Credit unions are vital to the financial ecosystem due to their member-focused operations. Their key aim is to enhance member engagement, which is crucial for retaining members, fostering growth, and delivering personalized banking experiences. In the context of credit unions, member engagement implies creating significant interactions to establish trust, foster long-term relationships, and promote loyalty through both in-person and online services. The current financial environment, characterized by rapid digital transformation and increased competition from traditional banks and fintech companies, necessitates more robust member engagement strategies. Credit unions need to align their practices with the changing expectations and behaviors of their members in order to stay competitive and relevant. Customer Relationship Management (CRM) systems can be powerful tools for credit unions looking to enhance member engagement. These systems allow for the collection and analysis of member data, facilitating effective segmentation. With this segmentation, credit unions can deliver more targeted, relevant messages that resonate with individual members' needs, thereby significantly improving engagement. Personalized communication is not merely about addressing members by their names. It involves understanding the specific needs, preferences, and financial goals of each member and tailoring messages accordingly. By sending communications that directly address individual member concerns or interests, credit unions can enhance the member experience, cultivate trust, and build long-term loyalty. In today's digital age, offering robust mobile banking solutions is imperative. As more members prefer managing their finances on the go, providing a user-friendly and functional mobile banking app can significantly drive member engagement. Such platforms should offer a wide range of services, from checking account balances to making payments and applying for loans. Providing seamless experiences across all digital touchpoints is another key factor for improving member engagement. This involves ensuring that members can easily navigate through online banking platforms, promptly resolve their queries, and receive consistent service across all channels. A cohesive and user-friendly digital experience can significantly improve member satisfaction and promote continuous engagement. By creating and sharing educational content, credit unions can position themselves as trusted financial advisors. Content, whether in the form of blog posts, webinars, eBooks, or newsletters, can help members make informed decisions about their finances. It's an opportunity to provide value, foster trust, and encourage deeper engagement. Social media provides an excellent platform for credit unions to interact with their members in a more informal, real-time setting. By sharing informative content and engaging in conversations on these platforms, credit unions can create a sense of community, promptly address member queries, and receive valuable feedback. Participating in local events and sponsorships allows credit unions to demonstrate their commitment to the community. Such engagements not only strengthen existing member relationships but also attract potential members. These initiatives further enhance the credit union's reputation as a community-focused institution. Forming partnerships with local businesses can be mutually beneficial. Credit unions can provide necessary financial services to these businesses and their employees, while the businesses can offer exclusive perks or discounts to credit union members. Such partnerships can enhance member benefits and promote engagement. With data analytics, credit unions can gain valuable insights into member behavior and preferences. By understanding how members interact with their services, what their transaction patterns are, and what their preferences might be, credit unions can tailor their services and communication more effectively. Predictive analytics involves using existing data to anticipate future trends or behaviors. For credit unions, this could mean predicting which services a member might need in the future, identifying potential risks, or uncovering growth opportunities. Such insights are valuable for proactive planning and decision-making. Before embarking on any strategic initiative, it's crucial for credit unions to establish clear goals. These goals might include increasing member satisfaction rates, reducing member churn, or increasing the adoption of specific products or services. By setting clear and measurable goals, credit unions can better strategize their approach toward enhancing member engagement. Once the goals are defined, they need to identify the Key Performance Indicators (KPIs) that will enable them to track progress and measure success. The implementation of engagement strategies also depends on the selection of the right tools and platforms. For example, an effective CRM system can support targeted and personalized communication, a robust content management system can aid in content marketing initiatives, and a user-friendly platform can facilitate seamless mobile banking experiences. The right tools can simplify processes, enhance efficiency, and ensure the effective execution of strategies. Employees play a crucial role in member engagement. They are the ones who interact directly with the members, whether in-person or via digital channels. They are also the ones who operate the systems and tools that drive engagement strategies. Therefore, credit unions need to provide adequate training and ongoing support to their employees, equipping them with the skills and knowledge they need to successfully contribute to engagement initiatives. Member engagement strategies are not a one-time endeavor. They are an ongoing process that requires continuous monitoring and optimization. Credit unions need to regularly track the performance of their strategies, gather member feedback, and analyze relevant data. Such monitoring can offer valuable insights into what's working and what's not, enabling credit unions to make necessary improvements and adjustments. The adoption of new technologies can bring with it a host of challenges. These might include integration issues, system errors, or security vulnerabilities. To address these challenges, credit unions can partner with reliable technology providers and ensure that their systems are thoroughly tested and audited. Regular system checks and prompt attention to issues can help prevent major disruptions and maintain a smooth digital experience for members. With the move towards more digital solutions, there might be resistance from both members and employees who are accustomed to traditional banking methods. Credit unions can address this challenge by providing ample education about the benefits of digital banking and offering the necessary support to ease the transition. Patience and empathy are crucial during this transition phase. Credit unions are subject to numerous data privacy regulations. Failure to comply with these regulations can lead to hefty fines and damage to their reputation. To ensure compliance, credit unions can conduct regular audits, provide training to employees on data privacy practices, and strictly adhere to industry standards and best practices. Members might have concerns about the security of their data. They might worry about their data being misused or falling into the wrong hands. Credit unions can address these concerns by being transparent about their data usage policies, implementing strong security measures, and promptly addressing any issues or concerns raised by members. Transparency and prompt communication can go a long way in building trust with members. As credit unions grow, maintaining the same level of personalized service can become a challenge. It's important for credit unions to remember that even with growth, they must strive to maintain their community-oriented ethos and personalized approach. Leveraging CRM systems and data analytics can help in delivering personalized experiences, even at a larger scale. Automation can significantly enhance efficiency, particularly when dealing with large volumes of data. However, it's important for credit unions to ensure that the use of automation does not compromise the authenticity of their interactions with members. A balance between automation and the human touch can help maintain a high level of member satisfaction. Credit unions play a pivotal role in the financial ecosystem, aiming to bolster member engagement for long-term growth and satisfaction. In an era of rapid digital transformation and increased competition, they need to adopt robust strategies for enhancing engagement. These strategies include personalized communication through CRM systems, digital transformation for seamless online experiences, content marketing for building trust, community involvement for fostering relationships, and data analytics for understanding member behaviors. Implementing these strategies entails setting clear goals, choosing the right tools, providing employee training, and conducting continuous monitoring for improvement. However, potential challenges such as technological hitches, resistance to change, data privacy concerns, and maintaining personalization at scale must be adequately addressed. With these approaches and solutions, credit unions can effectively enhance member engagement and stay competitive and relevant in the evolving financial landscape.Understanding Member Engagement in Credit Unions

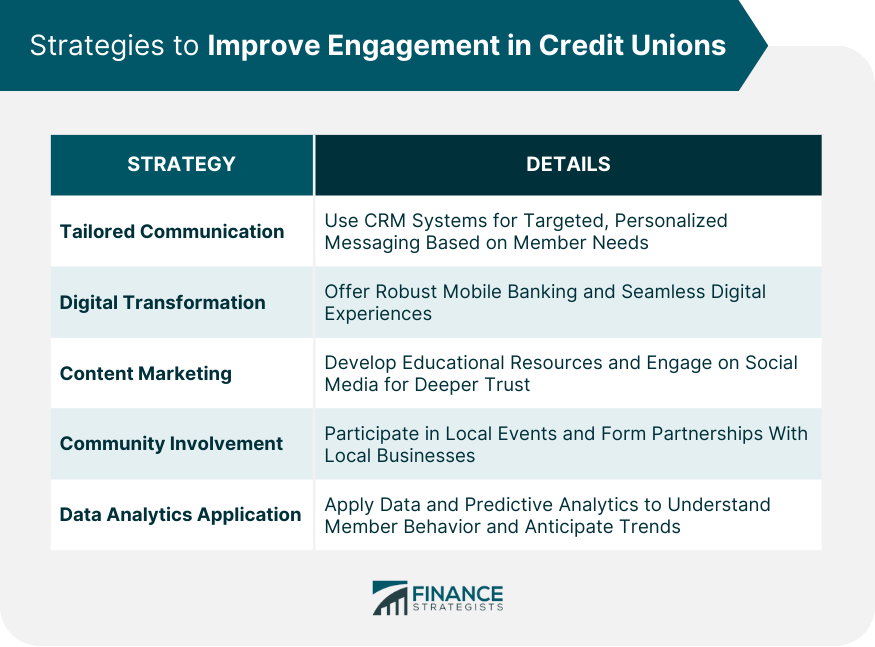

Strategies to Improve Engagement in Credit Unions

Tailored and Personalized Communication

Utilizing CRM Systems for Segmentation

Importance of Personalized Messaging

Digital Transformation

Mobile Banking Solutions

Seamless Online and Mobile Experiences

Content Marketing

Educational Resources

Social Media Campaigns

Community Involvement

Local Events and Sponsorships

Partnering With Local Businesses

Data Analytics Application

Understanding Member Behavior and Preferences

Predictive Analytics for Future Planning

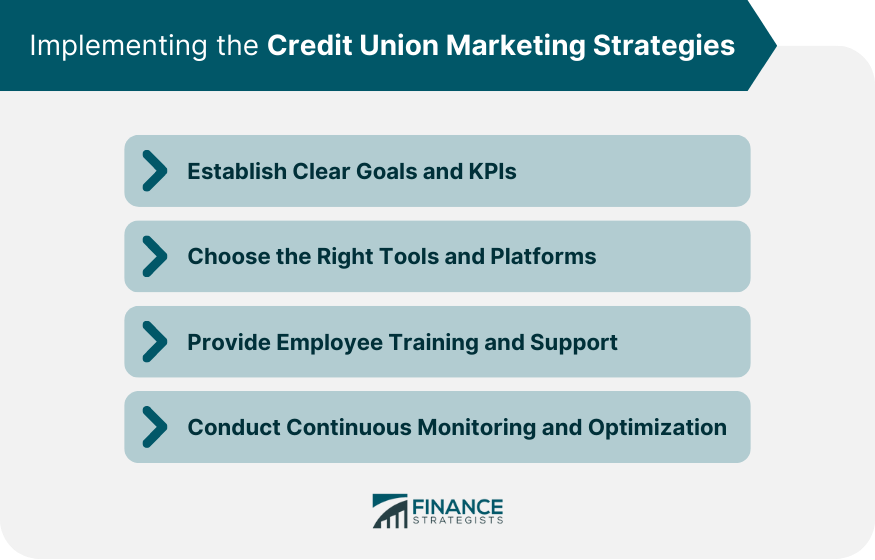

Implementing the Credit Union Marketing Strategies

Establish Clear Goals and KPIs

Choose the Right Tools and Platforms

Provide Employee Training and Support

Conduct Continuous Monitoring and Optimization

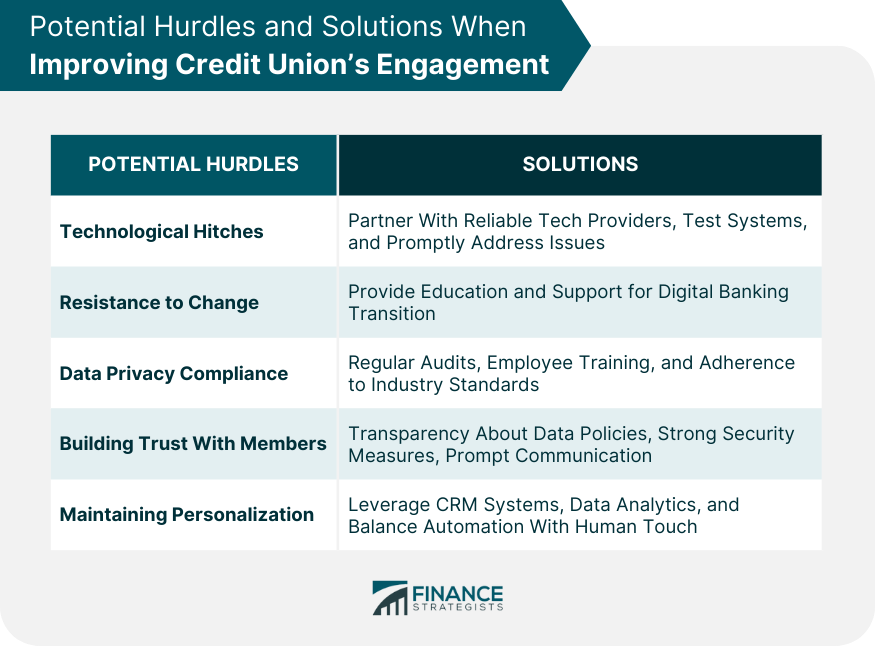

Potential Hurdles and Solutions When Improving Credit Union’s Engagement

Challenges in Digital Transformation

Technological Hitches

Resistance to Change

Data Privacy and Security Issues

Ensuring Compliance

Building Trust With Members

Maintaining Personalized Experience at Scale

Keeping Authenticity

Effective Use of Automation

Bottom Line

Credit Union Marketing Strategies to Improve Engagement FAQs

Personalized communication, digital transformation, content marketing, community involvement, and leveraging data analytics are key strategies to improve member engagement in credit unions.

Personalized communication helps credit unions understand specific member needs and preferences, thereby enhancing the member experience, cultivating trust, and fostering long-term loyalty.

Digital transformation, through mobile banking solutions and seamless online experiences, caters to modern members' preferences for managing their finances on the go, significantly improving member engagement.

Community involvement, via local events and partnerships with local businesses, strengthens member relationships, attracts potential members, and reinforces the credit union's reputation as a community-focused institution.

Clear goal setting, choosing the right tools, employee training, and continuous monitoring and optimization are crucial for the effective implementation of strategies to improve credit union member engagement.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.