An executor of a will is a person appointed by the deceased to oversee and carry out their wishes as specified in the will after they pass away. The executor's main job is to ensure that the deceased person's assets are given to the right people according to their wishes. The role of an executor can come with certain legal obligations, so it is important that the person appointed understands what they are being asked to do. Depending on the size of a decedent’s estate and its complexity, several duties may be associated with this role. Executors might need to work with a probate attorney to navigate the legal process and a tax professional to address any tax issues that may arise. The executor has a fiduciary duty to the estate and its beneficiaries and must act in good faith. In some cases, an executor may be a close family member or a trusted friend of the deceased. Still, it is common for a professional, such as a bank or trust company, to serve as the executor in protecting the estate's assets. The executor plays a critical role in ensuring that the deceased's assets are distributed accordingly and that the estate's administration is carried out fairly, transparently, and efficiently. There are several reasons why someone may choose to change the executor of their will. Some of the most common include: No Longer Wants the Role. The executor may have a conflict of interest and is no longer willing to take on the role of executor. Inadequate Skills or Abilities. The executor may lack the necessary skills or abilities to carry out the responsibilities. Illness or Incapacity. If the executor becomes ill or incapacitated, they may be unable to fulfill their responsibilities as executors. Change in Relationships. If the executor is a former spouse or family member who is no longer in close contact, it may be necessary to appoint a new executor. It is not necessary to provide a specific reason for changing the executor of a will. Should you choose to proceed, you have two alternatives: add a codicil to an existing will or draft an entirely new will. A codicil is a legal document used to make minor changes to an existing will. Adding a codicil involves drafting the document, having it signed and witnessed, and attaching it to the original will. Step 1: Choose a New Executor. This person must be an adult of sound mind, excluding felons. Step 2: Write the Codicil. Specify the changes to your will, including the new executor's name and the date the change should take effect. Step 3: Validate the Codicil. Sign and date the codicil in the presence of at least two witnesses who are legal adults of sound mind and do not have an interest in the will. Step 4: Attach the Codicil to Your Existing Will. Keep a copy of the will and codicil in a secure place. Consider giving a copy to your estate planning attorney. If the changes to the will are more extensive, you may need to write a new one. Drafting a new will follows the same steps as when you created your initial one. Step 1: Specify the Beneficiaries. Clearly specify the beneficiaries, how you wish to distribute your assets, and who should serve as the new executor. Step 2: Sign and Witness the New Will. It must be signed and witnessed correctly. Following the legal requirements for signing and witnessing a will in your state or jurisdiction is essential. Step 3: Destroy All Copies of the Original Will. Once you have drafted and signed a new will, it is essential to destroy all copies of the original will to avoid confusion and potential challenges. Step 4: Consult an Attorney. If you need confirmation that you have covered all legalities on drafting a new will or changing an executor, it is recommended to consult with an estate planning attorney. Failing to appoint an executor in a will can have significant consequences for the deceased individual and their beneficiaries. Without an executor, there is no one to take charge of the deceased's assets and distribute them according to their wishes. This can result in delays in settling the estate, increased costs, and the possibility that the deceased's assets may not be distributed according to their desires. Without an executor, the probate court will appoint an administrator to settle the estate. The administrator must follow the strict rules and procedures the court sets. Additionally, the appointed administrator may not be the person the deceased would have chosen, which can result in conflicts among the beneficiaries. Another potential outcome of not appointing an executor is that assets could be left uncollected. Without this oversight, assets may remain dormant without any beneficiary's claim, leaving them unprotected from creditors, devaluation, or taxes due on them. Having an executor in place and keeping wills updated reduces the risk of complications arising about administering an estate properly. Beneficiaries are, therefore, more likely to receive their allotted share quickly. There are several reasons why someone may need to change the executor of their will, including the executor's conflict of interest, lack of skills or abilities, illness or incapacity, and changes in relationships. Changing the executor of a will can be accomplished by either adding a codicil to the existing will or writing a new one. It is essential to choose a new executor who is an adult of sound mind and to ensure that the amendment or new will is properly signed and witnessed. Failing to appoint an executor in a will can have negative consequences, such as delays in settling the estate, increased costs, and misdistribution of assets. Consulting an estate planning attorney is recommended if there is any uncertainty about the process. Executor of a Will: Overview

Reasons for Changing an Executor

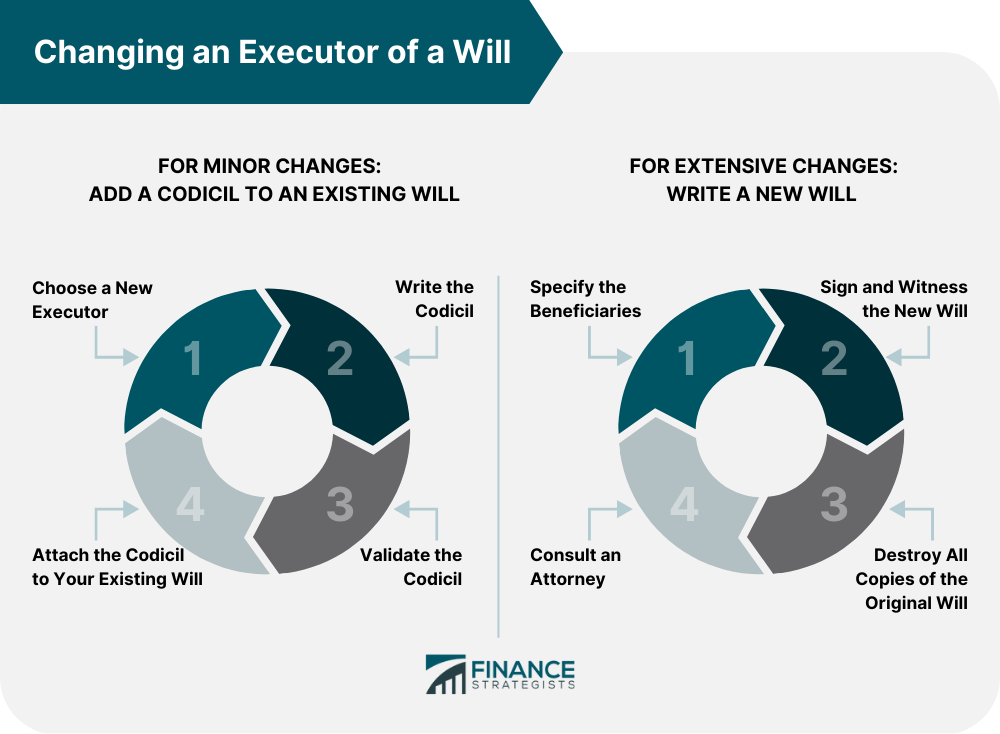

What You Can Do to Change an Executor of a Will

Add a Codicil to an Existing Will

Write a New Will

Consequences of Failing to Appoint an Executor

The Bottom Line

Changing an Executor of a Will FAQs

An executor of a will is a person or entity named in a will responsible for implementing the deceased's final wishes and distributing their assets according to the terms of the will. This includes paying debts and taxes and ensuring that the assets are distributed accordingly.

An executor of a will may need to be changed for several reasons, including a conflict of interest, lack of skills or abilities, illness or incapacity, changes in relationships, or death. The person appointed as the executor must be willing and able to carry out their duties effectively and efficiently. If any of these circumstances arise, it may be necessary to appoint a new executor.

This can be done by adding a codicil to an existing will or writing a new will. The new will should revoke the previous will and name a new executor. It is important to ensure that the new will is properly signed and witnessed and that all copies of the original will are destroyed.

A codicil is a written amendment to a will that changes its provisions but does not replace the entire document. A codicil is a separate legal document attached to the original will that must be executed with the same formalities as the original will and must comply with the exact legal requirements for creating a valid will in the jurisdiction in which it is made.

It is crucial to have an executor and keep the will updated to guarantee the proper distribution of assets according to the deceased's desires. Without an executor, the court will appoint an administrator, causing delays, increased costs, and potential misdistribution of assets. Updating the will ensures the deceased's wishes are fulfilled.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.