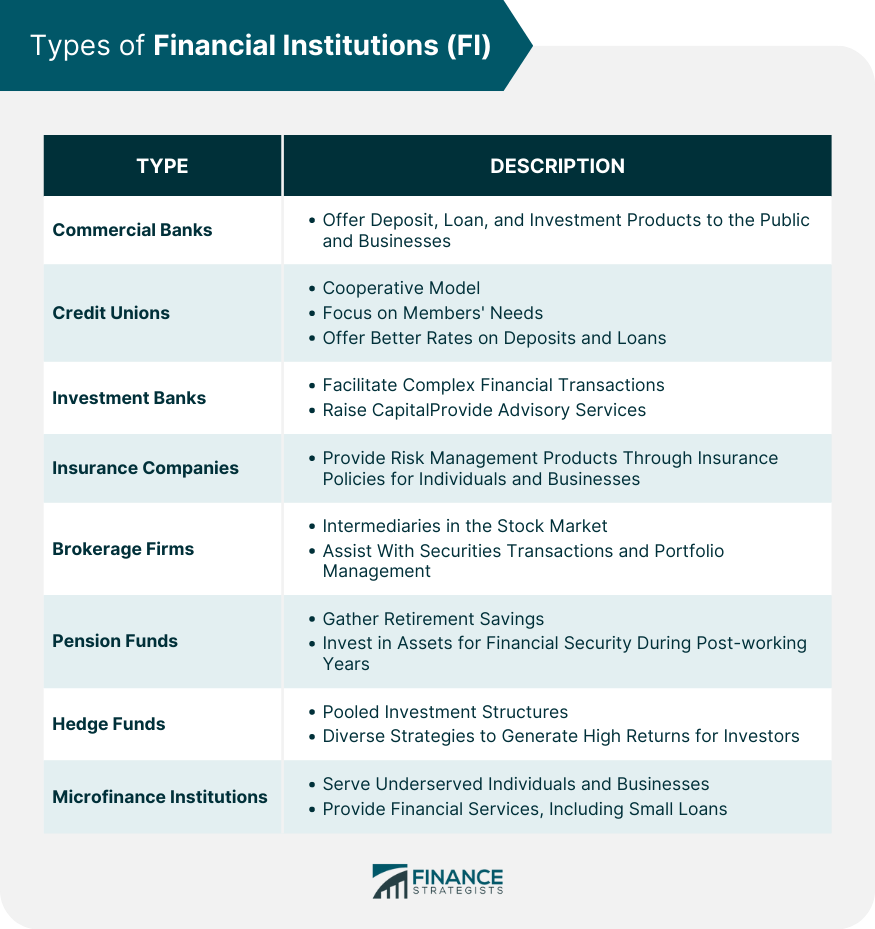

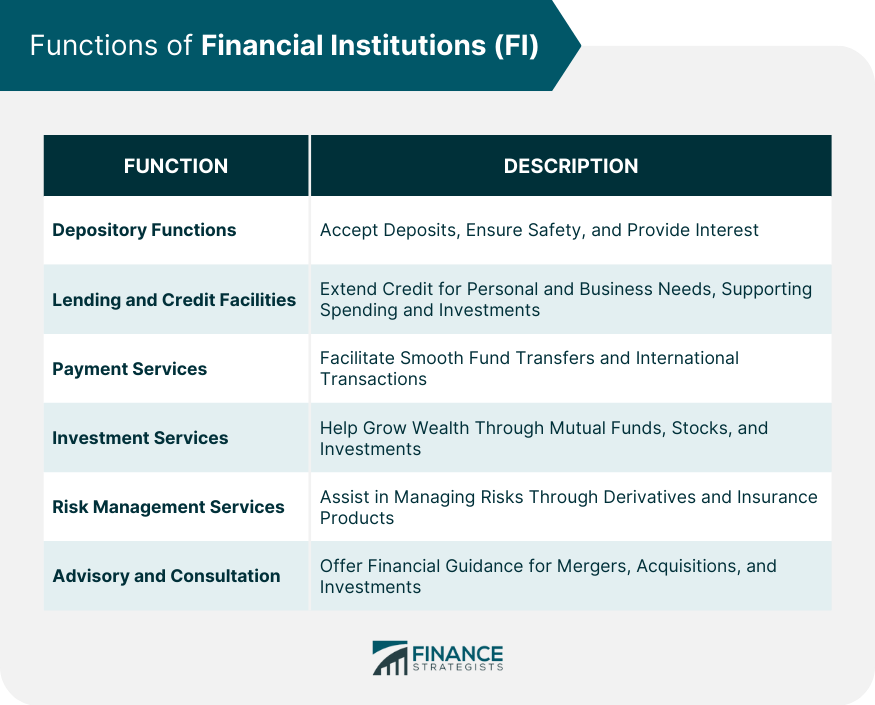

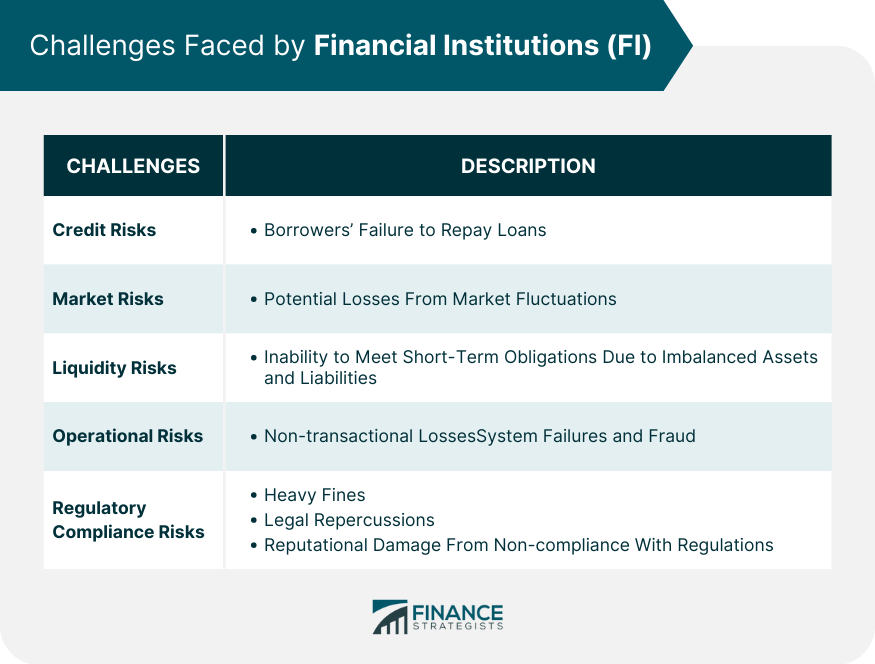

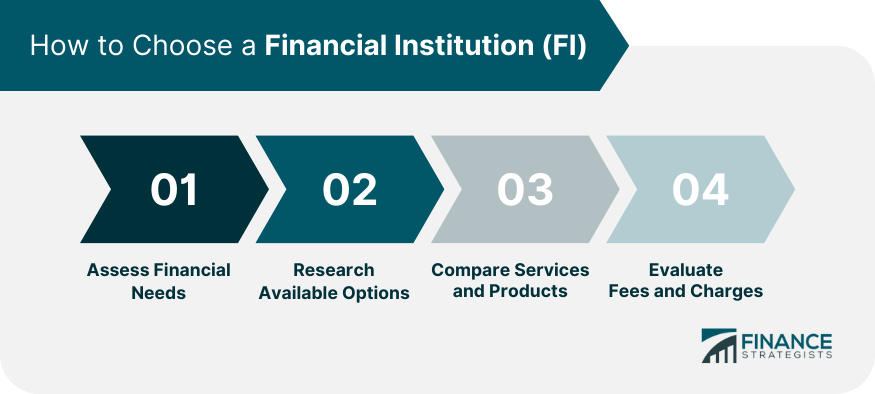

A financial institution is an umbrella term for a company dealing with financial and monetary transactions, including loans, deposits, and/or investments. Financial institution covers a wide range of businesses and activities. They can operate on several scales, ranging from local to global. These entities play a pivotal role in the smooth functioning of an economy by facilitating the flow of money and capital. The exact definition of a financial institution is contained in Title 31 of the United States code. It lists 26 different types of financial institutions, ranging from commercial banks and insurance companies to casinos and pawnbrokers. Financial institutions primarily make their money through interest on loans, transaction fees, and commissions for performing certain services. The purpose of financial institutions is to handle and facilitate monetary transactions at the consumer level and beyond. Most individuals in developed countries have an occasional, if not ongoing, need for a financial institution. They are a vital part of the economy, and because of their importance, governments consider it crucial to oversee and regulate their business. In the US, the Federal Deposit Insurance Corporation (FDIC) insures consumer deposit accounts to maintain individual confidence in the safety of putting money into banks. Historically, loss of confidence in financial institutions leads to bank runs, where citizens withdraw their accounts en masse, effectively defunding banks and threatening a cascading financial collapse. They provide platforms where consumers can save, invest, borrow, or protect their assets, ensuring financial stability and fostering economic growth. Some examples of financial institutions are: All manner of banks, from local credit unions to international investment banks Insurance companies Brokerages Commercial banks, often what people think of when they hear "bank", primarily offer deposit, loan, and basic investment products. They cater to the general public and businesses, providing services such as savings accounts, checking accounts, and mortgages. Commercial banks play a pivotal role in monetary creation within an economy. Credit unions operate on a cooperative model, where members own and run the institution. These entities focus on serving their members rather than maximizing profits. Typically, credit unions offer higher interest rates on deposits and charge lower rates on loans than commercial banks, reflecting their member-centric philosophy. Investment banks facilitate complex financial transactions, including mergers, acquisitions, and public stock offerings. They don't take deposits like commercial banks. Instead, they assist companies in raising capital, offer advisory services, and engage in proprietary trading. These institutions provide risk management products, primarily in the form of insurance policies. Whether covering health, life, property, or any other type of risk, insurance companies collect premiums from policyholders and pay out claims as needed, providing individuals and businesses with financial protection. Brokerage firms serve as intermediaries in the stock market, helping investors buy and sell securities. These firms can offer a broad spectrum of services, from simple trade execution to personalized investment advice and portfolio management. Pension funds gather savings for retirement and invest these funds in a variety of assets, aiming to provide retirees with income. Managed by financial professionals, these funds are pivotal for ensuring financial security in an individual's post-working years. Hedge funds are pooled investment structures, aiming to generate high returns for their investors. Operating with fewer regulations than mutual funds, they employ diverse strategies, including short selling, leveraging, and derivatives trading. Microfinance institutions aim to serve individuals and small businesses in underserved or developing areas, providing them with financial services, primarily small loans, even if they lack traditional collateral. One of the core functions of many financial institutions is to accept deposits from the public, be it in savings accounts, fixed deposits, or other instruments. They keep the deposited money safe and often provide interest to the depositor. Financial institutions extend credit to individuals, businesses, and other entities. This can be in the form of personal loans, mortgages, business loans, or credit cards. Through this, they support spending, investments, and economic growth. These institutions facilitate various payment services, from simple fund transfers between accounts to complex international transactions and digital payments, ensuring the economy functions smoothly. From offering mutual funds to individual stocks, financial institutions help individuals and entities grow their wealth through various investment vehicles, be it for short-term gains or long-term financial security. Through derivatives, insurance products, and other financial tools, these entities help individuals and businesses manage and hedge against potential risks, ensuring financial stability. Many financial institutions, especially investment banks and certain brokerage firms, offer advisory services, guiding clients in mergers, acquisitions, investments, and other financial decisions. Financial institutions, especially banks, face risks when borrowers fail to repay their loans. Credit risks can be influenced by individual borrower characteristics or broader economic factors. Market risks pertain to potential losses from fluctuations in market prices or rates, such as interest rates or stock prices. Institutions exposed to various securities or foreign currencies are particularly vulnerable. This risk involves the inability of a financial institution to meet its short-term financial obligations due to an imbalance between its liquid assets and its liabilities. The risk arises when there is an imbalance between the financial institution's liquid assets and its liabilities, making it challenging to cover unexpected demands for withdrawals or other financial commitments. From system failures to fraud, operational risks cover potential losses that aren't linked directly to financial transactions but can still impact an institution's financial health. Operational risks encompass a wide range of potential losses, including system failures, cyberattacks, internal fraud, and human errors. This may not be directly related to financial transactions but can significantly impact the overall financial health and reputation of a financial institution. Financial institutions operate in a heavily regulated environment. Failure to comply with established regulations can result in heavy fines, legal repercussions, and reputational damage. Before selecting a financial institution, thoroughly evaluate your specific financial requirements, such as banking services, investment opportunities, loan options, and long-term goals, to ensure the institution aligns with your individual needs. Conduct extensive research to identify and explore various financial institutions, considering factors like their reputation, customer reviews, branch or ATM accessibility, online banking capabilities, and their range of financial products and Different institutions might have varying terms for similar products. It's essential to compare these in detail, ensuring you get the best deal possible. Compare the services and products offered by different financial institutions, such as checking and savings accounts, credit cards, investment portfolios, loan terms, and interest rates. Scrutinize the fee structure of potential financial institutions, including account maintenance charges, transaction fees, ATM fees, and any additional costs. This ensures that the overall fees align with your financial capabilities and won't burden your finances over time. A financial institution is a company dealing with financial and monetary transactions, including loans, deposits, and/or investments. It covers a wide range of businesses and activities that can operate on several scales, ranging from local to global. Choosing the right financial institution requires careful consideration of individual financial needs, extensive research, and comparison of services, products, and fees. It is crucial to ensure the institution aligns with specific financial requirements and offers favorable terms that suit one's financial capabilities. Financial institutions face challenges such as credit risks, market risks, liquidity risks, operational risks, and regulatory compliance risks. By fulfilling their functions of accepting deposits, providing credit facilities, offering investment services, managing risks, and providing advisory services, financial institutions play a vital role in driving economic progress.Financial Institution Definition

Define Financial Institution in Simple Terms

What Is a Financial Institution in Finance?

Financial Institution Example and Types

Commercial Banks

Credit Unions

Investment Banks

Insurance Companies

Brokerage Firms

Pension Funds

Hedge Funds

Microfinance Institutions

Functions of Financial Institutions

Depository Functions

Lending and Credit Facilities

Payment Services

Investment Services

Risk Management Services

Advisory and Consultation

Challenges Faced by Financial Institutions

Credit Risks

Market Risks

Liquidity Risks

Operational Risks

Regulatory Compliance Risks

How to Choose a Financial Institution

Assess Financial Needs

Research Available Options

Compare Services and Products

Evaluate Fees and Charges

Conclusion

Financial Institution (FI) FAQs

FI is shorthand for Financial Institution.

A financial institution is an umbrella term for a company dealing with financial and monetary transactions, including loans, deposits, and/or investments.

The purpose of financial institutions is to handle and facilitate monetary transactions at the consumer level and beyond.

In the US, the Federal Deposit Insurance Corporation (FDIC) insures consumer deposit accounts to maintain individual confidence in the safety of putting money into banks.

Historically, loss of confidence in financial institutions leads to bank runs, where citizens withdraw their accounts en masse, effectively defunding banks and threatening a cascading financial collapse.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.