A Credit Union Routing Number is a unique nine-digit identifier assigned by the American Bankers Association (ABA) to each credit union in the United States. This number is crucial for various financial transactions, including direct deposits, automatic bill payments, and wire transfers. It guides the Automated Clearing House (ACH) system in directing the flow of money to the correct credit union and specific member account. You can typically find your credit union's routing number on the bottom left corner of your checks, on your bank statement, or on your credit union's website. Always remember to use the correct routing number to ensure smooth and successful transactions. One of the easiest ways to find your routing number is to simply look at the bottom of one of your checks. The routing number is usually the first set of nine-digit numbers printed on the bottom left corner of your checks. If you don't have a check handy, you can also find the routing number on your deposit slips. It's located in the same position as on your checks. Most Credit Unions post their routing numbers on their websites. You can usually find it in the footer of the website or in the 'Contact Us' section. If not, use the search bar and type 'routing number' to quickly locate it. If you're enrolled in online banking or have downloaded your Credit Union's mobile banking app, you can often find your routing number in your account details. Check under 'Account Information' or 'Account Services.' If you still need help finding the routing number, your best bet is to contact your Credit Union directly. You can call their customer service line, send an email, or visit a local branch. They can provide you with the routing number after verifying your identity. The ABA provides a lookup tool on its website where you can find your Credit Union's routing number. You'll need to enter your Credit Union's name and location, and the tool will provide you with the number. A routing number is a nine-digit code used to identify your credit union for different types of banking transactions, including wire transfers, direct deposits, and digital checks. Here's how you can find your credit union routing number online. Most Credit Unions make their routing numbers readily available on their official websites. Here's a step-by-step guide on how to locate it: Start by visiting the official website of your Credit Union. It's important to ensure you are on the correct site to avoid phishing scams. Once on the website, search for terms like "Routing number," "ABA number," or "RTN." This information may be found in various sections such as 'Account Services,' 'Help,' 'FAQ,' or 'Contact Us.' If you've signed up for online banking, finding your routing number can be just a few clicks away. Start by logging into your online banking account through your Credit Union's website. Once logged in, navigate to 'Account Information' or 'Account Details.' Your routing number is typically listed there. If your Credit Union offers a mobile banking app, it's another convenient way to find your routing number online. Download the app from the App Store or Google Play, and log in using your banking credentials. Just like with online banking, once you are logged in, look under 'Account Information' or 'Account Services' to find your routing number. The ABA offers a lookup tool that can be used to find your Credit Union's routing number. Visit the ABA website and navigate to their routing number lookup tool. You'll need to enter your Credit Union's name and location, and the tool will provide you with the routing number. Your credit union routing number is printed at the bottom left corner of your checks, preceding your account number. This number can also be found on your monthly bank statements. Routing numbers are crucial when sending or receiving domestic wire transfers. If you're sending money to someone else's account at a different credit union or bank within the U.S., you will need their institution's routing number to ensure the funds reach the correct destination. When you're on the receiving end of a domestic wire transfer, you'll need to provide your own Credit Union's routing number to the sender. Setting up direct deposits, like paychecks or government benefits, also requires a routing number. When setting up direct deposit with your employer or a government benefits provider, you'll need to provide your Credit Union's routing number and your account number. This allows the direct deposit to be routed correctly to your account. Routing numbers are also used for EFTs, including automatic bill payments and transfers between different financial institutions. When you set up automatic bill payments with a service provider, such as a utility company or a subscription service, you will need to provide your routing number so the funds can be automatically withdrawn from your account. When you're transferring money between accounts at different financial institutions, you will need the routing number for each institution to facilitate the transfer. The routing number on a check determines which Credit Union the check is drawn from. When you pay by check, the recipient's bank uses the routing number on the check to know where to request the funds from. When you're depositing a check, your bank uses the routing number on the check to know where to request the funds from. With the routing number and account number, fraudsters can create fake checks or initiate unauthorized electronic transactions, leading to the loss of funds from your account. Monitor your account activity regularly. If you see any suspicious transactions, report it to your Credit Union immediately. Most Credit Unions offer fraud protection services that can recover lost funds. In combination with other personal information, your routing number can be used by criminals to steal your identity and apply for credit or initiate transactions in your name. Protect your personal information. Don't share sensitive data like your social security number, account number, or routing number unless necessary, and ensure the recipient is trustworthy. Fraudsters can trick you into revealing your routing and account numbers through phishing emails or fraudulent websites posing as your Credit Union. Always verify the source before providing any information. Be wary of emails asking for your banking details, and ensure you're on the official Credit Union's website before entering your data. In the case of a data breach, your routing number, along with other personal data, could be exposed and potentially used for fraudulent activities. Regularly update your passwords and use multifactor authentication when available. If your Credit Union reports a data breach, take steps to protect your account, such as changing your passwords and monitoring your account for unusual activity. When a new credit union is established, or an existing one expands to the point of needing an additional routing number, they apply to the ABA for a new routing number. The ABA uses specific guidelines and criteria to assign these numbers. The ABA continually maintains and updates its database of routing numbers. It assigns new numbers as needed and removes ones that are no longer in use, such as when a credit union closes. It also keeps track of changes due to mergers and acquisitions. The nine-digit Credit Union Routing Number, assigned by the American Bankers Association (ABA), plays a vital role in various financial transactions. It directs the flow of funds correctly, ensuring smooth transactions. These numbers are readily accessible via your checkbook, credit union's website, online banking, mobile apps, or ABA's lookup tool. However, it's imperative to keep in mind that they are sensitive data that could be misused in fraudulent activities or identity theft. Hence, it's crucial to regularly monitor your accounts, protect your personal data, and remain vigilant against phishing scams and data breaches. When it comes to changes in these routing numbers, trust in the ABA's systematic management includes assigning, updating, and tracking changes due to credit union closures or mergers. To summarize, a Credit Union Routing Number is an integral part of banking operations that requires diligent handling.Credit Union Routing Number Overview

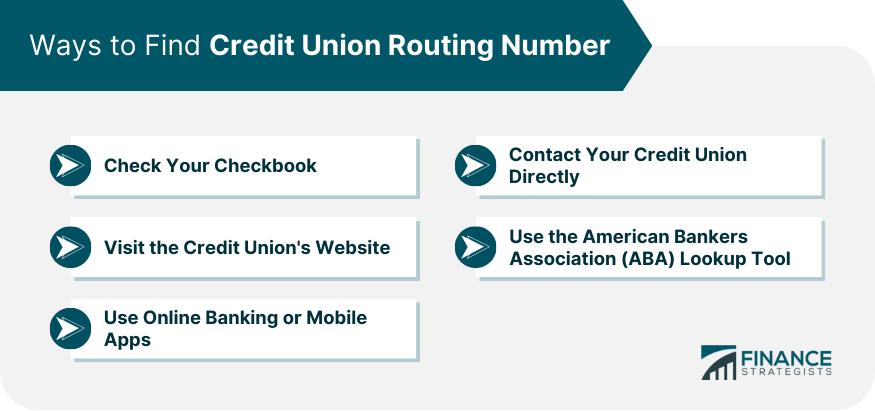

Ways to Find Credit Union Routing Number

Check Your Checkbook

Personal Checks

Deposit Slips

Visit the Credit Union's Website

Use Online Banking or Mobile Apps

Contact Your Credit Union Directly

Use the American Bankers Association (ABA) Lookup Tool

How to Find a Credit Union Routing Number Online

Use Your Credit Union's Website

Visit the Website

Locate the Routing Number

Online Banking

Log Into Online Banking

Navigate to Account Information

Mobile Banking Apps

Download and Log In

Find the Routing Number

Use the American Bankers Association (ABA) Website

Access the ABA Website

Enter the Required Information

Checking Credit Union Routing Numbers on Checks and Bank Statements

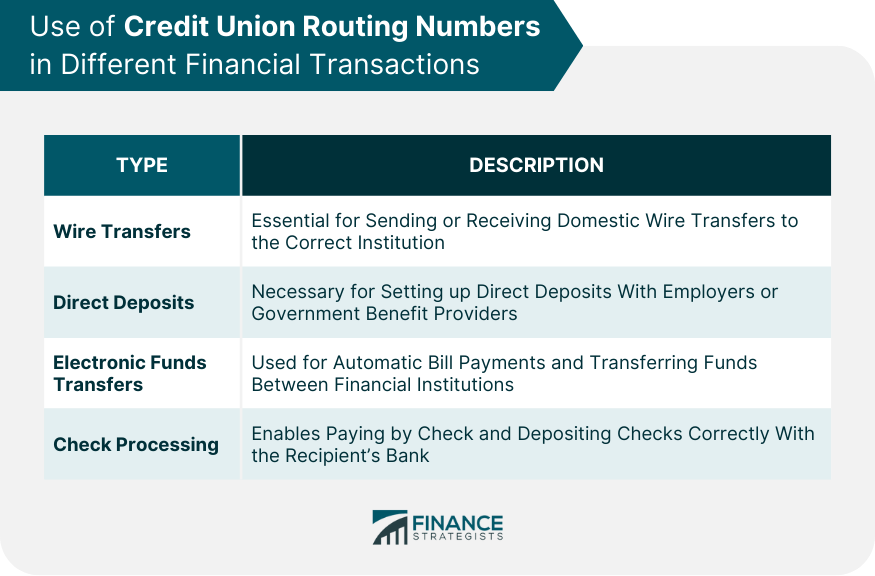

Use of Credit Union Routing Numbers in Different Financial Transactions

Wire Transfers

Domestic Wire Transfers

Receiving Domestic Wire Transfers

Direct Deposits

Setting up Direct Deposits

Electronic Funds Transfers (EFTs)

Automatic Bill Payments

Inter-Institution Transfers

Check Processing

Paying by Check

Depositing a Check

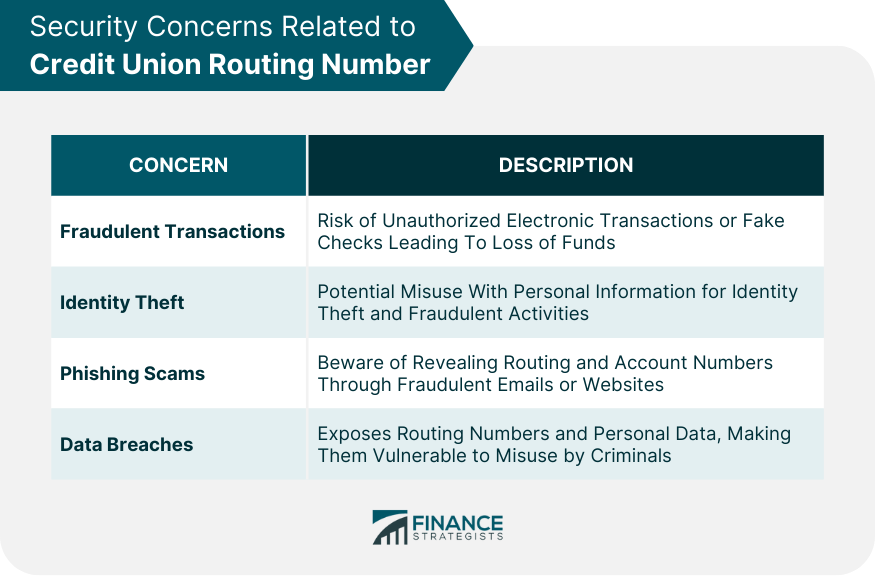

Security Concerns Related to Credit Union Routing Number

Fraudulent Transactions

Identity Theft

Phishing Scams

Data Breaches

Role of the ABA in Assigning Credit Union Routing Numbers

Conclusion

Credit Union Routing Number FAQs

A Credit Union Routing Number is a unique nine-digit code assigned by the American Bankers Association (ABA) to each credit union in the United States. It's used for different types of banking transactions, including wire transfers, direct deposits, and digital checks.

You can find your Credit Union Routing Number at the bottom left corner of your checks, on your bank statement, on your credit union's website, via online or mobile banking, or by using the American Bankers Association's lookup tool.

A Credit Union Routing Number directs the flow of money in various financial transactions. These include wire transfers, direct deposits, electronic funds transfers (EFTs), and check processing. The routing number ensures that the funds reach the correct credit union and specific member account.

The security concerns related to Credit Union Routing Numbers include fraudulent transactions, identity theft, phishing scams, and data breaches. Therefore, it's important to protect your routing number and monitor your account regularly for any suspicious activity.

The ABA assigns Credit Union Routing Numbers when a new credit union is established or an existing one needs an additional number. It continually maintains and updates its database of routing numbers, assigning new ones as required and removing ones that are no longer in use, such as when a credit union closes. It also tracks changes due to credit union mergers or acquisitions.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.