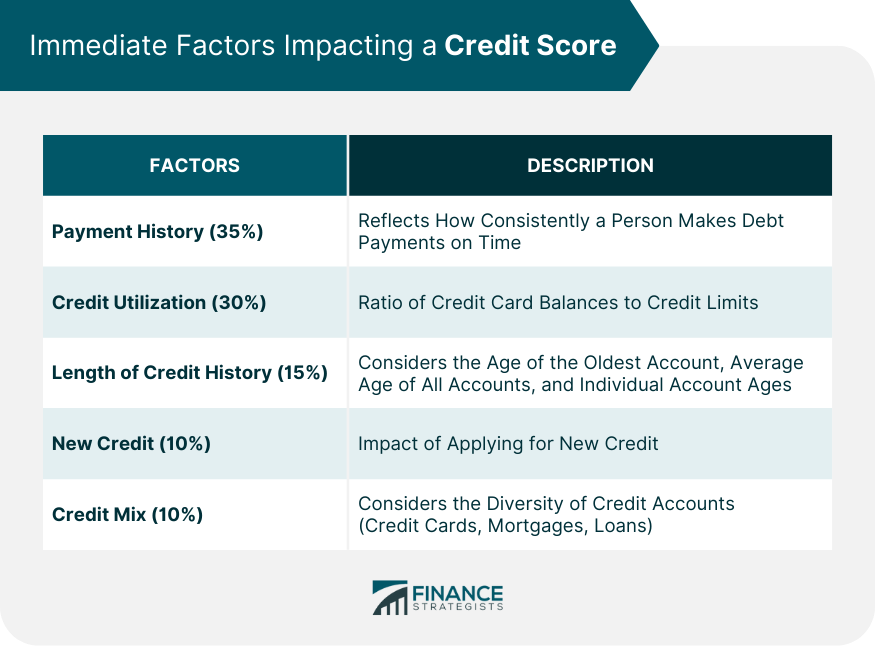

A credit score has become more than just a three-digit number. It is a powerful tool that serves as a window into an individual's financial habits, behaviors, and overall creditworthiness. This numerical representation is generated based on a person's credit history, which includes their borrowing and repayment patterns, credit utilization, and other financial activities. Lenders, landlords, employers, and other financial institutions heavily rely on credit scores to assess the risk associated with providing credit or services to a person. Understanding the factors affecting a credit score is essential for maintaining a healthy financial profile, as it can lead to better borrowing opportunities, lower interest rates, and improved access to various financial services. The payment history is the most significant factor influencing a credit score, accounting for 35% of the overall score. It reflects how consistently a person makes their debt payments on time. Timely payments demonstrate responsible financial behavior and positively impact the credit score. On the other hand, late payments, defaults, and bankruptcies can significantly harm the credit score, making it harder to obtain credit at favorable terms. Credit utilization refers to the ratio of credit card balances to credit limits. It makes up 30% of the credit score. A lower credit utilization ratio indicates that a person is using credit responsibly and not maxing out their available credit. Maintaining a credit utilization rate below 30% is generally considered optimal and can help improve the credit score. The length of credit history accounts for 15% of the credit score. It considers the age of the oldest account, the average age of all accounts, and the age of individual accounts. A longer credit history shows a more established credit profile and can positively influence the credit score. New credit applications can impact the credit score, comprising 10% of it. When a person applies for new credit, it generates hard inquiries on their credit report. Too many hard inquiries within a short period can signal higher credit risk, potentially lowering the credit score. It is essential to be cautious when applying for new credit and be mindful of the potential impact on the score. The credit mix accounts for 10% of the credit score. It considers the various types of credit accounts a person holds, such as credit cards, mortgages, student loans, auto loans, and more. A diverse mix of credit types, responsibly managed, can have a positive impact on the credit score, as it demonstrates the ability to handle different financial responsibilities. A balanced credit mix showcases a well-rounded credit history, positively contributing to overall creditworthiness. Public records, such as bankruptcies, tax liens, and civil judgments, can have a severe and lasting impact on an individual's credit score. These negative marks, when present on a credit report, indicate significant financial setbacks and may cause lenders to view the person as a higher credit risk. Bankruptcies, for instance, can stay on a credit report for up to ten years, while tax liens and civil judgments can persist for several years, making it challenging for the affected individual to access credit at favorable terms. The total amount of debt a person owes in relation to their income, known as the debt-to-income ratio, is an essential factor influencing creditworthiness. Lenders consider this ratio when assessing an individual's ability to manage additional debt responsibly. A high debt-to-income ratio can indicate that a person is heavily burdened with debt, leading to concerns about their ability to repay new obligations. Lenders closely scrutinize recent credit activity when evaluating a person's creditworthiness. Opening several new credit accounts within a short period can raise red flags, as it suggests an increased reliance on credit or potential financial instability. Each new credit application generates a hard inquiry on the credit report, and multiple hard inquiries within a short timeframe may lower the credit score temporarily. This is because multiple credit inquiries can indicate a higher credit risk, as it may suggest that the individual is urgently seeking credit due to financial difficulties. When individuals discover inaccuracies or discrepancies on their credit reports, it is crucial to take immediate action to rectify the situation. Reporting errors to the credit bureaus and providing supporting documentation can lead to the correction of inaccurate information. This process involves contacting the credit reporting agencies, explaining the issue, and providing evidence to support the dispute. Promptly addressing these errors can prevent them from negatively affecting the credit score and ensure that the credit report accurately reflects the individual's financial history. Dealing with the aftermath of identity theft requires swift and proactive measures to mitigate the impact on the credit score. Victims of identity theft should contact the concerned financial institutions and credit bureaus to report fraudulent activities. Filing an identity theft report with the Federal Trade Commission (FTC) and local law enforcement is also essential to create an official record of the theft. Additionally, placing a fraud alert or a credit freeze on the credit report can help prevent further unauthorized accounts or activities, safeguarding the individual's credit score and financial reputation. Enrolling in credit monitoring services can be a valuable tool for mitigating negative impacts on credit scores. These services provide real-time alerts for any significant changes or suspicious activities on credit reports. By promptly identifying potential issues, individuals can take immediate action to address inaccuracies, dispute fraudulent accounts, or detect identity theft, thereby protecting their creditworthiness. Maintaining a healthy credit score is crucial for financial success, and there are several proactive steps individuals can take to achieve this goal: High credit card balances can increase credit utilization, negatively impacting the credit score. By paying down credit card balances regularly and avoiding maxing out credit cards, individuals can demonstrate responsible credit management and boost their creditworthiness. Credit reports contain detailed information about credit history, accounts, and payment records. By checking their credit reports periodically, individuals can detect any errors, inaccuracies, or suspicious activities that may affect their credit scores. Early identification of such issues allows for timely corrections and can prevent potential damage to creditworthiness. If discrepancies or inaccuracies are found on a credit report, immediate action should be taken to dispute and rectify them. Reporting errors to the credit bureaus and providing supporting documentation can lead to corrections on the credit report. This ensures that the credit report accurately reflects the individual's financial history and prevents unwarranted negative impacts on their credit score. Responsible credit management involves making on-time payments for all debts, not just credit cards. Paying bills on time demonstrates reliability and responsible financial behavior, which positively influences the credit score. Consistently meeting financial obligations reflects a disciplined approach to managing finances and reinforces creditworthiness. Applying for new credit too frequently can generate multiple hard inquiries on the credit report, which may lower the credit score temporarily. Each hard inquiry indicates a request for new credit, and multiple inquiries within a short time frame can be interpreted as a sign of financial stress or excessive borrowing. To maintain a healthy credit score, individuals should be selective about applying for new credit and only do so when necessary. A credit score is more than just a three-digit number; it is a powerful tool that reflects an individual's financial habits and creditworthiness. To maintain a healthy credit profile, individuals should keep credit card balances low, regularly review credit reports, and promptly address any errors or discrepancies. Responsible credit management, on-time payments, and avoiding frequent credit applications are essential steps towards achieving a strong credit score. Mitigating negative impacts on credit scores involves disputing inaccuracies, recovering from identity theft, and utilizing credit monitoring services to detect potential issues early. Open communication with creditors during financial hardship can also help prevent negative credit reporting. By taking proactive measures and being mindful of credit management, individuals can build and maintain a positive credit history, unlocking better financial opportunities and paving the way for a secure financial future.What Affects a Credit Score?

Immediate Factors Impacting a Credit Score

Payment History (35%)

Credit Utilization (30%)

Length of Credit History (15%)

New Credit (10%)

Credit Mix (10%)

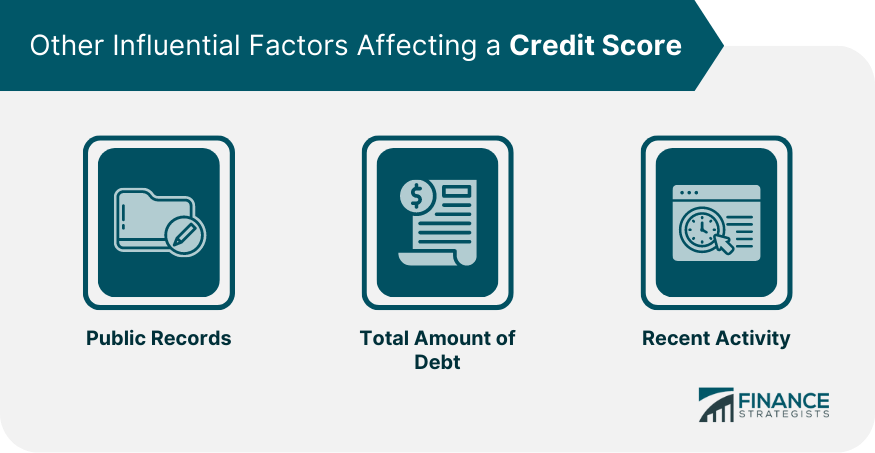

Other Influential Factors

Public Records

Total Amount of Debt

Recent Activity

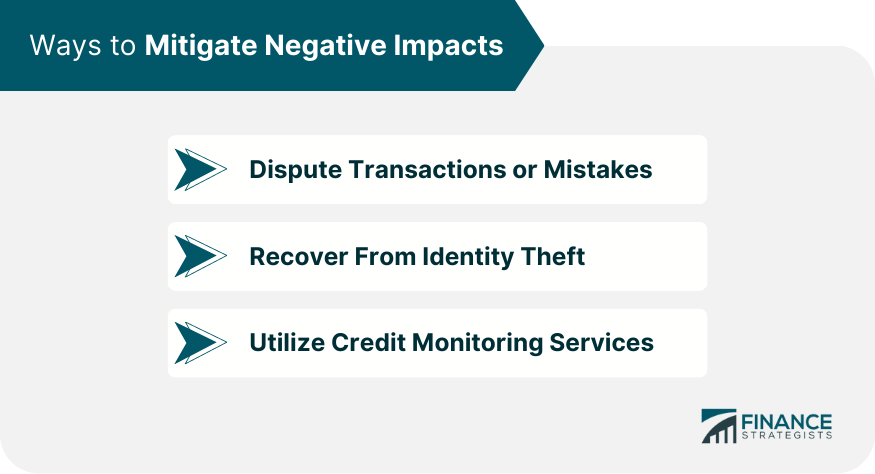

Mitigating Negative Impacts

Dispute Transactions or Mistakes

Recover From Identity Theft

Utilize Credit Monitoring Services

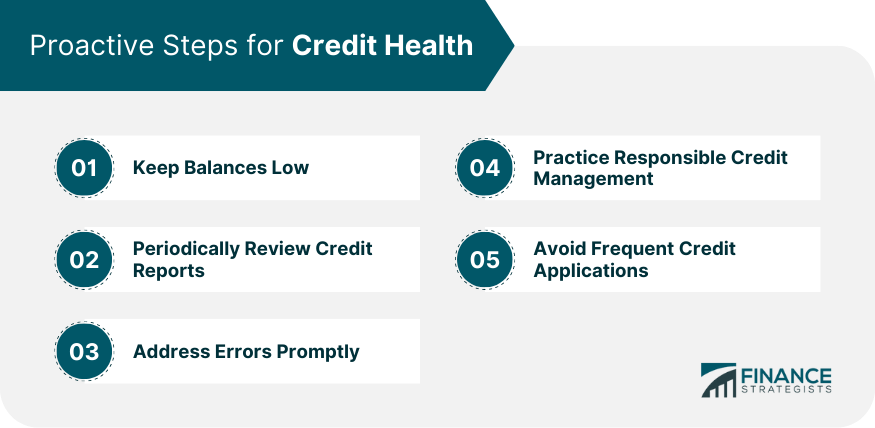

Proactive Steps for Credit Health

Keep Balances Low

Periodically Review Credit Reports

Address Errors Promptly

Practice Responsible Credit Management

Avoid Frequent Credit Applications

Conclusion

What Affects a Credit Score? FAQs

Various factors influence a credit score, including payment history, credit utilization, length of credit history, new credit applications, credit mix, public records, total amount of debt, and recent credit activity.

Payment history is a significant factor, accounting for 35% of a credit score. Timely payments positively impact the score, while late payments, defaults, and bankruptcies can lower it.

Credit utilization is the ratio of credit card balances to credit limits. Keeping this ratio below 30% is generally considered optimal and can help improve the credit score.

The age of the oldest account, average age of all accounts, and individual account ages contribute to the credit score. A longer credit history shows an established credit profile, positively affecting the score.

Yes, new credit applications can affect a credit score. Each application generates a hard inquiry on the credit report, and too many inquiries within a short period may temporarily lower the score.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.