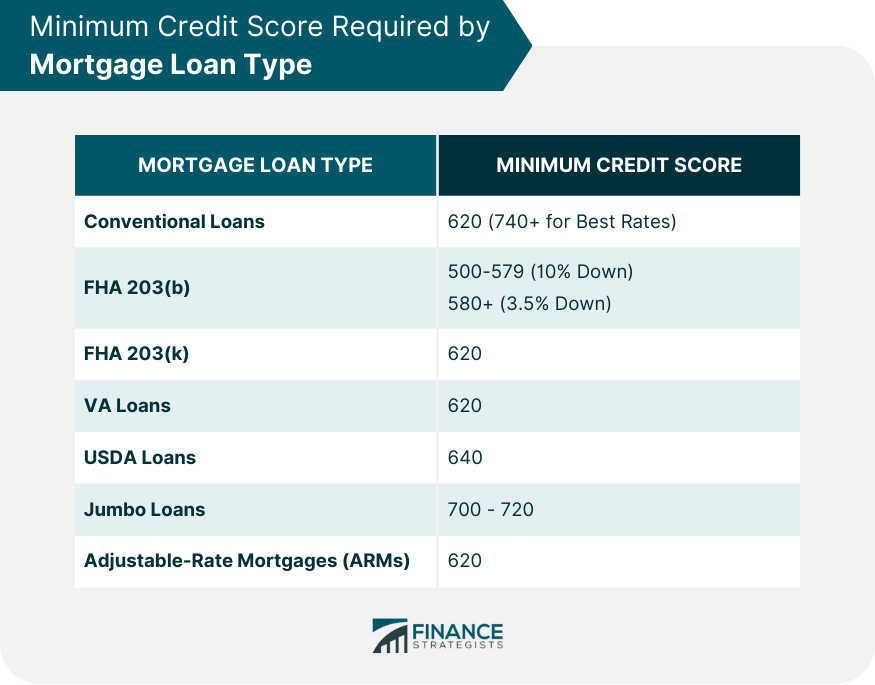

Credit scores serve as the financial fingerprint of individuals, offering a snapshot of their financial habits. These scores, typically ranging from 300 to 850, are derived from past borrowing habits, payment histories, and other financial behaviors. A high score indicates a track record of responsible financial behavior, while a low score suggests potential risks for lenders. Credit scores play a pivotal role when one steps into the world of home buying. These scores not only dictate the likelihood of securing a mortgage but also the terms of the loan, especially the interest rates. In essence, the better the credit score, the more savings a borrower stands to make throughout the mortgage's duration, making it a critical number in the home-buying journey. Credit scores can be grouped into distinct categories that help lenders quickly gauge creditworthiness: Poor (300-579): Lenders perceive significant risk in this range. Fair (580-669): A tad below the average American score, indicating moderate risk. Good (670-739): This range is generally trusted by lenders as borrowers here have demonstrated responsible borrowing. Very Good (740-799): Borrowers in this range enjoy more competitive rates and terms. Exceptional (800-850): The pinnacle of creditworthiness, offering the best lending terms. When considering home purchases, credit scores above 740 generally open doors to the best mortgage offers. Such scores almost guarantee competitive interest rates, flexible loan terms, and smoother lending experiences. However, even scores in the Good range can yield decent mortgage offers, though possibly with a slight increase in rates. While credit score requirements can vary depending on various factors like the lender, geographical location, and economic climate, here's a general breakdown of the minimum credit scores often required for different mortgage loan types: Conventional loans are the most common type of mortgage and are not insured by the federal government. Lenders typically use guidelines set by two major institutions, Fannie Mae and Freddie Mac. Generally, a score of 620 is the threshold. However, a higher score—like 740 or above—can earn you the most competitive interest rates. With a lower score, while you may still qualify, you might face higher interest rates as lenders see you as a slightly riskier borrower. FHA loans cater to borrowers with lower credit scores or those who can't afford a large down payment. They come with a guarantee from the FHA, which means that the government insures the loan, reducing the risk for lenders. h While scores as low as 500 are accepted, there are caveats: Scores 500-579: Expect to put down 10% of the home's purchase price. Scores 580+: You can often get away with just a 3.5% down payment. Beyond credit scores, FHA loans also consider other factors like employment history and debt-to-income ratio. Mortgage insurance premiums are typically required, adding to the cost of the loan. This is a unique loan type for those looking to buy and renovate a home. The loan amount is based on the projected value of the home after renovations. A score of 620 is usually the norm. Exclusively for those with military ties, VA loans often come with favorable terms, including zero down payments in some cases. Many lenders operate with a baseline of 620, but some might go as low as 580. However, in many cases, the VA itself doesn't mandate a minimum score but looks at the overall loan profile. They assess factors like income, employment, and other debts. Tailored for rural home buyers, USDA loans offer zero down payments for those who qualify. The general score sits at 640. However, with a robust automated underwriting system, some lenders might be more flexible. Beyond the credit score, USDA loans also consider consistent income and that the property lies within a qualifying rural area. These are high-value loans exceeding the limits set by Fannie Mae and Freddie Mac. The range is usually 700-720, depending on the lender and loan amount. Jumbo loans are riskier for lenders since they can't be sold to government-backed agencies, so they often come with stricter criteria, not just in terms of credit scores but also in terms of debt-to-income ratios and cash reserves. With ARMs, your interest rate is variable, which means it can rise or fall over time based on market conditions. A score of around 620 might be required, though this varies among lenders. ARMs can be beneficial if you plan on selling the home before the adjustable period kicks in. However, they come with the inherent risk of rising rates, potentially increasing your monthly payments in the future. A score within the ideal range almost invariably leads to more attractive mortgage rates. Over time, even a seemingly marginal rate difference can culminate in significant savings. Furthermore, with a better rate, monthly payments become more manageable, making homeownership more financially comfortable. It also reduces the total debt burden over the loan's tenure, ensuring more money remains in the homeowner's pocket. Banks and lenders have more confidence in borrowers with high credit scores. Hence, having an ideal score enhances the probability of loan application approval. Additionally, a high credit score can act as a buffer, compensating for other potential shortcomings in the loan application. It showcases a track record of financial responsibility, making lenders more comfortable extending a mortgage. From conventional loans to specialized loan programs, a top-tier credit score grants borrowers a broader spectrum of financing options. With this extended palette of choices, potential homeowners can find a loan tailored precisely to their financial situation and homeownership goals. This flexibility also means borrowers can capitalize on various lender incentives, such as cashback offers or temporary rate reductions. Armed with a commendable credit score, borrowers can often negotiate better terms or request concessions from lenders. Being in this favorable position means not just settling for what's offered but actively shaping the mortgage terms to one's advantage. This might mean securing a waiver on certain fees or even obtaining a special rate for the initial period of the loan. Beyond just the credit score, several other factors weigh in on the home-buying process. Understanding these can be paramount in ensuring a seamless transition into homeownership. Lenders often use employment history to assess a borrower's income stability. A consistent income stream generally augments the prospects of loan approval. Long-term employment in the same field or with the same employer can boost a lender's confidence in the borrower's ability to maintain consistent repayments. Conversely, frequent job changes or gaps in employment can raise red flags, potentially leading to higher interest rates or even loan denial. Debt-to-Income Ratio is a metric lenders utilize to gauge a borrower's capability to manage monthly payments. A lower debt-to-income ratio suggests that a borrower has a good balance between income and debt, which makes them a safer bet for lenders. On the flip side, a high ratio can signal potential over-leverage, making lenders wary about the borrower's ability to take on additional debt. Lenders often have a threshold for this ratio, beyond which loan approval becomes challenging. While a sizable down payment can lessen the loan amount and potentially eliminate the need for PMI (Private Mortgage Insurance), lenders also scrutinize its source to ensure it's legal and not an undisclosed loan. A larger down payment signifies a borrower's commitment and financial discipline, often leading to more favorable loan terms. If the down payment is gifted or borrowed, lenders may require documentation to ensure transparency. Undisclosed loans or dubious sources can complicate the loan process and even jeopardize approval. Lenders usually commission property appraisals to ascertain its value. A property's appraised value can influence the loan amount and terms, impacting the overall home-buying equation. If an appraisal comes in lower than the purchase price, a borrower might need to renegotiate the deal or come up with additional funds. Moreover, a higher appraised value can be beneficial, potentially allowing for more flexible loan terms or even refinancing opportunities in the future. Credit scores play a crucial role in the home-buying journey, serving as a financial fingerprint that lenders use to assess borrowers' creditworthiness. A high credit score, generally above 740, opens doors to the best mortgage offers, with competitive interest rates and flexible loan terms. However, even scores in the Good range can yield decent mortgage offers, though with slightly higher rates. Different mortgage loan types have varying minimum credit score requirements, such as 620 for conventional loans, 500-579 for FHA loans, and 640 for USDA loans. Beyond credit scores, other factors like employment, debt-to-income ratio, down payment, and property value also play significant roles in the home-buying process. Understanding these considerations ensures a smooth transition into homeownership and helps borrowers secure the most suitable financing options.What Is a Credit Score?

Ideal Credit Score for Home Purchases

Minimum Credit Score Required by Mortgage Loan Type

Conventional Loans

FHA Loans (Federal Housing Administration)

FHA 203(b)

FHA 203(k)

VA Loans (Veterans Affairs)

USDA Loans (U.S. Department of Agriculture)

Rural Development Guaranteed Housing Loan Program

Jumbo Loans

Adjustable-Rate Mortgages (ARMs)

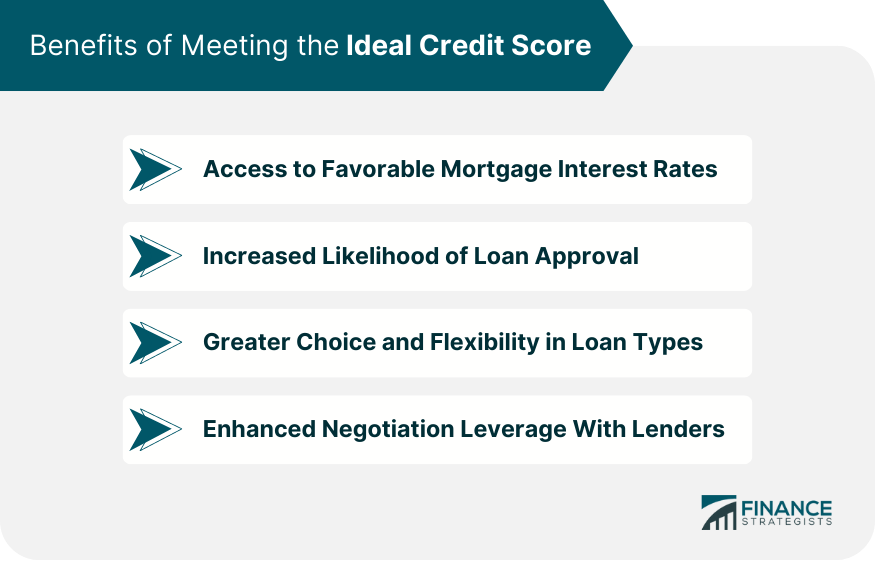

Benefits of Meeting the Ideal Credit Score

Access to Favorable Mortgage Interest Rates

Increased Likelihood of Loan Approval

Greater Choice and Flexibility in Loan Types

Enhanced Negotiation Leverage With Lenders

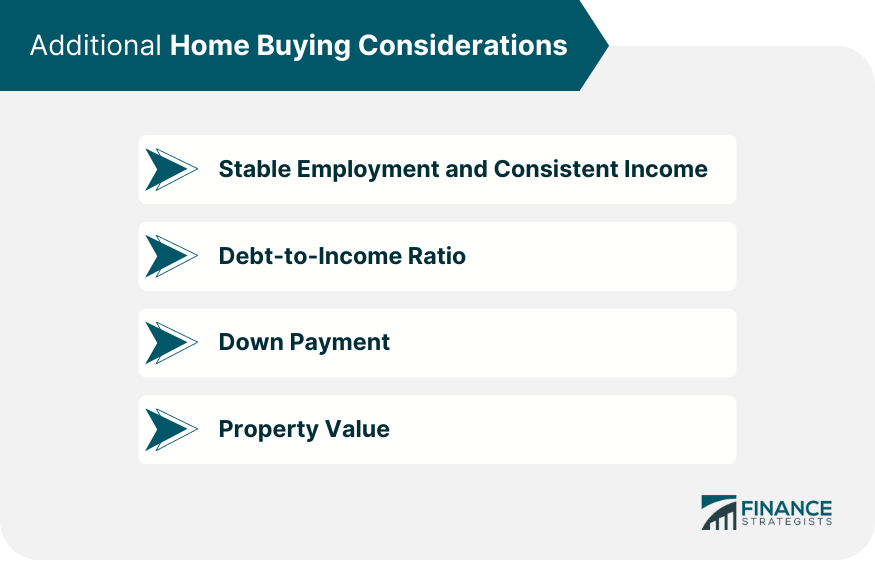

Additional Home Buying Considerations

Stable Employment and Consistent Income

Debt-to-Income Ratio

Down Payment

Property Value

Conclusion

Ideal Credit Score to Buy a House FAQs

The ideal credit score to buy a house is generally above 740. This score ensures access to the best mortgage offers with competitive interest rates and favorable loan terms.

Yes, you can still buy a house with a credit score lower than the ideal range. While scores in the Good range (670-739) may yield decent mortgage offers, lower scores might result in slightly higher interest rates and stricter lending terms.

Your credit score significantly affects loan approval for a house. A higher credit score increases your chances of approval, as it demonstrates financial responsibility to lenders. It can also compensate for other potential weaknesses in your loan application.

Yes, different types of mortgage loans have varying credit score requirements. For example, conventional loans often require a minimum score of 620, while FHA loans may accept scores as low as 500-579 with certain conditions.

Besides the credit score, consider stable employment history, consistent income, debt-to-income ratio, down payment amount, and the property's appraised value. These factors play vital roles in the home-buying process and impact loan approval and terms.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.