A thrift institution is a financial organization created primarily to take consumer deposits and issue home mortgages. Thrifts are relatively smaller and operate locally; they lack the reach and resources of a large national bank. Mutual banks and savings and loan associations are the two most common thrift institutions. Some examples of thrift institutions in the U.S. are the Navy Federal Credit Union, Alliant Credit Union, and Pentagon Federal Credit Union. Thrift institutions are seen as an attractive alternative to traditional commercial banks due to their typically higher interest rates on deposits. This higher rate of return is made possible by the loans they receive from the Federal Home Loan Bank System at a discounted cost. Thrift banks work in the same way that traditional banks do. They provide checking and savings accounts, debit and credit cards, certificates of deposit, and personal and auto loans. Thrifts can be mutual, which means depositors own it or a corporation owned by investors. Thrift and commercial banks have become increasingly regulated under the Dodd-Frank Wall Street Reform and Consumer Protection Act. The Federal Deposit Insurance Corporation (FDIC) ensures the safety of accounts by monitoring institutions for signs of risk or fraud. Both types of institutions are in place to provide consumer security and stability in an ever-evolving financial landscape. The two main types of thrift institutions are savings and loan associations and mutual savings banks. Savings and loan associations are owned and operated by their customers or shareholders. These associations are often locally based, with legislation requiring that most of their lending is used to finance residential properties. They are not required to insure their deposits with the state or the FDIC. Commonly referred to as savings associations, savings banks, thrifts, or thrift institutions, they offer simple yet invaluable services to members of their communities. They can be found throughout the country. Mutual savings banks are financial institutions that provide reliable, low-risk services to people with lower incomes. They have more significant investment flexibility and are less heavily invested in mortgages. Its deposits are insured by the FDIC and allow customers to have accounts with low balances while still earning interest. They are primarily concentrated in the northeast areas of the country. These accounts do not require investors, as mutual savings banks do not have outside shareholders like traditional banks. The depositors become owners of the institution through their stake in the retained earnings. Thrift banks started in the United Kingdom in the late 18th century before opening in the United States. The Philadelphia Savings Fund Society was one of the first thrifts established in America. The government's backing bolstered its stability. Their primary asset remained fixed-rate mortgages for low- and moderate-income families. In the 1980s and 1990s, deregulation had significant implications in the banking industry, leading to a financial crisis. In response, the Federal Savings & Loan Insurance Corporation liquidated distressed thrift banks nationwide. President George H.W. Bush passed the Financial Institutions Reform Recovery Enforcement Act (FIRREA). It established the Office of Thrift Supervision (OTS) for effective control, oversight, and coverage provided by the FDIC insurance corporation. FIRREA reinstated higher net-worth requirements for financial institutions while abolishing some existing regulations; this allowed them to be more competitive in the market. This act streamlined the financial system and enabled it to remain stable through financial crises that arose in later decades. While thrift and commercial banks offer similar accounts, such as checking and savings, some key differences distinguish them. Furthermore, these banks differ significantly from credit unions. Thrift banks and consumer unions usually focus more locally and serve consumers. This differs from commercial banks, which often offer financial services to businesses in addition to consumer accounts. The FDIC covers up to $250,000 per depositor for thrift and commercial banks. However, the National Credit Union Administration (NCUA) insured credit union deposits of up to $250,000 per depositor. Thrifts and credit unions are typically cooperatively owned by their members, allowing them to provide lower loan rates and higher dividend rates than traditional commercial banks. On the other hand, commercial banks are owned and operated by a board of directors and selected shareholders. Thrift banks usually yield higher interest for depositors because they can borrow from the Federal Home Loan System at a lower cost than larger, national commercial banks. Similarly, credit unions can provide the same advantages. Commercial banks are almost always for-profit organizations. While they typically offer competitive rates, they almost always charge higher fees than credit unions and thrifts. One institution may be more suitable for specific reasons. A thrift institution is the best option if you want a high deposit yield. A commercial bank is more suitable for many products and services. Credit unions are best if you prefer convenient transactions. A thrift institution is a financial organization specializing in consumer deposits and issuing home mortgages. There are two main types of such institutions: savings and loan associations and mutual savings banks. Thrift institutions, such as credit unions and savings banks, accept deposits and provide simple financial services to members or depositors. Thrift institutions were created in the 18th century to provide improved access to mortgages for people who may not have otherwise been able to afford them. It first appeared in the UK, eventually spreading to the U.S. Thrift banks are more similar in terms of focus on consumer accounts and customers' ownership stake and offer lower interest rates than commercial banks. Consider speaking with a financial advisor to see how you can benefit from thrift institutions.What Are Thrift Institutions?

How Thrift Institutions Work

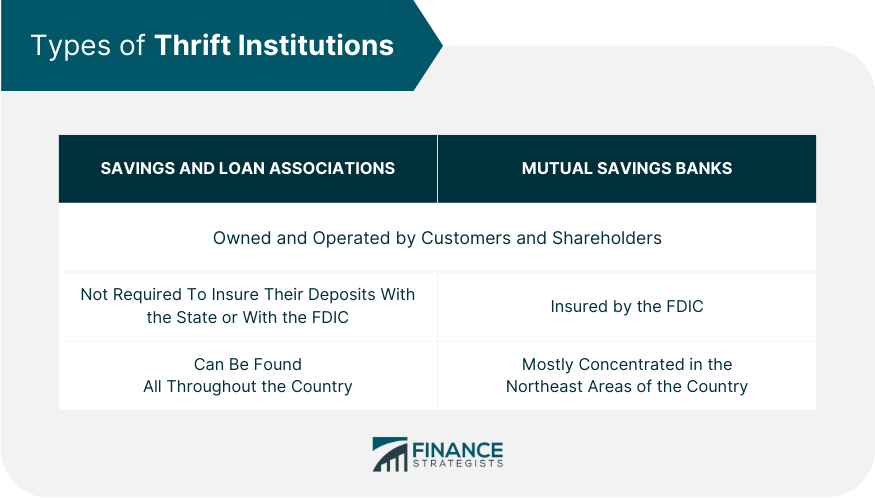

Types of Thrift Institutions

Savings and Loan Associations

Mutual Savings Banks

History of Thrift Institutions

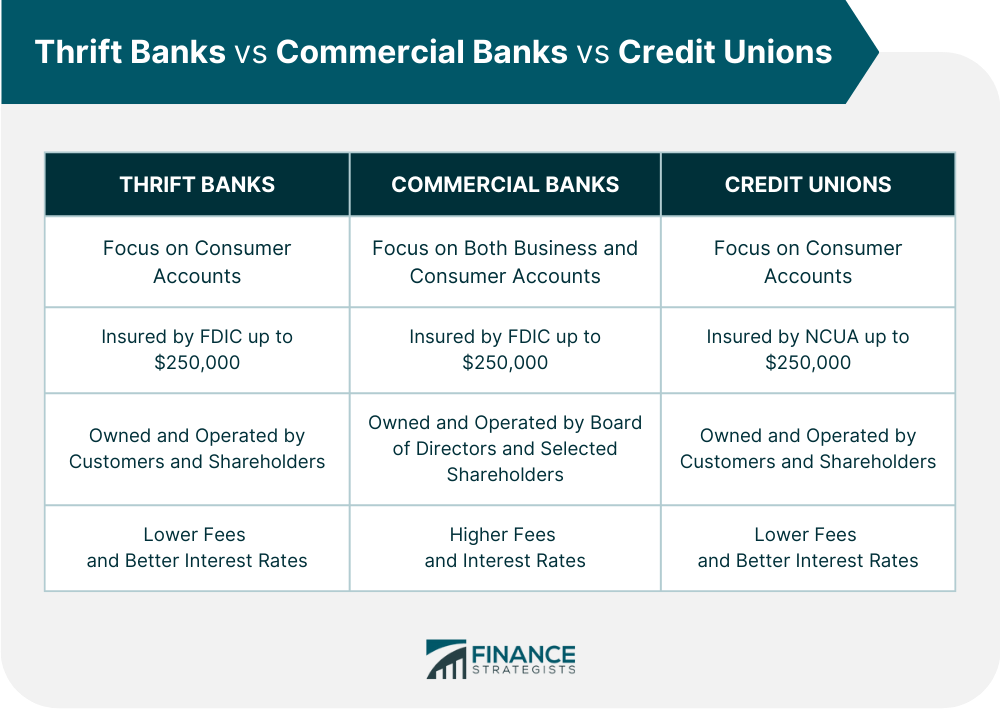

Thrift Banks vs Commercial Banks vs Credit Unions

Focus

Insurance

Owner and Operations

Interest Rates

Final Thoughts

Thrift Institutions FAQs

A thrift institution is a financial organization that primarily provides savings and mortgage services. It collects money from depositors in the form of savings deposits, uses this money as capital to make loans, and invests the remainder in securities and other investments.

Some examples of thrift institutions in the US are the Navy Federal Credit Union, Alliant Credit Union, and Pentagon Federal Credit Union.

Thrift institutions typically offer lower interest rates on loans but higher rates on deposits, savings accounts, and other savings products than commercial banks. Commercial banks usually provide a more extensive range of products and services than thrift Institutions.

The primary benefit of a thrift institution is the ability to earn higher interest rates on deposits. Additionally, thrift institutions are heavily regulated by the federal government.

The different thrift institutions include savings and loan associations, mutual savings banks, building societies, credit unions, and industrial banks. Each type of financial institution has unique features and benefits that should be considered when deciding which suits you.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.