Planning for dementia and Alzheimer's disease is crucial for individuals and families to ensure that they receive the care and support they need as the disease progresses. These conditions can cause significant physical, emotional, and financial stress for both the individual affected and their loved ones. Planning ahead can help families navigate the challenges associated with these conditions and ensure that their wishes are respected. It is essential to establish legal and financial plans, develop a comprehensive care plan, and communicate openly with family members and healthcare providers. With proper planning, individuals and families can have peace of mind and be better prepared for the challenges that come with dementia and Alzheimer's. Dementia and Alzheimer's patients often require specialized medical care, including regular doctor visits, medications, and medical equipment. These expenses can add up over time, making it crucial for families to plan for these costs. Long-term care facilities, such as nursing homes and assisted living facilities, provide specialized care for individuals with dementia and Alzheimer's. The cost of these facilities can be quite high, depending on the level of care required and the facility's location. In-home care services provide support and assistance to dementia and Alzheimer's patients within the comfort of their own homes. The cost of in-home care can vary depending on the type and frequency of services provided. Individuals diagnosed with dementia or Alzheimer's may need to reduce their work hours or retire early, leading to a decrease in their income. This can create a significant financial burden on the family. Caregivers may also face financial challenges due to the demands of providing care. They may need to take time off work, reduce their work hours, or even leave their jobs altogether to provide full-time care for their loved ones. Begin by identifying all sources of income, such as salaries, pensions, Social Security benefits, and investments. This will help you determine your current financial standing and inform your future planning. Take inventory of your assets, such as property, investments, and savings accounts, as well as your liabilities, such as mortgages, loans, and credit card debts. This will give you a clear picture of your net worth and help you create a comprehensive financial plan. List your current monthly expenses, including housing, utilities, food, transportation, and healthcare costs. This will help you identify areas where you may need to cut back or make adjustments to accommodate future expenses. Estimate the future costs associated with dementia and Alzheimer's care, such as medical expenses, long-term care, and in-home care services. This will allow you to create a budget that accounts for these anticipated expenses. Designate a trusted individual to manage your financial affairs should you become unable to do so due to dementia or Alzheimer's. This can help prevent financial mismanagement and ensure your wishes are followed. Similarly, appoint a healthcare power of attorney to make medical decisions on your behalf if you are unable to do so. Create or update your will and estate plan to ensure your assets are distributed according to your wishes and minimize potential conflicts among family members. Long-term care insurance can help cover the cost of care for dementia and Alzheimer's patients. However, policies can be expensive, and not all plans cover these specific conditions. Be sure to thoroughly research and compare policies before making a decision. When considering long-term care insurance, factor in the policy premiums, elimination period, and benefit amounts to ensure the coverage aligns with your needs and budget. Medicare and Medicaid are government programs that can help cover some costs associated with dementia and Alzheimer's care. Determine your eligibility for these programs, as well as the specific services they cover. While Medicare and Medicaid may provide some coverage for dementia and Alzheimer's care, it is essential to understand the limitations and gaps in coverage. For example, Medicare typically does not cover long-term care costs, while Medicaid may cover them for eligible individuals. The Aid and Attendance program is a benefit available to eligible veterans that can help cover the cost of in-home care, assisted living, or nursing home care for dementia and Alzheimer's patients. Explore other potential benefits available to veterans, such as disability compensation, pension benefits, and healthcare services, to ensure you are taking full advantage of the resources available to you. Creating an irrevocable trust can help protect your assets from being used to pay for long-term care costs, while still providing financial support to your family. A special needs trust is designed to provide financial support to disabled individuals without disqualifying them from government assistance programs such as Medicaid. Annuities can provide a steady stream of income during retirement, which may help cover the costs associated with dementia and Alzheimer's care. Life insurance policies can help protect your family's financial future in the event of your death. Some policies also offer living benefits that can be used to cover long-term care costs. Social Security Disability Insurance (SSDI) provides financial support to individuals who are unable to work due to a disability. Determine your eligibility for SSDI and consider applying if you qualify. Supplemental Security Income (SSI) is a needs-based program that provides financial support to individuals with limited income and resources. Determine your eligibility for SSI and consider applying if you qualify. The Alzheimer's Association offers resources and support for individuals affected by Alzheimer's disease and their families, including financial planning and assistance programs. Local dementia support groups can provide emotional support and practical resources, such as information on financial assistance programs and local service providers. Certified Financial Planners (CFPs) are professionals who specialize in helping individuals create comprehensive financial plans. Consider consulting a CFP to help you navigate the complexities of financial planning for dementia and Alzheimer's care. Geriatric care managers are professionals who specialize in helping families coordinate and manage care for aging loved ones. They can provide guidance on financial planning and connect you with resources and services in your community. Elder law attorneys specialize in legal issues affecting older adults, such as estate planning, long-term care planning, and guardianship. Consult an elder law attorney for assistance with your legal and financial planning needs. Estate planning attorneys can help you create or update your will and estate plan, ensuring your assets are distributed according to your wishes and minimizing potential conflicts among family members. The importance of proactive financial planning for dementia and Alzheimer's patients cannot be overstated. By taking the necessary steps to secure your financial future and protect your assets, you can alleviate some of the stress and uncertainty that comes with managing these conditions. By creating a comprehensive financial plan, you not only provide peace of mind for yourself but also ensure the long-term well-being of your family and loved ones. Remember to consult with financial and legal professionals to help navigate the complexities of financial planning for dementia and Alzheimer's care. With proper planning and support, you can face the challenges of dementia and Alzheimer's with confidence and financial security.Dementia and Alzheimer’s Planning Importance

Understanding the Financial Impact of Dementia and Alzheimer's

Cost of Care

Medical Expenses

Long-Term Care Facilities

In-Home Care

Loss of Income

Reduced Work Hours or Early Retirement

Impact on Caregiver's Income

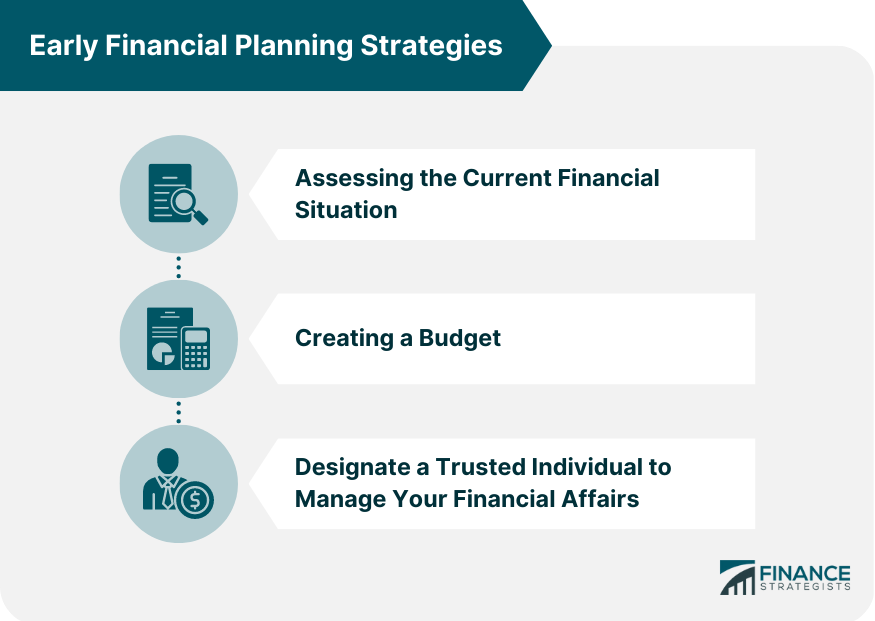

Early Financial Planning Strategies

Assessing the Current Financial Situation

Income Sources

Assets and Liabilities

Creating a Budget

Current Expenses

Projected Future Expenses

Legal Documentation

Power of Attorney for Finances

Healthcare Power of Attorney

Will and Estate Planning

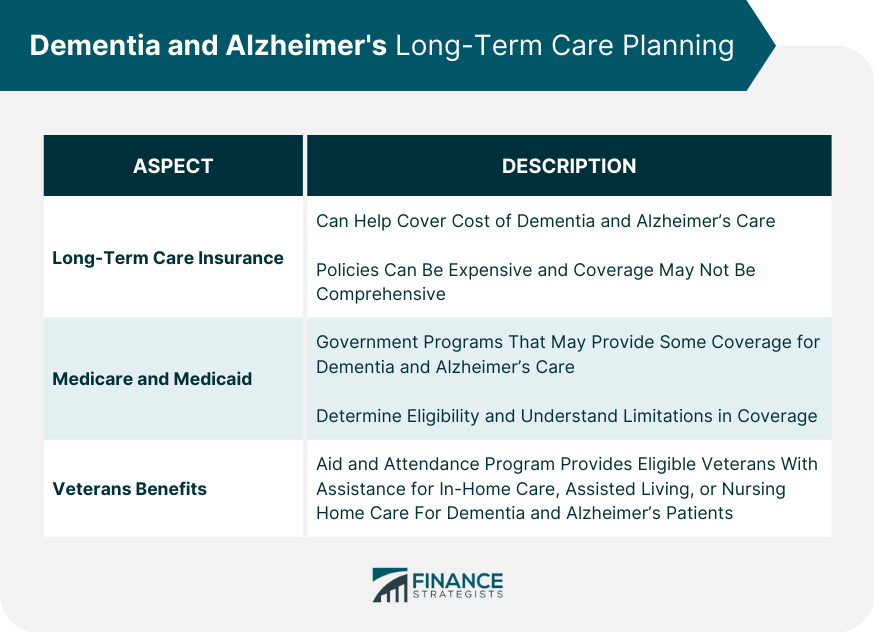

Long-Term Care Planning

Long-Term Care Insurance

Benefits and Limitations

Cost Considerations

Medicare and Medicaid

Eligibility Requirements

Coverage for Dementia and Alzheimer's Care

Veterans Benefits

Aid and Attendance Program

Other Potential Benefits

Protecting Assets and Income

Trusts and Asset Protection Strategies

Irrevocable Trusts

Special Needs Trusts

Income Protection

Annuities

Life Insurance

Financial Support and Resources

Government Programs

Social Security Disability Insurance (SSDI)

Supplemental Security Income (SSI)

Non-profit Organizations and Support Groups

Alzheimer's Association

Local Dementia Support Groups

Engaging Professional Help

Financial Advisors

Certified Financial Planners (CFPs)

Geriatric Care Managers

Legal Assistance

Elder Law Attorneys

Estate Planning Attorneys

Final Thoughts

Dementia and Alzheimer’s Planning FAQs

Dementia and Alzheimer's planning involves understanding the financial impact of the diseases, early financial planning strategies, long-term care planning, protecting assets and income, exploring available financial support and resources, and engaging professional help, such as financial advisors and legal assistance.

To estimate future costs, consider the expenses associated with medical care, long-term care facilities, and in-home care services, as well as the potential loss of income due to reduced work hours or early retirement for both the patient and caregiver.

In dementia and Alzheimer's planning, establishing a power of attorney for finances and a healthcare power of attorney ensures that trusted individuals can manage your financial and medical affairs if you become unable to do so. Additionally, creating or updating your will and estate plan is essential for protecting your assets and distributing them according to your wishes.

Government programs like Medicare, Medicaid, SSDI, and SSI, as well as veterans benefits, can provide financial assistance and resources for dementia and Alzheimer's care. Non-profit organizations, such as the Alzheimer's Association and local dementia support groups, offer emotional support, resources, and information on financial assistance programs and local service providers.

Financial advisors, such as Certified Financial Planners (CFPs) and geriatric care managers, can help navigate the complexities of financial planning and connect you with resources and services. Elder law attorneys and estate planning attorneys can assist with legal matters related to dementia and Alzheimer's planning, including estate planning, long-term care planning, and guardianship.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.