Estate planning is the process of arranging for the management, preservation, and distribution of an individual's assets during their lifetime and after their death. It involves the creation of legal documents and strategies to ensure that one's wishes are carried out and that their loved ones are provided for. Estate planning is particularly important during retirement, as individuals typically have accumulated significant assets and may face various tax implications. Proper estate planning can ensure that assets are distributed according to one's wishes while minimizing taxes and other financial burdens on loved ones. A will is a legal document that specifies how an individual's assets should be distributed after their death. It can also designate guardians for minor children and outline other specific wishes or instructions. A revocable living trust is a legal entity that holds assets for the benefit of designated beneficiaries. The creator of the trust, called the grantor, can make changes to the trust during their lifetime. Assets held in this living trust can bypass probate, potentially saving time and costs for beneficiaries. An irrevocable trust is a legal entity that cannot be changed or revoked once established. Assets placed in an irrevocable trust may provide certain tax advantages and can be used for specific purposes, such as asset protection or charitable giving. A financial power of attorney is a legal document that designates someone, called an agent, to manage an individual's financial affairs if they become incapacitated. A healthcare power of attorney designates an agent to make medical decisions on behalf of the individual if they cannot do so themselves. Beneficiary designations specify who will receive the proceeds of various assets, such as life insurance policies, retirement accounts, and annuities, upon the owner's death. An advance health care directive, also known as a living will, outlines an individual's preferences for medical treatment and end-of-life care in the event they become unable to communicate their wishes. Guardianship nominations designate who will care for an individual's minor children or dependents with special needs in the event of the individual's death or incapacity. The estate tax is a federal tax levied on transferring assets from deceased individuals to their heirs. Proper estate planning can help minimize estate tax liability. The gift tax is a federal tax on the transfer of assets between living individuals. Strategies such as annual exclusion gifts and direct payments for medical and educational expenses can help reduce gift tax liability. The generation-skipping transfer tax is a federal tax applied to transfers of assets to beneficiaries who are two or more generations younger than the grantor. Proper planning can help minimize this tax burden. Individuals can make annual exclusion gifts, which are tax-free gifts up to a certain dollar amount per recipient per year. Charitable giving can provide tax benefits while supporting causes important to the individual. Direct payments made to medical or educational institutions on behalf of others are not subject to gift tax. Life insurance proceeds are generally not subject to income tax and can be structured to minimize estate tax liability. Properly designating beneficiaries for retirement accounts, such as IRAs and 401(k)s, is crucial to ensuring these assets are distributed according to one's wishes and can minimize tax consequences for beneficiaries. Retirement account owners must begin taking RMDs at a certain age, which can have tax implications. Proper planning can help manage the tax burden associated with RMDs. Converting traditional retirement accounts to Roth accounts can provide tax-free growth and withdrawals, potentially benefiting both the account owner and their beneficiaries. Establishing a charitable remainder trust can provide a stream of income for the account owner while benefiting a charity upon their death, potentially reducing estate and income taxes. Retirees should consider how their retirement income sources, such as Social Security, pensions, and annuities, align with their estate planning goals to ensure a cohesive financial plan. By balancing tax-efficient income strategies, such as Roth IRA conversions, with wealth transfer strategies, retirees can minimize taxes while maximizing the assets they pass on to their beneficiaries. Retirees should regularly review their investment portfolio to manage risk and ensure their asset allocation aligns with their retirement income needs and estate planning goals. Significant life events, such as marriage, divorce, or the birth of a child, may necessitate updates to an individual's estate plan to ensure it remains aligned with their wishes. Tax laws can change over time, and it is essential to review and update one's estate plan to ensure it remains tax-efficient. Beneficiary designations should be periodically reviewed and updated to ensure they continue to reflect the account owner's wishes. Legal documents, such as wills and powers of attorney, should be periodically reviewed and updated to ensure they remain valid and up-to-date. Estate planning attorneys can provide expert advice and assistance in drafting legal documents and developing strategies to meet an individual's estate planning goals. Financial advisors can help individuals develop a comprehensive financial plan that incorporates both retirement income planning and estate planning strategies. CPAs can provide tax planning advice and assist in developing strategies to minimize tax liability in estate planning. Trust officers can help manage and administer trusts, ensuring that the grantor's wishes are carried out, and the trust's assets are managed appropriately. Estate planning is a critical aspect of retirement planning, as it ensures the efficient management, preservation, and distribution of assets both during an individual's lifetime and after their death. By coordinating estate planning with retirement income planning, retirees can create a cohesive financial plan that maximizes their assets and provides for their loved ones. Individuals should be proactive in their estate planning efforts, regularly reviewing and updating their plans to ensure they remain aligned with their personal circumstances and the current tax environment. Working with experienced professionals, such as estate planning attorneys, financial advisors, CPAs, and trust officers, can help individuals develop a comprehensive estate plan that meets their unique needs and goals, ensuring long-term financial security for themselves and their loved ones. These professionals can provide valuable advice, guidance, and support throughout the estate planning process, ensuring that all aspects of the plan are properly coordinated and executed.Estate Planning in Retirement: Overview

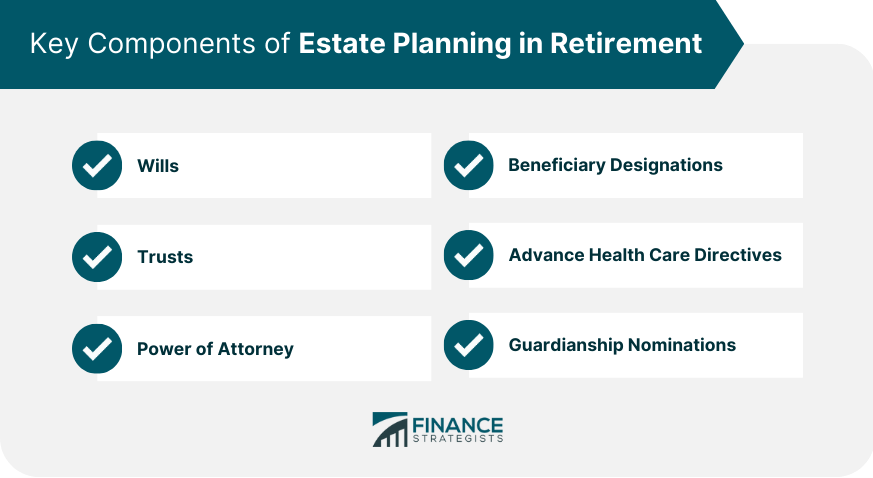

Key Components of Estate Planning in Retirement

Wills

Trusts

Revocable Living Trusts

Irrevocable Trusts

Power of Attorney

Financial Power of Attorney

Healthcare Power of Attorney

Beneficiary Designations

Advance Health Care Directives

Guardianship Nominations

Tax Implications and Strategies in Estate Planning

Estate Tax

Gift Tax

Generation-Skipping Transfer Tax

Tax-Efficient Gifting Strategies

Annual Exclusion Gifts

Charitable Giving

Direct Payments for Medical and Educational Expenses

Life Insurance and Tax Planning

Estate Planning and Retirement Accounts

Designating Beneficiaries for Retirement Accounts

Required Minimum Distributions (RMDs)

Roth Conversions

Charitable Remainder Trusts

Coordinating Estate Planning With Retirement Income Planning

Aligning Retirement Income Sources and Estate Planning Goals

Balancing Tax-Efficient Income and Wealth Transfer Strategies

Managing Investment Risk and Portfolio Allocation in Retirement

Importance of Regular Estate Plan Review and Updates

Changes in Personal Circumstances

Changes in Tax Laws

Regular Review of Beneficiary Designations

Periodic Updates to Legal Documents

Working With Professionals in Estate Planning

Estate Planning Attorneys

Financial Advisors

Certified Public Accountants (CPAs)

Trust Officers

Conclusion

Estate Planning in Retirement FAQs

Estate planning in retirement is the process of arranging and managing your assets to ensure they are distributed according to your wishes after you pass away. It includes creating a will, establishing trusts, and designating beneficiaries for your retirement accounts and life insurance policies.

Estate planning is important in retirement because it allows you to control the distribution of your assets and ensures that your loved ones are taken care of after you pass away. It can also help minimize estate taxes and avoid probate court.

Some common estate planning documents for retirees include wills, trusts, durable powers of attorney, healthcare directives, and beneficiary designations for retirement accounts and life insurance policies.

It's never too early to start estate planning, but it's especially important in retirement when you have accumulated significant assets. It's recommended to start estate planning in your 50s or 60s, but if you haven't started yet, it's better late than never.

Yes, it's highly recommended to consult with a professional, such as an estate planning attorney or financial planner, for estate planning in retirement. They can provide guidance on the best strategies for your individual situation and ensure that your estate plan is legally valid and up-to-date.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.