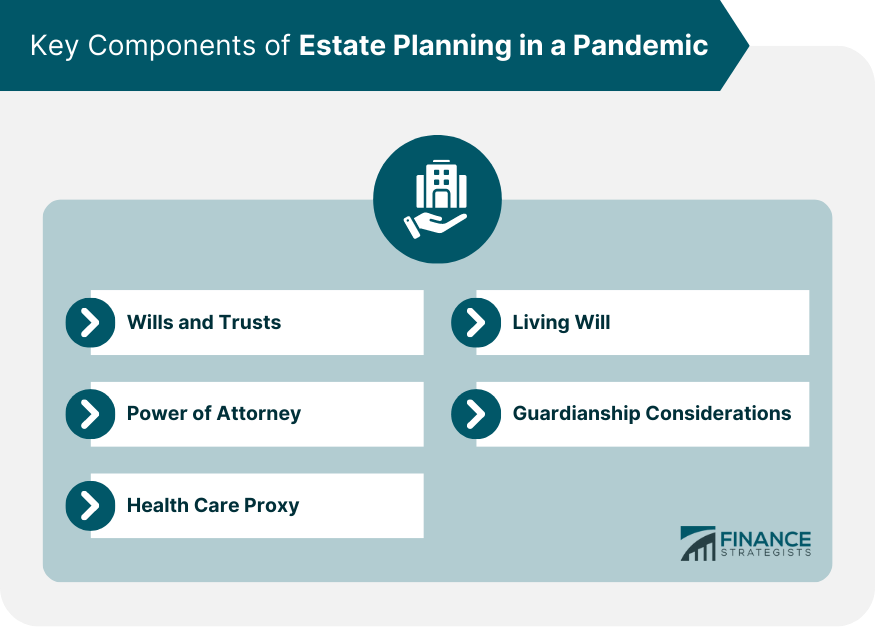

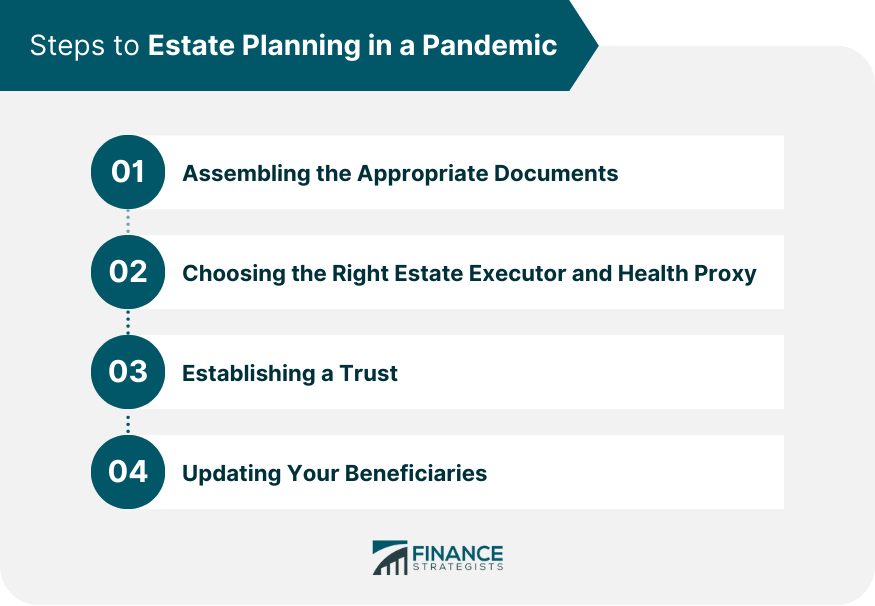

Estate Planning During a Pandemic refers to the crucial process of arranging the management and disposal of an individual's assets in the event of severe illness or death during a health crisis such as a pandemic. This involves creating or updating wills, trusts, powers of attorney, and health care proxies to ensure wishes are honored, and administrative burdens on loved ones are minimized. In the context of a pandemic, estate planning gains heightened importance due to increased health risks and potential changes in legislation related to estate taxes and wealth transfers. Understanding and actively participating in estate planning can provide with a sense of control and peace of mind in uncertain times, ensuring that their financial affairs and healthcare directives are in order according to their wishes. Estate planning includes several key components: Wills and Trusts: A last will and testament express your wishes about the distribution of your assets after your death. Trusts are legal entities that hold assets for beneficiaries. Both should be reviewed and updated as needed during a pandemic. Power of Attorney: This designates an individual to manage your finances if you become unable to do so. Health Care Proxy: Also known as a healthcare power of attorney, this designates someone to make medical decisions on your behalf if you are unable to communicate. Living Will: This document outlines your wishes for end-of-life medical care. Guardianship Considerations: If you have minor children, it's important to nominate a guardian in the event of your untimely demise. Estate planning can be complex, but by breaking it down into manageable steps, the process can become more straightforward. Documents are the backbone of any estate plan. It is crucial to have them updated and validated to ensure they reflect your current situation and wishes. For example, if you've recently divorced, you might need to revise your will, power of attorney, and healthcare proxy documents. Choosing the right people to execute your will and act as your health proxy is crucial. These individuals should be trustworthy, capable, and willing to take on these roles. It's important to discuss your plans with them to ensure they're comfortable with the responsibilities involved. Trusts can be an important part of estate planning, especially during a pandemic. They allow for more control over asset distribution and can help avoid probate. Types of trusts include living trusts, testamentary trusts, revocable trusts, and irrevocable trusts. Regularly reviewing and updating your beneficiary designations is vital. This includes life insurance policies, retirement accounts, and any accounts or policies that allow for a payable-on-death designation. Understanding the legal and financial aspects of estate planning can help you make informed decisions. In the face of a pandemic, alterations to estate tax laws can occur. Having an up-to-date understanding of these laws and any potential modifications is key for effective planning and for potentially reducing the tax burden on your estate. Implementing financial gifts and transfers may serve as a tax-efficient strategy to decrease an estate's overall value. However, the timing of these transfers and the associated tax implications demand careful consideration to maximize benefits and minimize drawbacks. In the rapidly evolving digital era, the inclusion of digital assets in an estate plan becomes critical. Such assets encompass online bank accounts, digital currencies, social media profiles, and digital photo repositories. These elements need comprehensive accounting and documentation within the plan. Moreover, it is advisable that access details for these assets are made available to the designated executor of the estate, ensuring a smoother transition and management process. An estate planning attorney can provide valuable advice and assistance in navigating the intricacies of estate law. They can help you draft and revise legal documents, advise on estate taxes, and more. Financial advisors can provide advice on investment strategies and financial planning to ensure your assets are allocated according to your wishes. They can help manage your financial portfolio and advise on financial gift strategies. Online estate planning services can provide a more accessible and sometimes more affordable alternative to traditional estate planning. They often provide resources and tools to help you draft your will, power of attorney, and other necessary documents. The process of estate planning during a pandemic is an essential exercise in foresight, facilitating the organized management and distribution of one's assets during uncertain health crises. Its importance is underscored by elevated health risks and potential legislative shifts impacting estate taxes and wealth transfers. This procedure ensures wishes are respected, and spares loved ones from administrative burdens. Pertinent components encompass updating wills and trusts, designating power of attorney and healthcare proxy, formulating a living will, and making guardianship considerations. Effectual planning includes regular revision of documents, appointing reliable executors and proxies, establishing suitable trusts, and maintaining current beneficiaries. Given the complexities of the financial and legal landscape, professional advice is invaluable. Estate planning attorneys can aid in navigating legal intricacies, while financial advisors provide guidance on asset allocation and investment strategies.Estate Planning During a Pandemic: Overview

Key Components of Estate Planning in a Pandemic

Practical Steps to Estate Planning in a Pandemic

Assembling the Appropriate Documents

Choosing the Right Estate Executor and Health Proxy

Establishing a Trust

Updating Your Beneficiaries

Navigating Legal and Financial Aspects

Understanding Estate Tax Implications

Consideration of Financial Gifts and Transfers

Role of Digital Assets in Estate Planning

Seeking Professional Advice

Role of an Estate Planning Attorney

Importance of Financial Advisors in Estate Planning

Utilizing Online Estate Planning Services

Conclusion

Estate Planning During a Pandemic FAQs

Estate planning during a pandemic is crucial because it ensures your wishes are respected if you become seriously ill or die. It eases the administrative burden on your loved ones and allows you to designate a person to make financial and medical decisions on your behalf if you're unable to do so.

The key components of estate planning during a pandemic include wills and trusts, power of attorney, health care proxy, living will, and guardianship considerations. These components help manage your assets and wishes effectively in case of incapacity or death.

You can include digital assets in your estate planning during a pandemic by listing all your digital assets, such as online bank accounts, digital currencies, and social media accounts, and providing access information to your executor or trustee. You should also consider the terms and conditions of each platform regarding the transferability of assets upon death.

Seeking professional advice in estate planning during a pandemic is essential because estate laws can be complex and may change in response to a pandemic. Professionals such as estate planning attorneys and financial advisors can provide expert guidance, helping you navigate potential legal and financial pitfalls.

Some practical steps in estate planning during a pandemic include assembling the appropriate documents like wills, trusts, and power of attorney, choosing the right estate executor and health proxy, establishing a trust if applicable, and regularly updating your beneficiaries. It's also important to understand the tax implications of your decisions.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.