Estate Planning is the legal and financial process of arranging the distribution of a person's property and assets after their death. It's a vital process that ensures an individual's wealth and assets are transferred to their desired beneficiaries, in the manner and time they wish, with minimal complications, financial strain, or legal entanglements. For the ultra-wealthy, estate planning is a far more complex process due to the size and diversity of their estate. They often own multiple businesses, diverse investments, luxury properties, precious art collections, and substantial cash reserves in various jurisdictions, each with its unique legal and taxation frameworks. This scale and complexity necessitate advanced estate planning strategies and professional assistance to safeguard their wealth and ensure a smooth transition to their heirs or chosen charities.

The first step in estate planning is to understand the total value of the estate. This includes all owned property, investments, businesses, cash, retirement accounts, life insurance policies, and any other assets. Valuation should consider tax implications, market volatility, and potential future growth. Next, it's important to identify all tangible and intangible assets. Tangible assets include properties, cars, art, jewelry, and others, while intangible assets may include stocks, bonds, intellectual property rights, and other forms of investments. Estate planning also involves understanding the legal implications of wills, trusts, and estate taxes. A will is a legal document outlining how the estate should be distributed after death. Trusts are legal entities that hold assets for beneficiaries and can provide tax benefits and greater control over asset distribution. Estate taxes are taxes levied on the value of the estate upon death and can significantly reduce the estate's worth if not properly planned for. Executors and trustees play a crucial role in estate planning. Executors carry out the instructions in the will, while trustees manage any trusts. They have a legal obligation to act in the best interests of the beneficiaries, making their selection a critical part of the estate planning process. Family Limited Partnerships (FLPs) and Family Limited Liability Companies (LLCs) are popular structures for the ultra-wealthy. They allow for centralized management of family assets, provide asset protection, and can offer significant estate and gift tax advantages. ILITs can remove the value of life insurance from the estate, potentially reducing estate taxes and providing a tax-free inheritance to beneficiaries. It's an irrevocable trust designed to hold and own life insurance policies, and once the trust is set up, it cannot be revoked, amended, or modified in any way. GRATs are an effective strategy to transfer wealth without incurring estate and gift taxes. The grantor contributes assets to the trust and receives an annuity payment for a fixed term. If the grantor survives the term, the remaining assets pass to the beneficiaries tax-free. Charitable trusts offer two options. Charitable Lead Trusts provide income to a charity for a certain period, after which the remaining assets go to the beneficiaries. On the other hand, Charitable Remainder Trusts provide income to beneficiaries for a certain period, after which the remaining assets go to a charity. These can offer tax benefits while fulfilling philanthropic desires. GSTTs allow the ultra-wealthy to pass on significant wealth to grandchildren and future generations, skipping their children while avoiding or minimizing estate and gift taxes. Private foundations and Donor Advised Funds offer an opportunity to combine family philanthropy with tax-efficient strategies. They allow a family to make charitable contributions, receive immediate tax benefits, and recommend grants from the fund over time. QPRTs can be an effective strategy to reduce estate taxes by removing the value of a primary residence or vacation home from the estate. The property is transferred into a trust, but the grantor retains the right to live in the home for a period. After this period, the property can pass to the beneficiaries at a reduced taxable value. Estate tax is a tax on the transfer of a deceased person's assets. The tax is levied on the total value of the estate before distribution to the heirs. The estate tax threshold refers to the amount of wealth that can be transferred upon death without incurring estate taxes. Understanding the current estate tax exemption limit and the threshold is crucial to minimize potential tax liabilities. One method to reduce the value of an estate, and hence the estate tax, is through gifting. This can include annual exclusion gifts, tuition or medical expenses paid on someone else's behalf or charitable gifts. It's important to utilize the correct strategy, as each gift type has its own rules and exclusions. Lifetime Gift Tax Exemption is another tool for reducing estate taxes. It is the total amount that an individual can give away during their lifetime without incurring the gift tax. The remaining portion of this exemption at death becomes the estate tax exemption for the estate. Estate tax exemption portability allows a surviving spouse to use the deceased spouse's unused estate tax exemption. This can significantly increase the amount that a couple can give or leave to their heirs tax-free. Grantor trusts is a type of trust where the grantor retains certain powers, resulting in the income of the trust being taxed to the grantor, not the trust. These trusts can help to freeze the value of assets for estate tax purposes, transfer wealth tax-free, and potentially reduce the overall estate tax liability. Succession planning is crucial for family business owners, ensuring a smooth transition of management and ownership to the next generation. Without a robust plan, businesses face estate taxes, family conflicts, and potential forced sales. A well-structured succession plan outlines the successor, transition process, and timing. It addresses tax implications, business valuation, retirement plans for outgoing owners and prepares successors through training and development. Buy-sell agreements provide clear guidelines for business interests during triggering events like death, disability, or retirement. They secure liquidity for the deceased owner's family, establish business value, and facilitate a seamless transition of management. A comprehensive succession plan helps minimize estate taxes by accurately valuing the business, utilizing gifting strategies, and leveraging trusts. These measures significantly reduce the estate tax liability. Family offices play a vital role in succession planning, ensuring continuity, coordinating with advisors, facilitating family communication, and managing complex interdependencies between personal and business assets. Cross-border estate planning refers to planning for individuals who have assets, beneficiaries, or even citizenship in more than one country. Such planning needs to take into account the various tax and estate laws in each country to avoid unfavorable tax consequences or legal complications. Different countries have diverse tax regimes and rules regarding estates and inheritances. Some countries levy a tax on the deceased (estate tax), others tax the beneficiaries (inheritance tax), and some may tax both. Understanding these differences is vital in cross-border estate planning. Tax treaties between countries can help mitigate the risk of double taxation, where two countries levy tax on the same income or assets. These treaties can impact the taxation of income, estates, and gifts. Offshore trusts and companies can provide advantages in terms of privacy, asset protection, and tax planning. However, they also come with regulatory complexity and risks. Therefore, professional advice is essential when using these structures in cross-border estate planning. Selecting an experienced estate planning attorney is crucial. The attorney should be familiar with the complexities of estate planning for the ultra-wealthy, including advanced estate planning strategies, tax laws, and the legal environment of any jurisdictions involved. An attorney can help draft necessary legal documents, provide advice on legal structures and tax implications, and represent the estate in legal matters. Financial planners and advisors play an essential role in estate planning. They can help identify goals, assess the financial landscape, develop strategies to meet those goals and monitor the plan's progress. They also collaborate with other professionals like attorneys and tax advisors to ensure a comprehensive approach. Given the complexities of tax laws and their implications for estate planning, tax professionals are indispensable. They can provide up-to-date advice on tax laws, ensure compliance, identify tax-saving opportunities, and help with tax return preparation and filing. Estate plans should not be static documents. Regular reviews are vital to ensure the plan still aligns with personal goals, financial situation, tax laws, and family dynamics. Significant life events, such as marriage, divorce, the birth of a child, death of a beneficiary, purchase or sale of a business, and significant changes in net worth, should prompt a review and possible update of the estate plan. Laws and regulations related to estate planning, tax, and trusts often change, and these changes can significantly impact an estate plan. Regular reviews can help identify any necessary adjustments to keep the plan current and legally compliant. Estate planning for the ultra-wealthy is a multifaceted task requiring deep understanding and meticulous strategy. From understanding basic estate planning concepts, utilizing advanced strategies, navigating the tax implications, and planning succession for family businesses, to considering global aspects, each step is critical. Furthermore, the importance of professionals such as estate planning attorneys, financial advisors, tax professionals, and family offices can't be overstated in ensuring a comprehensive and efficient estate plan. Given the complexities and stakes involved, it is advisable to seek guidance from an experienced estate planning attorney. Proactively safeguard your legacy, ensure your wealth is efficiently transferred according to your wishes, and mitigate potential legal disputes or hefty taxes. Overview of Estate Planning for the Ultra-Wealthy

Estate Planning Basics for Ultra-Wealthy Individuals

Understand the Value of the Estate

Identify the Estate's Assets: Tangible and Intangible

Legal Implications: Wills, Trusts, and Estate Taxes

Estate Executors and Trustees

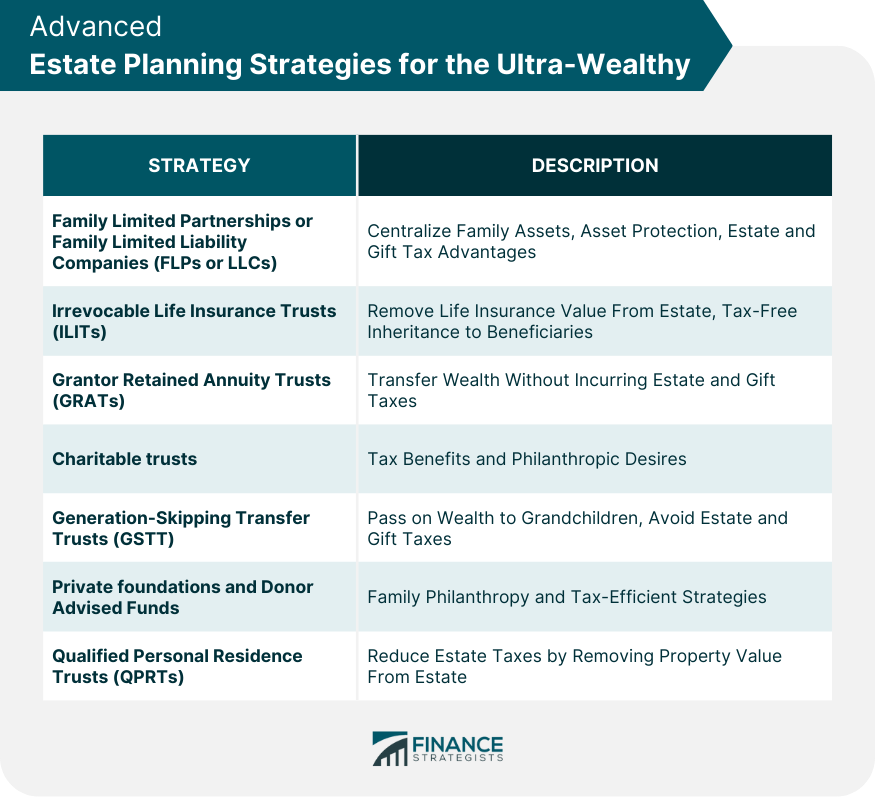

Advanced Estate Planning Strategies for the Ultra-Wealthy

Family Limited Partnerships or Family Limited Liability Companies

Irrevocable Life Insurance Trusts (ILITs)

Grantor Retained Annuity Trusts (GRATs)

Charitable Lead Trusts and Charitable Remainder Trusts

Generation-Skipping Transfer Trusts (GSTT)

Private Foundations and Donor Advised Funds

Qualified Personal Residence Trusts (QPRTs)

Estate Tax Planning for the Ultra-Wealthy

Understand the Estate Tax Threshold and Exemptions

Reduce Estate Tax Liability Through Gifting Strategies

Examine the Role of Lifetime Gift Tax Exemption

Grasp the Portability of Estate Tax Exemption Between Spouses

Utilize Grantor Trusts for Tax Benefits

Succession Planning for Family Business Owners

Establish Wealth Preservation Strategies

Key Components of a Well-Structured Succession Plan

Utilize Buy-Sell Agreements

Mitigate Estate Taxes in Family Business Succession

Role of Family Offices in Succession Planning

Estate Planning in a Global Context

Dealing With Different Estate and Inheritance Tax Regimes

Understand the Role of Tax Treaties

Use of Offshore Trusts and Companies

Role of Professionals in Estate Planning

Estate Planning Attorney

Financial Planners and Advisors

Tax Professionals

Regular Review and Updates to the Estate Plan

Life Events That Trigger a Need for Plan Updates

Changing Laws and Regulations Impacting Estate Plans

Bottom Line

Estate Planning for the Ultra-Wealthy FAQs

Estate planning for the ultra-wealthy is unique due to the size and diversity of their assets, including multiple businesses, diverse investments, and properties in various jurisdictions. This complexity necessitates advanced strategies and professional assistance.

Advanced estate planning strategies for the ultra-wealthy can include Family Limited Partnerships, Irrevocable Life Insurance Trusts, Grantor Retained Annuity Trusts, Charitable Lead Trusts, Generation-skipping Transfer Trusts, and more.

Estate tax liability can be reduced through several strategies, such as gifting, making use of the lifetime gift tax exemption, leveraging the portability of estate tax exemption between spouses, and using certain types of trusts.

Professionals such as estate planning attorneys, financial advisors, tax professionals, and family offices play a critical role in estate planning. They provide advice, draft necessary documents, ensure tax compliance, and manage assets, among other tasks.

Regular review of an estate plan is important to ensure alignment with personal goals, financial situation, family dynamics, and changing laws and regulations. Significant life events can also trigger the need for updates.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.