An account in trust refers to a financial arrangement where a person (the grantor) transfers assets to another individual or entity (the trustee) to manage and hold them for the benefit of a third party (the beneficiary). It is a legal structure that allows for the protection and controlled distribution of assets according to the grantor's instructions. This type of account is commonly used for estate planning, asset protection, and managing funds for minors or individuals who may not be capable of handling their financial affairs. The trustee is responsible for managing the assets, making investment decisions, and distributing funds to the beneficiary in accordance with the terms set forth in the trust agreement. Revocable trusts, also known as living trusts, can be amended, modified, or revoked by the trust creator during their lifetime. These trusts provide flexibility and control, allowing the creator to change their mind about the trust's terms or beneficiaries. Once established, irrevocable trusts cannot be changed or revoked by the trust creator. These trusts provide asset protection and potential tax benefits but come with a loss of control over the trust's assets. A testamentary trust is created through a will and becomes effective only after the creator's death. These trusts allow for greater control over asset distribution and can provide support for minors or beneficiaries with special needs. Special needs trusts are designed to provide financial support to a beneficiary with disabilities without jeopardizing their eligibility for government benefits. These trusts must adhere to strict legal guidelines to maintain their tax-exempt status. Charitable trusts are established to benefit a charitable organization or cause. These trusts can provide tax advantages for the trust creator while supporting a meaningful cause. The trustee is responsible for managing and administering the trust according to its terms. Careful consideration should be given when selecting a trustee, as their integrity, financial acumen, and ability to manage complex legal matters are crucial. Beneficiaries are the individuals or organizations that will receive the trust's assets. Clearly identifying beneficiaries in the trust document is essential to ensure the correct distribution of assets. The terms and conditions of the trust dictate how the assets will be managed, distributed, and invested. These terms should be carefully crafted to reflect the trust creator's intentions and provide clear guidance to the trustee. Transferring assets into the trust is necessary to establish the account. The types of assets that can be placed in a trust include real estate, bank accounts, investments, and personal property. Once established, the trust must be administered and managed according to its terms. This may include investing assets, making distributions to beneficiaries, and filing taxes on behalf of the trust. Estate planning lawyers provide expert guidance on the best type of trust to meet a client's goals and circumstances. They advise on the legal and tax implications of establishing a trust and recommend strategies for optimizing asset protection and tax efficiency. An estate planning lawyer drafts the trust document, ensuring it accurately reflects the client's intentions and complies with relevant state and federal laws. Estate planning lawyers help navigate complex trust laws, ensuring the trust is established and administered according to legal requirements. This includes filing necessary documents with the appropriate government agencies. Lawyers often work closely with financial institutions to set up trust accounts and transfer assets into the trust. Estate planning lawyers can assist trustees with the ongoing administration and management of a trust, providing legal guidance and helping to resolve disputes among beneficiaries or address other challenges that may arise. One of the main advantages of establishing an account in trust is avoiding probate, the legal process of distributing assets upon a person's death. Probate can be time-consuming and expensive, and trusts allow assets to be distributed directly to beneficiaries without court intervention. Trusts can help minimize estate taxes by removing assets from the trust creator's taxable estate. This can result in significant tax savings for beneficiaries, especially in cases where the estate value exceeds the federal estate tax exemption. Irrevocable trusts can provide asset protection, shielding assets from creditors and potential lawsuits. This can be especially beneficial for individuals with a high net worth or those in professions with a higher risk of litigation. Trusts offer privacy by keeping the details of the trust and its assets confidential. Unlike probate, which is a public process, trusts are not subject to public scrutiny. Trusts allow trust creators to specify the terms and conditions for asset distribution, providing control over when and how beneficiaries receive assets. This can be particularly helpful in cases where beneficiaries may not be financially responsible or have special needs. Poor management by a trustee can lead to financial loss or legal disputes. It is crucial to select a trustworthy and competent trustee to avoid such issues. Conflicts can arise among beneficiaries, particularly if the trust terms are unclear or if beneficiaries feel they have been treated unfairly. Engaging an experienced estate planning lawyer can help minimize potential disputes by drafting clear and comprehensive trust documents. Changes to trust and tax laws can impact the efficacy of a trust. It is essential to work with an estate planning lawyer to regularly review and update the trust to ensure it remains compliant with current laws and continues to meet the trust creator's goals. Modifying or terminating a trust can be challenging, especially for irrevocable trusts. Working with an estate planning lawyer can help navigate these complexities and explore potential options for trust modification or termination. An Account in Trust is an invaluable estate planning tool that offers numerous benefits, including probate avoidance, tax savings, asset protection, and privacy preservation. Different types of trusts, such as revocable, irrevocable, testamentary, special needs, and charitable trusts, cater to varying goals and circumstances. Estate planning lawyers play a crucial role in establishing and managing trusts by providing expert guidance, drafting trust documents, ensuring legal compliance, and assisting with trust administration. It is essential to carefully consider potential challenges, such as trustee mismanagement, beneficiary disputes, and legal changes, and work closely with an experienced estate planning lawyer to regularly review and update estate plans and trusts to ensure they remain effective and compliant with current laws.What Is an Account in Trust?

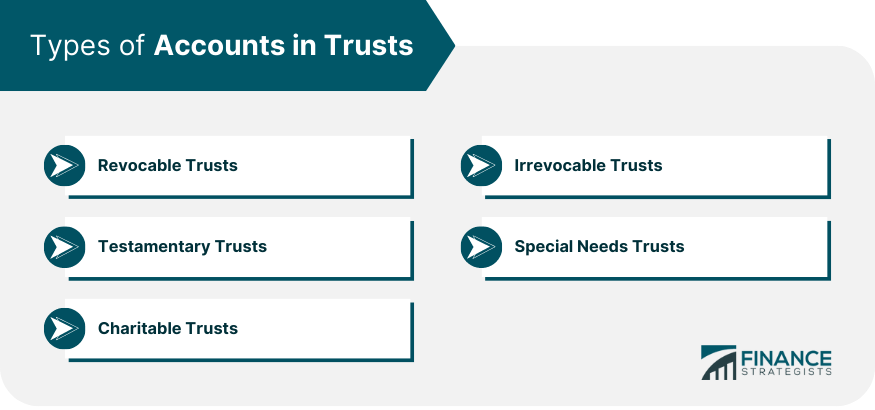

Types of Accounts in Trusts

Revocable Trusts

Irrevocable Trusts

Testamentary Trusts

Special Needs Trusts

Charitable Trusts

Establishing an Account in Trust

Selecting a Trustee

Identifying Beneficiaries

Determining the Terms and Conditions

Funding the Trust

Trust Management and Administration

Role of an Estate Planning Lawyer in Setting up an Account in a Trust

Legal Consultation and Advice

Drafting Trust Documents

Ensuring Compliance With State and Federal Laws

Coordinating With Financial Institutions

Trust Administration and Management Assistance

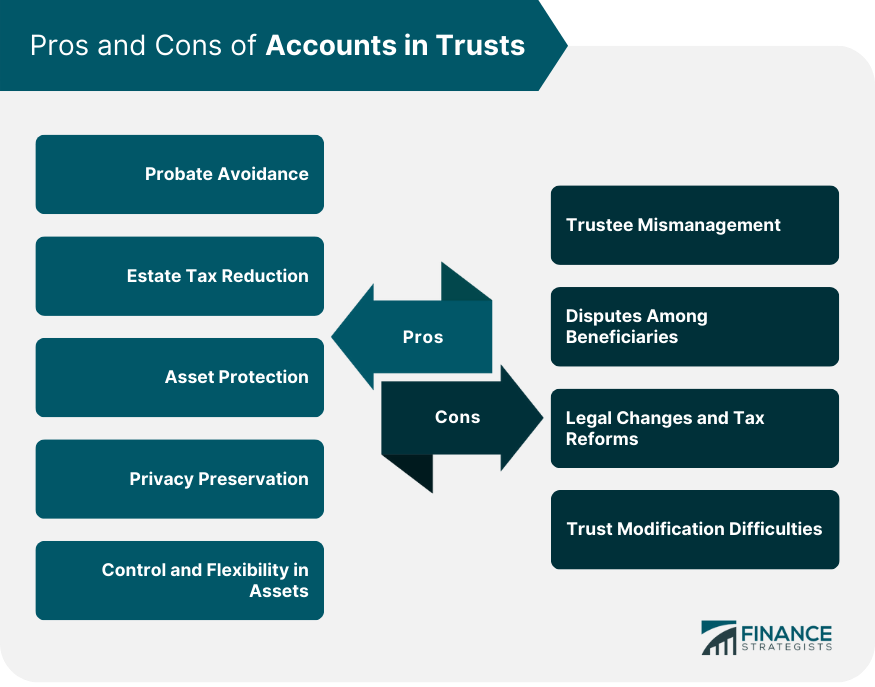

Pros of Accounts in Trusts

Probate Avoidance

Estate Tax Reduction

Asset Protection

Privacy Preservation

Control and Flexibility in the Distribution of Assets

Cons of Accounts in Trusts

Trustee Mismanagement

Disputes Among Beneficiaries

Legal Changes and Tax Reforms

Trust Modification or Termination Difficulties

Conclusion

Account in Trust FAQs

An Account in Trust is a legal arrangement that allows a trustee to manage and distribute assets on behalf of beneficiaries. It is used in estate planning to provide control, flexibility, and privacy in managing assets, avoid probate, reduce estate taxes, and protect assets from creditors.

An estate planning lawyer provides expert guidance in selecting the appropriate type of trust, drafts the trust document, ensures compliance with state and federal laws, coordinates with financial institutions to establish trust accounts, and assists with trust administration and management.

The main types of trusts include revocable trusts, irrevocable trusts, testamentary trusts, special needs trusts, and charitable trusts. Each type of trust serves different purposes and offers varying levels of control, tax benefits, and asset protection.

The key advantages of establishing an Account in Trust include probate avoidance, estate tax reduction, asset protection, privacy preservation, and control and flexibility in the distribution of assets to beneficiaries.

Potential challenges and issues include trustee mismanagement, disputes among beneficiaries, legal changes and tax reforms that may impact the trust and difficulties in modifying or terminating the trust. Working with an experienced estate planning lawyer can help address these challenges and ensure the trust remains effective and compliant.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.