When buying a car, most people need financial assistance to afford the vehicle, and lenders typically assess the borrower's creditworthiness based on their credit history. However, individuals with no credit history or a low credit score may face challenges in obtaining traditional car financing from banks or credit unions. In response to this, specialized financing programs and lenders offer no or low credit financing options to cater to those with limited credit. These programs aim to provide opportunities for individuals with less-established credit backgrounds to secure car loans or leases. These may come with more relaxed credit requirements, higher interest rates, and potentially longer loan terms to make car ownership more attainable for individuals who might not otherwise qualify for conventional car loans. By offering tailored solutions and more flexible terms, no or low credit financing helps individuals with limited credit purchase the car they need, establishing a path to improve their creditworthiness over time. The following steps can guide you in your journey to obtain car financing even with limited credit: Obtain copies of your credit reports from all three major credit bureaus (Experian, Equifax, and TransUnion) to review your credit history. Look for any errors, inaccuracies, or discrepancies that may be negatively affecting your credit score. If you identify any errors, dispute them with the respective credit bureaus to have them corrected. Next, calculate your debt-to-income (DTI) ratio, which is a crucial metric lenders use to assess your ability to take on new debt. Taking a thorough look at your financial standing will help you identify areas for improvement and provide a clearer picture of what you can afford. A larger down payment can significantly enhance your chances of securing car financing with limited credit. By putting down more money upfront, you reduce the amount you need to borrow and demonstrate your commitment to the purchase. Lenders are more likely to offer favorable terms and lower interest rates to borrowers with substantial down payments. Start saving early to build a sizeable down payment that can strengthen your position when applying for car financing. A co-signer is someone who agrees to take responsibility for the loan if you default on payments. This added layer of security reassures lenders and increases their confidence in extending credit to you. When selecting a co-signer, look for someone with a solid credit history and a stable financial situation. Typically, a family member or a close friend is a suitable co-signer. However, keep in mind that co-signing is a significant responsibility, as any late or missed payments can affect both your and the co-signer's credit scores. Don't settle for the first financing option that comes your way. Instead, shop around and explore different lenders, including traditional banks, credit unions, and online lenders. Each lender may have unique eligibility criteria and offers, so comparing their terms can help you find the best fit for your financial situation. Additionally, get pre-qualified with multiple lenders to see what loan terms they can offer you. Pre-qualification involves a soft credit check that won't impact your credit score. It allows you to know the loan amount you're likely to qualify for and the interest rate you may be offered. Many lenders and dealerships offer special financing programs specifically designed for individuals with no or low credit. These programs may have more lenient credit requirements and tailored terms to accommodate borrowers with limited credit history. Take the time to research and inquire about such programs, as they could present viable options for your car financing needs. A less expensive vehicle will not only lead to lower loan amounts but also more manageable monthly payments. This choice will showcase your financial responsibility to lenders and increase your chances of getting approved. Consider what features and options are essential to you in a vehicle, and be willing to compromise on non-essential luxuries to stay within your budget. By choosing a more affordable car, you'll be better positioned to handle loan payments and demonstrate your financial stability to lenders. When seeking car financing with no or low credit, various options are available to accommodate individuals with limited credit history or lower credit scores. Traditional banks are a common and familiar option for car financing. These loans may come with higher interest rates or require a larger down payment to mitigate the perceived risk of lending to borrowers with limited credit history. Applying for a traditional bank loan provides an opportunity to build a relationship with the bank, potentially opening doors to more favorable loan terms in the future as your credit improves. Credit unions are not-for-profit financial institutions that serve their members' needs. They often offer more personalized services and may be more willing to work with individuals with limited credit history. Credit union loans for no or low credit applicants may have lower interest rates and more flexible terms than traditional banks. Membership requirements may apply to join a credit union, but the effort can be worthwhile, as credit union loans can be a valuable resource for car financing with limited credit. The rise of online lenders, often referred to as fintech lenders, has revolutionized the lending landscape. Online lenders leverage technology to streamline the loan application process and assess borrowers based on factors beyond traditional credit scores. This approach allows some online lenders to offer car financing options for individuals with no or low credit history. While interest rates may be higher than those of traditional lenders, online lenders offer convenience and accessibility, making them a viable choice for those seeking car financing with limited credit. BHPH refers to dealership financing, where the car dealer acts as both the seller and the lender. BHPH dealerships cater to individuals with no or low credit by offering in-house financing options. These dealerships may be more lenient with credit requirements, making them an option for those who have been turned down by traditional lenders. However, BHPH financing often comes with higher interest rates and less favorable terms, as the dealer assumes higher risk. Careful consideration and research are essential before opting for BHPH financing to ensure that the terms align with your financial goals. Here are some effective strategies to enhance your prospects and increase the likelihood of loan approval: Build Your Credit: If you have no credit history, consider starting with a secured credit card. A secured credit card requires a refundable security deposit, which becomes your credit limit. Responsible use and timely payments will help establish a positive credit history. Alternatively, consider becoming an authorized user on a family member or friend's credit card to piggyback on their positive credit history. Credit-Builder Loans: These loans work by depositing the loan amount into a savings account, which you can access once the loan is paid off. Regular payments on the loan are reported to the credit bureaus, contributing to the establishment of a positive credit history. Reduce Debt and Pay Bills on Time: If you have existing debts, focus on reducing them to lower your debt-to-income ratio. Additionally, make it a priority to pay all bills, including credit cards, loans, and utility bills, on time. Consistent, on-time payments demonstrate your financial responsibility to lenders. Keep Credit Utilization Low: Aim to keep your credit card balances below 30% of your credit limit. High credit utilization can negatively impact your credit score. Monitor Your Credit: Stay vigilant by monitoring your credit regularly. Keep track of any changes, review credit reports for accuracy, and promptly dispute any errors you come across. Securing car financing with no or low credit may be challenging, but several strategies can improve your chances. Start by assessing your financial situation and reviewing credit reports for accuracy. Saving for a larger down payment reduces the loan amount. Consider a co-signer with good credit to increase lender confidence. Shopping around for lenders, including traditional banks, credit unions, and online lenders, helps find the best fit. Explore special financing programs and opt for a more affordable car to showcase financial responsibility. Additionally, focus on building your credit by using secured credit cards or credit-builder loans, reducing debt, and making timely payments. Monitoring your credit and seeking virtual financial counseling can also provide valuable guidance. By implementing these strategies, you can improve your creditworthiness and increase the likelihood of securing car financing with no or low credit.What Is No or Low Credit Financing?

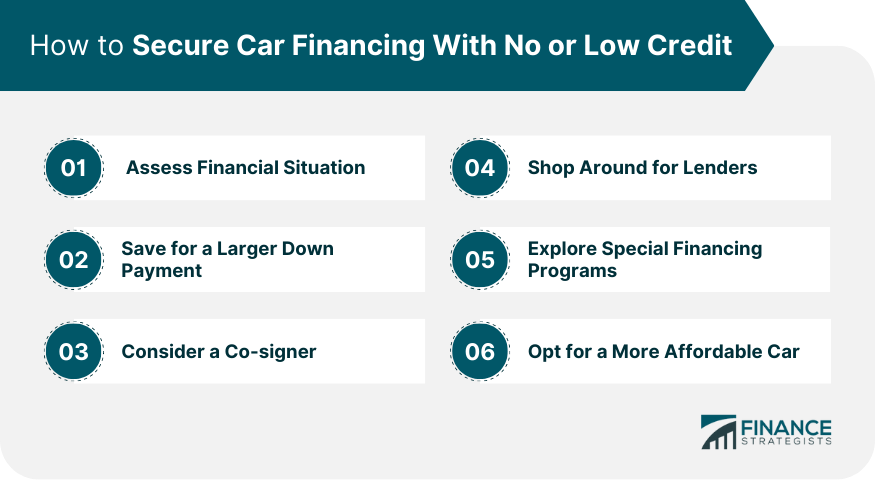

How to Secure Car Financing With No or Low Credit

Step 1: Assess Your Financial Situation

Step 2: Save for a Larger Down Payment

Step 3: Consider a Co-signer

Step 4: Shop Around for Lenders

Step 5: Explore Special Financing Programs

Step 6: Opt for a More Affordable Car

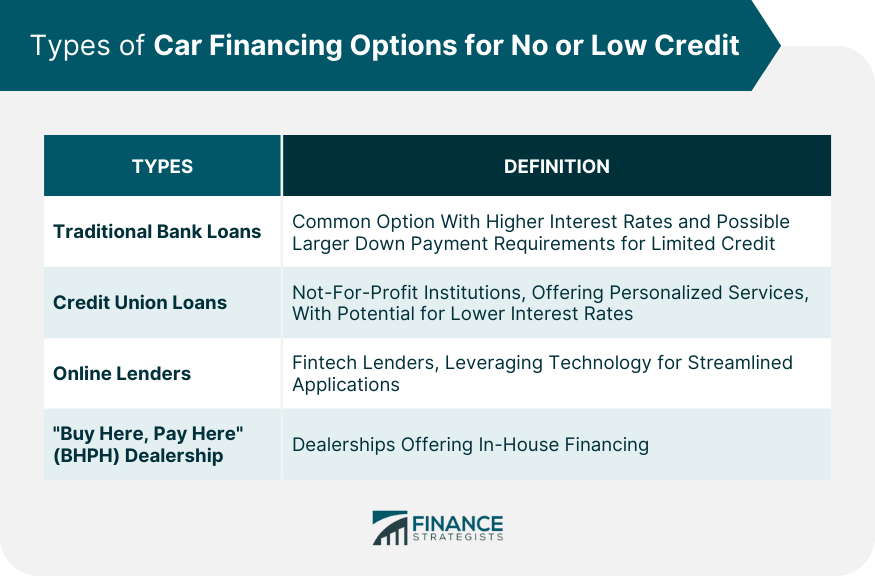

Types of Car Financing Options for No or Low Credit

Traditional Bank Loans

Credit Union Loans

Online Lenders

"Buy Here, Pay Here" (BHPH) Dealership

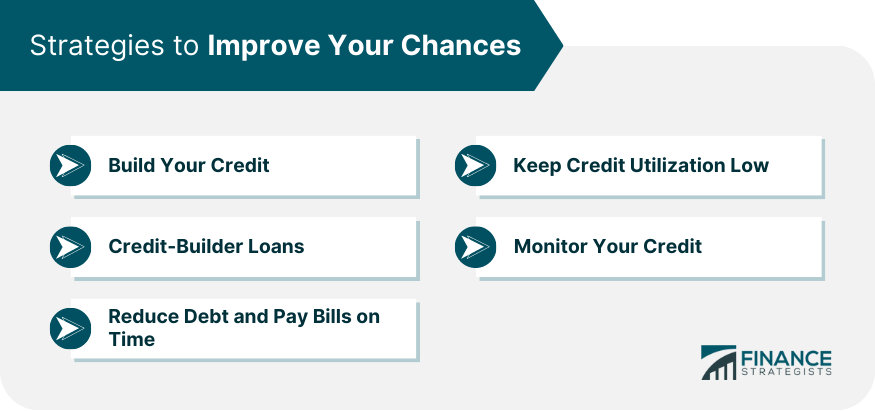

Strategies to Improve Your Chances

Conclusion

How to Finance Your Car With No or Low Credit FAQs

You can finance your car with no or low credit by exploring specialized financing programs for individuals with limited credit history. Consider options like credit-builder loans, secured credit cards, or "Buy Here, Pay Here" dealership financing.

You can get a car loan without a credit history by seeking lenders who offer no credit financing. Some lenders may consider other factors beyond credit scores to assess your creditworthiness.

A co-signer with a strong credit history can increase your chances of loan approval. They provide additional assurance to the lender, as they agree to take responsibility for the loan if you default.

Online lenders can be a viable option for car financing with low credit. Some online lenders consider alternative factors beyond traditional credit scores, providing more opportunities for loan approval.

To improve your chances, start by building credit through secured credit cards or credit-builder loans. Additionally, save for a larger down payment, explore special financing programs, and monitor your credit regularly for accuracy.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.