Credit Union Mobile Deposit Funds Availability refers to the timeframe in which funds from check deposits made through a credit union's mobile app become accessible for use. This availability can vary based on several factors. For smaller checks or accounts in good standing, funds may be available immediately or within minutes. Certain credit unions may offer same-day availability if the deposit is made before a specific cutoff time. For most mobile check deposits, funds are typically available the next business day. However, larger checks, new accounts, or accounts with negative histories may experience extended holds to allow for check clearance. Credit unions must adhere to Regulation CC, ensuring at least $200 of a deposit is available by the next business day. To maximize availability, maintain a positive account history, deposit early in the day, and follow the credit union's guidelines. In some instances, credit unions may make funds available immediately or within a few minutes of deposit. This policy is common for smaller checks or accounts in good standing with a history of no overdrafts or bounced checks. The immediate availability policy can be a great asset for members who need quick access to their funds. Certain credit unions may also have policies that allow for same-day availability of funds. If the mobile deposit is made before a specific cutoff time (often in the afternoon), the funds might be made available later the same day. This service is convenient for members who deposit checks early in the day and want to access their money on the same day. More commonly, credit unions have policies where funds from mobile check deposits become available the next business day following the day of deposit. This policy is standard among many credit unions, providing a predictable timeline for funds availability. It's important to note that if a deposit is made on a weekend or holiday, the next business day rule will apply. For larger checks, new accounts, or accounts with a history of overdrafts, credit unions may enforce an extended hold on the deposited funds. The purpose of this policy is to allow time for the check to clear before the funds are made available. This can be a few business days or more, depending on the credit union and the specifics of the deposit. Regulation CC is a Federal Reserve regulation that stipulates the standard hold periods for various types of deposits. Credit unions adhere to this regulation, meaning that, under normal circumstances, at least the first $200 of a check deposit must generally be made available by the next business day. One crucial factor affecting the availability of funds from a mobile deposit at a credit union is the size of the deposit. Typically, larger deposits may be subject to longer hold periods. This policy is in place to ensure the check clears before the funds are released to the account. For smaller checks, funds may become available much faster, sometimes even immediately. Your account's standing and history with the credit union can significantly impact the availability of funds from a mobile deposit. If you maintain your account in good standing, with no history of bounced checks or overdrafts, your credit union may provide quicker access to deposited funds. Conversely, accounts with negative histories may be subject to longer holds. The timing of the deposit can also affect when your funds become available. If a deposit is made early in the day, it may be processed the same day, leading to quicker funds availability. However, deposits made after the daily cut-off time, on weekends, or on holidays may not be processed until the next business day, delaying the availability of funds. Regulation CC is a Federal Reserve regulation that sets standard hold periods for various types of deposits. Under this regulation, the first $200 of a deposit must be available the next business day. How your credit union applies this regulation can affect when the rest of your funds become available. Finally, technology and processing issues can also affect credit union mobile deposit funds availability. For instance, if there is an issue with the image quality of the check you've deposited or if you enter incorrect information, the processing of the deposit could be delayed, which would delay the availability of the funds. Therefore, it's crucial to ensure that you follow all the instructions correctly when making a mobile deposit. Regulation CC plays a critical role in the policies and procedures surrounding credit union mobile deposit funds availability. In compliance with this regulation, credit unions must ensure that funds from check deposits become available within the standard timeline. This means that after you make a mobile deposit at your credit union, a portion of those funds (typically $200) should be available by the next business day. While the guidelines under Regulation CC are straightforward, there are a few exceptions where a longer hold might be placed on your check deposit. These exceptions can include large deposits, redeposited checks, repeated overdrafts, reasonable doubt of collectability, emergency conditions, and new accounts. In such cases, credit unions might hold the funds longer than the standard next-day availability. Credit unions, like all financial institutions, are required to adhere to the mandates of Regulation CC. This includes providing a disclosure of their funds' availability policies to all account holders. These disclosures outline when funds from deposits are available for withdrawal, any exceptions to their standard policy, and what constitutes a business day for the credit union. Credit unions may assess the account's history while determining funds availability. If your account is in good standing with no history of bounced checks or overdrafts, the credit union might release the funds more quickly. So, strive to maintain a positive account balance and demonstrate responsible banking habits. The time of deposit can influence the availability of funds. Most credit unions have a cut-off time, typically in the afternoon. If you make your deposit before this time, your funds may become available more quickly. Conversely, deposits made after the cut-off time, on weekends, or holidays, might only be processed on the next business day. For successful mobile deposits, the quality of the check images is paramount. Ensure there's good lighting and the check is placed on a contrasting, flat surface. Both the front and back of the check should be clearly visible, with all details legible. Poor-quality images can lead to processing delays. Different credit unions have different policies regarding mobile deposit funds availability. Familiarize yourself with your credit union's policies to avoid unexpected delays. Knowing the guidelines for deposit limits, hold policies, and cut-off times can help you manage your deposits effectively. A strong, positive relationship with your credit union can work to your advantage. Over time, as your relationship grows, your credit union might offer additional benefits such as quicker funds availability. By following these tips, you can help ensure a smoother mobile deposit experience and quicker access to your deposited funds. Understanding Credit Union Mobile Deposit Funds Availability is crucial for effectively managing your finances. The availability of funds can be influenced by various factors, including your account history, the timing and size of the deposit, and your adherence to mobile deposit guidelines. Additionally, credit unions' policies and federal regulations, such as Regulation CC, also play significant roles. Maximize mobile deposit funds availability by maintaining a good account history, depositing early, using clear images, understanding policies, and building a relationship with your credit union. As with any financial service, always make sure to ask your credit union any questions you may have to ensure you are fully informed about the process and any policies in place.Credit Union Mobile Deposit Funds Availability Overview

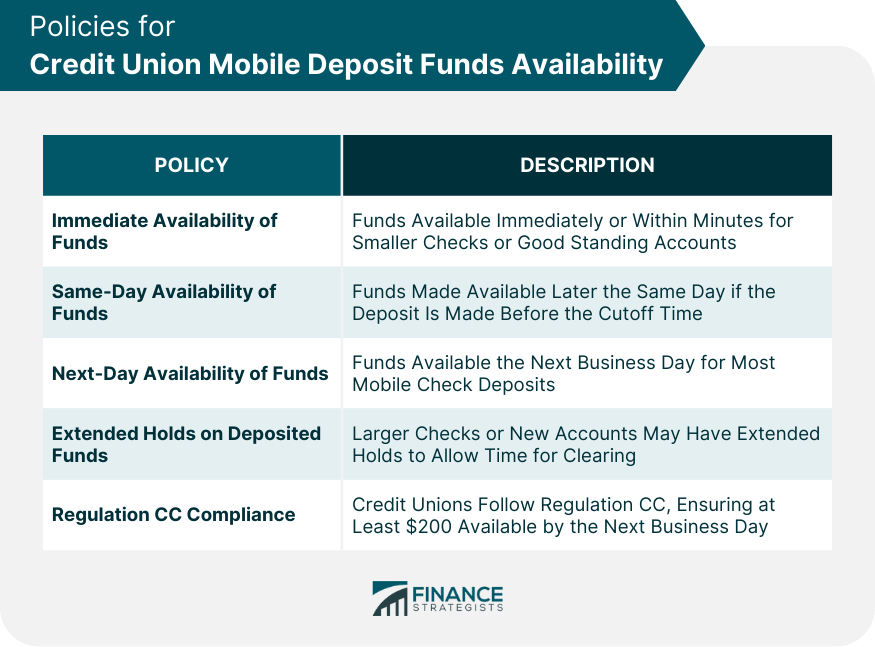

Policies for Credit Union Mobile Deposit Funds Availability

Immediate Availability of Funds

Same-Day Availability of Funds

Next-Day Availability of Funds

Extended Holds on Deposited Funds

Regulation CC Compliance

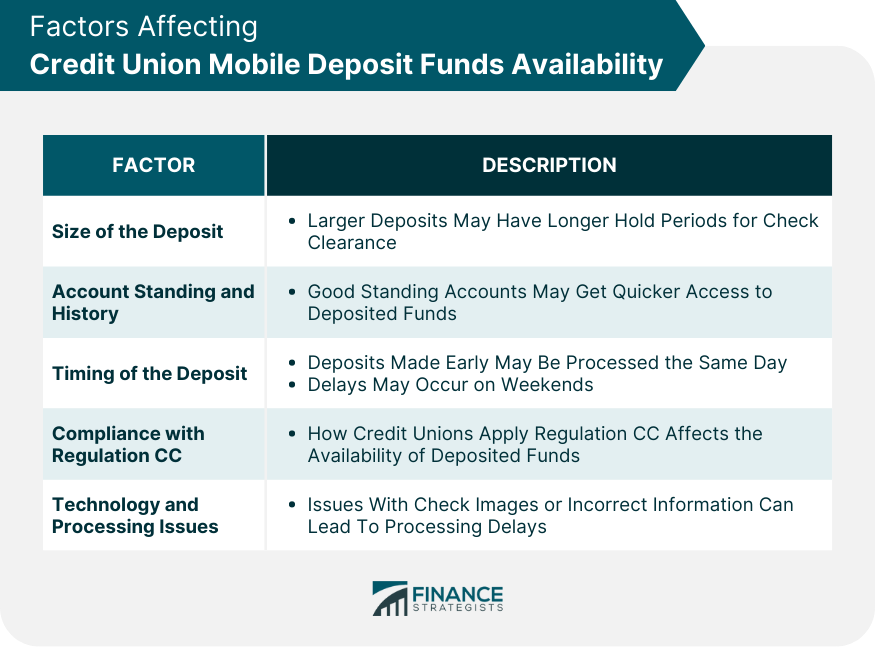

Factors Affecting Credit Union Mobile Deposit Funds Availability

Size of the Deposit

Account Standing and History

Timing of the Deposit

Compliance With Regulation CC

Technology and Processing Issues

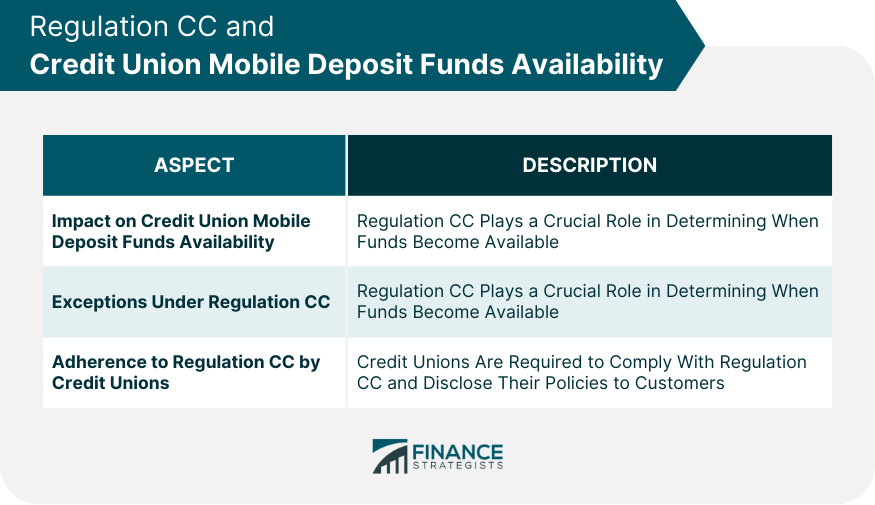

Regulation CC and Credit Union Mobile Deposit Funds Availability

Impact on Credit Union Mobile Deposit Funds Availability

Exceptions Under Regulation CC

Adherence to Regulation CC by Credit Unions

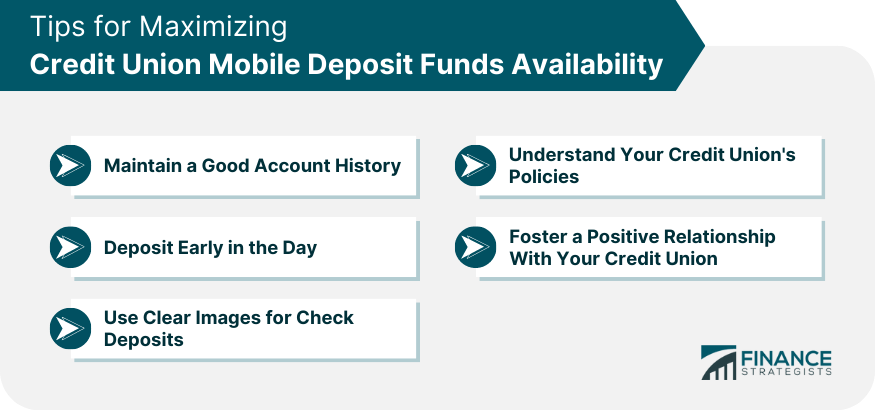

Tips for Maximizing Credit Union Mobile Deposit Funds Availability

Maintain a Good Account History

Deposit Early in the Day

Use Clear Images for Check Deposits

Understand Your Credit Union's Policies

Foster a Positive Relationship With Your Credit Union

Conclusion

Credit Union Mobile Deposit Funds Availability FAQs

Credit Union Mobile Deposit Funds Availability refers to the time frame in which funds from a check deposited via a credit union's mobile app become accessible for use. This timeline can vary based on the credit union's specific policies, the size of the deposit, account history, and other factors.

Typically, funds from mobile deposits are available the next business day. However, some credit unions may offer same-day or immediate availability for smaller deposits or accounts in good standing. Large deposits or deposits made late in the day may require an extended hold period.

Yes, Regulation CC, a Federal Reserve regulation, applies to credit unions and outlines standard hold periods for various types of deposits. Under this regulation, the first $200 of a deposit must generally be available the next business day.

Improving availability could involve maintaining a positive account standing, making deposits early in the day, and ensuring accurate and clear check photos when making a deposit. Developing a positive relationship with your credit union may also help.

Yes, deposits made on weekends or holidays usually count as being made on the following business day. This delay can affect when your funds become available, often pushing the availability to the second business day after the deposit.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.