as you realize a payment has been overlooked, reach out to your lender. Being upfront and explaining your situation honestly can make all the difference. Many a time, life's unpredictabilities can lead to such oversights, whether it's a sudden medical emergency or just the overwhelming demands of daily routines. Lenders are often more understanding than we give them credit for. By reaching out proactively, you're showing responsibility and initiative, which might make them more inclined to offer a solution or even a grace period. The importance of clearing the missed payment swiftly cannot be stressed enough. The longer you delay, the more severe the potential consequences. Not only can this lead to additional fees, but the lender might also consider you less reliable in the future. Prioritizing this payment can also be seen as a sign of good faith, indicating to the lender that while you may have missed the payment initially, you're committed to rectifying the error. Setting up automatic payments is like having a safety net for your financial obligations. This ensures your bills are paid promptly, saving you from the possibility of forgetfulness or oversight. Besides being convenient, it also brings peace of mind. You no longer need to keep track of various due dates manually, and there's a lesser chance of any unpleasant financial surprises at the end of the month. Having a clear budget is one of the foundational pillars of good financial health. It's not just about noting down your expenses; it's about understanding where your money goes and ensuring you're never caught off guard. By actively setting aside funds for bills and other obligations, you create a financial buffer for yourself. In the face of unexpected expenses, this buffer can be the difference between managing comfortably and missing another payment. If you've missed multiple payments and are struggling to get your finances back in order, it may be time to seek the help of a professional. Credit counselors can provide invaluable advice on budgeting, debt management, and improving your credit score. They can guide you through the steps necessary to regain control of your financial health. The credit score, a critical determinant for loan approvals, interest rates, and even job opportunities, heavily relies on the payment history. Missing a single payment can lead to an immediate and significant drop in the credit score, affecting borrowing costs and access to credit. The repercussions extend to long-term consequences, with missed payments staying on credit reports for up to seven years, eroding financial reputation and creditworthiness. As lenders become wary of missed payment patterns, borrowers may face less favorable loan terms, hindering major financial milestones like buying a home or a vehicle. To manage missed payments effectively, individuals should promptly contact their lenders, explain the situation, and pay as soon as possible. Setting up automatic payments and budgeting wisely can prevent future oversights while seeking professional assistance can be beneficial for those facing financial challenges.How a Missed Payment Affects Your Credit Score

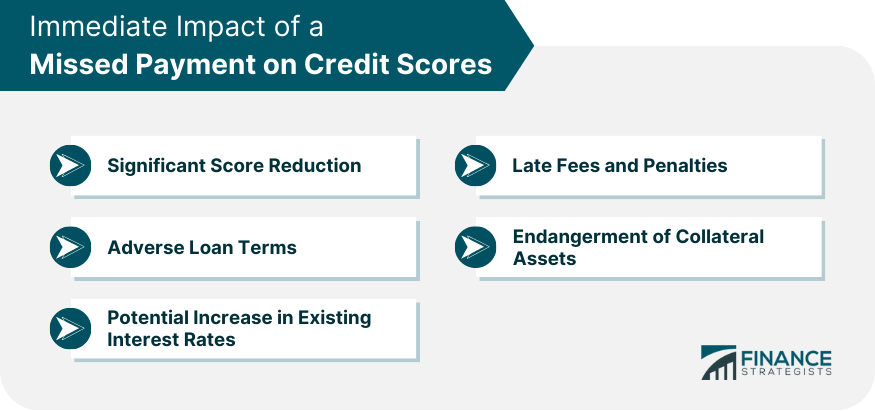

Immediate Impact of a Missed Payment on Credit Scores

Significant Score Reduction

Adverse Loan Terms

Potential Increase in Existing Interest Rates

Late Fees and Penalties

Endangerment of Collateral Assets

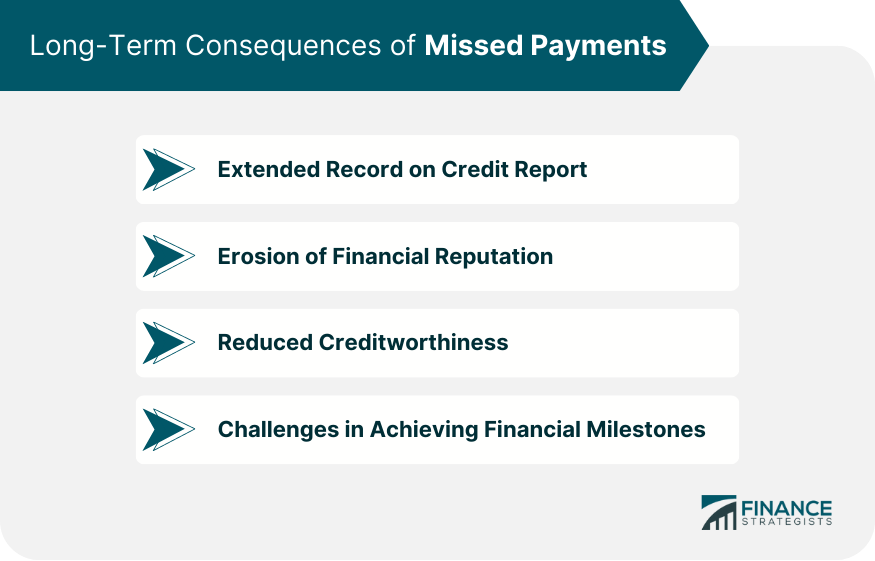

Long-Term Consequences of Missed Payments

Extended Record on Credit Report

Erosion of Financial Reputation

Reduced Creditworthiness

Challenges in Achieving Financial Milestones

Late vs Missed Payments

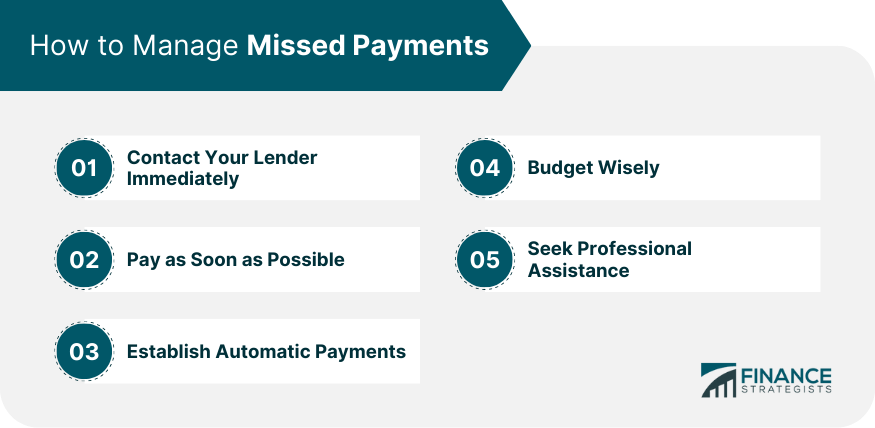

How to Manage Missed Payments

Contact Your Lender Immediately

Pay as Soon as Possible

Establish Automatic Payments

Budget Wisely

Seek Professional Assistance

Conclusion

How a Missed Payment Affects Your Credit Score FAQs

A missed payment can lead to a significant drop in your credit score, making borrowing more expensive and potentially limiting access to credit.

A missed payment can remain on your credit report for up to seven years, impacting your creditworthiness during that period.

Yes, even a single missed payment can cause a notable decline in your credit score, especially if you have an otherwise impeccable payment history.

No, late payments occur within a grace period and usually do not affect your credit score if paid within that window. Missed payments, however, can have a severe impact if not paid within 30 days or more.

To minimize the impact, contact your lender immediately, pay the missed amount as soon as possible, establish automatic payments, budget wisely, and seek professional assistance if facing financial challenges.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.