The maturity date is the date a promissory note is due. When a business borrows money, it is common for the lender to require that the borrower make monthly payments until the loan is repaid in full. Each payment includes interest on top of repayment of all principal owed by the end date. This type of transaction has an agreed-upon maturity or due date when all outstanding debt must be paid or there will be a penalty. Generally, the maturity date is posted on the face of the certificate of instrument. A maturity date is specified on every promissory note that's created during a money lending transaction which specifies when repayment must occur or else penalties are incurred by both parties. The terms of the loan dictate how much total interest has been accrued so far, when the borrower must pay in full and how many monthly payments have been made towards repayment. Maturity date may also refer to the time when an investment matures. It is the time when the principal invested is paid back to the investor and by the same time, interest payments cease to be paid. However, other kinds of investment may also be tagged as "callable." This means that no fixed maturity date is set for the investment and such principal amount may be paid back to the investor at any given time. Maturity date is termed as expiration date for derivatives such as futures or options. It matters because the term specifies when repayment of principal must be made in full and there will not be any more interest charges or other fees owed to the lender. If a business is unable to repay all that it owes on time, this can have serious consequences for both parties involved since the lender will not be repaid and the borrower may end up in legal trouble. To help investors in estimating as to when their principal investments will be paid back, maturity can be classified into these three: This refers to investments that are set to mature within one to three years. This refers to investments that are going to mature in 10 or more years. Investments under this term generally mature in longer periods of time such as 30 years or more. Suppose for example that in April 2023, business XYZ borrowed $10,000 from the lender and put up their office building as collateral. There would be a maturity or due date specified on the note to pay back all principal plus interest by this specific date or else legal action would occur between both parties. This document also specifies how many months until the payment must occur and if any other fees (like late charges) apply as well as what happens if the payment is late. Borrower: Business XYZ Interest rate: 14% per year (may vary) Number of months until repayment: 36 months Late fee: $25 per month (if not paid by due date) The maturity or due date for this amount to be repaid in full would be six years from now, which is April 2029. If payment is not made by the agreed-upon maturity date, both parties may be held liable and legal actions could follow which would include any property (office building) that had been put up as collateral for repayment of debt or else even garnishment of wages etc. The above example pertains to business XYZ borrowing money from an individual, but the same goes for corporations and their lenders as well. Since the maturity date is an important date for both lender and borrower, it's safe to say that it has influence on all parties involved in some way. Businesses may be able to take advantage of higher-interest rates if they are willing to pay back their loan at a certain time or else larger fees will be incurred if they don't repay on time which could potentially harm the business' credit rating. Also, if a business cannot pay its debt by the maturity date, legal actions may occur which could include seizing any property or assets owned by them until the entire amount owed has been repaid. How Does a Maturity Date Work?

Why Does a Maturity Date Matter?

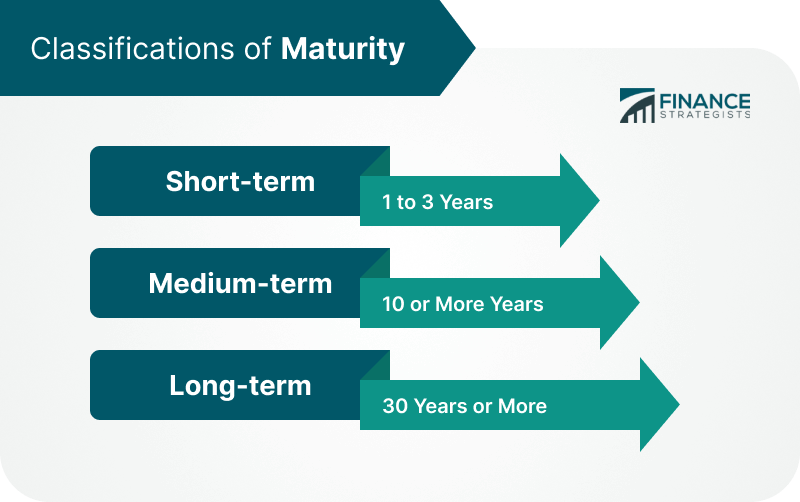

Classifications of Maturity

Short-term

Medium-term

Long-term

Illustration of Maturity Date

Final Thoughts

Maturity Date FAQs

A maturity date is specified on every promissory note that's created during a money lending transaction which specifies when repayment must occur or else penalties are incurred by both parties. It may also refer to the time when an investment matures. It is the time when the principal invested is paid back to the investor and by the same time, interest payments cease to be paid.

It matters because the term specifies when repayment of principal must be made in full and there will not be any more interest charges or other fees owed to the lender.

On the maturity date of a loan, the borrower should be able to repay what has been owed to the lender. In the case of an investment, the principal amount invested should be paid back to the investor and all interest payments will cease to be paid.

There are three classifications of maturity for investments. These are short-term, medium-term, and long-term. Short-term investments refer to investments that are to mature within 1 to 3 years. Medium-term investments are those that are maturing in 10 or more years. Long-term investments are those that are set to mature in longer periods of time such as 30 years or more.

If a business is unable to repay all that it owes on time, this can have serious consequences for both parties involved since the lender will not be repaid and the borrower may end up in legal trouble.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.