An executor is a person named in a will to carry out the terms of the will. Sometimes this is referred to as an administrator, not to be confused with a probate court administrator or a state official responsible for supervising public administrators and deputy public administrators. The executor’s job is to marshal the estate assets, pay the debts and taxes of the estate, and then distribute what’s left to the beneficiaries named in the will. The executor must compile a list of all the assets and liabilities of the estate. This inventory should be as complete and accurate as possible. Assets can include bank accounts, real estate, investments, vehicles, collectibles and personal effects. Liabilities include the outstanding balance on the mortgage loan on the deceased’s house, credit card balances owed by the deceased, or debts outstanding to medical providers. The executor must pay all debts and taxes of the estate. This may include selling assets to generate cash flow to pay the bills. The executor must distribute the estate to the beneficiaries named in the will. This may involve gathering documents such as birth certificates and Social Security cards to prove that the beneficiary is who they say they are. If a beneficiary is a minor, the executor will need to appoint a guardian to manage the inheritance until the beneficiary turns 18. The executor must file certain forms with the court in order to begin the process of probating the will. The following are some of these forms. In every state, the executor files a probate petition with the probate court along with a copy of the will and letters testamentary (permission to act as an executor). The probate court where the deceased’s estate is filed can be determined by looking at clause (a) of the Uniform Probate Code (UPC), which determines where the deceased had their primary residence at the time of death. The probate petition is a document that asks the court to admit the will to probate and appoint the executor named in the will. The executor must also file an executor’s affidavit along with the probate petition. The affidavit is a document in which the executor swears to the truth of the information contained in the petition. It contains information about the deceased, including their date of birth, place of birth, death certificate number and where to send notices concerning the probate proceedings. After the executor files the petition with the court along with a copy of the will and letters testamentary, they must file a separate document called a petition for administration. This document requests that the court appoint the executor to carry out their duties. A notice of probate is a document filed with the court and given to certain interested parties such as creditors, co-executors and heirs. The purpose of this document is to notify them that there will be a probate proceeding in which they can participate. The executor must give notice that the will is being probated to all creditors of the deceased person whose names are not included in the will. The notice must state “that there is on file in this court a written instrument purporting to be the last will and testament of the decedent, that the instrument has been offered for probate, and that any person interested in the estate of the decedent may file a petition contesting the validity of the will.” The notice must also state the date, time and place of the hearing on the petition to contest the will. The executor must also file a life insurance claim form with the insurance company that issued the life insurance policy on the deceased person. The life insurance claim form is filled out and sent to the life insurance company by the executor or heirs of the estate. This document gives them permission to release any proceeds from a life insurance policy belonging to the deceased person. An executor's role is vital in the estate administration process. It is important to clearly understand what your role as an executor will be after someone dies. This includes understanding the forms that will need to be filed with the court in order to probate the will. By understanding the forms that must be filed, executors can ensure a smooth and timely transfer of assets to the beneficiaries. Responsibilities of an Executor

Accounting for All Assets and Liabilities of the Estate

Paying Debts and Taxes of the Estate

Distributing the Estate to the Beneficiaries

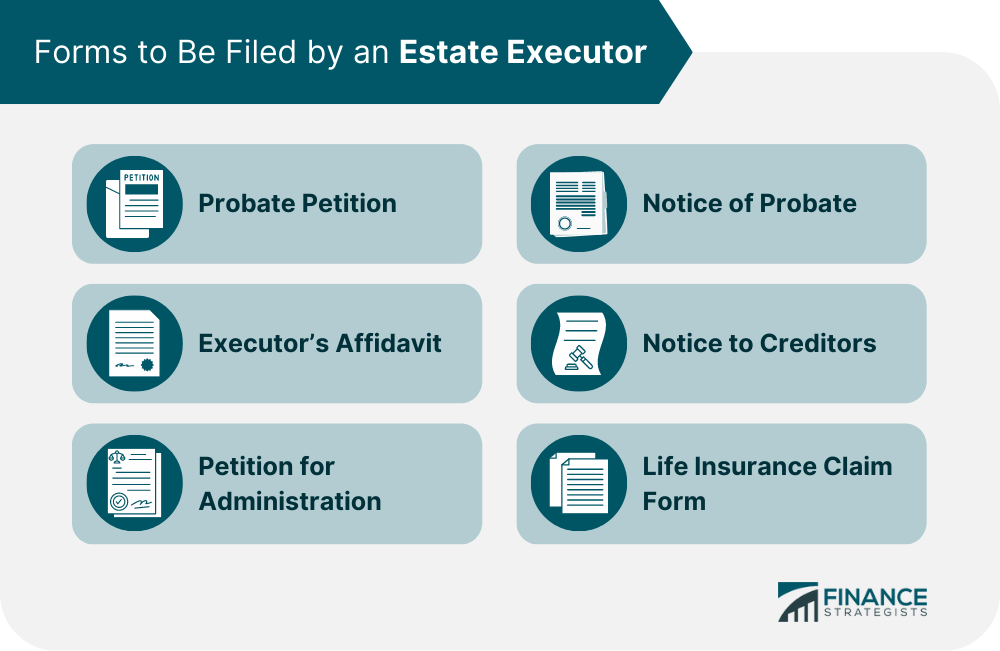

What Are the Forms to Be Filed by an Estate Executor?

Probate Petition

Executor’s Affidavit

Petition for Administration

Notice of Probate

Notice to Creditors

Life Insurance Claim Form

Final Thoughts

Forms to Be Filed by an Estate Executor FAQs

An executor is a person appointed by a will to administer an estate. They are responsible for gathering the deceased’s assets, paying any debts owed by the estate and distributing the remaining items in accordance with the will.

An executor of an estate can be any person chosen by the deceased or a person named in their will.

The length of time it takes to probate a will can vary depending on the state and the complexity of the estate. However, it is typically completed within a few months to a year.

The executor’s role in settling an estate includes notifying creditors of the death, paying any outstanding debts or taxes owed by the estate and distributing property according to the will. They also file all of the necessary forms with the probate court in order to begin carrying out their duties.

An executor should begin processing the estate as soon as possible after the death of the deceased person. They must file a petition with the court to open probate proceedings and notify any creditors that an estate exists.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.