Your credit score is a pivotal determinant of the financial opportunities available to you. A strong score often signals to lenders that you're a reliable borrower, leading to easier access to loans, credit cards, and mortgages. Additionally, those with higher scores typically benefit from more favorable interest rates, resulting in potential long-term savings. In essence, a commendable score opens doors to diverse financial products, enhancing your ability to secure funds when needed, purchase a home, or even start a business. Beyond the realm of borrowing, a credit score wields influence in various other facets of life. For instance, when seeking to rent a property, landlords might review your credit score to gauge your financial reliability. Some employers, particularly in the finance sector, may also consider it during the hiring process. Furthermore, individuals with superior credit scores can often secure lower insurance premiums. Thus, a credit score, while a simple number, profoundly impacts multiple dimensions of personal and financial life. A high score not only facilitates approval for loans, mortgages, or credit cards but can also lead to higher credit limits. Conversely, a less-than-ideal score can limit these possibilities. When lenders evaluate credit applications, those with higher scores are perceived as lower risk, enhancing their chances of securing desired financial products. Financial institutions often provide more favorable rates and terms to individuals with stellar credit profiles. A marginal reduction in interest rates, stemming from a commendable score can translate to substantial savings over a loan's tenure, further emphasizing the tangible benefits of a high score. Landlords and property management entities frequently assess potential tenants' credit scores during application evaluations. A compromised credit score can necessitate a higher deposit or even lead to application denial. Conversely, a good score can accelerate the rental application process and widen access to sought-after properties. Employers in select sectors might assess a prospective employee's credit report as a measure of their responsibility and reliability. While a score might not singularly determine employability, it can influence hiring decisions when contenders have similar qualifications. A credit score, while seemingly abstract, has palpable implications for wealth generation. Access to lower interest rates on loans and credit cards, courtesy of a favorable score, can redirect funds from interest payments to investments or other wealth-accretive avenues. This potential for savings and growth underscores the credit score's long-term significance. As individuals traverse their financial journey, large-scale undertakings like property acquisition or business ventures might necessitate loans. A robust credit history positions them advantageously for such aspirations. Maintaining a solid credit foundation ensures that when such milestones arise, potential borrowers are viewed favorably by lenders, leading to competitive loan offers. In unforeseen financial emergencies, access to prompt credit can be invaluable. A robust credit score is instrumental in these scenarios, ensuring that individuals can secure emergency funds or credit extensions, thereby providing a financial buffer in tumultuous times. Insurers may employ credit scores to calibrate premiums for policies like auto or homeowner's insurance. The rationale is that higher scores denote lower risk, potentially correlating with fewer claims, leading to preferential premium rates. Utility providers, before initializing services, may assess a client's credit profile. An impressive score can mitigate or entirely obviate deposit prerequisites. This facilitates a more seamless initiation of services like water, electricity, or cable, reducing upfront financial commitments. A poor credit score can result in struggles to secure loans or credit cards, higher interest rates and insurance premiums, and issues finding housing or employment. It may also necessitate hefty security deposits for utilities. Conversely, regularly checking your credit score allows for monitoring potential identity theft, verifying the accuracy of your credit report, and tracking progress on credit improvement strategies. • Pay Bills on Time: Punctual bill payments are foundational to credit score enhancement. Implementing mechanisms like automated payments or setting periodic reminders can forestall missed deadlines. • Credit Card Balances Management: Regular card usage, counterbalanced by prompt payments, indicates responsible credit management. Maintaining low balances and settling the full balance monthly can mitigate interest accrual and sustain a favorable utilization ratio. • Avoid Unnecessary Hard Inquiries: While individuals can check their scores without repercussions (soft inquiries), applications for credit initiate hard inquiries, which can temporarily dent a score. Exercising discernment about when to seek credit and spacing out such requests can minimize the cumulative impact on a credit score. • Establish a Diverse Credit Mix: A diverse credit portfolio might include credit cards, retail accounts, installment loans, mortgages, and more. While it's not recommended to open accounts you don't need solely for the sake of diversifying, over time, naturally accruing a mix of credit types can enhance your credit profile. • Regularly Monitor and Correct Credit Report Errors: If you find errors, promptly dispute them with the relevant credit bureau. Ensuring the information on your credit report is accurate and up-to-date is crucial, as any mistakes can undeservedly lower your score. Your credit score holds a significant influence over your financial life. It is more than a number; it is pivotal in shaping your financial opportunities and security. A strong score grants access to diverse credit opportunities and favorable interest rates. It impacts renting, job opportunities, and insurance premiums. Long-term benefits include wealth building, securing future loans, and providing emergency preparedness. To improve your score, pay bills on time, manage credit card balances, and monitor your credit report for errors. Moreover, a commendable credit score can lead to lower insurance premiums, further affecting your overall financial well-being. By understanding and actively managing your credit score, you can leverage its power to build a stronger and more secure financial future.Why Your Credit Score Matters

Immediate Implications for Your Credit Scores

Access to Credit Opportunities

Interest Rates and Terms

Renting and Housing

Job Opportunities

Long-Term Implications of Your Credit Scores

Build Wealth

Secure Future Loans

Emergency Preparedness

Impact on Insurance and Utilities

Insurance Premiums

Utility Deposits

Consequences of Poor Credit Score

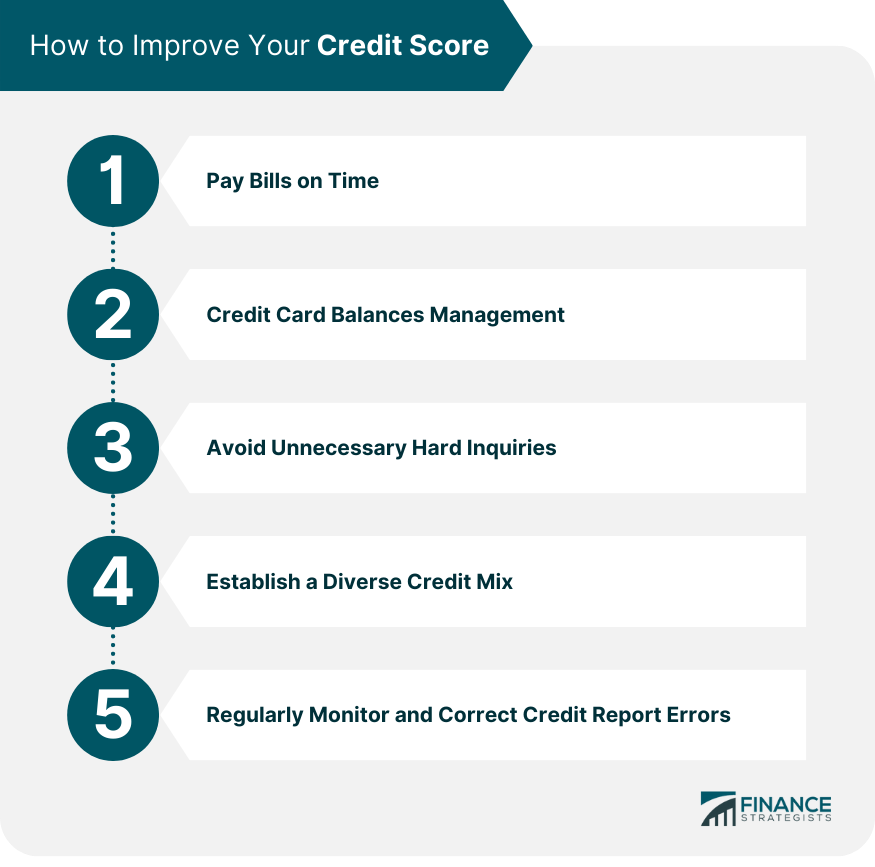

How to Improve Your Credit Score

Conclusion

Importance of a Credit Score FAQs

A credit score is crucial as it determines your creditworthiness, impacting your access to loans, credit cards, and mortgages.

A strong credit score increases the chances of loan approval and secures more favorable interest rates, leading to potential long-term savings.

Yes, beyond borrowing, it influences renting decisions, job opportunities in certain sectors, and even insurance premiums.

A favorable credit score enables access to lower interest rates, allowing more funds for investments and wealth-accretive endeavors.

To boost your credit score, pay bills on time, manage credit card balances, maintain a diverse credit mix, and regularly monitor your credit report for errors.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.