A custodial account is a kind of savings account controlled by an adult on behalf of a minor, also known as a beneficiary. This account can be opened through a financial institution, mutual fund company, or brokerage business. A custodial account may also refer to any account maintained by a responsible individual bound by fiduciary duty on behalf of a beneficiary. A typical example is an employer-based retirement account managed by a plan administrator for qualified employees. This article will focus on custodial accounts being opened for minors. A custodial account works similarly to any other savings account. However, one main difference is that the account legally belongs to the minor but is managed by the custodian until the child reaches the age of majority. The custodian abides by a fiduciary duty to the minor, which means they must act in the child's best interest at all times. They have to manage the account prudently and control how the money is spent. Each state has specific regulations governing the age of majority when children become legally independent from their guardians. In some states, a minor is someone under 18, while in others, they are under 21. Before the age of majority, undertaking transactions with the account will require the custodian's approval. Ownership and control of the account legally transfer to the child when they reach this age. In case of the minor's death before the age of majority, the account's content will be a part of the child's estate. The following are the main varieties of custodial accounts: This type of account holds almost any form of an asset, ranging from real estate to intellectual property or even artwork. This type of account can contain financial assets like cash and investments, such as stocks, bonds, and mutual funds. This type of account is solely cash-funded. It helps families afford school-related expenditures for minor beneficiaries. However, its funds can only be used for qualified educational expenses. It is also subject to income and contribution limitations. Custodial accounts are frequently established due to the benefits they provide, such as the following: Custodial accounts are easy to set up. Any financial institution, mutual fund company, or brokerage business can open one. Only the basic personal information of the child and the custodian is required. Custodial accounts are flexible. They can be used for almost anything that would benefit the child, including education, medical expenses, and other essential needs. Custodial accounts are an excellent alternative to trusts. They are less expensive to establish because there are no setup or administration costs. Custodial accounts come with some drawbacks that must be considered: Deposits made to the account are irreversible and irrevocable. At the age of majority, the minor inherits the entirety of the account's holdings, and guardians lose control of the funds. Custodial accounts can impact the financial aid prospects of the child when they go to college. They will be considered the child's assets, reducing the amount of financial aid they are eligible for. Custodial accounts are not as tax-exempt as other types of accounts. A custodian can move money to an eligible 529 plan to reduce the tax impact. However, the custodian must liquidate any non-cash investments in the custodial account to do so. Contributions for UTMA, UGMA and Coverdell ESA are all made with after-tax dollars. For UTMA and UGMA accounts, the first $1,300 of unearned income is tax-free in 2024, with the following $1,250 taxed at the child's tax rate. Meanwhile, income above $2,600 is taxed at the parent's rate. When a minor meets the age of majority, they can file their own tax return. All earnings in an UTMA or an UGMA account will be taxed according to the beneficiary's tax bracket at the time of filing. For Coverdell ESA, both withdrawals and earnings can be tax-free, provided that they do not go over the beneficiary's qualified education expenses. An account can be opened by approaching a financial institution, mutual fund company, or brokerage business. After deciding which type of custodial account to set up, necessary details like social security number, address, and contact information must be provided. The initial deposit can be done by cash, check, or other transfer methods. The custodian can fund the account through regular deposits or transfers from another account. Custodial accounts are a type of account that allows adults to save and invest money for children. The adult who establishes the account is in charge of administering it and is known as the custodian. The custodian makes investment selections and spending decisions. Custodial accounts come with specific benefits and drawbacks. The main advantage is the account's flexibility. Another benefit is that custodial accounts are relatively inexpensive compared to trusts. The chief disadvantage is that custodians lose control of the money once the minor reaches the age of majority. Having custodial accounts can also negatively affect the financial aid prospects of a child. With this in mind, it is essential to consider the pros and cons when deciding whether a custodial account is the best option.What Is a Custodial Account?

How Do Custodial Accounts Work?

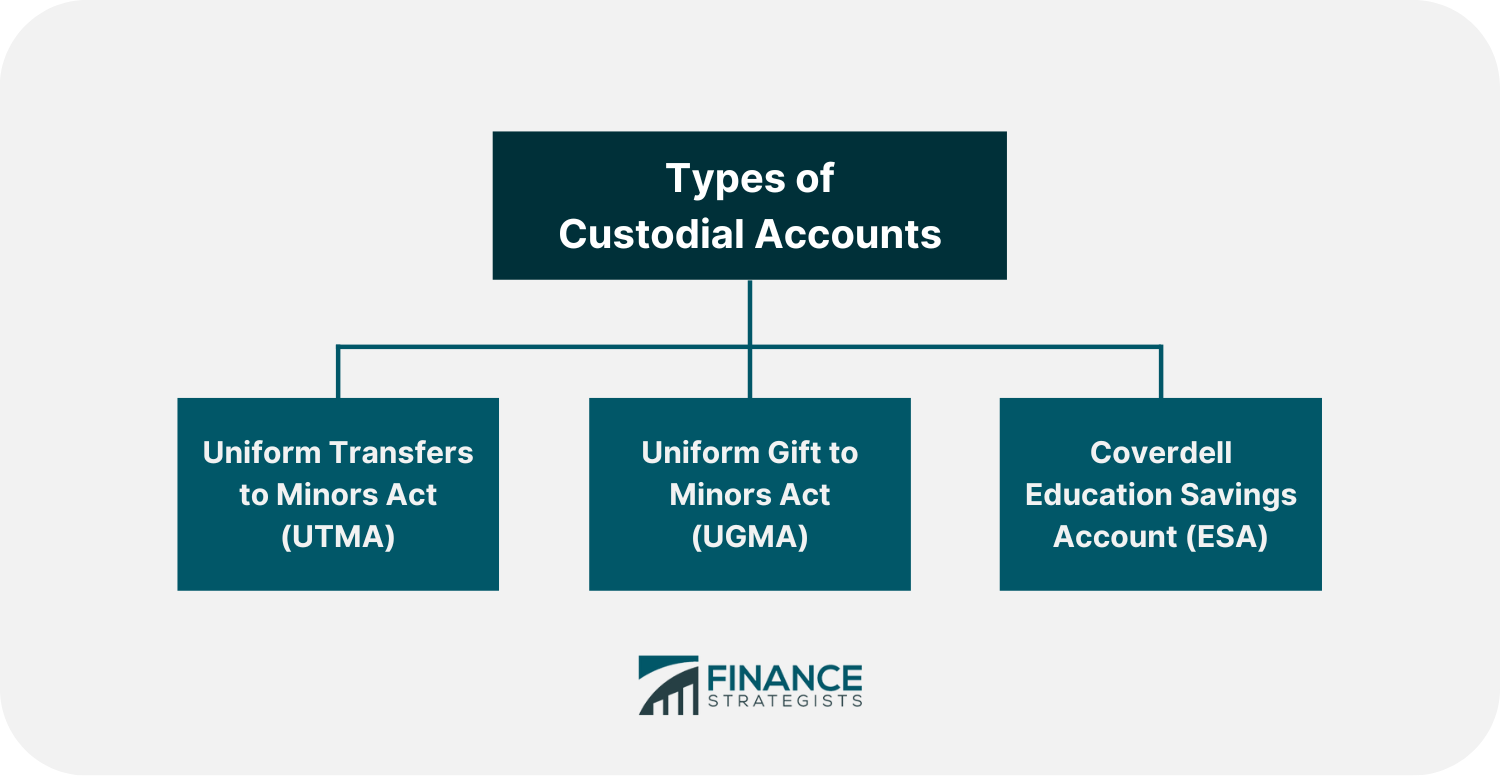

Types of Custodial Accounts

Uniform Transfers to Minors Act (UTMA)

Uniform Gift to Minors Act (UGMA)

Coverdell Education Savings Account (ESA)

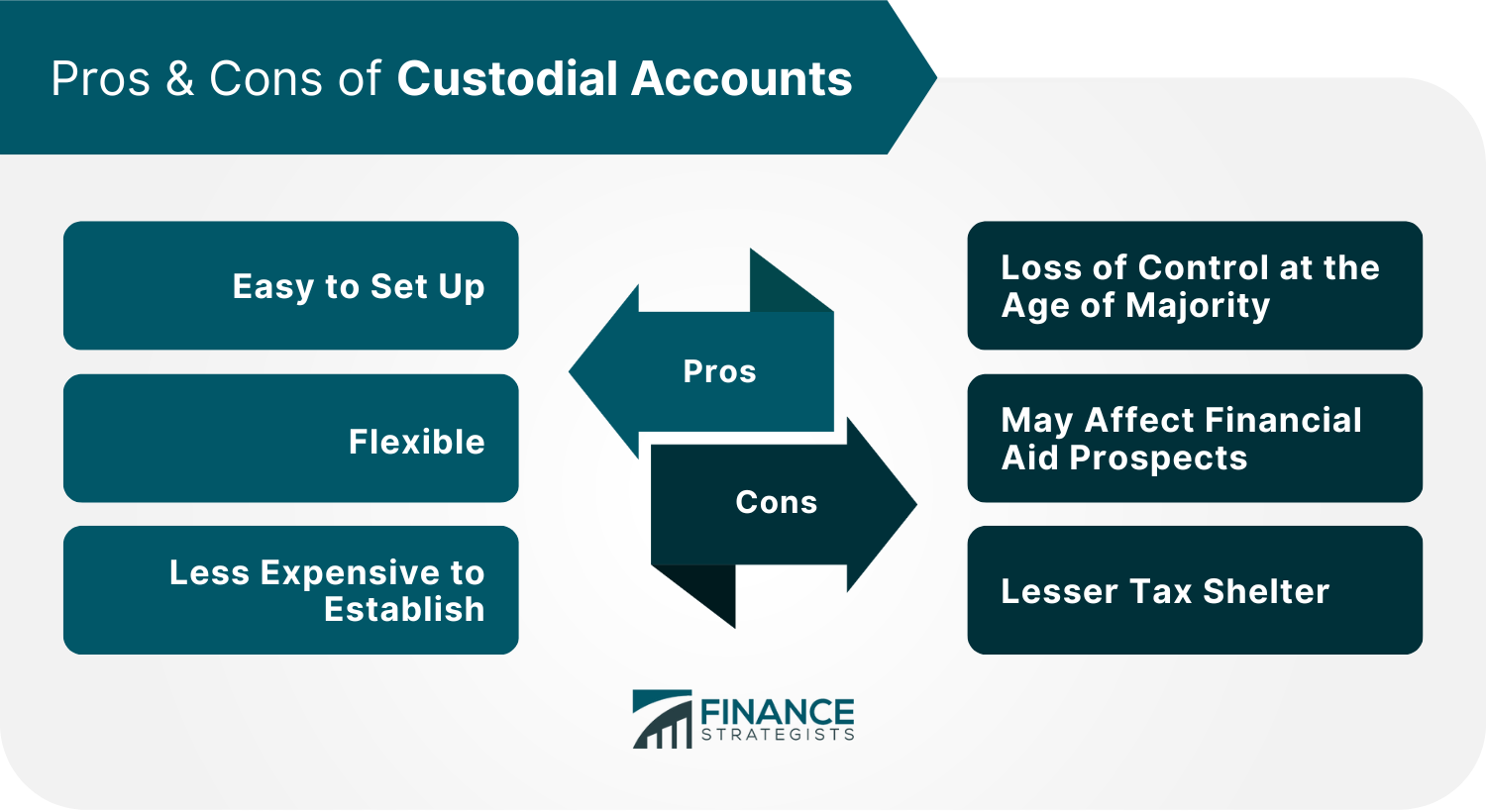

Benefits of Custodial Accounts

Easy to Set Up

Flexible

Less Expensive to Establish

Drawbacks of Custodial Accounts

Loss of Control at the Age of Majority

May Affect Financial Aid Prospects

Lesser Tax Shelter

Taxes on Custodial Accounts

In 2025, the first $1,350 of unearned income is tax-free, while the following $1,350 is taxed at the child's rate. Then, income above $3,150 is taxed at the parent's rate.Opening a Custodial Account

The Bottom Line

Custodial Account FAQs

The account can be easily set up through a financial institution. There are no monetary restrictions when it comes to adding and withdrawing from the account. There are no expensive fees associated with its establishment.

The account holder loses all control over the money once the child reaches the age of majority. The account is also subject to taxation, which can reduce the amount of money available for investment. If the child applies for college financial aid, the custodial account could negatively affect their eligibility.

A custodial account can be opened by going to a financial institution and providing the necessary information. The account can then be funded through cash, check, or other transfer methods.

UTMA investments can include real estate, intellectual property, and works of art. UGMA accounts are limited to investments that involve cash, securities and insurance policies. With Coverdell ESA, investments can be in the form of exchange-traded funds (ETFs), individual stocks, bonds, mutual funds, and real estate.

For UTMA and UGMA accounts, earnings are taxed at the child's tax rate up to a certain amount. For Coverdell ESA, both withdrawals and earnings can be tax-free, provided that they do not go over the beneficiary's qualified education expenses.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.