Credit unions are member-owned financial cooperatives that provide traditional banking services, such as savings accounts, checking accounts, and loans, to their members. They're built on a democratic structure where each member, regardless of the size of their deposits, has an equal vote in deciding the union's policies and electing the board of directors. Credit unions operate on the "people helping people" principle. This guiding philosophy encourages collaboration, community support, and shared prosperity. This principle is reflected in their operational procedures, fee structures, and overall attitude towards their members, especially those with less-than-perfect credit scores. While both banks and credit unions offer similar services, there are some fundamental differences. Banks are profit-driven entities owned by shareholders. Their primary objective is to generate profit for those shareholders. On the contrary, credit unions are non-profit entities owned and operated by their members. The emphasis is on service rather than profit. Credit refers to the trust that lenders have in a borrower's ability to repay a loan in the future. It's the foundation of any loan process, playing a crucial role in determining who can borrow, how much they can borrow, and at what interest rate. Credit can be seen as a measurement of financial trustworthiness, affecting various aspects of an individual's financial life. When lenders talk about "credit," they're often referring to your credit history, a record of how responsibly you've managed your financial obligations. This record includes information about your debts, payment history, the length of your credit history, and more. All these factors shape your reputation as a borrower. A credit score is a three-digit number derived from your credit history. It gives potential lenders a quick snapshot of your creditworthiness. The higher the score, the less risk you pose to lenders, and the better terms you'll likely be offered. On the flip side, a lower credit score suggests higher risk to lenders. As a result, you might face higher interest rates, stricter loan terms, or difficulty in securing loans at all. It's important to remember, though, that having a bad credit score isn't a financial death sentence. There are institutions, like credit unions, that are willing to work with those who have bad credit. Bad credit can be a barrier to many financial opportunities, making it harder to secure loans, mortgages, or even some jobs. It often signifies that an individual has had trouble managing their finances in the past, which makes lenders wary. However, a bad credit score isn't permanent and can be improved over time. Moreover, not all financial institutions view bad credit in the same light. Credit unions, for example, often look beyond the credit score and consider other factors when evaluating a loan application. Traditional banks often shy away from lending to individuals with poor credit scores, viewing them as high-risk clients. However, credit unions can offer a lifeline. They often provide loan products designed specifically for those with less-than-perfect credit. Credit unions look at more than just the credit score when evaluating loan applications. They consider the applicant's overall financial picture, personal circumstances, and potential for future success. This holistic approach opens up possibilities for those who may be shut out of traditional lending avenues. When evaluating loan applicants, credit unions consider various factors. These include income, employment stability, debt-to-income ratio, and collateral, if applicable. They also consider the applicant's relationship with the credit union and the community, which can play a significant role in the decision-making process. By considering these factors, credit unions can often extend credit to individuals who might otherwise struggle to secure a loan. This underscores the role of credit unions in promoting financial inclusion and stability within their communities. While credit unions still have to consider the risk associated with lending to individuals with bad credit, their rates and fees are often more favorable than those of traditional banks. Credit unions, as not-for-profit entities, aren't driven by the need to maximize profits for shareholders. This allows them to offer more competitive rates and lower fees. It's important for borrowers to understand all the associated costs of a loan, beyond just the interest rate. This includes any application fees, service charges, or early repayment penalties. An understanding of these costs helps ensure that the loan remains manageable throughout its term. Secured loans are one type of loan product that credit unions may offer to individuals with poor credit scores. These loans are backed by an asset, such as a car or home. If the borrower defaults on the loan, the credit union can seize the asset to recoup its loss. Since the risk to the lender is lower, secured loans often come with more favorable terms, like lower interest rates. For individuals with bad credit, a secured loan can be a viable option to access needed funds and begin rebuilding their credit. Unsecured loans, on the other hand, don't require collateral. Because of this, they're riskier for lenders and usually come with higher interest rates. However, credit unions may still offer unsecured loans to individuals with bad credit, particularly if they have a steady income and a positive relationship with the credit union. Unsecured loans from credit unions can provide much-needed funds without requiring borrowers to risk their assets. These loans can also help individuals build or rebuild their credit when managed responsibly. Payday Alternative Loans (PALs) are a type of loan product offered by many credit unions to help members avoid predatory payday loans. These short-term loans offer smaller amounts at reasonable interest rates, making them a safer, more affordable alternative. PALs can be a viable option for those with bad credit who need access to quick cash. By choosing a PAL over a traditional payday loan, borrowers can avoid the cycle of high-interest debt that often accompanies payday loans. The first step in applying for a credit union loan is finding a credit union that you're eligible to join. Credit unions serve specific communities, so you'll need to find one that aligns with your circumstances. This might be based on your location, profession, or membership in certain groups or organizations. Once you've found a potential credit union, take the time to understand its values, services, and products. Look for information about their approach to lending and their treatment of members with bad credit. Once you've selected a credit union, review their loan options. They may offer a variety of loan types, each with different terms, interest rates, and eligibility requirements. Understand the details of each loan product and consider which one might be the best fit for your needs. Consider consulting with a loan officer at the credit union who can guide you through the options and answer any questions you may have. Before applying for a loan, gather all necessary documentation. This usually includes proof of income, employment verification, and identification documents. Some credit unions may also require proof of membership in the qualifying group or community. Having all necessary documents ready can streamline the application process and improve your chances of approval. It also demonstrates to the credit union that you're organized and serious about your loan application. Once you have all your documents in order, it's time to submit your application. The process may vary between credit unions. Some may allow you to apply online, while others might require a face-to-face meeting. Regardless of the method, make sure you understand the process and complete all required steps. Be honest and accurate in your application. Any discrepancies can lead to delays or denial of your application. After submitting your application, follow up with the credit union to ensure they've received it and that it's being processed. This is also a good time to ask any additional questions that may have arisen since your application. Follow-up not only shows your interest in the loan but also helps ensure any potential issues are resolved quickly. It's a crucial step in the loan application process. Once your loan application is approved, there may be room to negotiate the terms. This could include the interest rate, repayment schedule, and any associated fees. Don't be afraid to ask for what you need – the worst they can say is no. Remember, the goal is to secure a loan that is manageable and beneficial for you. Negotiating the terms can help ensure your loan fits your budget and financial goals. With everything negotiated and finalized, the final step is to accept the loan offer. Before you do, make sure you thoroughly understand all the terms and conditions. If there's anything you're unsure about, ask for clarification. Once you accept the loan, you're legally obligated to meet the terms. Be confident in your understanding of these terms before you sign on the dotted line. Successfully managing a loan involves consistent, on-time payments. Creating a repayment strategy can help ensure this. The strategy might involve setting up automatic payments or budgeting for your monthly payment. Your repayment strategy should also consider any potential extra payments. Paying more than the minimum when you can reduces the amount of interest you'll pay over the life of the loan. Making loan payments on time is crucial. Late or missed payments can lead to fees, higher interest rates, and damage to your credit score. They can also strain your relationship with the credit union, potentially impacting future loan opportunities. On the other hand, consistent on-time payments demonstrate to the credit union and other potential lenders that you're a responsible borrower. This can open up more financial opportunities in the future. Failing to repay a loan – known as defaulting – can have severe consequences. It can lead to increased fees, higher interest rates, and significant credit score damage. If your loan is secured, defaulting could also lead to the loss of your collateral. If you're struggling with loan payments, don't ignore the problem. Reach out to your credit union as soon as possible. They may be able to work with you to modify the loan terms or find another solution. Loan repayment plays a significant role in your credit score. Each on-time payment helps improve your credit history, contributing to a higher credit score. Conversely, late or missed payments can hurt your score. Therefore, responsibly managing a credit union loan can help you improve your bad credit score. It's an opportunity to demonstrate to lenders that you can be trusted to fulfill your financial obligations. There are several strategies to boost your credit score while repaying your loan. These include making all loan payments on time, keeping your credit utilization low, and regularly checking your credit report for errors. It's also a good idea to maintain a mix of credit types – such as credit cards, retail accounts, and installment loans – to show that you can handle different forms of credit responsibly. Remember, improving your credit score is a marathon, not a sprint. It takes time and consistent effort, but the rewards are worth it. Improving your credit score has many long-term benefits. It can make it easier to secure loans, often with better terms and lower interest rates. It can also help you save on insurance premiums, get approved for rental applications, and even open up job opportunities. By responsibly managing a credit union loan, you can start rebuilding your credit and move toward a more secure financial future. It's a journey, but with persistence and discipline, you can achieve your financial goals. Credit unions serve as a bridge towards financial inclusion for those with bad credit, providing various loan options that consider more than just credit scores. They offer secured and unsecured loans, as well as Payday Alternative Loans (PALs), each designed with their own features to cater to different financial needs. Not only do they extend credit opportunities, but credit unions also offer competitive rates and fees, adding to their appeal. Applying for these loans involves careful research, document preparation, negotiation, and most importantly, a commitment to responsible repayment. Successfully managing a credit union loan can pave the way for credit score improvement and open more financial opportunities in the future. Credit unions provide a lifeline for individuals with bad credit, enabling them to regain financial stability and improve their creditworthiness over time.Understanding Credit Unions

Understanding Credit and Credit Scores

Credit Definition

Credit Score Importance

Bad Credit Implications

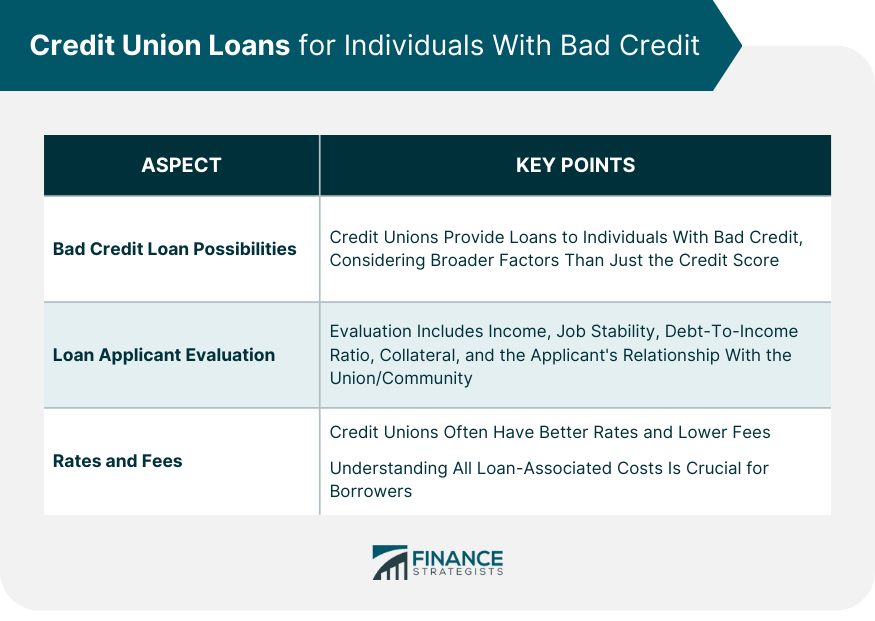

Credit Union Loans for Individuals With Bad Credit

Bad Credit Loan Possibilities

Loan Applicant Evaluation

Rates and Fees

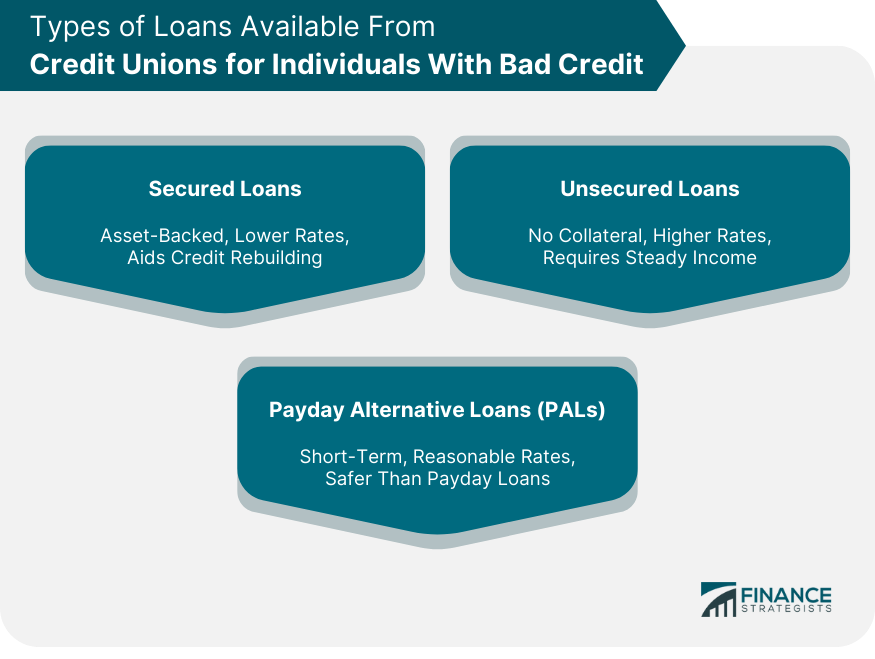

Types of Loans Available From Credit Unions for Individuals With Bad Credit

Secured Loans

Unsecured Loans

Payday Alternative Loans (PALs)

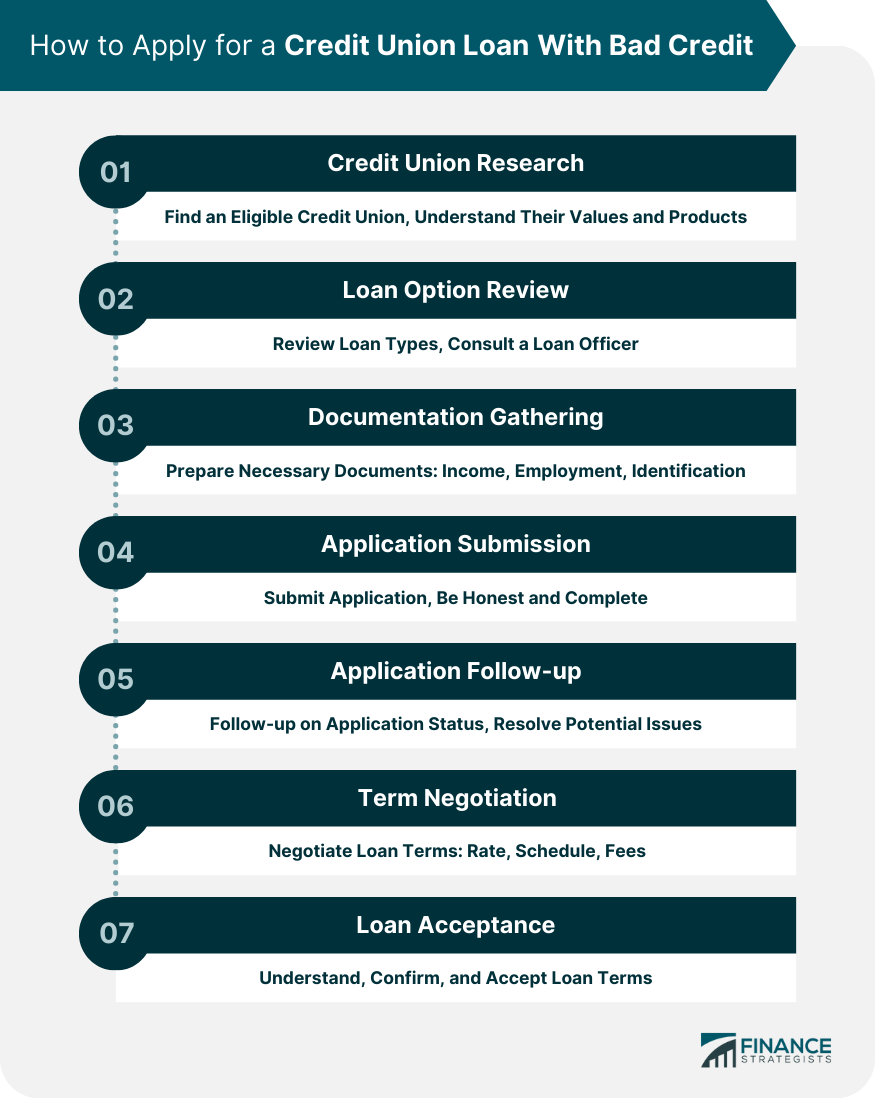

How to Apply for a Credit Union Loan With Bad Credit

Credit Union Research

Loan Option Review

Documentation Gathering

Application Submission

Application Follow-up

Term Negotiation

Loan Acceptance

Managing a Credit Union Loan With Bad Credit

Repayment Strategies

Prompt Payment Importance

Default Consequences

Improving Your Credit Score While Repaying Your Loan

Repayment and Credit Score

Credit Score Boosting Strategies

Long-Term Credit Benefits

Bottom Line

Credit Union Loan for Bad Credit FAQs

Credit unions can provide loans to individuals with bad credit by looking beyond their credit scores and considering their overall financial situation.

Credit unions may offer secured loans, unsecured loans, and payday alternative loans (PALs) to individuals with bad credit.

By making on-time payments on a credit union loan, individuals can demonstrate financial responsibility, thereby improving their credit score over time.

Credit unions often offer more flexible loan options to individuals with bad credit compared to banks, as they are more focused on service than profit.

Credit unions consider income, employment stability, debt-to-income ratio, and other factors beyond just the credit score when evaluating loan applications.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.